How Bitcoin’s Rising Exchange Reserves Threaten its Rally To $100,000

Bitcoin’s rising exchange reserve and declining whale activity signal increased selling pressure, hindering a breakout above $100K.

- BTC exchange reserves have surged since February 6, signaling increased selling pressure and limiting upside potential.

- Whale netflow has dropped 299%, indicating large holders are offloading BTC, which may trigger further selloffs.

- BTC risks falling to $92,325 if support at $95,650 fails, while a breakout above $98,663 could push prices toward $102,753 and beyond.

Bitcoin’s price recovery above $100,000 may continue to face significant resistance as its exchange reserve continues to rise.

The trend indicates that more coins are being moved to exchanges, likely for onward sales. This puts more downward pressure on BTC’s price and keeps it further from breaking above the critical $100,000 mark.

Bitcoin’s Exchange Reserves Surge, Raising Sell-Off Fears

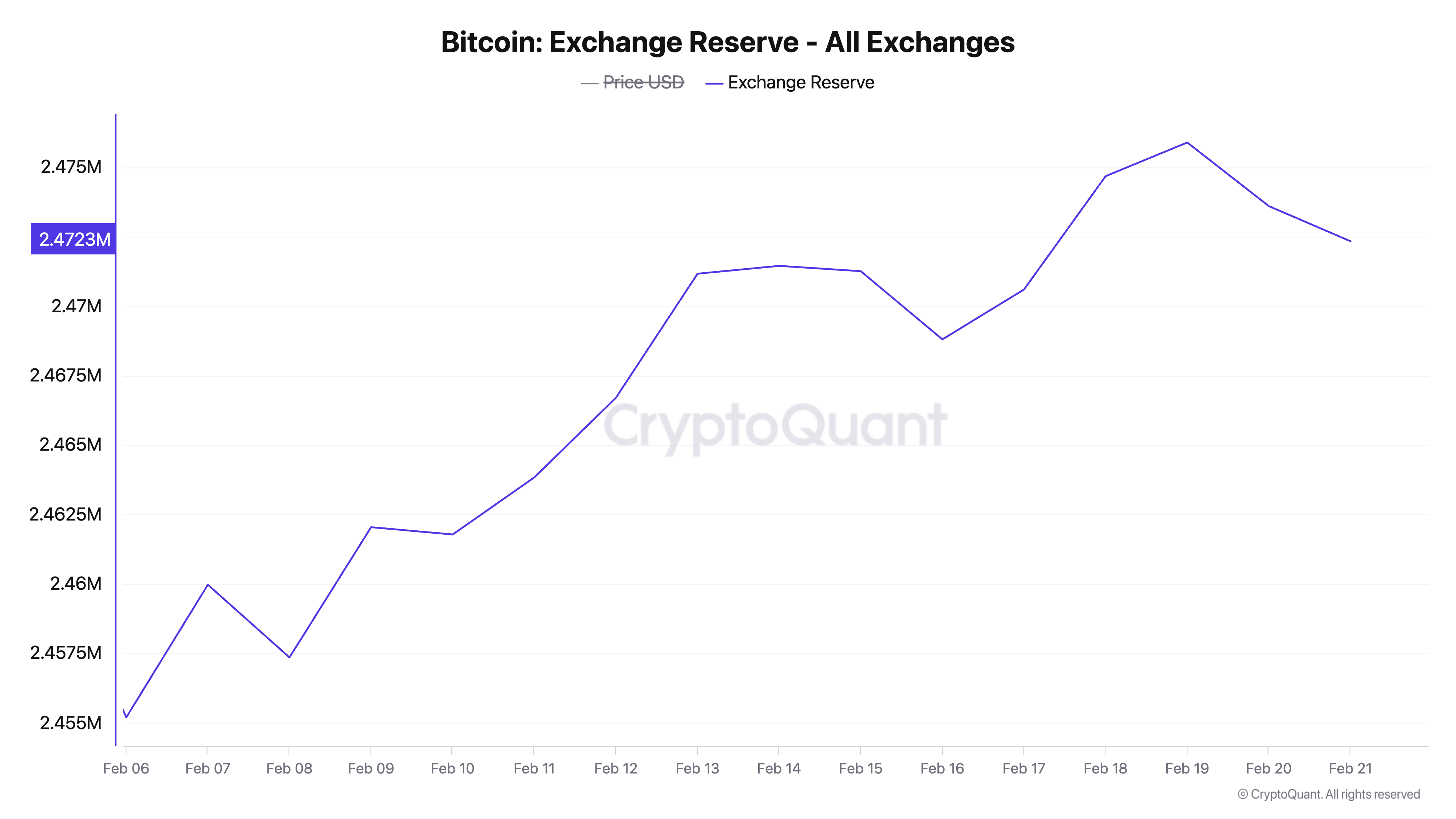

Data from CryptoQuant shows a steady uptick in BTC’s exchange reserve since February 6. As of this writing, 2.47 million BTC are held in exchange wallets, noting a 1% surge since the beginning of the month.

Bitcoin exchange reserve refers to the total amount of BTC held in exchange wallets. When this spikes, more coins are being deposited into exchanges, signaling increased selling pressure in the market.

Notably, this trend coincides with BTC’s sideways price movement since the beginning of February. Over the past 15 days, the leading cryptocurrency has traded within a tight range, facing resistance at $98,663 while finding support at $95,650.

The rising exchange reserve suggests that the persistent selling activity is preventing a strong breakout to the upside. If the buildup of exchange reserves continues, it could trigger a downside breakout, putting BTC at risk of a price correction.

Another cause for concern is the decline in BTC whale activity. Over the past week, the coin’s large holders’ netflow has plummeted by 299%, highlighting a significant selloff among them.

Large holders refer to whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the amount of coins they hold and sell at a specified period.

When netflow drops, it means whales and institutional investors deposit more tokens into exchanges than they withdraw. This signals increased selling pressure among major holders, a trend that could also prompt retail traders to sell their holdings, further amplifying the downward pressure on BTC’s price.

BTC at a Crossroads: Will It Break $98K or Drop to $92K?

If selloffs intensify, BTC’s price could attempt to test the support at $95,650. If this level fails to hold, the coin risks plunging downward to $92,325.

On the other hand, a resurgence in demand could propel a breakout above the resistance formed at $98,663. If successful, BTC could extend its gains toward $102,753.

A breach of this price level could propel the coin toward its all-time high of $109,356, which it last reached on January 20.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.