Admiral Markets card: more efficient trading

Admiral Markets card is a great solution to make your trading more efficient。Why so?Let's take a look at this article.。

Admiral Markets card is a great solution to make your trading more efficient。Why so?Let's take a look at this article.。

Admiral Markets is a leading Forex and Contracts for Difference (CFD) broker, founded in 2001, which operates under the supervision of several top institutions, including ASIC Australia and FCA UK.。

To achieve this, Admiral Markets is always looking for ways to improve its services and make them more accessible to traders around the world.。One of the innovations is the Admiral Markets card, which is basically a Visa debit card with physical and virtual forms。

Admiral Markets cards provide a convenient one-stop source of funding for a variety of transactions anywhere Visa is accepted。It can be used for online purchases, telephone transactions and cash withdrawals from supported ATMs。

In this guide we will walk you through all the information about the Admiral Markets card。

Introduction to the Admiral Markets card

The Admiral Markets card is an innovative Visa card that you can use to store funds, make and receive payments, and transfer money to other accounts。The card connects directly to your Admiral Markets account and can be used both physically and virtually。It works with the Admiral Markets wallet, which can be accessed from the trading room console。

The card has a base currency of Euro with a maximum balance of €12,000 and you can always top up the card using any payment method supported by the broker。In addition, the Admiral Markets card can be used in online and physical stores anywhere in the world that accepts Visa.。Therefore, it is very convenient and easy to use for traders all over the world。

The Admiral Markets card is for all customers who are at least 18 years old and have EAA residency, customers must pass KYC verification to get this additional service。Each eligible customer receives a physical card and a virtual card, which are used in conjunction with each other。

It is worth noting that the card is valid for three years from the date of issuance, and after the validity period, the card will no longer be used。

Multiple Uses of Admiral Markets Cards

Admiral Markets cards have multiple uses, including:

- SEPA transactions, you can use the IBAN number within the SEPA area to make payments in euros to any person or business。

Invest money into your trading account and any transfers you make from the card are instant, so it is easy to invest in any available tool。

Authorize any merchant that accepts Visa debit card payments to conduct transactions, including chip password payments, magnetic stripe card payments, contactless payments, Internet payments, mail payments, e-wallet payments, and phone payments。

ATM withdrawals, cash withdrawals from any ATM with Visa logo。

How to get started with the Admiral Markets card

The easiest way to get an Admiral Markets card is to apply for a virtual card form。Remember that before applying, you must first go through the full KYC verification process, including submitting your identification and proof of address。After you complete this important step, you can continue with the following steps:

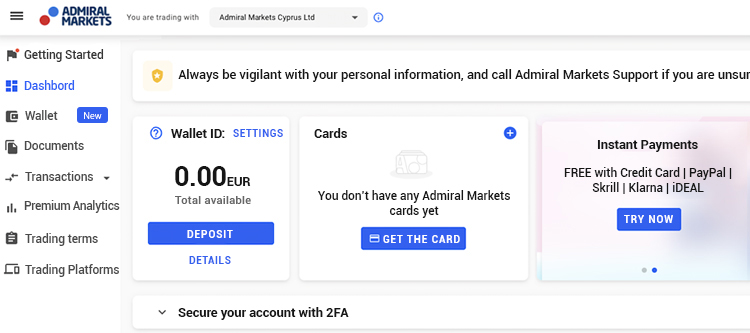

- Visit the Admiral Markets website and log into your trading room console。

Find the card module and click "Get Card"。

Find the card module and click "Get Card"。

Before generating a card, you must first make a deposit using the methods available on the platform, such as your existing credit card, bank transfer, Skrill or Admiral Markets wallet。

You will also need to create a PIN to access the card and make ATM withdrawals。

The Admiral Markets virtual card is ready! You can use and access it from the console at any time。

While virtual cards are sufficient to conduct transactions, you may still need to acquire physical cards to be more convenient。To get the entity card, you can do as follows:

- Open your trading room and select the card module。

Apply for an Admiral Markets physical card。

Enter your actual address and other details, be sure to check the delivery address carefully to avoid any problems。

After receiving the physical card, please sign the signature strip on the back of the card。

Then, log into your account or activate the card by sending an email to the broker's customer service。Please note that the card must be activated within three months, otherwise it will be automatically cancelled。

Keep in mind that you will need to pay a card fee of €10 for your physical card (free if your wallet balance exceeds €5,000) and the issued card will be delivered within 10 working days。

How Admiral Markets Cards Make Your Trading More Efficient

Admiral Markets cards offer a range of benefits that can increase your trading efficiency and enhance your user experience。

You can manage all financial activities within your account with one card。Since the card is connected to the console and wallet, you can easily use your funds to invest in any asset。

You can even connect it to an e-wallet like Samsung Pay, Google Pay, or Apple Pay to make transactions easier than ever。It works similar to a normal debit card, so once connected to your account, you can seamlessly recharge and make online purchases。

In addition, if you want to avoid expensive bank fees, this card is also a good solution。Admiral Markets cards are very convenient and affordable because they do not require hidden management fees; virtual cards are completely free, while physical cards only require a one-time fee of 10 euros and a monthly management fee of 2 euros。

Admiral Markets Card FAQ

Is the Admiral Markets card safe??

Yes, the card is completely secure, but please keep your card information and credentials in a safe place, and never disclose security information such as your PIN code or password details to anyone。It is highly recommended to check the balance regularly by logging in to your account or contacting customer service via email。Can I change my PIN??

If you forget your PIN, you can receive a reminder via your online Admiral account; alternatively, you can change your PIN at any ATM that supports PIN management。Can I cancel my Admiral Markets card?

Yes, you can cancel your Admiral Markets account and card within 14 days from the date of registration without paying any penalty and the card issuing fee will also be refunded。After 14 days, you can always contact customer service to cancel the card, however, the broker will charge a redemption fee of €2。After canceling the card, you should divide your card in half by the signature box, magnetic stripe and chip。What to do if my card is lost or stolen?

If your physical card is stolen or you suspect that someone else has found your PIN, password or account credentials, you must immediately contact the broker by phone or email, and you can also log in to your account and contact customer service。After that, the broker will cancel your card and freeze the account to avoid further violations。Can I trade in any currency??

Theoretically yes, but the base currency of the card is the euro。Therefore, if you trade in another currency, you may have to pay an exchange fee based on the exchange rate set by Visa on the day of the transaction.。

Admiral Markets is a Forex and CFD brokerage firm,Since 2001, it has been committed to providing smart financial solutions for global traders.。The main services revolve around three key activities: learning, trade and investment。To this end, it has a number of registered subsidiaries, including Admiral Markets UK Ltd, Admiral Markets Pty Ltd (Australia), Admiral Markets AS Jordan Ltd, Admiral Markets Cyprus Ltd, Admirals SA (Pty) Ltd (South Africa) and Aglobe Investments Ltd (Seychelles), for global markets。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.