Optimism (OP) Price Rebounds to Avenge 40% Decline

Optimism's price is aiming for recovery and appears to be receiving the necessary support from its investors.

- Optimism’s price is potentially ending its month-long drawdown, which has led to a 40% drop.

- The MVRV ratio is well below the opportunity zone, signifying that investors have little left to lose.

- OP holders are, regardless, refraining from selling at a low price as they expect recovery.

Optimism’s (OP) price is now at the cusp of initiating a recovery after following the bearish broader market cues.

The altcoin is finding support from its investors, which could translate into OP reclaiming $2 as support.

Optimism Investors Help Trigger a Rise

Optimism’s price, $1.7, is observing a positive reception from investors who are now pining for a price rise. The first sign of this is visible in the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio measures investor profit/loss. Optimism’s 30-day MVRV at 10% signals losses, potentially prompting buying. Historically, OP MVRV between -10 % and -20 % often precedes recoveries and rallies, terming it an opportunity zone for accumulation.

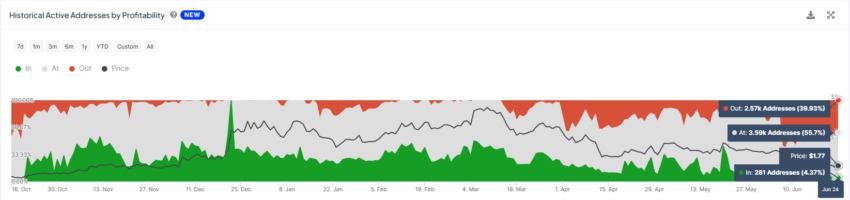

In addition, the investors are holding off on selling their holdings. Upon observing the active addresses by profitability, less than 5% of the participating investors are in profit.

Read More: What Is Optimism?

Crossing the 25% mark of OP holders in profit is considered a bearish sign, indicating profit-taking. On the other hand, lower participation is a bullish sign as it suggests HODLing among investors.

This could aid the altcoin in noting a recovery.

OP Price Prediction: Taking Back the Losses

Optimism’s price, trading at $1.7 at the time of writing, is bouncing back from support at $1.6. The altcoin’s target is to reclaim $2.0 as a support floor, for which breaching $1.8 is necessary. The rise is being supported by investors’ bullishness; however, the chances of recovery remain bleak until $2.0 is secured.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

If this fails, Optimism’s price could remain consolidated under $1.8 or subdued under $2.0. Any decline below this line would invalidate the bullish thesis, extending the losses.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.