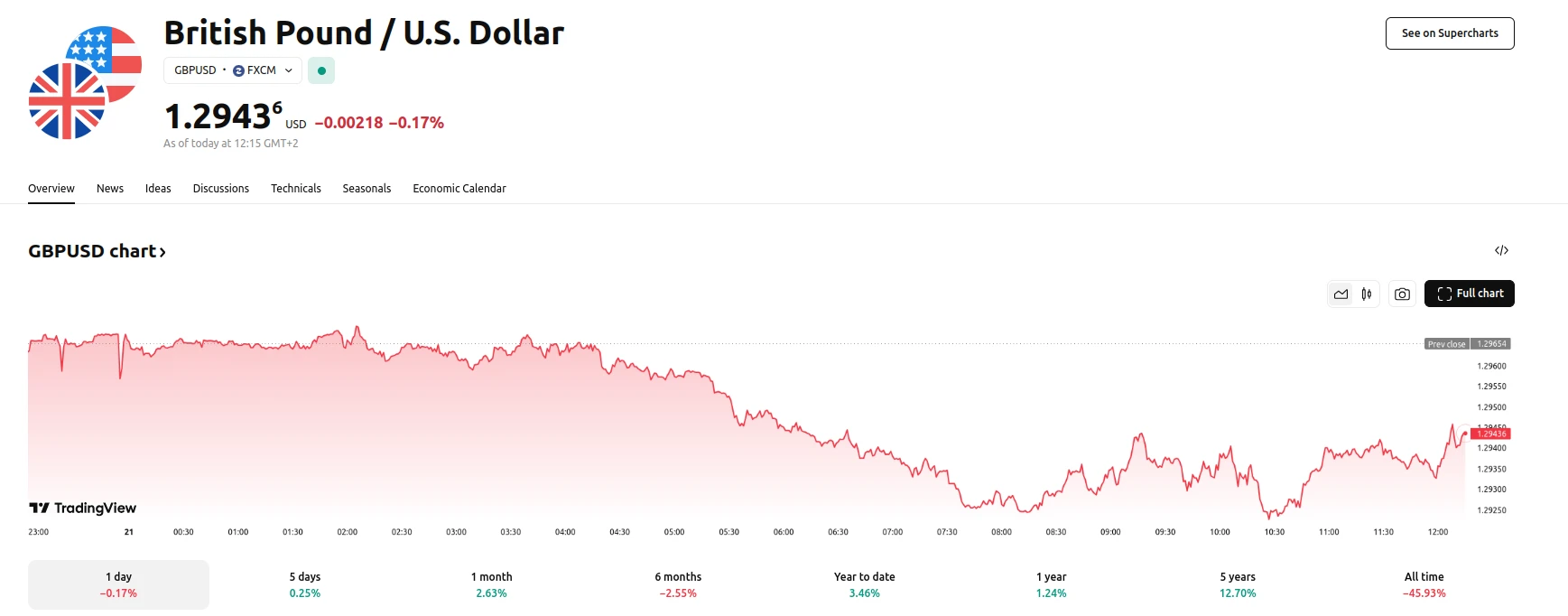

GBP/USD Day's Range 1.2921-1.2969 Amid Fed’s Unchanged Rate Policy

Key momentsThe value of the Pound Sterling decreased against the US Dollar, approaching 1.2920, due to the Federal Reserves decision to keep interest rates unchanged.Due to the Trump administrations p

Key moments

- The value of the Pound Sterling decreased against the US Dollar, approaching 1.2920, due to the Federal Reserve’s decision to keep interest rates unchanged.

- Due to the Trump administration’s policy implementations, the Federal Reserve has identified a notably high degree of uncertainty in the US economic forecast.

- Anticipation of reciprocal tariffs imposed by the US on April 2 contributes to a capped global risk appetite and strengthens the US Dollar.

Impact of US Monetary Policy and Trade Measures on GBP/USD Exchange Rate

The Pound Sterling (GBP) experienced a decline against the US Dollar (USD), falling to approximately 1.2920 during European trading hours. This movement is largely attributed to the strengthening US Dollar, which has been buoyed by growing expectations that the Federal Reserve will maintain its current interest rate levels. The US Dollar Index (DXY) has subsequently risen above the 104.00 resistance level, reflecting this strengthening trend.

An assessment of significant uncertainty regarding the US economic outlook led the Federal Reserve to maintain interest rates in the 4.25%-4.50% range This uncertainty is primarily linked to the implementation of significant policy changes by the Trump administration. Fed Chair Jerome Powell highlighted that the administration’s tariff policies could potentially drive inflation higher and negatively impact near-term economic growth. Despite these concerns, market indicators, such as the CME FedWatch tool, suggest a high probability that the Fed will maintain current interest rates in its upcoming May meeting, with a potential rate cut anticipated in June.

Furthermore, the anticipation of reciprocal tariffs, set to be imposed by the US on April 2, has contributed to a capped global risk appetite. These tariffs, which aim to equalize import and export tariffs with trading partners, are expected to have an unfavorable impact on global economic growth. This trade policy, combined with the Fed’s cautious stance, has strengthened the US Dollar and exerted downward pressure on the GBP/USD exchange rate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.