German IFO Index Hits 86.7, EUR/USD Recovers Above 1.0800 German IFO Index Hits 86.7, EUR/USD Recovers Above 1.0800

Key momentsOn Tuesday, the EUR/USD fell to approximately 1.0770.The euro managed to regain value, allowing the EUR/USD to once again breach the 1.0800 mark.Newly released data shows the German IFO Bus

Key moments

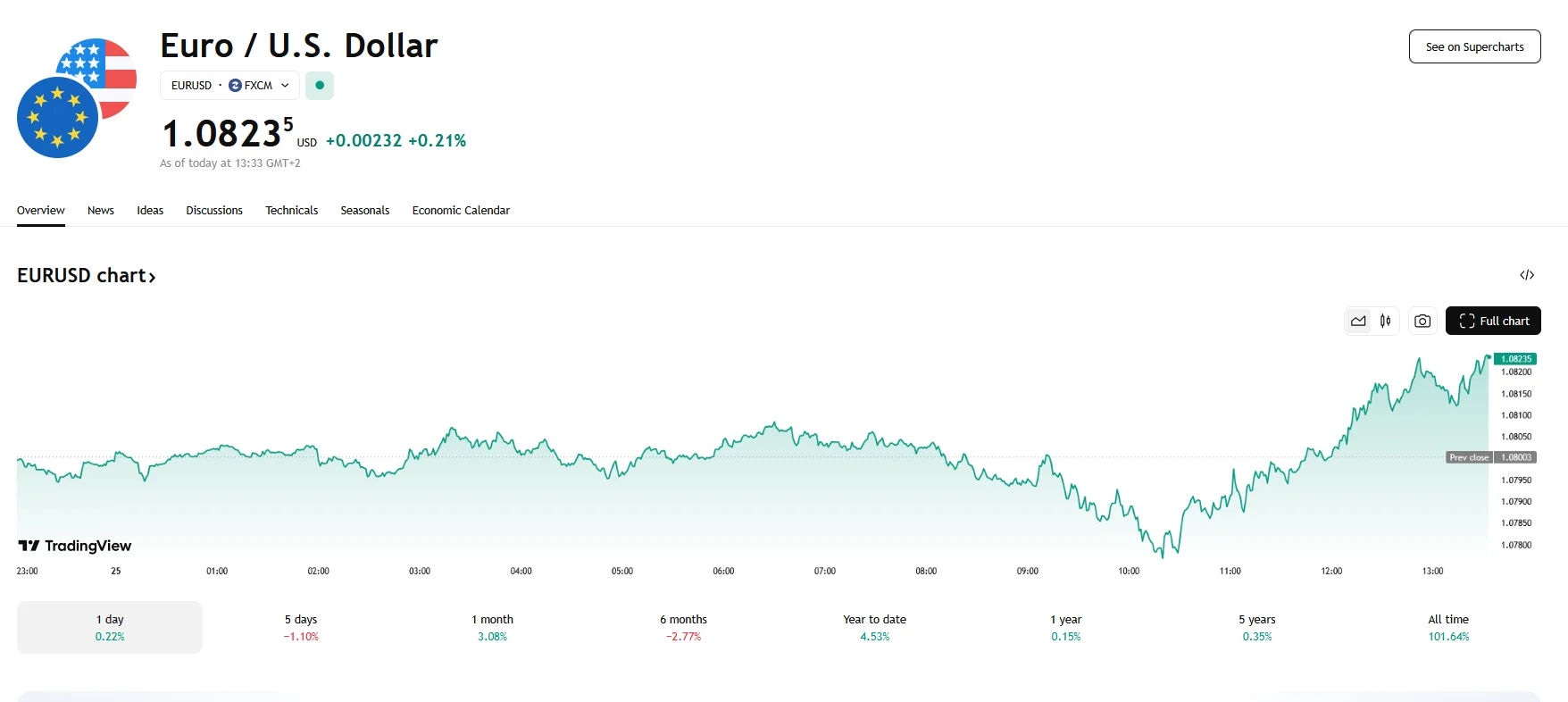

- On Tuesday, the EUR/USD fell to approximately 1.0770.

- The euro managed to regain value, allowing the EUR/USD to once again breach the 1.0800 mark.

- Newly released data shows the German IFO Business Climate index rose to 86.7 in March.

EUR/USD Climbs After Tuesday’s Sharp Decline

The EUR/USD currency pair experienced a volatile trading session, dipping below the 1.0800 threshold earlier today to reach a low of around 1.0776, before staging a notable recovery. The pair achieved a rebound of 0.21%, climbing above 1.0820. This fluctuation occurred amidst a complex interplay of economic data releases and shifting market sentiment.

The euro was influenced by a range of factors. Notably, the release of the German IFO Business Climate data for March revealed a mixed picture of Germany’s economic health. While the overall index improved to 86.7 from 85.3, it fell short of the anticipated 86.8. Similarly, the Expectations component, projecting the next six months, rose to 87.7 from 85.6 but failed to reach the forecasted 87.9.

Despite the initial downturn, the euro demonstrated resilience, regaining momentum and pushing the EUR/USD pair back above the 1.0800 level. This recovery coincided with a broader weakening of the U.S. dollar, which struggled to maintain its upward trajectory despite positive economic data from the United States. The preliminary U.S. S&P Global Services PMI for March, which showed a notable increase, did not provide sustained support for the dollar.

Market participants are also closely monitoring the European Central Bank’s (ECB) monetary policy. The ECB is widely expected to implement another interest rate cut in April, a move that could potentially exert downward pressure on the euro. However, last week’s statements by ECB President Christine Lagarde suggested that the impact of U.S. trade policies on inflation would be temporary. Lagarde’s assessment that lower economic activity would dampen inflationary pressures in the medium term has led some traders to reconsider their expectations of aggressive ECB easing.

Looking ahead, traders will continue to monitor economic data releases and central bank communications for further clues about the direction of the EUR/USD. The ECB’s upcoming policy decisions and the evolving trade landscape between the United States and the Eurozone will be key factors influencing the currency pair’s trajectory.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.