Fed's September interest rate decision: no surprises in suspending rate hikes Long-term rates may be higher

And this revision of the long-term interest rate undoubtedly confirms this view of the market, which is one of the most critical messages revealed in this rate resolution。

A no-surprise hikes pause。

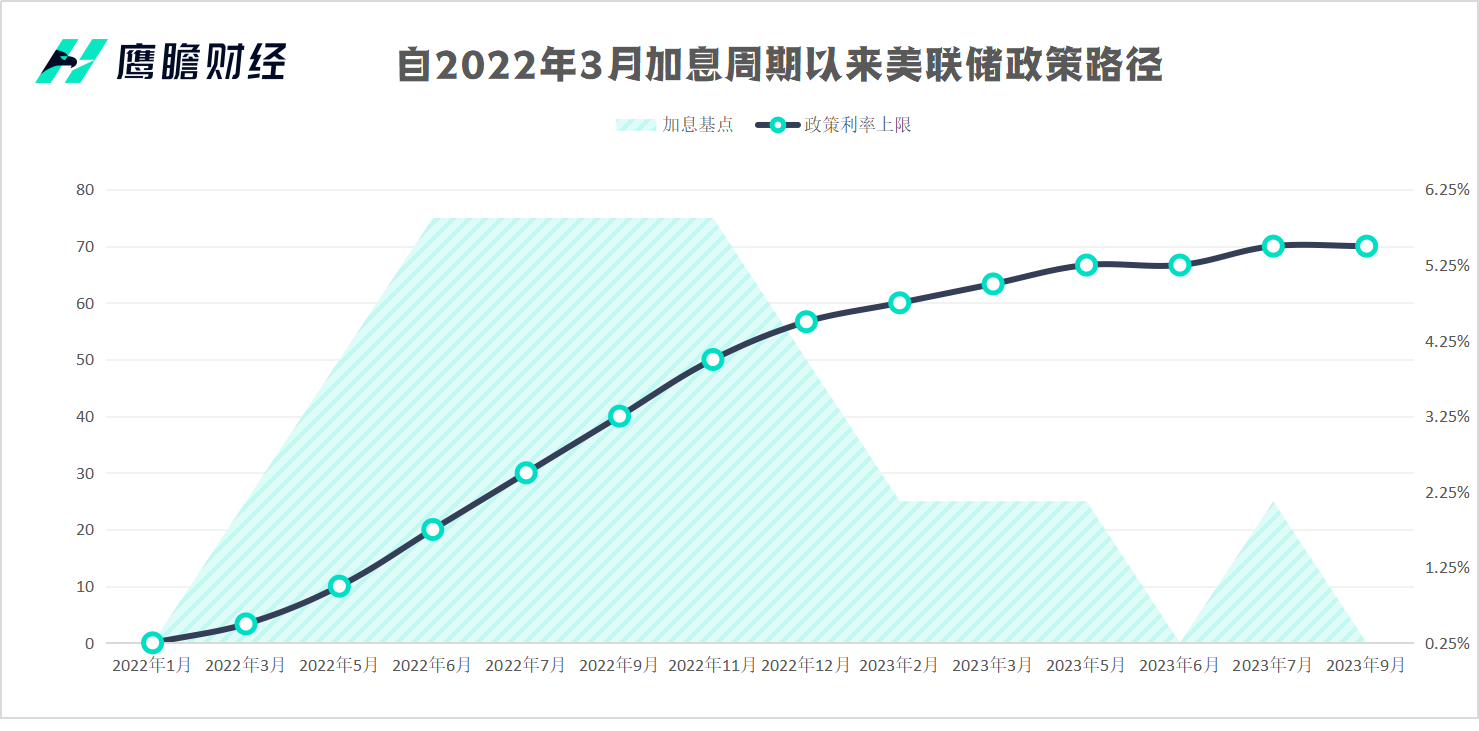

On September 20, local time, the Federal Reserve held its September meeting as scheduled, announcing that it would maintain the target range for the federal funds rate at 5.25% -5.5% range, the second suspension of interest rate hikes during the year, in line with market expectations。The interest rate is also the highest in nearly 22 years.。

Meanwhile, the Fed announced that it would keep the reserve requirement rate at 5.4% unchanged; hold overnight repo rate at 5.5% unchanged; will keep overnight reverse repo rate at 5.3% unchanged; maintain Tier 1 credit rate at 5.5% unchanged。In terms of tapering, the Fed will remain at its original size, passively reducing $60 billion of Treasuries and $35 billion of agency bonds and MBS each month.。

The rate resolution statement was little changed from July, with the only two changes: replacing the original "moderate" (moderate) with "solid" (solid) when describing the pace of economic growth, and replacing the original "continued strong" with "somewhat slower but remained strong" when describing job creation.。

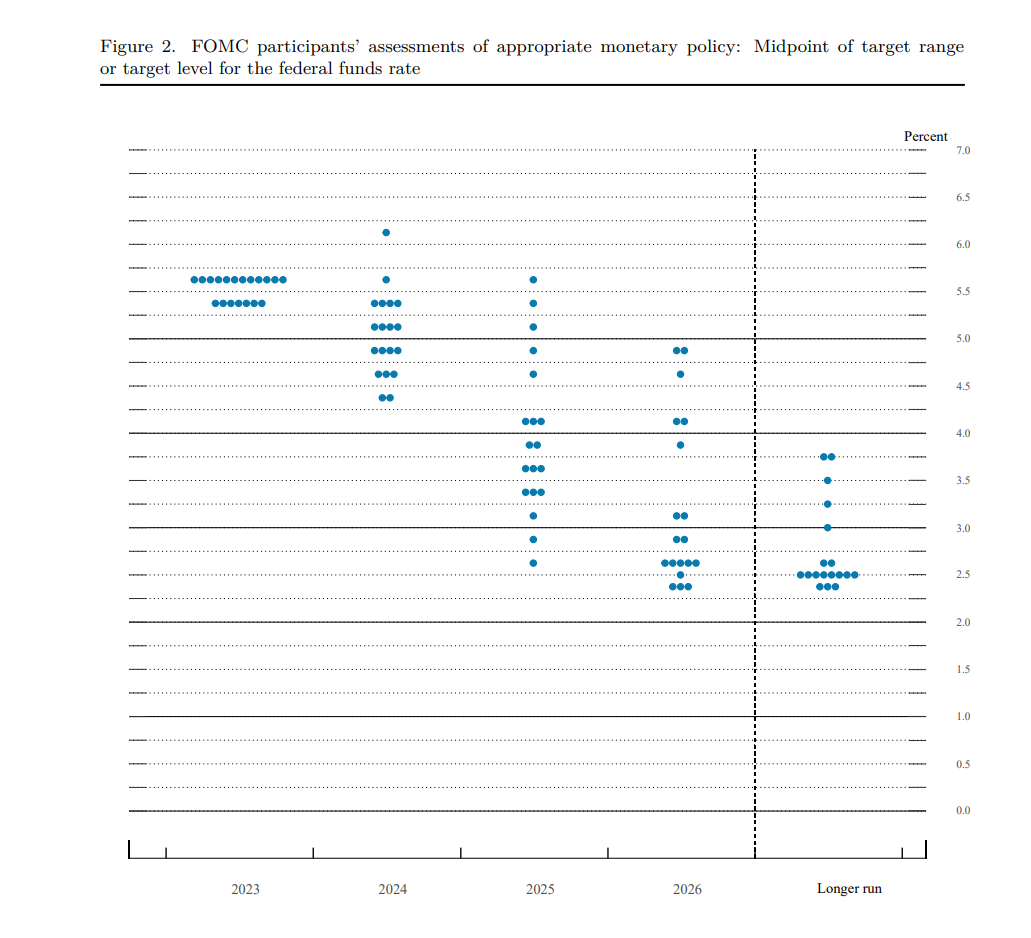

In addition, the resolution statement retained some of the key language on the path of interest rate hikes in the previous two statements, including that the Committee would continue to "assess additional information and its impact on monetary policy," without deleting the language of "additional policy confirming" and emphasizing that follow-up would take into account "the cumulative tightening of monetary policy, the lagging impact of monetary policy on economic activity and inflation, and developments in the economic and financial situation."。This suggests that the Fed has refused to signal that the rate hike cycle is over, as evidenced by the dot plot released with the resolution statement。

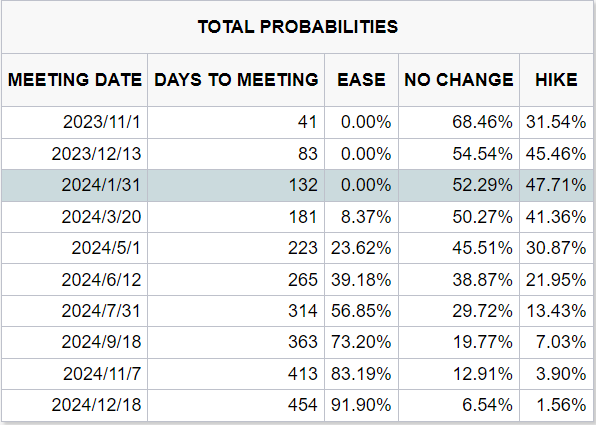

In fact, long before the start of the September meeting, markets were betting that the probability of the Fed holding down in September was as high as 99%, almost entirely pricing the Fed to skip rate hikes at this meeting。Because of this, other information released in the Fed's documents yesterday is even more worthy of market attention than the suspension of rate hikes itself.。

I. Dot matrix diagram

In terms of the latest interest rate expectations, Fed officials gave a median interest rate that was consistent in September and June, remaining at 5.6%。This suggests that the Fed will also raise interest rates once during 2023 by 25 basis points。According to the arrangement, the Fed will hold two more interest rate meetings during the year, in November and December.。For now, the market is pricing in a higher probability that the Fed will raise rates again in December。

In addition, according to Fed officials, the median interest rate in 2024 and 2025 will be 5.1% and 3.9%, a significant increase of 50 basis points, while maintaining long-term interest rates at 2.5%。The correction was interpreted by the market as a sign of an extreme eagle, as many economists had said before the meeting that the Fed's era of low interest rates would be gone and that the neutral rate could be higher in the future than in the past.。

And this revision of the long-term interest rate undoubtedly confirms this view of the market, which is one of the most critical messages revealed in this rate resolution。

In terms of the dot matrix, 12 of the 19 members involved in the forecast expect a year-end interest rate target range of 5.50% -5.75%, 7 are expected to stay put, only 1 more than in June, not much change。However, from the 2024 interest rate guidance, the median dot plot from the previous 4.5% -4.75% uplift to 5% -5.25% (i.e., a possible rate cut next year), and the dot plot distribution becomes smaller between regions, with a predicted minimum of 4.25% -4.10 of 19 officials believe that high interest rates of more than 5 per cent will still need to be maintained in 2024; the median interest rate in 2025 is also higher than the previous 3 per cent..25% - 3.5% up to 3.75% -4%。This suggests that the Fed's rate cut next year may be very limited。

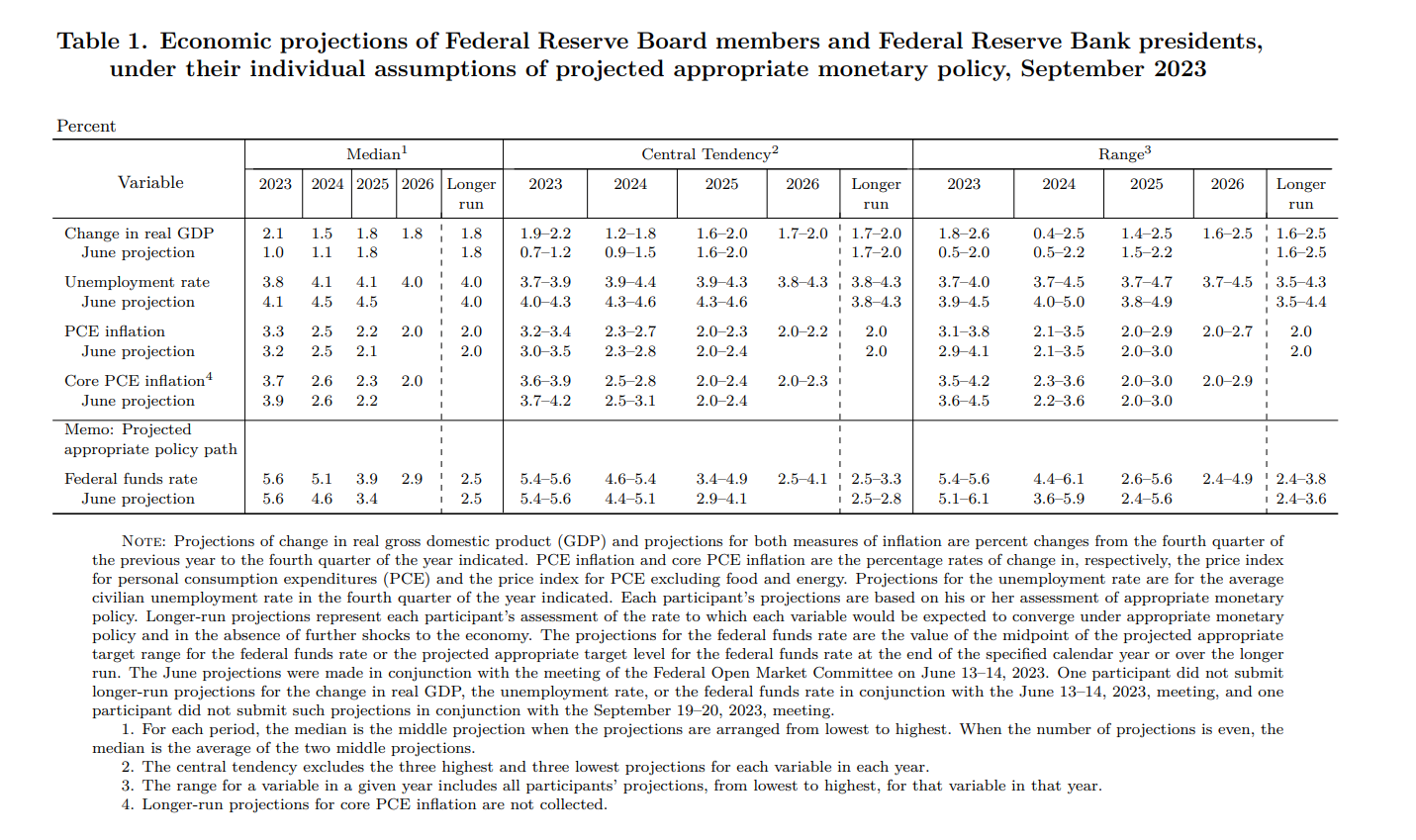

II. Economic Forecasting

In this document, Fed officials also significantly raised their expectations for the U.S. economic growth this year, the U.S. is not expected to have a recession in the short term, that is, a successful "soft landing."。In economic forecasts, officials expect U.S. GDP to grow by 2 percent this year.1%, more than double the June estimate。

In addition, officials have set U.S. GDP growth in 2024 from 1.1% up to 1.5%, and the growth rate will remain at 1 in 2025 and the long term..8%。

On the inflation front, officials raised the overall inflation level slightly in 2023, while the core PCE was revised downward, with PCE and core PCE levels expected to be adjusted to 3.3% and 3.7%。PCE inflation rate remained at 2 in 2024..5%, inflation rate revised to 0 in 2025.1 percentage point to 2.2%, long-term inflation 2.0% remain unchanged。

But meeting the Fed's 2% inflation target could take until 2026。

In terms of unemployment, the Fed expects the unemployment rate to be 3 in 2023..8%, compared with June repair 0.3 percentage points, unchanged from the latest non-farm report。Unemployment rate in 2024 and 2025 4.1%, under repair 0.4 percentage points, the long-term unemployment rate also remained at 4.0% unchanged。

After the expected data, Vanguard's senior economist Andrew Patterson said, combined with the Fed's increase in GDP expectations and lower unemployment expectations, the Fed is increasingly confident that a soft landing can be achieved, as well as the economy can withstand the impact of high interest rates for a longer period of time.。

III. Press Conference

At a press conference, Fed Chairman Jerome Powell said the FOMC decided to keep interest rates unchanged this time, given the progress the Fed has already made。However, keeping interest rates unchanged does not mean that the Fed has reached the restrictive position sought by the agency, and the Fed has not made a decision on whether interest rates are sufficiently restrictive。

Powell also said that in the future, the FOMC will continue to make decisions on a case-by-case basis and, if appropriate, be prepared to raise interest rates further - a statement that once again confirms that the Fed's rate hike cycle is not yet over。Powell revealed that most policymakers believe another rate hike this year is more likely to be appropriate。For now, the Fed's decisions will be based on data and risk assessments, the Fed will be careful, and officials want to be careful not to jump to any conclusions.。

On the key concept of "neutral interest rate," Powell said, mainly because the U.S. economy is performing strongly, so higher interest rates are needed.。In subsequent questions, the Fed chairman acknowledged that the (current) neutral rate is likely to be higher than the long-term rate, largely due to the lagged effects of monetary policy。When talking about why the U.S. economy is better than expected, he also explained that it may be because "neutral interest rates are higher than expected."。

Attributing the resilience of the U.S. economy to the possibility that the neutral rate may be higher than market perceptions is another hawkish remark that the Fed may have more room to raise rates。

For the only rate hike left in the year, Powell said the Fed's decision at the two meetings will depend on the combination of all the data - not admitting or denying, very much in line with the Fed chairman's usual style.。

Of course, this also suggests that the Fed will rely more on data in the future.。

On inflation governance, Powell said there is still a long way to go to reduce inflation to 2%, but it is reassuring that long-term inflation expectations remain well anchored。He says he's very aware that high inflation is causing people significant hardship。Fed has ability to move cautiously as inflation target nears。

Attached: Full text of the Federal Reserve's September interest rate resolution statement

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.