Superstar legend today's IPO: new retail and build IP as the core business value "bundle" Jay Chou?

On May 31, Superstar Legend Group Limited (listing name: Superstar Legend) announced its prospectus on the HKEx.。According to the announcement, the company will open the public offering in Hong Kong at 9: 00 a.m. on May 31, 2023 (Wednesday) and close the subscription on June 5, 2023 (Monday)。

On May 31, Superstar Legend Group Limited (listing name: Superstar Legend) announced its prospectus on the HKEx.。According to the announcement, the company will open the public offering in Hong Kong at 9: 00 a.m. on May 31, 2023 (Wednesday) and close the subscription on June 5, 2023 (Monday)。

According to the documents, the superstar legend proposed to issue about 1.2.7 billion shares, of which 1,266 were publicly offered.40,000 shares (10%), international offering of approximately 1.1.4 billion shares (90%) at issue price of 5 per share.5-6.HK $3, 500 shares per lot, expected to list on June 13。

Company Profile

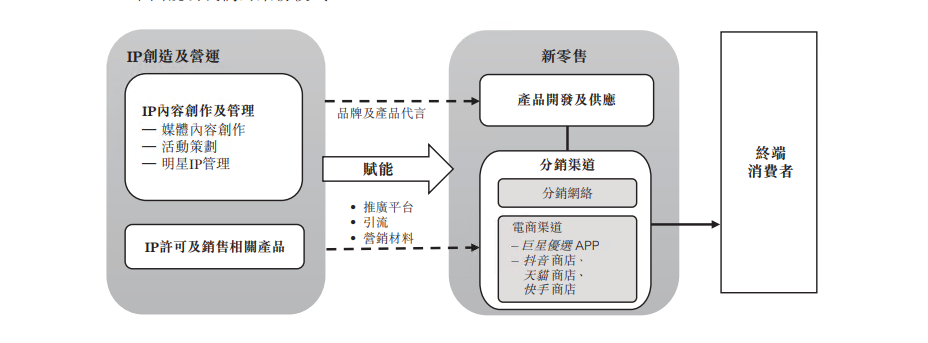

The prospectus shows that Superstar Legend's business consists of two main areas, new retail, IP creation and operation, and its IP creation and operation business can be used as one of the marketing tools to promote its new retail products.。

Specifically, the company's business model is to develop and bring suitable products to market; establish a sales network, including an extensive distribution network and e-commerce channels; collaborate with stars on IP content creation; and use the company's star IP and related IP to market and promote its products in conjunction with other sales and marketing strategies and activities.。

New retail business, the company focuses on the sale of low-carb health management products and skin care products。During the Track Record Period, the Company's new retail business generated revenue primarily from the sale of Marvel Coffee (a bulletproof beverage, a high-fat beverage designed for low-carbon water diet plans).。The coffee has been distributed nationwide since April 2019, and in 2021 the company will be the largest company in China's bulletproof beverage market by total merchandise turnover, with a market share of 25.6%。

With the success of Magic Coffee, Superstar Legend has launched a number of other low-carbon water drinks and foods under the Konoketone brand, further reflecting the strategy of the low-carbon water health management product portfolio.。In 2022, the company will also launch a new product line featuring healthy and additive-free food, matcha powder, which loves to eat fresh tea.。In addition, the company has launched a number of product sub-brands in the skincare market, including Dr. Muscle and Miss Tea.

IP creation and operation business, including media content creation, event planning, star IP management services and IP licensing.。

In terms of media content creation, the company is the main creator and owner of the reality show Travel Week I starring Mr. Jay Chou, and is preparing to launch Travel Week II, which is expected to be broadcast in the second half of 2023, a music talk show with Mr. Yu Chengqing as the core, and a variety show with Mr. Liu as the core.。

In terms of event planning, the company usually acts as an event planning service provider, investor and / or subcontractor for large concerts and other events.。For example, Zhanjiang Superstar Concert in August 2019 and Ningbo Superstar Action Super Night in January 2020。

In terms of star IP management services, the company mainly has Mr. Jay Chou, Mr. Liu and Ms. Wang's second-dimensional style incarnation of "Zhou," "Coach Liu," "Vivi" and so on.。The company has established long-term mutually beneficial relationships with Mr. Jay Chou, Jewell Music and Archstone.。

Market Size and Directors

Market size of China's new retail market from 2017 to 2021 at a CAGR of 160.8% to RMB 1.8 trillion yuan。The new retail market is developing rapidly and will further penetrate the Chinese retail market in the foreseeable future..1% CAGR growth。China's new retail market is expected to reach RMB 4 by 2026..9 trillion yuan, a record high。

In terms of total merchandise transactions, China's social e-commerce industry has grown significantly over the past few years, reaching approximately RMB4,464.1 billion in 2021, compared to RMB362.7 billion in 2016, a compound annual growth rate of 65.2%。According to data from Insight Consulting, the industry is expected to maintain a compound annual growth rate of 15.0% growth, which will reach RMB8,981 billion by 2026。

It's worth noting that the superstar legend board is almost all related to singer Jay Chou。According to the document, the company's board of directors consists of eight directors (three executive directors, two non-executive directors and three independent non-executive directors) and seven members of senior management.。These include Ms. Ma Xinting, Jay Chou's longtime business partner, Mr. Yang Junrong, CEO of Jewell Music and Jay Chou's agent, and Mr. Chen Zhong, a brokerage firm executive and concert partner, with Mr. Fang Wenshan, a well-known lyricist who has long worked with Jay Chou, as Chief Cultural Officer of Superstar Legends.。

Financial Overview

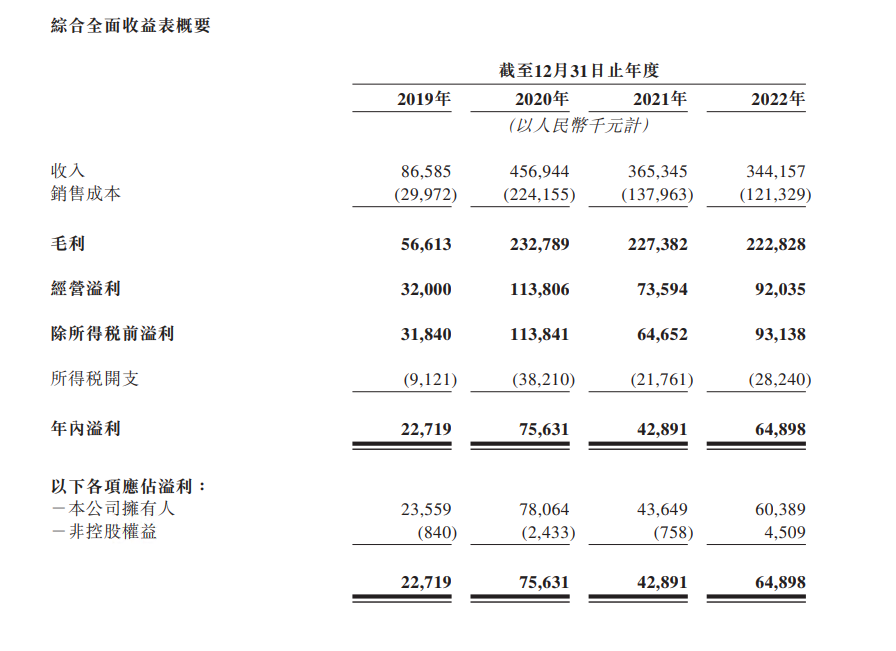

The prospectus shows that Superstar Legends' 2019-2022 revenue for the year ended December 31 was 86.6 million, 4.56.9 billion, 3.65.3 billion and 3.44.2 billion yuan (RMB, the same below), with a CAGR of approximately 58.4%; profit for the year was 2271, respectively..90,000, 7563.10,000, 4289.10,000 and 6489.80,000 yuan, with a compound annual growth rate of about 41.9%。

Funding purposes

Based on the median range of the prospectus offering (5.HK $9) It is estimated that Superstar Legends will receive a net proceeds from the Global Offering of approximately 3.HK $69.5 billion。of which about HK $72.2 million (22% of the total.2%) will be used to diversify the product portfolio; approximately HK $82.3 million (22% of the total.3%) will be used to increase brand exposure and product sales through MCN, including cooperation with selected top KOLs to develop proprietary live accounts; approximately 1.HK $3.8 billion (37% of total.3%) will be used to create unique star IP and related IP content, including media content and large-scale concerts; approximately HK $30.2 million (8% of the total amount.2%) will be used to upgrade the company's IT infrastructure and increase investment in IT development; approximately HK $37 million (10% of the total amount.0%) will be used for working capital。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.