The Fed raised interest rates by 25 basis points as scheduled and may continue to raise rates in the fourth quarter.

As the Fed's rate hike has been almost completely priced by the market, until the policy conference before the Fed released a positive, the rate hike has hardly caused any waves in the market。

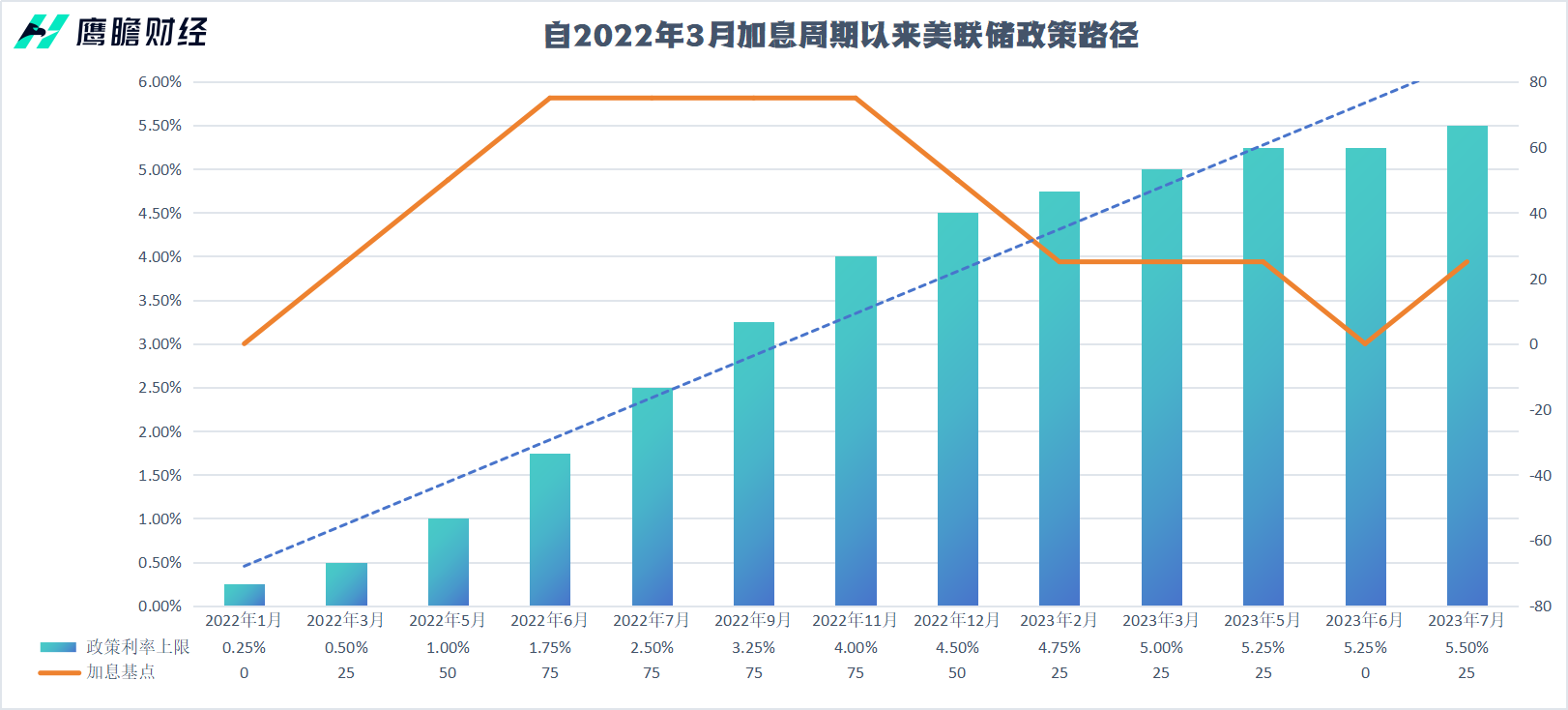

As expected, after a one-month pause in rate hikes, the Fed reopened its rate window in July, raising its benchmark interest rate by 25 basis points to 5.25% -5.50% interval。

The Fed raised interest rates by 25 basis points as scheduled. The market was untroubled.

The rate hike is the Fed's 11th since March 2022, and the benchmark interest rate ceiling has surpassed its pre-Lehman crisis peak and is the highest range since before the dotcom bubble burst in March 2001.。From this perspective, the market witnessed history yesterday。However, as the Fed's rate hike has been almost completely priced by the market, until the policy conference before the Fed released a positive, the rate hike has hardly made any waves in the market。

In addition to the benchmark interest rate, the Fed yesterday announced other policy rate moves: raising the reserve requirement rate to 5.4%; increase the overnight repo rate to 5.5%; increase the overnight reverse repo rate to 5.3%; increase the primary credit rate to 5.5%。In terms of tapering, the Fed said it would maintain its original plan to passively scale back $60 billion of Treasuries and $35 billion of agency bonds and MBS each month.。

From the FOMC statement released after the meeting, the wording of the meeting and last month compared to almost no change, only one noteworthy change, that is, for the current economic growth judgment, the Fed from moderate (modest) to moderate (moderate)。Some analysts say this may mean that the Fed is more optimistic about the economic situation。

In the economic and policy description section, the Fed still retains some of the key language from the June meeting statement, including that the Committee will continue to "assess additional information and its impact on monetary policy," retain the reference to "additional policy consolidation," and emphasize that follow-up actions will take into account "the cumulative tightening of monetary policy, the lagging impact of monetary policy on economic activity and inflation, and developments in the economic and financial situation."。

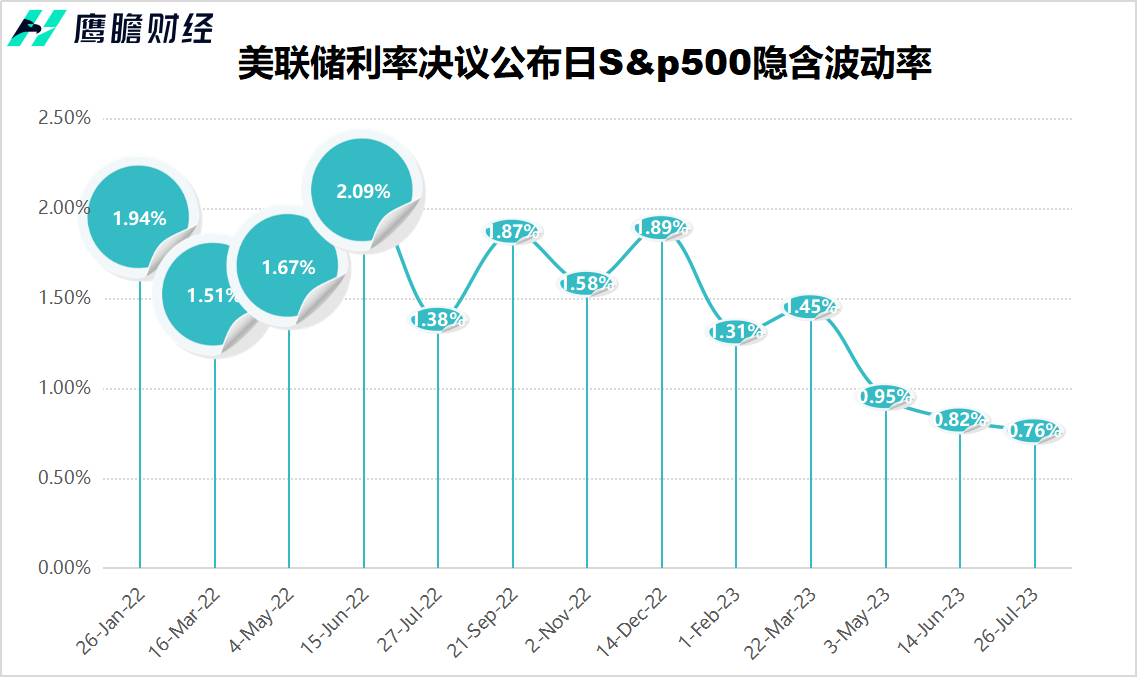

After the interest rate hike boots landed, the dollar, U.S. debt almost unchanged, financial markets fell only slightly narrowed, and even the implied volatility of the S & P 500 index is the smallest in the Fed's interest rate decision day since 2021, which can be called the quietest rate hike in recent times.。

That didn't change until Fed Chairman Jerome Powell held a press conference.。In fact, with the July rate hike already almost fully priced in, the market may even be taking this press conference more seriously than the rate decision itself。

"Skip" September rate hike?The Fed may turn its attention to the fourth quarter

At the press conference, Powell did not forget to stand for the Fed's protracted rate hike action, which is also its "standard procedure" for every press conference.。Powell said: "My colleagues and I remain focused on our dual mission - to promote maximum employment and stable prices for the American people.。We understand the difficulties caused by high inflation and we remain firmly committed to our goal of reducing inflation to 2 per cent.。Price stability is the Fed's job。Without price stability, the economy doesn't work for anyone。More importantly, without price stability, we cannot achieve a consistently strong labor market that benefits all.。"

He continued: "Since the beginning of last year, the Federal Open Market Committee (FOMC) has significantly tightened its monetary policy stance.。Today, we took another step forward by raising the policy rate by 0.25 percentage points and continued to rapidly reduce securities。Despite the measures we have taken in many areas, the full impact of our austerity has yet to be felt.。Looking ahead, we will continue to decide whether we will introduce further measures based on changes in the data.。"

For his interpretation of inflation, he remains as cautious as ever。In the case of recent inflation data, the Fed chairman still said that since the middle of last year, inflation has eased, but to reach the Fed's 2% target "still has a long way to go."。

As the Fed in this policy statement mentioned "additional policy consolidation" of the words, a reporter asked Powell questions, said whether such language means that the Fed has further interest rate hike plans?On this issue, Powell said that future decisions are made on camera, on a case-by-case basis, and that the Fed will keep asking itself the same questions throughout the process。

Powell also stressed that although the June inflation data has fallen, but this is only "a reading," the Fed needs to see more data。For future monetary policy, he said there are two jobs and inflation reports before the next meeting, and the Fed may raise interest rates or keep them unchanged.。The passage was also seen by the market as Powell's suggestion that the Fed might skip its September rate hike and turn its attention to the fourth quarter。

Due to the weakening of the base effect, it is theoretically possible that inflation will indeed rise at the end of the year in the United States, which means that the Fed may raise interest rates once more at its two policy meetings in November and December this year.。

In addition, according to the CME FedWatch as of the Fed meeting, the probability of the Fed raising interest rates at least once at its September and November meetings is 42%, with the probability of no increase in September and another increase in November being 19.2%, higher than September plus but November without probability 16.8%。

Subsequently, the so-called "Fed mouthpiece" veteran reporter Nick Timiraos (Nick Timiraos) asked Powell, said inflation needs to fall back to what extent, the Fed will consider stopping rate hikes。On this issue, Powell began to play Tai Chi, he declined to disclose the specific assessment criteria, adding that the Fed will look at the overall inflation situation, but also look at a lot of data (in addition to inflation)。

The reporter asked sharp questions, and Powell was somewhat overwhelmed.

As the conference progressed, Powell also encountered some slightly pointed questions, with reporters at the conference publicly questioning the logic of the Fed's June rate hike。Such views roughly say that the Fed's decision in June to suspend interest rate hikes, employment and inflation data is still strong, but in July decided to continue to raise interest rates by 25 basis points, the background is the inflation data more than expected to fall, whether this is somewhat contradictory?

For this issue, Powell slightly embarrassed。According to reports, he initially mentioned the possibility of raising interest rates only once every 2-3 meetings, but immediately changed his tune to say that the Fed is not able to provide much forward guidance at this stage and that every future meeting is brand new.。He also did not fully respond positively to questions about this, except to say that at each meeting officials had more or less different views, and that the Fed's decision as a whole (broadly), rather than perfectly (perfectly), was in line with the current economic situation.。

Some reporters also focused on the question of when the window for future rate cuts will open, and Powell did not deny the possibility of a rate cut next year, although he avoided talking too much about the future at his press conference.。Powell hinted that the Fed would consider lowering interest rates from the current restrictive level (restrictive level) to the neutral level (neutral level) at an appropriate time, and that this shift will not wait until the absolute level of inflation at 2%, because this "may take until 2025 to see."。

After Powell's speech, the market remained two-way volatile and volatile.。The Dow rose 82 on Wednesday, driven by expectations that the Fed may suspend interest rate hikes in September.05, to 35,520.12 points, up 0.23%, recording a 13-day gain, the best consecutive gain since 1987, while the S & P 500 edged down 0.02%, at 4,566.75 points; Nasdaq composite down 0.12%, to 14,127.28 points。

Attached: Full text of the Fed's July FOMC statement.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.