Chainlink (LINK) Large Investors Refrain From Selling Holdings: Price Impact

Chainlink (LINK) large investors await a price rebound as they reduce their netflow to cryptocurrency exchanges.

- Chainlink (LINK) large investors have significantly reduced their netflow to exchanges.

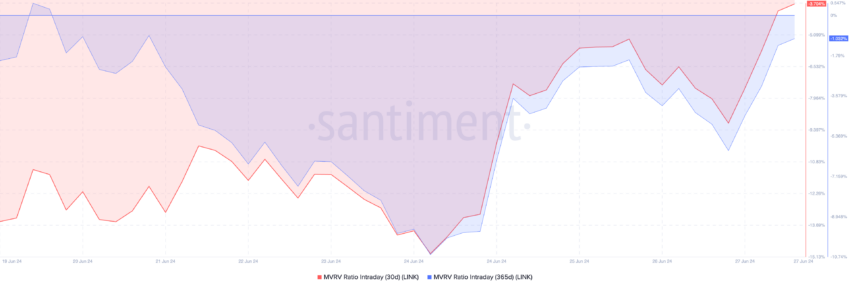

- LINK’s Market Value to Realized Value (MVRV) ratios suggest a potential buying opportunity.

- If large investors continue to hold and others accumulate more tokens, LINK's price could rally to $15.17.

The last month has been marked by a decline in Chainlink’s (LINK) large holder netflow to exchanges. This means that the altcoin major holders have only sent a small portion of their holdings to exchanges for sale.

This is attributable to the LINK’s current price performance. As of this writing, the altcoin trades at $14.31. Its value has dropped by 21% in the last month.

Chainlink Whales Await Rally

As LINK’s price drops, the netflow from its whales to cryptocurrency exchanges has also decreased. In the past 30 days, this has fallen by 110%.

As of this writing, LINK’s large holder netflow to exchanges to exchange netflow ratio is -0.06%.

This metric measures the proportion of cryptocurrency transferred from whales to exchanges relative to the total exchange netflow. When its value is negative, it means that only a smaller portion of large investor holdings are being sent to exchanges.

This may be read as a bullish signal, suggesting that large investors are accumulating and not selling their assets.

According to the token’s market value to realized value (MVRV) ratio, now might be a good time to buy for cohorts of LINK holders anticipating a rebound.

As of this writing, the token’s MVRV Ratios assessed over 30-day and 365-day moving averages are -3.7% and -1.0%, respectively.

Read More:What Is Chainlink (LINK)?

This metric tracks the ratio between an asset’s current market price and the average price of every coin or token acquired for that asset.

When its value is negative like this, the market price of the asset in question is less than the average purchase price of all its tokens in circulation.

This is viewed as a buy signal because it means that the asset trades at a discount relative to its historical cost basis.

LINK Price Prediction: Price Will Grow if Investors Seize the Buying Opportunity

If LINK whales continue to refrain from selling, and other investors take advantage of the current dip in the altcoin’s value, its price may rally to $15.17.

However, if the price decline continues, LINK’s price may fall under $13.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.