Minutes of Fed's July meeting released: under restrictive interest rates, a realistic version of the Big Short is about to play out?

On Tuesday, Kiyosaki said in a television interview, "Buffett is sitting on the sidelines with $147 billion, and his money is on short-term U.S. Treasuries.。Big Short's Michael Bury is now shorting the market。"

Local time on August 16, the Federal Reserve released the Federal Open Market Committee (FOMC) July 25-26 monetary policy meeting minutes, due to the bank's policy action in September is not conclusive, the market remains highly concerned about the minutes。

Judging from the minutes of the previous two meetings, the Fed hawked in the document。In the minutes of the May meeting, Fed officials agreed in their discussions that inflation continued to be too high, core inflation fell too slowly, and core non-housing inflation remained largely unchanged.。

In June, while the U.S. symbolically paused the rate hike window, the Fed's Super Eagle dot plot unleashed no less power than a single rate hike。In this panic, the Fed still said in the minutes of the meeting that although it has foreseen the economic slowdown that will be brought about by high interest rates, it still believes that the current level of inflation is too high and needs to continue to raise interest rates.。

After the storms of May and June, there have been a number of comments that the Fed's insistence on raising interest rates is likely to lead to an early recession in the U.S. economy。

According to the official dot plot given by the Fed in June, the bank will also raise interest rates once during the year。Currently, according to CME Fed Watch, the probability of the bank holding down in September is as high as 86.5%。If you skip September, there are two interest rate meetings in November and December for the Fed to choose from.。

If the Fed does raise rates by another 25 basis points during the year, the U.S. policy rate will come to 5.50% to 5.75% interval。

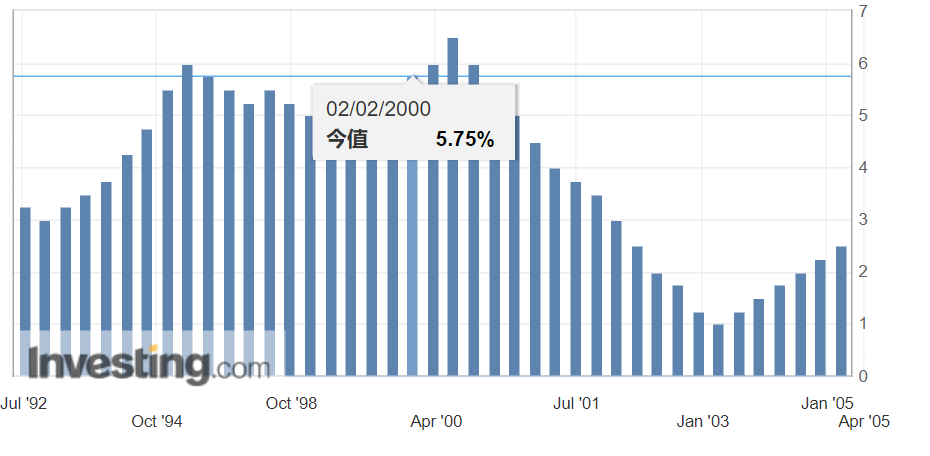

The last time the Fed's rate hike cycle touched this range, dating back to 1999-2000。At the time, the U.S. federal funds rate ceiling target was from 4.75% to 6.50%, six consecutive increases over 11 months, with a cumulative net increase of 175 basis points。

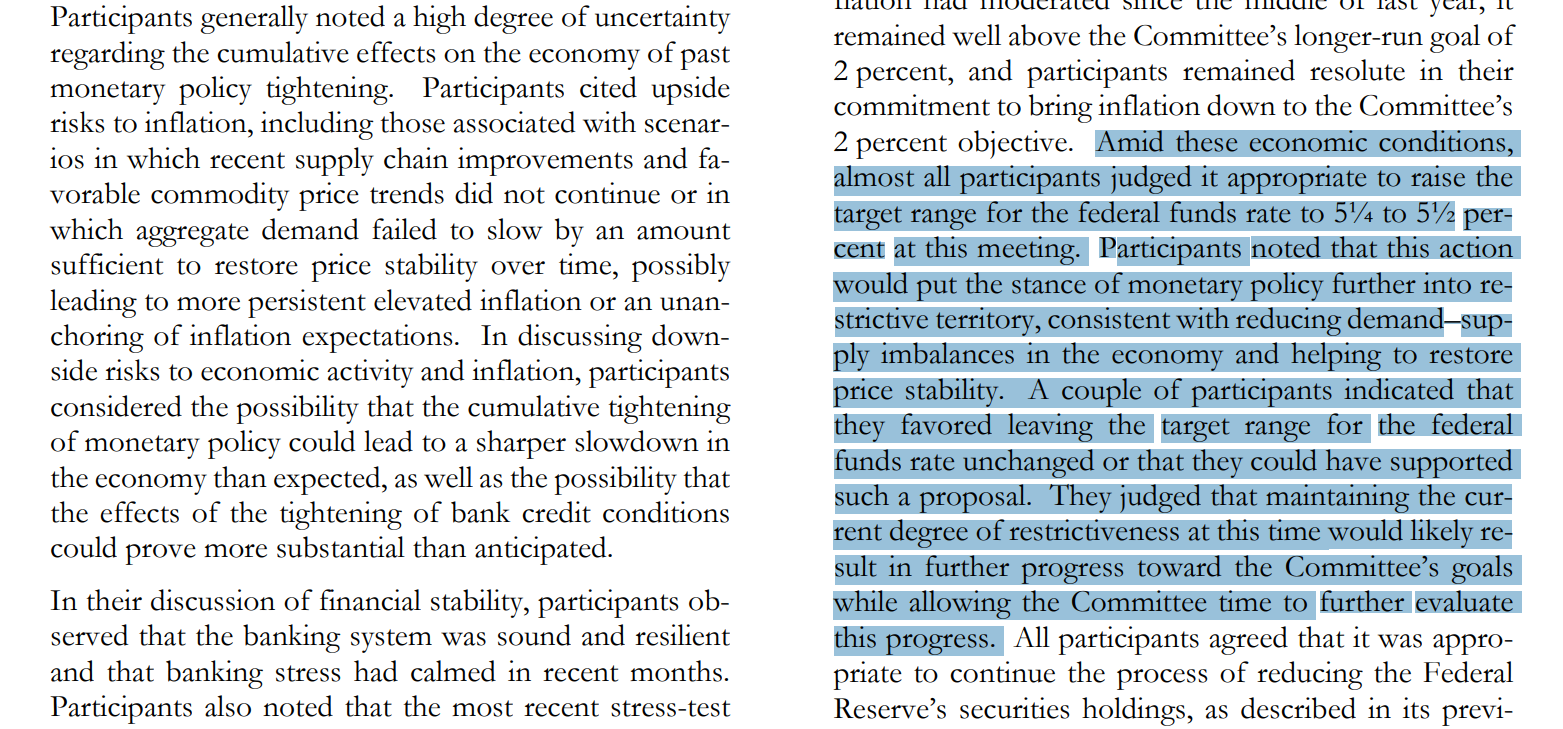

Fed's July meeting: two people prefer interest rates unchanged

Fed officials remain wary of inflation, according to the minutes of this meeting。In their eyes, inflation remains well above the Committee's long-term target and the labor market remains tight.。

It is worth noting that in the wording, the minutes showed that "the majority of participants continued to believe that there are significant upside risks to inflation, which may require further tightening of monetary policy," indicating that there were also officials at the meeting who expressed different views.。According to the minutes, the Fed announced a 25 basis point rate hike on July 26, and the 11 members of the FOMC voted unanimously to raise rates, but the decision did not win the support of all participants, two of whom preferred to keep rates unchanged.。

This may indicate that some Fed officials have realized that the risk of raising interest rates too high is gradually increasing, the Fed is now in the restrictive interest rate range, every step forward needs to be extra cautious.。

in assessing the economic outlook, officials attending the meeting noted that real gdp growth continued to show resilience in the first half of this year and the economy has been showing considerable momentum。However, economic activity appears to be gradually slowing, consistent with the dampening of demand from the cumulative tightening of monetary policy since the beginning of last year and the related impact on financial conditions.。Inflation remains unacceptably high and further evidence is needed to convince them that inflation is moving towards the Committee's 2% target.。

It was also noted that, despite recent favourable developments, inflation remained well above the Committee's long-term target of 2 per cent and that rising inflation continued to hurt businesses and households, particularly low-income households。Participants stressed that the Committee needs to see more data on inflation and further signs that aggregate demand and aggregate supply are moving towards a better balance to be confident that inflationary pressures are weakening and that inflation is expected to return to 2 per cent over time.。

On the inflation front, participants believe that aggregate and core price inflation rates for PCE will decline over the next few years.。Most of the decline in core inflation is expected to occur in the second half of 2023, with forward-looking indicators suggesting that the pace of growth in housing service prices will slow, and core non-housing service prices and core commodity prices are expected to slow for the remainder of 2023.。As the imbalance between supply and demand continues to be resolved, inflation is expected to ease further in 2024; by 2025, total PCE price inflation is expected to reach 2.2%, core inflation is expected to be 2.3%。

Previously, according to China Merchants macro forecast, due to the slowdown in housing inflation and energy inflation upward, the U.S. core CPI and the overall CPI may diverge in the follow-up trend, the U.S. core CPI or will quickly decline, in the end of this year to early next year or fall to near 2%。

This statement is currently supported by David Kelly, chief global strategist at Morgan Asset Management.。The expert is convinced that U.S. inflation will fall back to 2 percent on its own by the end of next year。

The reality version of "Big Short" will be staged again?

High Fed restrictive interest rates have weighed on U.S. stocks to some extent, especially after better-than-expected retail sales data in July, raising concerns that an overly resilient U.S. economy will increase the amount of time the Fed will keep interest rates high, while pushing up U.S. bond yields and depressing the market.。

Some economists have expressed their concerns.。Quincy Krosby, chief global strategist at LPL Financial, said: "In this case, the good news is actually bad news, and Tuesday's data hit the already sensitive Treasury and equity markets.。"

In addition, Deutsche Bank analyst Allen (Henry Allen) also said: "The actual cost of borrowing is still becoming more and more limited.。The Fed's maintenance of restrictive policy for longer is the main factor in higher yields, and the market will continue to reassess the path of monetary policy in a more 'hawkish' direction.。"

There are also some Wall Street figures who are taking action to show that they may be gradually withdrawing from the market after the strong performance of U.S. stocks in the first half of this year, including two well-known figures: investment legend Warren Buffett (Warren Buffett) and the movie "Big Short" prototype character Bury (Michael Burry)。

Recently, according to media reports, the best-selling financial book "Rich Dad, Poor Dad" author Kiyosaki (Robert Toru Kiyosaki) believes that Buffett and Burry's recent series of operations show that they are preparing for the collapse of U.S. stocks.。

On Tuesday, Kiyosaki said in a television interview, "Buffett is sitting on the sidelines with $147 billion, and his money is on short-term U.S. Treasuries.。Big Short's Michael Bury is now shorting the market。He added: "I just watch these people wait for the market to crash and then go back.。There's a lot of money on the sidelines right now.。"

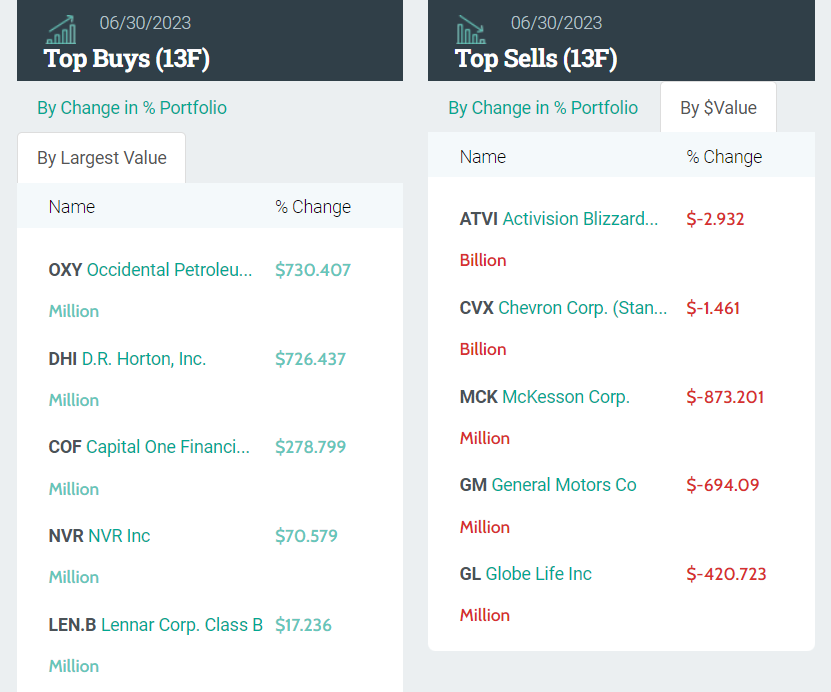

According to Buffett's Berkshire Hathaway's latest Q2 13F report, the company sold a net $8 billion worth of shares in the second quarter and slowed the pace of buybacks。This boosted its total cash and Treasuries by 13% to a near-historical peak of $147 billion.。

According to Kiyosaki, Buffett is likely to be bearish on U.S. stocks, which is why he hoarded a lot of cash in the second quarter。It is also possible that, as an investor who has always pursued value investing, Buffett did not find a worthy target to intervene during the reporting period before investing heavily in U.S. short-term Treasuries.。It's just that in the current situation, whatever situation Buffett is facing, it's not good news for the market.。

As for Bury, he has repeatedly warned that U.S. stocks are in a historic bubble and predicted a crash the size of "the mother of all crashes" would occur.。

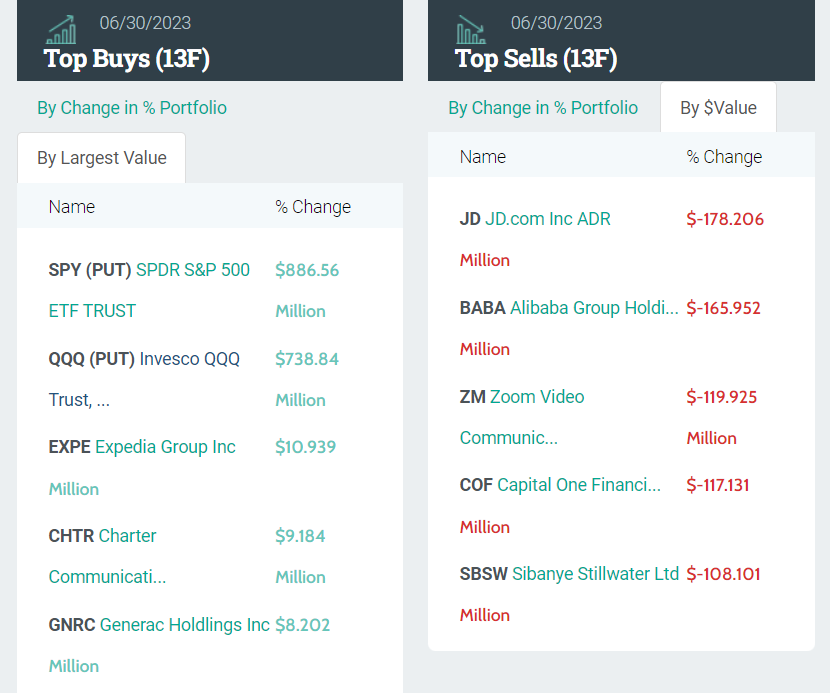

In the second quarter of this year, the Scion Asset Management fund he manages aggressively bought put options on ETFs that track the Nasdaq 100 in the market, as well as put options on ETFs with a nominal value of 8.$8.6 billion bought put options on the SPDR S & P 500 ETF。

The so-called put option refers to the right to give investors the right to sell securities at a fixed price in the future, for example, if the NASDAQ 100 and S & P 500 are oversold in the future, Bury still has the right to sell these assets at the price specified in the option contract, locking in his own losses, so the purchase of put options is usually considered to be an investor's expression of a bearish or defensive view.。

Not only did he buy put options, Bury also accelerated his exit in the second quarter。According to a 13F report disclosed on Monday local time, Scion Asset Management has emptied most of its shares in U.S. regional banks, in addition to two companies, Alibaba and Jingdong.。It's worth noting that these two stocks were still on Bury's mind last quarter, and at one point were heavily overweight, becoming their top two heavyweights。

This radical exit, is it a real-life version of "The Big Short" that will be staged again??

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.