Bitcoin Stable Above $81,000 Bitcoin Stable Above $81,000

Key momentsBitcoin’s price has recovered to $81,726.Earlier, the coin rose even higher to around $83,468.Crypto enthusiasts’ optimism can be traced back to an announcement issued by President Donald T

Key moments

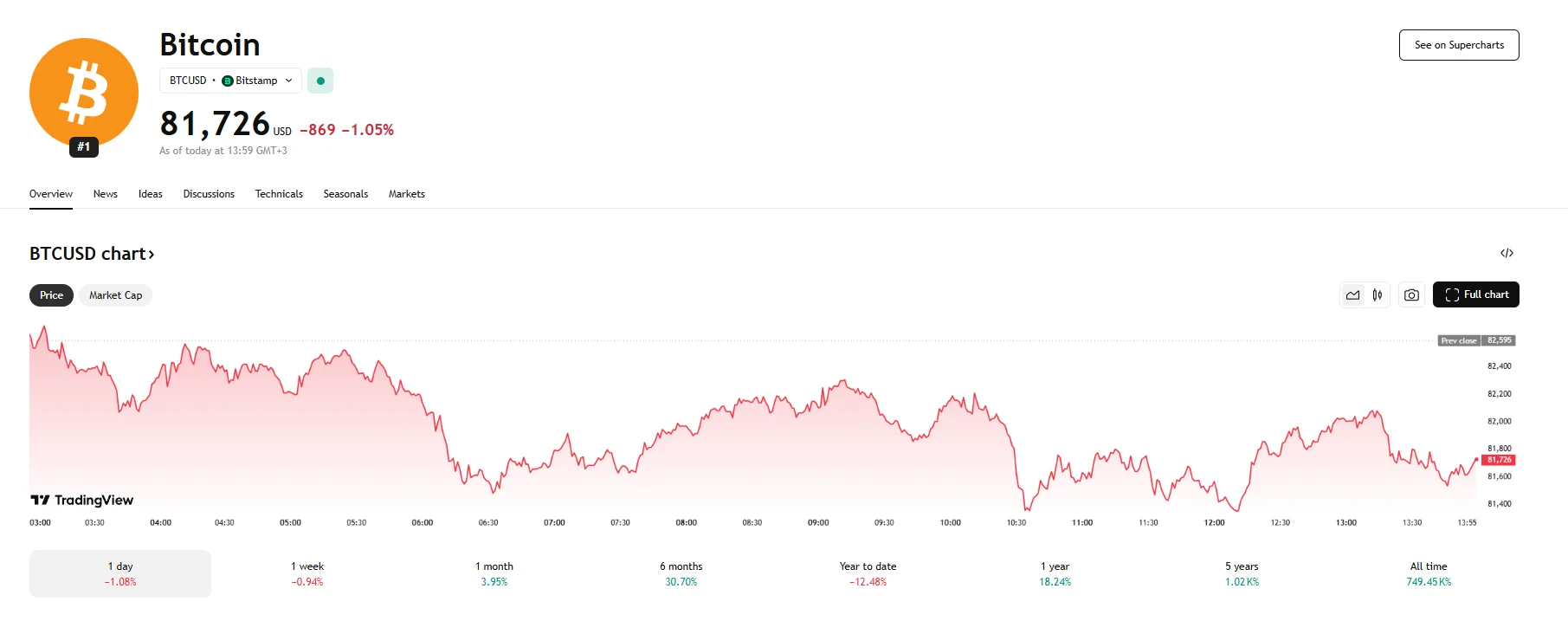

- Bitcoin’s price has recovered to $81,726.

- Earlier, the coin rose even higher to around $83,468.

- Crypto enthusiasts’ optimism can be traced back to an announcement issued by President Donald Trump on Wednesday regarding a temporary cancellation of major tariffs on imports from US trade partners.

Bitcoin Sustains $81,000 Level After Tariff-Fueled Rally

Bitcoin’s price has managed to maintain a trading position above the $81,000 threshold on Thursday. This resilience represents a decline from a significant surge experienced earlier, where the leading cryptocurrency’s value was propelled past the $83,000 mark. The said upward movement was triggered by the announcement of a temporary postponement of planned tariff increases by the United States.

While the initial momentum that drove Bitcoin’s price to these higher levels has since slowed, the digital asset has managed to hold onto a substantial portion of those gains. Its trading value of over $81,700 represents a notable contrast to Bitcoin’s performance earlier this week, during which its price remained below the $80,000 level.

The cryptocurrency market, including Bitcoin, experienced a broad rally in response to the news of delayed tariff implementations. This mirrored the positive reaction observed in global stock markets, as investors interpreted the pause as a signal of easing trade tensions. Bitcoin, often considered a risk-on asset, saw renewed buying interest following this development.

However, while many countries received a temporary reprieve from escalating tariffs, the United States simultaneously increased the tariff rate on goods imported from China to 125%. This decision underscored that trade conflict between the two largest economies has not dissipated, introducing a degree of caution into the overall market optimism. Furthermore, a baseline tariff of 10% on nearly all imports remains in effect, indicating that the broader trade landscape is still subject to certain levels of restriction.

According to some analysts, the ongoing global trade dynamics, including a potentially weaker US dollar resulting from trade imbalances, could actually be beneficial for Bitcoin. The argument, presented by chief investment officer at Bitwise Matt Hougan, posits that as the dollar’s reserve currency status faces scrutiny and potential weakening, alternative assets like Bitcoin may become more attractive to investors interested in hedging.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.