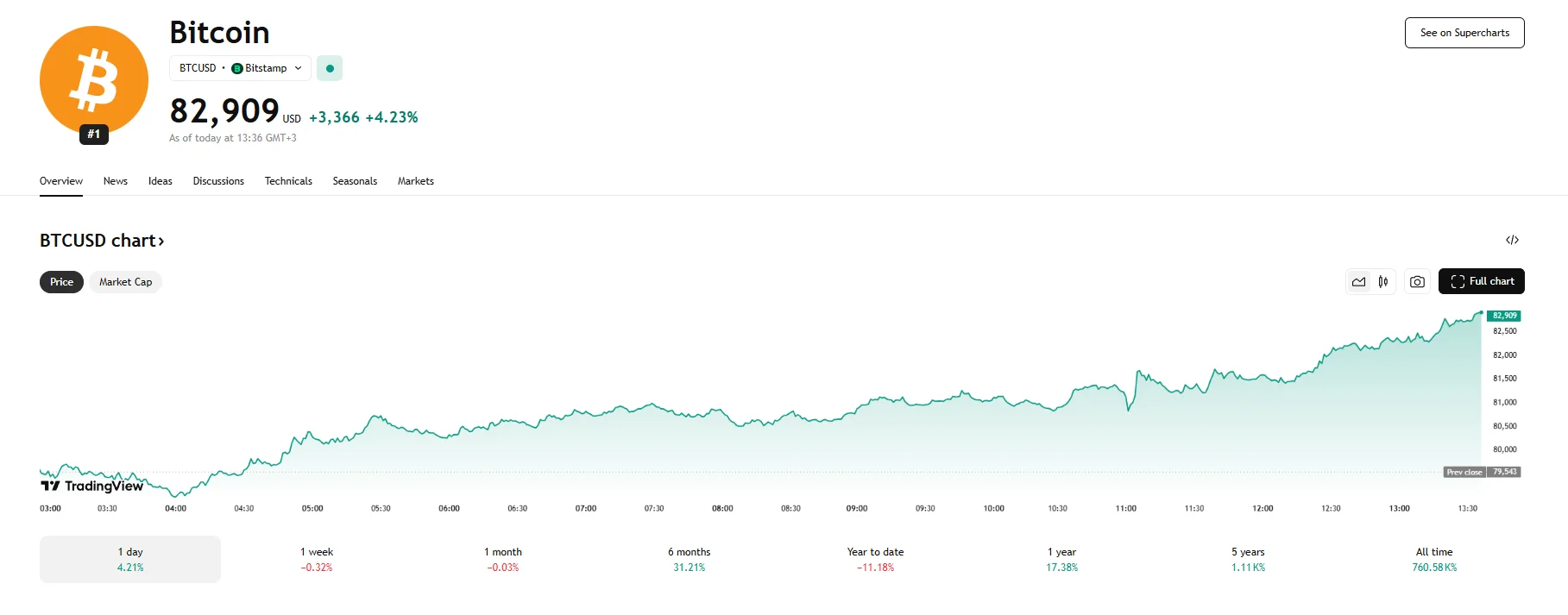

Bitcoin Gains 4.23% to $82,909 Following 28,000 BTC Options Contracts Expiry Bitcoin Gains 4.23% to $82,909 Following 28,000 BTC Options Contracts Expiry

Key momentsBitcoin soared 4.23% on Friday, breaching $82,900.This surge occurred after earlier volatility led to Bitcoin almost hitting $79,000.A total of 28,000 BTC options contracts expired on Frida

Key moments

- Bitcoin soared 4.23% on Friday, breaching $82,900.

- This surge occurred after earlier volatility led to Bitcoin almost hitting $79,000.

- A total of 28,000 BTC options contracts expired on Friday.

Bitcoin Jumps 4.23% as 28,000 Options Liquidation Looms

Friday witnessed a notable rebound in the price of Bitcoin, as the leading cryptocurrency climbed by 4.23% to reach $82,909. This upward movement toward the $83,000 threshold signified a recovery from an earlier dip below $80,000.

Several factors appear to be influencing today’s notable price fluctuations. Market sentiment has been particularly sensitive to global economic events, including the evolving trade dynamics between major economic powers. Recent announcements regarding US tariffs and retaliatory measures have injected uncertainty into broader financial markets, and Bitcoin, often exhibiting correlation with traditional assets, has not been immune to these shifts.

Adding another layer of complexity to Bitcoin’s price action was the significant activity among large-scale holders. According to CryptoQuant, over 48,570 Bitcoins were transferred into accumulation addresses. The transaction was valued at around $3.8 billion. This considerable movement of Bitcoin by potentially long-term-oriented investors suggests underlying confidence in the asset’s future performance.

The current price volatility is occurring against the backdrop of a highly anticipated event in the cryptocurrency derivatives market. Today marks the expiration of a substantial number of Bitcoin options contracts, totaling 28,000 and valued at over $2.20 billion. Such large-scale options expirations often exacerbate volatility as traders adjust their positions, and the market observes the settlement point where the maximum number of options expire at a loss for the holders, a level known as the “max pain” point. As revealed by Greeks.live, the said max pain point hit $81,500, while the put-to-call ended up at 0.88.

Analysts note that while Bitcoin has shown resilience in recovering above the $82,000 mark, the asset still faces uncertainty. The expiration of multi-billion dollar options contracts has the potential to trigger further price swings, either reinforcing the recent recovery or leading to renewed downward pressure. The outcome of this expiration event, coupled with ongoing macroeconomic developments, will likely play a crucial role in shaping Bitcoin’s price trajectory.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.