US Dollar Index Plummets Below 100, EUR/USD Surges 1.64% to 1.1381 US Dollar Index Plummets Below 100, EUR/USD Surges 1.64% to 1.1381

Key momentsThe US Dollar Index sank 1.25% on Friday, breaching the 100 threshold to 99.654.The EUR/USD exchange rate rose by 1.64% to reach 1.1381.Tariff-fueled fears have exerted downward pressure on

Key moments

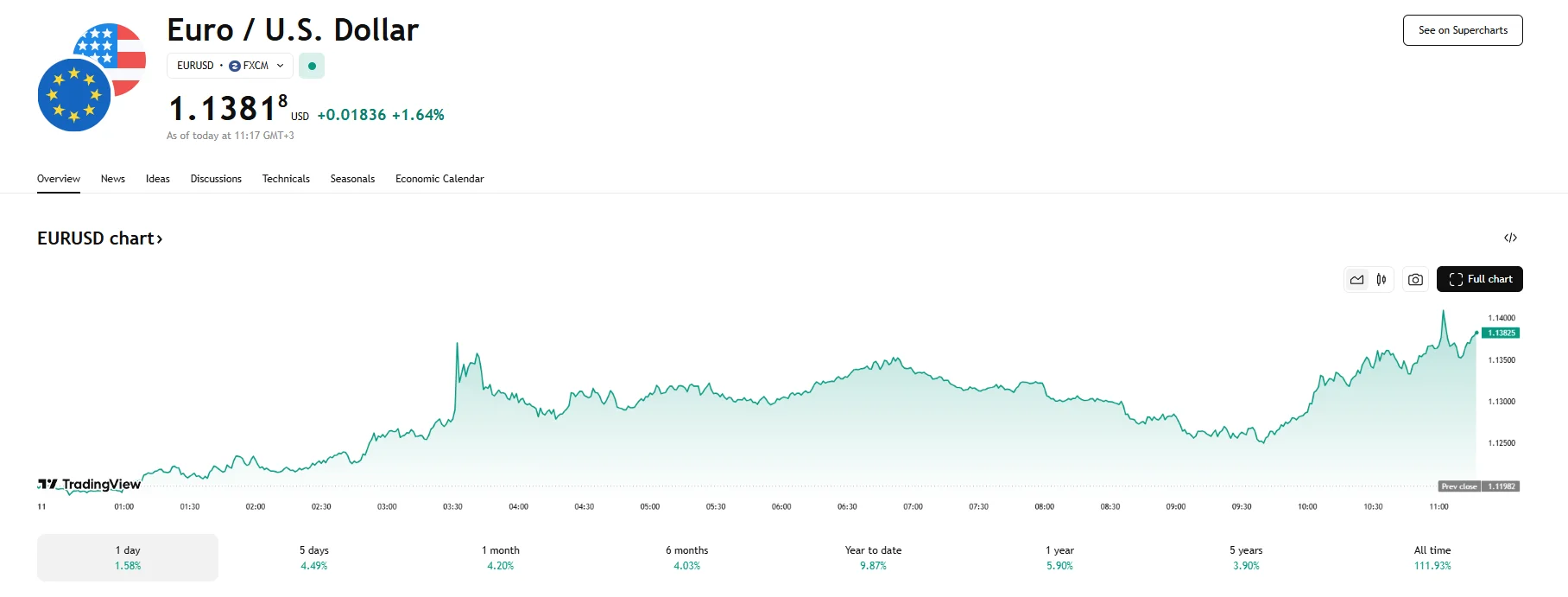

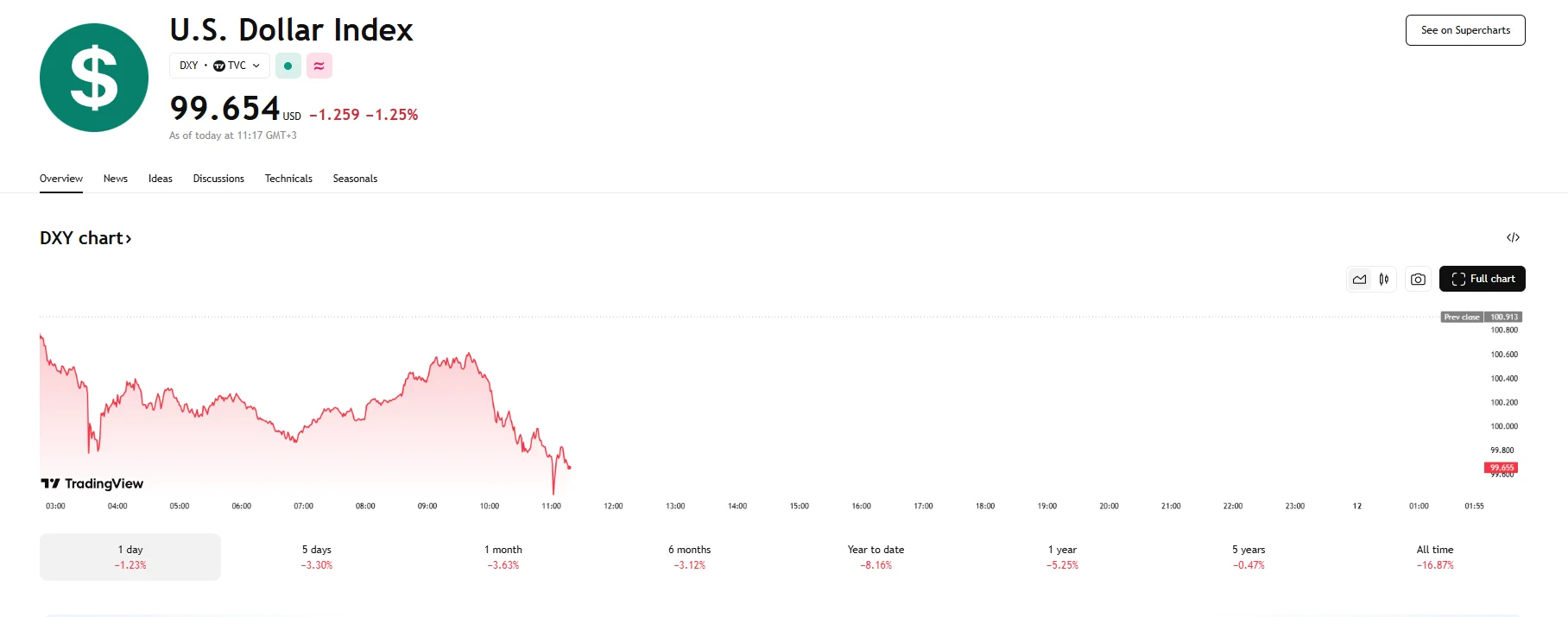

- The US Dollar Index sank 1.25% on Friday, breaching the 100 threshold to 99.654.

- The EUR/USD exchange rate rose by 1.64% to reach 1.1381.

- Tariff-fueled fears have exerted downward pressure on the greenback.

Euro Ascends to Multi-Year Peak as Dollar Weakens Amid Trade Tensions

Friday witnessed the euro experiencing a notable surge against the US dollar. The EUR/USD pair climbed by 1.64%, reaching 1.1381. This upward momentum saw the currency pairing briefly touch 1.11409 earlier in the session, marking its highest valuation in several years.

The robust performance of the euro occurred against a backdrop of broad dollar depreciation across various currency pairings, with the US Dollar Index (DXY) declining considerably. The index fell over 1%, hitting 99.654, highlighting the significant selling pressure on the greenback.

Several interconnected factors appear to be driving these currency movements. A primary catalyst is the ongoing trade conflict surrounding international trade, as China is now facing a total tariff rate of 145% when it comes to US exports. The White House’s latest decision followed earlier Chinese levy hikes, as well as Beijing’s efforts to retaliate. It was also revealed after a Wednesday announcement by the Trump administration that all country-specific tariffs beyond the 10% baseline, excluding levies on Chinese goods, have been postponed for 90 days.

The fluctuating stance on tariffs emanating from Washington has seemingly eroded confidence in the stability of the US dollar as a reliable store of value. The decline in the Dollar Index below the critical 100 level, a threshold breached for the first time since 2023, underscores the magnitude of the recent shift in sentiment as market participants have grown increasingly concerned about the potential for a disorderly decoupling of the world’s two largest economies, leading investors to reduce their dollar holdings.

Additionally, this period of dollar weakness coincides with a notable rise in US Treasury yields. Data from LSEG indicates that the benchmark 10-year Treasury yield recently reached 4.45% after a surge not seen in over two decades.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.