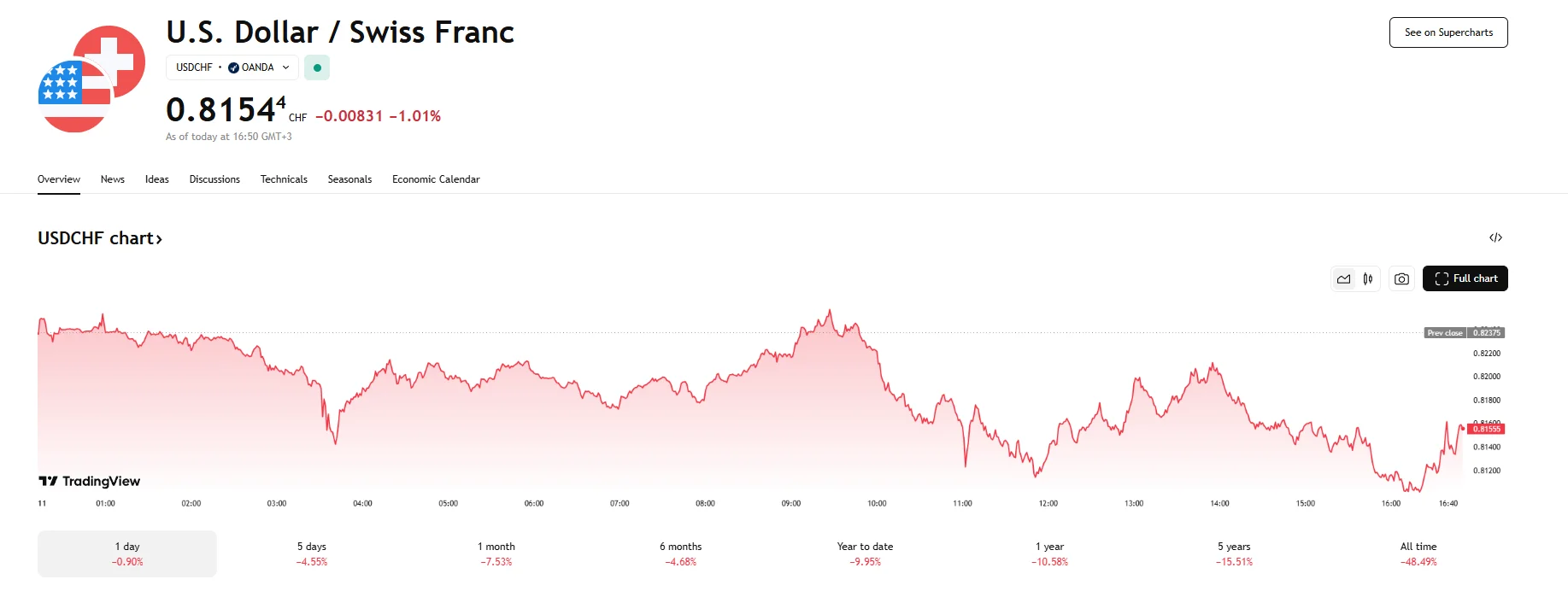

USD/CHF Falls 1% to 0.8154 Amid Market Jitters USD/CHF Falls 1% to 0.8154 Amid Market Jitters

Key momentsThe US dollar suffered a significant decline against the Swiss franc, with the USD/CHF exchange rate dropping to 0.8154.The Dollar Index (DXY) continues trading below 100.As global trade co

Key moments

- The US dollar suffered a significant decline against the Swiss franc, with the USD/CHF exchange rate dropping to 0.8154.

- The Dollar Index (DXY) continues trading below 100.

- As global trade conflicts continue heating up, many investors turn to the Swiss franc for its safe-haven status.

Trade Anxieties Fuels Franc Rally

The USD/CHF exchange rate tumbled by 1% to 0.8154 on Friday. This marked a continuation of a downward trend, with the currency pair having earlier breached even lower levels near the 0.8100 mark. This substantial weakening of the dollar against the franc represents a level not observed in years, as escalating global trade tensions have had a negative impact on the greenback.

In particular, trader anxieties surrounding the dollar have to do with the escalating friction between the United States and China. The latest developments saw Beijing announce a dramatic increase in tariffs on US imports, raising them to 125% after the Trump administration announced its decision to impose duties of 145% on Chinese goods. This rattled investor confidence and fueled concerns about the potential disruption to global supply chains and the broader economic fallout.

In this environment of heightened uncertainty, the Swiss franc, traditionally viewed as a safe-haven currency, has experienced a surge in demand. Investors seeking refuge from the market turmoil have increasingly turned to the franc, bolstering its value against the weakening dollar. This flight to safety has been a significant driver behind the sharp decline in the USD/CHF exchange rate, pushing it to levels reminiscent of periods of intense global economic stress.

Adding further pressure on the US dollar is its broader underperformance against a basket of other major currencies. The Dollar Index (DXY), a measure of the dollar’s strength against six key rivals, fell below the 100 threshold today and has yet to stage a notable recovery.

The weakening of the dollar is not solely attributable to trade tensions. Growing concerns about potential stagflation in the US economy, characterized by slow growth and rising inflation, have also contributed to the dollar’s decline. Furthermore, recent economic data, such as the lower-than-expected US CPI figures for March, have led investors to anticipate a more dovish stance from the Federal Reserve, with increased expectations of interest rate cuts later this year.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.