Cardano Bulls Rejoice: Strong Move Indicates Breakout Hasn’t Failed Yet

Cardano’s bullish momentum grows as traders bet on a breakout. Can ADA flip $0.85 into support and rally toward $0.99?

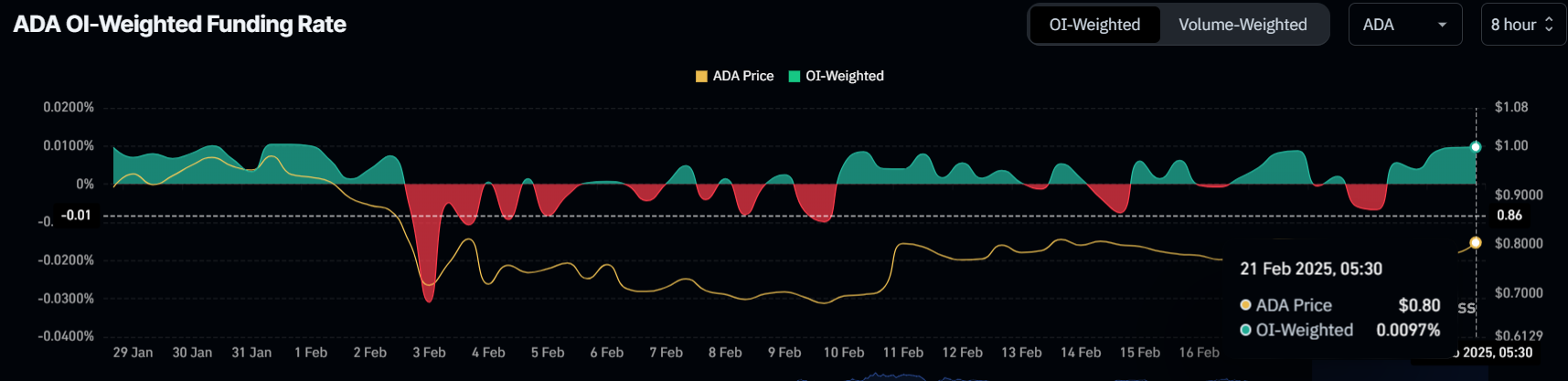

- Cardano’s positive funding rate signals strong trader confidence, with long positions dominating and anticipating a breakout.

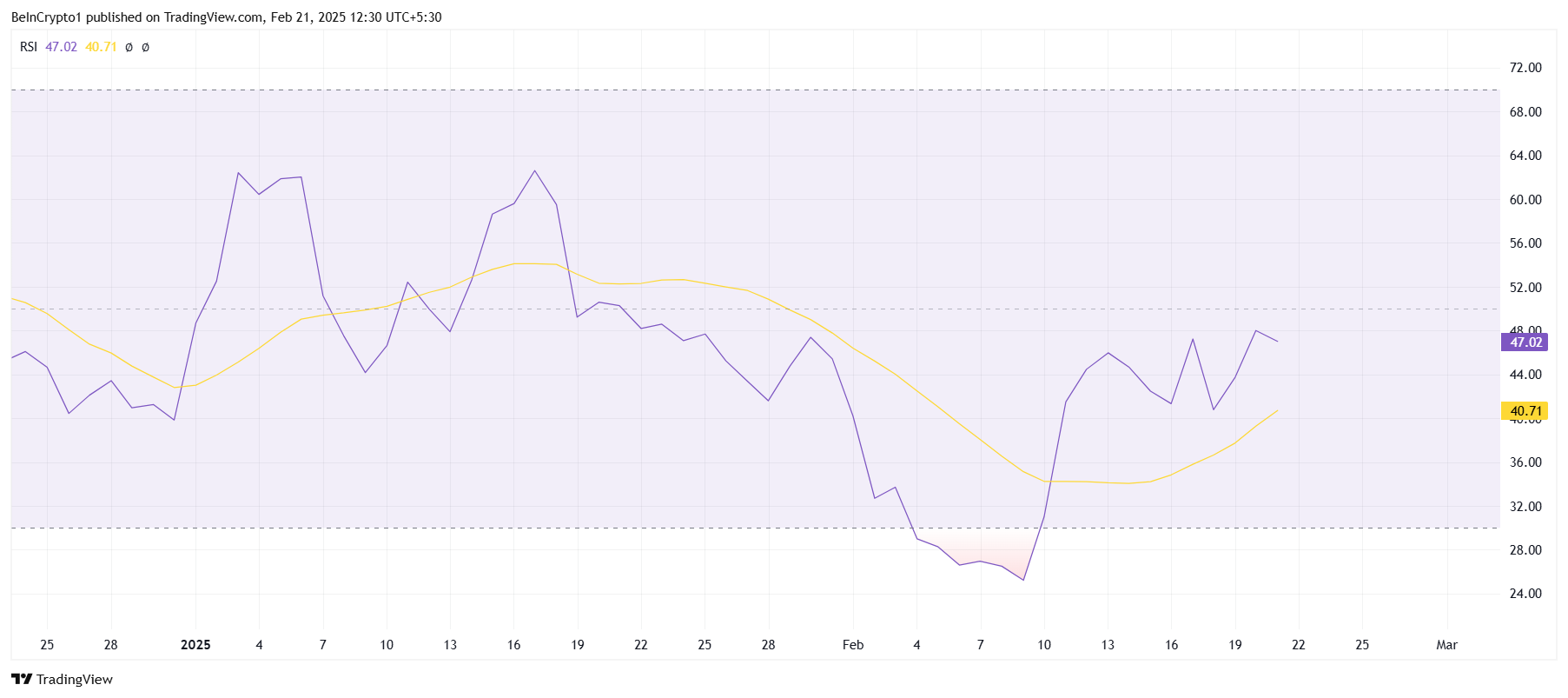

- RSI near the 50 mark suggests growing buying pressure; a move into the bullish zone could reinforce ADA’s upward momentum.

- ADA aims to break a bullish wedge pattern, targeting $0.99, but failure to hold $0.85 as support could push it down to $0.70.

Cardano (ADA) has recently shown promising signs of a potential breakout, supported by favorable market conditions and growing optimism among traders.

After fluctuating over the past month, ADA is now preparing to break key resistance levels, as positive investor sentiment and broader bullish cues give the altcoin a chance at recovery.

Cardano Has Support

Despite the volatility in the cryptocurrency markets, Cardano’s funding rate is currently positive. This suggests that long positions are dominating, as traders remain confident in ADA’s upward potential. The positive funding rate indicates that more traders are betting on the price rise, which signals optimism in the market for ADA’s future performance.

Over the past few weeks, however, market sentiment has been fluctuating. Still, the positive funding rate trend suggests that traders are preparing for a rally rather than a downturn. This shift towards long contracts over short contracts implies that investors are positioning themselves for a potential breakout as they anticipate higher prices in the near term.

Technically, Cardano’s market momentum is showing encouraging signs. The Relative Strength Index (RSI) is hovering near the 50 mark and could soon breach it into the bullish zone. An RSI crossing into this zone suggests that buying pressure is increasing, and ADA could experience a continued upward movement if this momentum is sustained.

If the RSI successfully moves above 50, it will further strengthen the case for a price rise. This indicator would reinforce the view that Cardano’s current price action is part of a broader recovery trend, supporting the case for a potential breakout in the coming weeks.

ADA Price Is Presenting an Opportunity

Cardano’s current price action suggests it is aiming to break out of a bullish descending wedge pattern. This pattern projects a potential rally of 26%, targeting $0.99. However, before confirming the breakout, ADA must secure $0.85 as support, which would validate the bullish outlook and set the stage for higher prices.

If Cardano successfully flips $0.85 into support, the altcoin could rally toward $0.99, potentially recovering most of the losses experienced in February. A successful breach of $0.99 would bring ADA closer to the $1.00 mark, significantly boosting investor confidence and supporting a sustained rally.

However, if Cardano fails to hold above the critical support level of $0.85 and momentum falters, ADA could fall back to $0.77. In this case, the price could slide further to $0.70, which would invalidate the bullish thesis and potentially delay Cardano’s recovery.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.