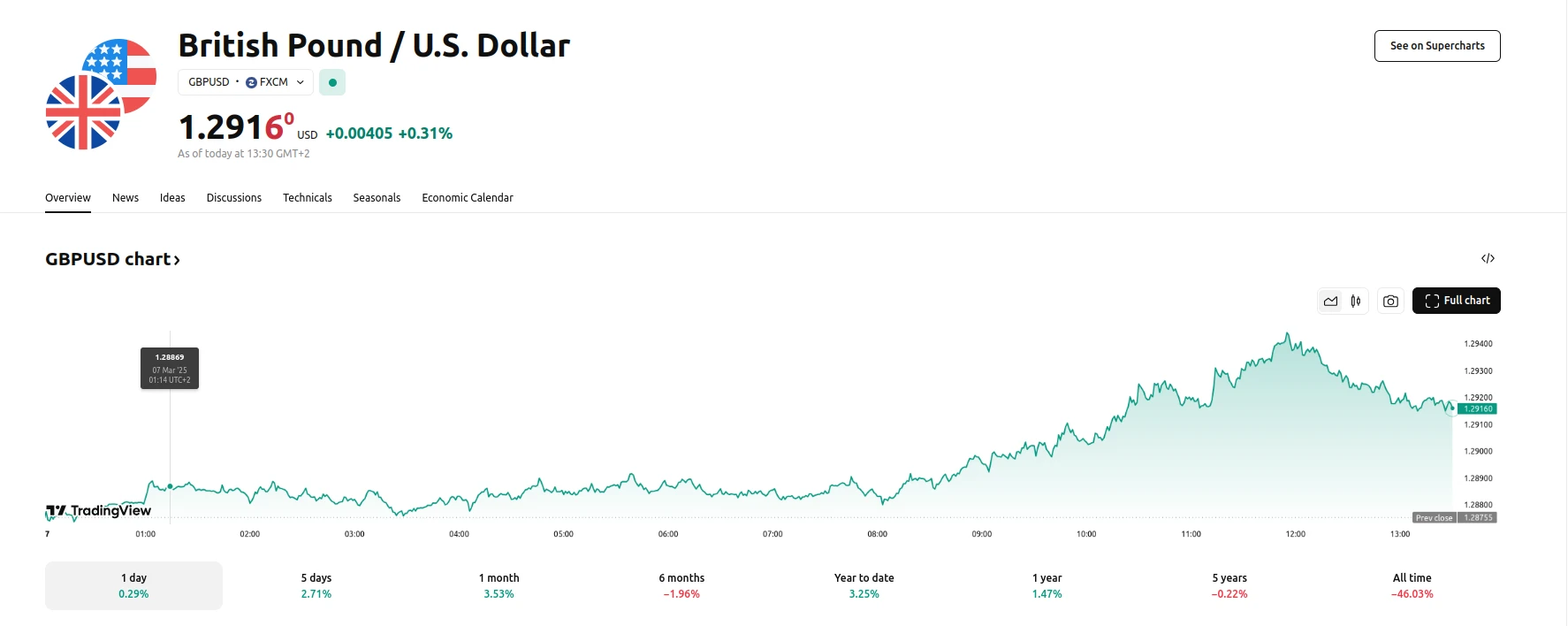

GBP Nears 1.2940 Despite BoE Warning and Global Uncertainty

Key momentsPound Sterling Gains: GBP advances against the USD, approaching 1.2940 ahead of key US economic data.BoE Dissent: Catherine Mann argues against gradual policy easing amid heightened market

Key moments

- Pound Sterling Gains: GBP advances against the USD, approaching 1.2940 ahead of key US economic data.

- BoE Dissent: Catherine Mann argues against gradual policy easing amid heightened market volatility.

- USMCA Tariff Exemptions: President Trump postpones tariffs on certain goods from Canada and Mexico.

GBP Tests 1.2940 as Markets Weigh BoE Dissent, USMCA Changes, and NFP Data

The Pound Sterling (GBP) demonstrated resilience, trading higher against the US Dollar (USD) and nearing the 1.2940 mark, even as Bank of England (BoE) Monetary Policy Committee (MPC) member Catherine Mann voiced strong opposition to a gradual approach to monetary policy easing. This advancement occurs against a backdrop of ongoing global economic uncertainties and geopolitical tensions, further complicated by the anticipation of the US Nonfarm Payrolls (NFP) data.

Catherine Mann’s stance diverges significantly from the prevailing sentiment among her BoE colleagues, including Governor Andrew Bailey, who have advocated for a measured reduction in monetary policy restrictiveness. In her address at a Reserve Bank of New Zealand (RBNZ) research conference, Mann asserted that the “founding premise” for a gradualist approach is no longer valid, citing “substantial volatility” stemming from financial markets and “cross-border spillovers.” This divergence reflects concerns that a slow easing strategy could be inadequate in addressing the rapid and unpredictable shifts in the global economic landscape.

Adding to the complexity of the situation, US President Trump has granted a reprieve on tariffs for goods imported from Canada and Mexico under the United States-Mexico-Canada Agreement (USMCA) until April 2nd. This decision, which follows discussions with major US automakers, provides temporary relief from potential trade barriers. However, it also introduces an element of uncertainty, as the future of these tariffs remains subject to change. The market is now closely observing how these factors, combined with the upcoming US NFP data, will influence the GBP/USD exchange rate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.