Bitcoin Dips Below $90,000 Amid U.S. Crypto Reserve Concerns Bitcoin Dips Below $90,000 Amid U.S. Crypto Reserve Concerns

Key momentsBitcoin failed to stay above the $90,000 threshold on Friday. The 5.7% drop, testing $85,000, followed the $92,000+ surge Bitcoin experienced on Thursday.The U.S. governments strategic Bitc

Key moments

- Bitcoin failed to stay above the $90,000 threshold on Friday. The 5.7% drop, testing $85,000, followed the $92,000+ surge Bitcoin experienced on Thursday.

- The U.S. government’s strategic Bitcoin reserve, intended to stabilize the market, instead fueled uncertainty.

- Major funds like BlackRock and Grayscale reported substantial withdrawals, and the significant outflows from Bitcoin spot ETFs deepened the market’s downturn.

U.S. Reserve Uncertainty Triggers Market Downturn

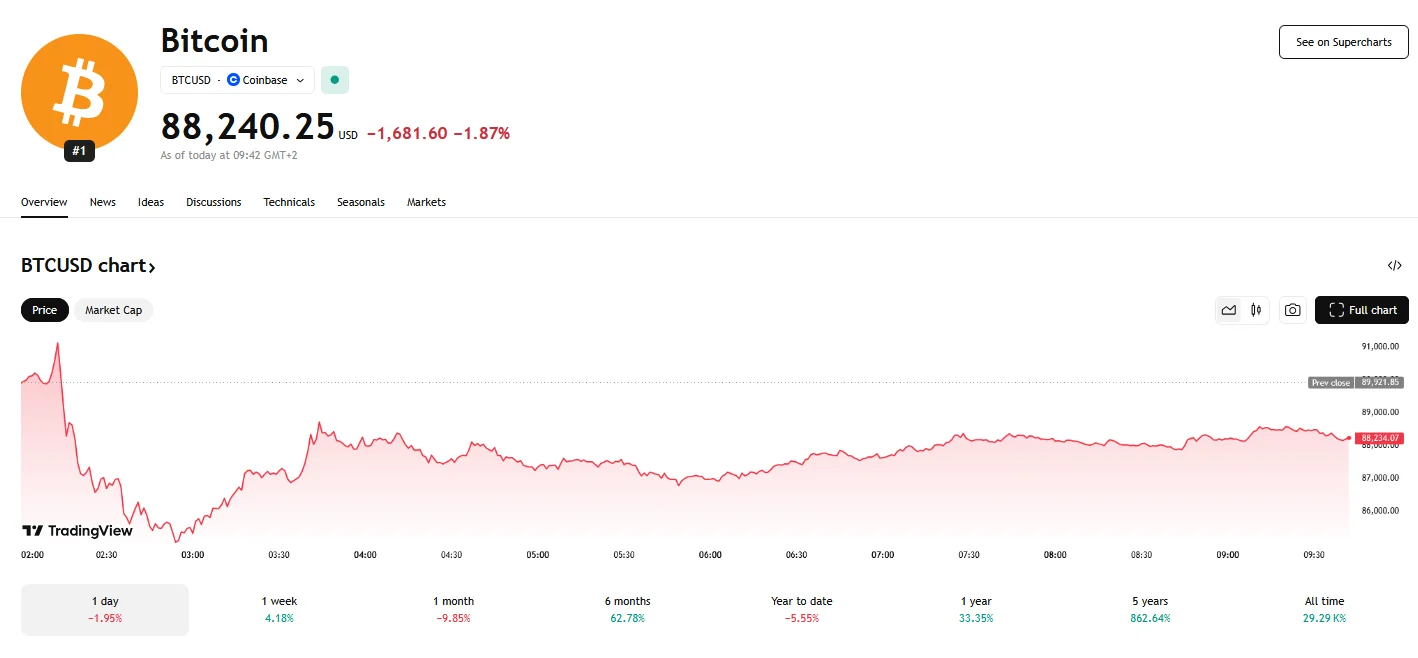

Friday saw Bitcoin’s valuation plunging below $90,000, a stark contrast to its prior ascent past $92,000. This fluctuation, marked by a 5.7% decrease as Bitcoin struggled to remain above $85,000, ignited concerns among investors and highlighted the volatile nature of digital assets. The catalyst for this market shift was the unveiling of a strategic Bitcoin reserve by U.S. authorities. While the initiative was intended to bolster confidence, its implementation, primarily focusing on existing seized assets rather than new acquisitions, failed to generate the anticipated market surge.

Consequently, Bitcoin’s price plummeted, briefly testing the $85,000 floor before rebounding to above $88,000. This fluctuation was not isolated, as other prominent cryptocurrencies, including Ethereum, Solana, and Cardano, also experienced declines.

Several factors appear to have served as catalysts for this market volatility. Firstly, the ambiguity surrounding the U.S. government’s future Bitcoin acquisition plans fueled investor skepticism. While the initiative was intended to bolster confidence, its implementation, primarily the focus on existing seized assets rather than new acquisitions, failed to generate the anticipated market surge since the reserve’s formation did not guarantee further government purchases.

Significant outflows from Bitcoin spot ETFs further exacerbated the selling pressure. Data revealed substantial withdrawals, with major funds like BlackRock’s iShares Bitcoin Trust and Grayscale Bitcoin Trust reporting significant outflows.

In addition, the surge in market liquidations added to the selling pressure. Over $531 million in liquidations occurred within a 24-hour period, with long traders bearing the brunt of these losses. These liquidations triggered a cascade effect, further driving down Bitcoin’s price as leveraged positions were forcibly closed.

Despite the recent downturn, Bitcoin’s year-to-date performance remained positive, largely driven by inflows into U.S.-listed spot Bitcoin ETFs. However, market participants are now closely monitoring regulatory developments and seeking clarity on the government’s long-term Bitcoin strategy.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.