WTF? Option Bets Surge Before Trump Tweet

Yesterday, former President Donald Trump first encouraged investors to "buy the dip" in U.S. stocks — including shares of his own company, DJT — and then announced a 90-day suspension of tariffs (excl

Yesterday, former President Donald Trump first encouraged investors to "buy the dip" in U.S. stocks — including shares of his own company, DJT — and then announced a 90-day suspension of tariffs (excluding China). The market reaction was explosive: global equities surged, and the Nasdaq soared 12%, marking its second-largest single-day gain in history.

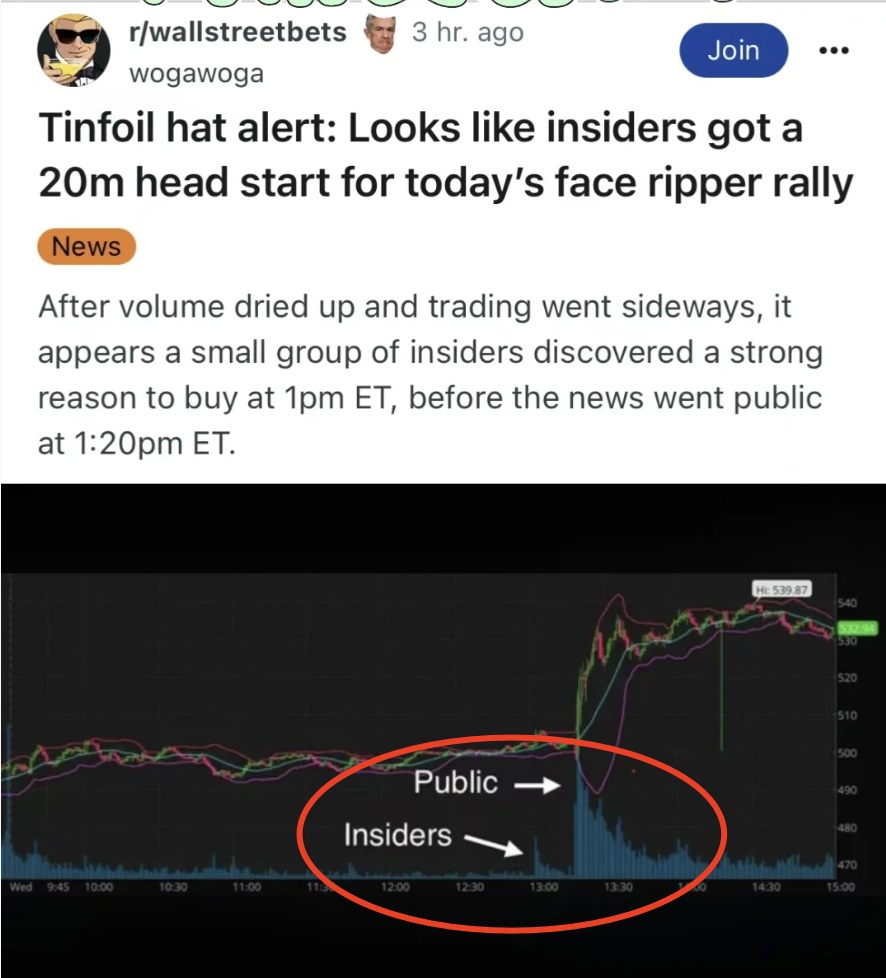

However, unusual activity had already been spotted in the options market before Trump made the announcement. Traders placed massive bets on same-day expiring call options on the S&P 500 — some of them 0DTE (zero days to expiration) — and reaped more than 100-fold gains. The precision of these trades has raised serious suspicions of insider trading.

Given the extremely high volatility in U.S. equities recently, option premiums were expensive, and under normal circumstances, it would have made more sense to be an options seller rather than buyer. The sheer size and boldness of these trades suggest that traders had prior knowledge — making the case for potential insider activity hard to ignore.

Tracking of abnormal options flows reveals the suspicious trades went beyond 0DTE contracts. Same-day bullish positions were opened in:

$QQQ, $TQQQ, and $SPY call options

$QQQ calls: Estimated investment of $2.45 million, with gains exceeding 600%.

$SPY 510 calls: Returns of up to 3,000%.

0DTE options: One trader reportedly turned a $100,000 bet into $21 million in hours.

Market watchers called it "the greatest index options trade you've ever seen in your life." But from another angle, it's also one of the clearest signs yet of insider trading.

️ Lawmakers React

Several members of Congress quickly raised red flags.

"How is this not market manipulation?"— Representative Mike Levin, Democrat of California, said on social media."If you're a Trump supporter and followed his advice, you did great. But if you're a retiree or middle-class investor who couldn't stomach the risk and sold, you got screwed."

"If this isn't manipulation, what is it? Who benefited? Which billionaire just got richer?"— Representative Steven Horsford, Democrat of Nevada.

️ White House Pushes Back

White House officials dismissed the allegations, insisting that Trump's posts were intended to reassure the public.

"It is the responsibility of the president of the United States to reassure markets and Americans about their economic security in the face of nonstop media fear-mongering,"— said Kush Desai, White House spokesman.

The administration framed Trump's move as a strategic gesture following requests from some of China's closest allies to negotiate with the U.S. They denied any intention to manipulate the markets.

"Instead of grasping at straws to play partisan political games, Democrats should focus on working with the administration to restore American greatness,"— Desai added.

️ Ongoing Scrutiny

Yet, the White House's response failed to calm concerns.

"The abrupt reversal provides dangerous opportunities for insider trading,"— said Senator Adam Schiff, Democrat of California. He plans to contact the White House to determine who knew in advance about Trump's tariff decision.

Kathleen Clark, a professor at Washington University School of Law who specializes in government ethics and corruption, commented:"Mr. Trump's actions would ordinarily trigger an investigation by the Securities and Exchange Commission."

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.