Best Forex Broker in India (2024 Edition)

Forex trading is a relatively new and quite exciting investment option in India。Although the authorities have imposed strict restrictions on this activity, speculation in the foreign exchange market is legal。

Forex trading is a relatively new and quite exciting investment option in India。Despite strict restrictions imposed by the authorities on this activity, foreign exchange market speculation is legal in India and is attracting a growing number of people.。

Before understanding the specifics of trading in the Indian forex market, we need to consider a few basic facts about this exotic and very interesting country。India is the second most populous country with 13.500 million people, accounting for nearly 17 of the world's total population.5%。Interestingly, more than 65% of Indians are under the age of 35, and more are moving to cities where they can find better job opportunities.。The working class is expanding, and more people than ever before have access to the Internet and new technologies.。

Forex trading has been hugely popular in India over the past decade, but at first there were a lot of broker scams。This, coupled with the high risk of foreign exchange trading, has all prompted the authorities to impose various restrictions on foreign exchange trading.。Currently, Indian citizens can trade on the foreign exchange market, but they need to comply with various rules and restrictions.。

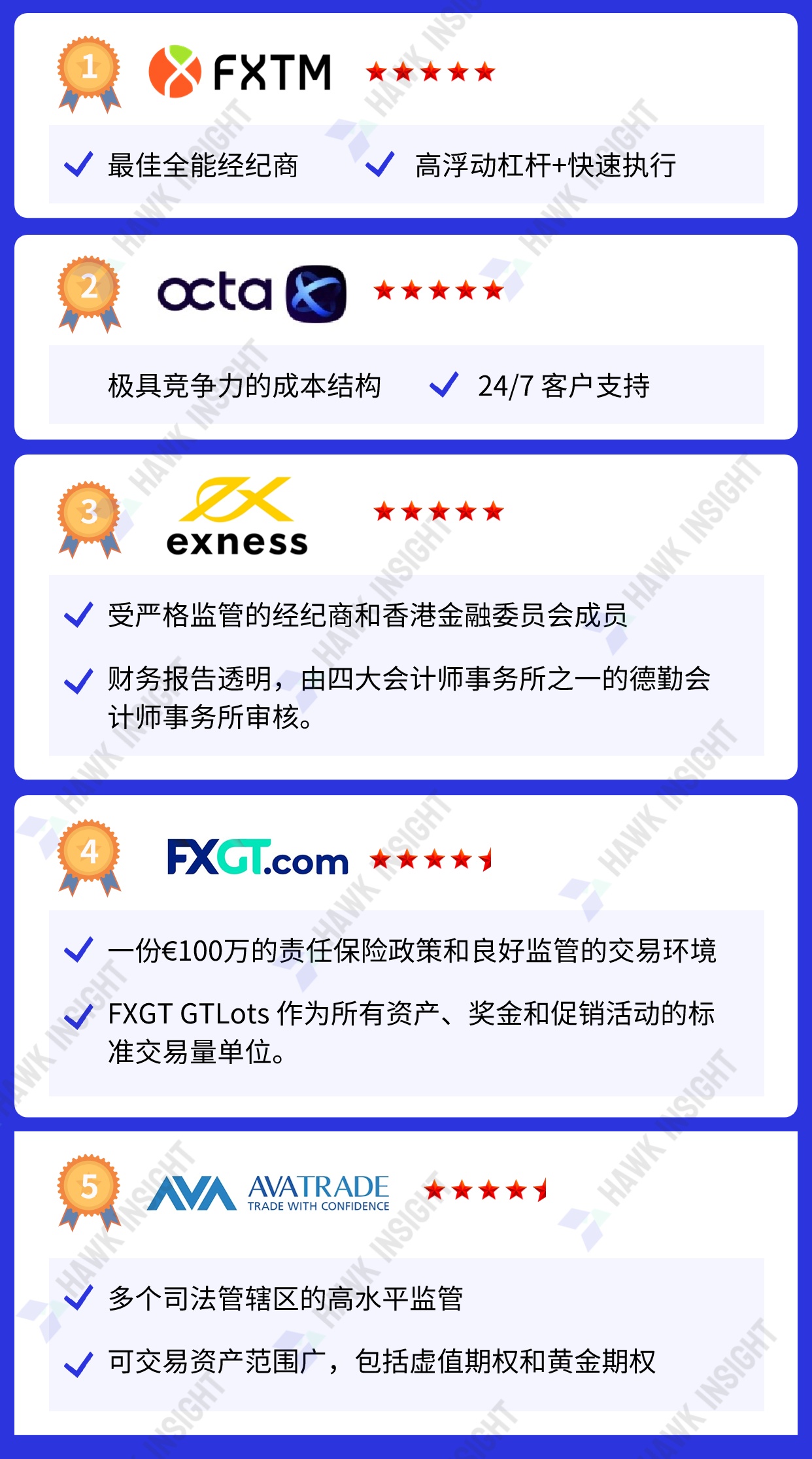

▍ Best Forex Broker

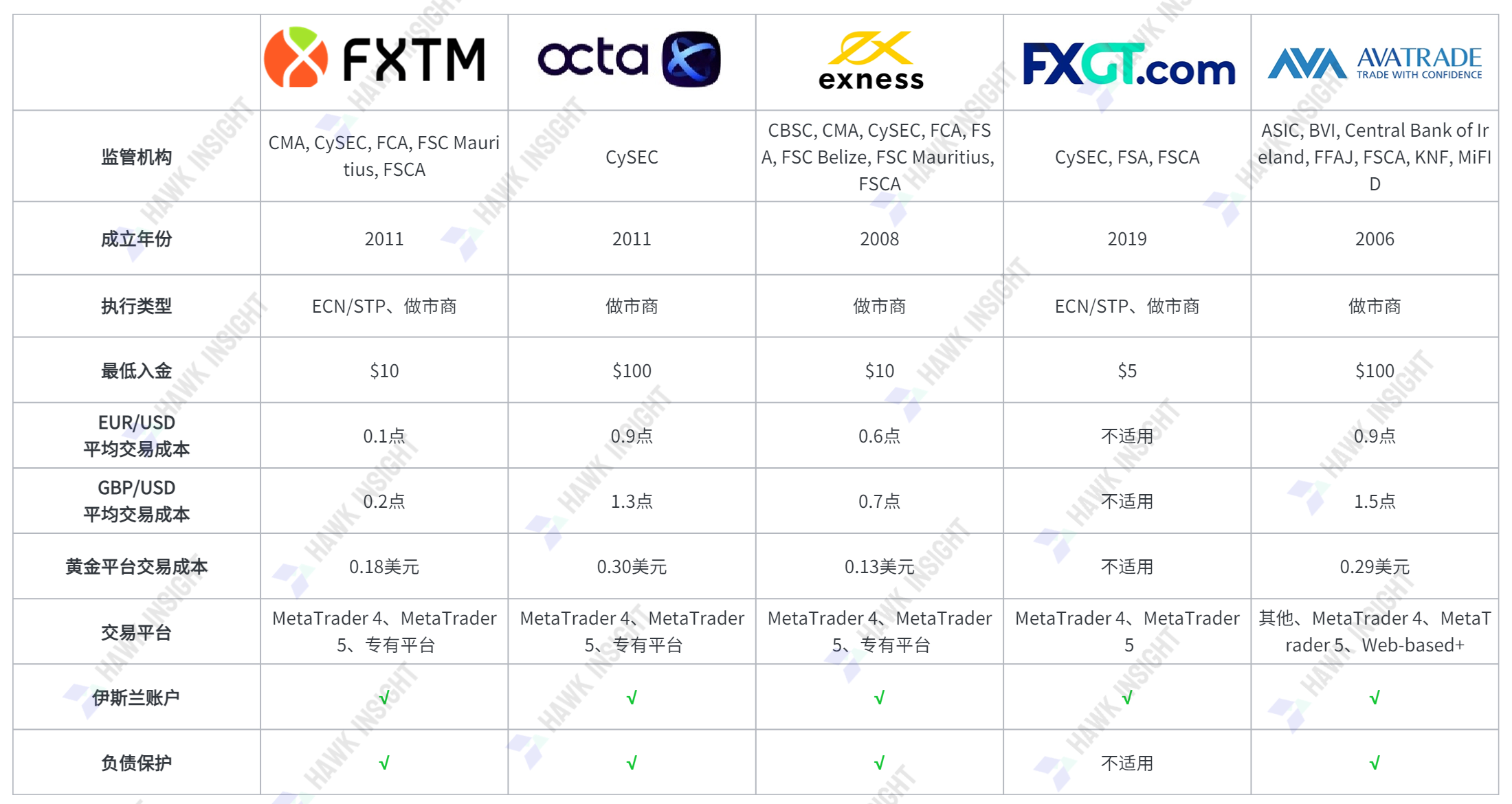

▍ Best Forex Broker Comparison

○ FXTM · Futto

FXTM is one of the most competitive Forex brokers in India。Depending on the monthly transaction, each transaction costs $0..80 to $4.Between 00。The higher the volume of transactions, the lower the transaction costs, and the low level of fees is far ahead of the industry.。Forex traders can trade using the upgraded MT4 / MT5 trading platform and FXTM Trader mobile app。

Traders need to deposit a minimum of $500 to obtain a maximum floating leverage ratio of 1: 2000.。Mini account only costs $10, but the transaction cost is higher。FXTM has also developed FXTM Invest, an internal copy trading service that provides quality education and Islamic accounts.。

| Advantages | Disadvantages |

√ Excellent commission-based forex pricing environment & transparency |

* No cryptocurrency, limited choice of commodities |

| √ Upgraded MT4 / MT5 Trading Platform and FXTM Trader Mobile APP | |

| √ Quality market research and education content for junior traders | |

| √ Internal copy trading service FXTM Invest, low minimum deposit + high leverage |

○ OctaFX

OctaFX offers Indian traders a very competitive choice of cryptocurrencies and remains one of the most competitively priced brokers among all Indian forex brokers。Its commission-free cost structure is from 0..6 pips (or $6 per standard hand.00) start, while the MT5 trading platform it offers does not charge any overnight swap fees, providing a unique advantage for leveraged overnight trading strategies。World Finance names Octa Islamic account as best Islamic forex account in 2020。

In addition to the core MT4 / MT5 trading platform, OctaFX also offers its proprietary mobile app。This, together with its internal copy trading service, provides a competitive solution for Indian traders。The minimum deposit of $100, the maximum leverage ratio of 1: 500 and the generous bonus together ensure its competitive advantage.。

| Advantages | Disadvantages |

√ Quality educational tools and generous bonuses |

× Asset Selection Priority |

| √ Minimum deposit amount of $100 and maximum leverage ratio of 1: 500 | |

| √ Proprietary Copy Trading Service and Mobile APP | |

| √ No commission, no swap cost structure |

○ Exness

Exness official website has been localized to 15 languages, customer service across 13 languages, of which 11 languages service time is 24 hours a day, five days a week, and English and Chinese customer service is 24 hours a day, seven days a week。

Exness uses the leading trading platforms in the global marketplace, including MT4 / MT5 and web terminals。Traders can develop and implement trading strategies of various levels of complexity through MetaTrader 4, as well as submit most types of trade orders by using both order execution methods, instant execution and market execution.。

| Advantages | Disadvantages |

√ 24 / 7 multilingual customer service |

* No education for beginners |

| √ Multi-regulated broker with excellent order and volume statistics | |

| √ High transparency and financial audit of the big four accounting firm Deloitte | |

| √ Instant withdrawals from trusted brokers with numerous payment processors |

○ FXGT

With a minimum deposit requirement of $5 and no overnight interest for 3-6 days, FXGT ranks among the best brokers in India。The MT4 / MT5 trading platform supports algorithmic trading and copy trading, with a maximum foreign exchange leverage of up to 1: 1000, and provides debt protection, thereby expanding its competitive advantage。

Bitwallet and STICPAY as payment processors enable fast, low-cost transactions。FXGT GTLots ensures standard trading volume units for all assets, while FXGT also offers bonuses and promotions。This includes $200 live trading account promotions for all PRO and ECN accounts。

| Advantages | Disadvantages |

√ Cryptocurrency deposit bonuses and financial transactions |

* Do not accept customers residing in the US, EU and UK。 |

| √ Tier 1 liquidity & low latency trade execution | |

| √ Multiple cryptocurrency options, including synthetic cryptocurrency pairs | |

| √ Minimum deposit of $5, maximum foreign exchange leverage of 1: 1000, liability protection |

○ AvaTrade

AvaTrade is an ECN / STP broker based in Dublin, Ireland, founded in 2006。AvaTrade is one of the world's largest forex brokers and a trusted, highly regulated trading platform.。Key regulators include the Australian Securities and Investments Commission (ASIC), Japan's Financial Services Authority (JFSA) and the Investment Industry Regulatory Organization of Canada (IIROC).。However, AvaTrade enjoys a high level of regulation in Australia, Japan, South Africa, the British Virgin Islands and the European Union.。Traders in India can expect maximum leverage of up to 400: 1 and take advantage of the most advanced trading options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO and WebTrader。

| Advantages | Disadvantages |

√ Provide high-quality education services through SharpTrader |

× Transaction costs are competitive, but nothing special |

| √ A variety of trading platforms to choose from to meet various trading needs | |

| √ Broad asset selection and cross-asset diversification opportunities | |

| √ Under the supervision of the Central Bank, brokers are well regulated and trustworthy |

▍ Foreign Exchange Regulation in India

Indian government imposes tight restrictions on how individuals can trade on foreign exchange market。Generally speaking, as long as the currency pair traded contains the Indian Rupee (INR), buying and selling in the foreign exchange market is a legal activity.。Even this type of trading is strictly regulated and can only be done through licensed brokers。

The main law in India that deals with the foreign exchange market and all market participants is the Foreign Exchange Management Act 1999 (FEMA).。The law was passed by the Indian Parliament and replaced the Foreign Exchange Control Act (FERA), which was enacted in 1973 to prohibit foreign exchange market transactions.。The new law is in line with the government's liberalization policy and, among other things, it makes foreign exchange trading easier。

Under FEMA, Indian residents are not allowed to remit funds to forex brokers overseas。The conversion of the Indian rupee into other currencies for the purpose of trading in the foreign exchange market is also prohibited.。This means that Indian traders have only a few options when buying and selling forex currency pairs - they can buy and sell currency derivatives and currency pairs, which include the rupee and several major currencies: the dollar, the euro, the pound and the yen.。

In addition, traders need to ensure that they trade through Indian exchanges and with the help of licensed brokers.。Exchanges offering foreign exchange instruments are the National Stock Exchange of India Limited (NSE), the Stock Exchange of India (BSE (NSE), BSE (formerly Bombay Stock Exchange) and MCX-SX (Metropolitan Stock Exchange)。In general, retail traders in India can trade currency options (option contracts for USD / INR) and currency futures - USD / INR, GBP / INR, EUR / INR and JPY / INR.。

Traders are required to deposit margin with the exchange through intermediaries (i.e. brokers) and use the margin when offering currency derivatives。In futures trading, the volume is 1,000 units per lot, with the exception of the yen / Indian rupee currency pair, which is 100,000 units.。Futures cycles range from 1 month to 12 months。Of course, trading non-Indian rupee currency pairs is illegal under current law。

All this suggests that India's financial markets are not fully open。While the forex market is usually a decentralized global market, freely accessible to anyone, the situation in India is quite different.。However, India is expected to continue its liberalization policy, which is good news for all traders.。It should also be noted that many traders prefer to work with unregulated offshore brokers, but this may bring certain risks。

Indian Financial Regulators

India's financial markets and all forex trading activities are regulated by multiple central authorities。One of these is the Reserve Bank of India (RBI), which, as India's central bank, is responsible for the issuance and supply of the Indian rupee.。It oversees the entire Indian banking sector, including all commercial banks and non-bank financial companies.。Its main purpose is to ensure the stability of the country's currency。

India's main foreign exchange and securities market regulator is the Securities and Exchange Board of India (SEBI).。The agency was established in 1988, but did not receive formal regulations until the Securities and Exchange Commission of India Act of 1992.。After obtaining statutory powers in 1992, the agency became an autonomous body responsible for regulating and protecting the interests of securities issuers, investors and intermediaries.。

Forex brokers and stock exchanges must be licensed and authorized by SEBI to operate legally in the country。The agency also imposed certain restrictions on the types of transactions allowed in India, the maximum leverage allowed by brokers, and the currency pairs that can be traded.。

▍India foreign exchange payment methods

Although India's technology is more advanced than ever before, digital payment methods are still only used by a specific group of people - those who live in cities and have at least an average income.。In fact, cash is still king in this country, but not in online forex trading。People who invest in this market prefer credit and debit cards, followed by online banking and digital wallets.。

Most brokers that accept Indian traders accept Visa and MasterCard - both brands are well known around the world and are also available to Indians。However, debit cards are more popular than credit cards.。Another option is RuPay, a local card scheme launched by India's National Payments Corporation.。These credit and debit cards can be used almost anywhere in India, as well as in the UAE, Bahrain, Singapore and Bhutan。These cards are also accepted by international websites and forex brokers that support Discover Financial Services。

Indian investors can also use online banking to inject capital into trading accounts。The availability of such services depends on the bank they open an account with。In addition, online bank transfers are often slower and more expensive than using a bank card or e-wallet。

Speaking of e-wallets, we must point out that they are not as popular in India as they are in the West。However, as more and more people begin to recognize the convenience and cost-effectiveness of e-wallets compared to traditional payment methods, e-wallets are rapidly evolving。Traders in India can use PayPal, Skrill, PayU, Citrus Pay and mobile wallet MobiKwik。

▍Popular Trading Software in India

When choosing a good online forex broker, the most important point is the software platform provided by the broker。The choice of software is crucial because each platform has its specific features and functions。Some software is specifically designed to trade currency pairs, while others are suitable for stocks or futures。In addition, some trading systems are very advanced and complex, suitable for experienced and knowledgeable traders.。

However, the vast majority of forex traders prefer to use MetaTrader 4, a software released in 2005.。The software was developed by MetaQuotes Software and is currently used by about 90% of the world's foreign exchange traders.。Of course, India is no exception, and most Indian investors interested in currency pairs tend to execute trades through MetaTrader 4.。

The so-called MT 4 is an electronic trading platform that supports all currency pairs, commodities, stocks and futures.。It has built-in 30 technical indicators, 24 graphical objects, custom tools, tutorials and news feeds。In addition, traders can use the platform for free because it is provided by a broker。Of course, this isn't the only good software for trading forex currency pairs - there are plenty of other options, including cTrader, NinjaTrader, ZuluTrade and more。

▍Mobile transactions in India

The Forex market is very popular among retail traders for a variety of reasons。First of all, it provides huge liquidity and is decentralized, which means that everyone can easily and freely enter the foreign exchange market through intermediaries (ie online brokers)。In addition, traders can take advantage of these exciting investment opportunities around the clock。

Mobile phones may be the best tool to enter the foreign exchange market anytime, anywhere。It keeps investors up to date with economic news and market trends, helping them determine their next steps.。With the ability to track markets and trades via mobile devices, traders are more likely to be informed and properly prepared for trading in the next few hours, days or weeks。

In India, as in the rest of the world, more and more investors prefer to trade on the go。Mobile usage rises sharply in India, driven by mobile devices and internet subscription plans。In addition, most forex brokers offer fast, seamless native apps that can be downloaded for free from Google Play or Apple's App Store.。

Whether it's an app for iOS or Android devices, traders should consider the following - whether they have their own native language version, and whether brokers use Indian rupees for payments。This can be a bit tricky as only a few major online brokers support the Indian rupee as the base account currency or Hindi。In most cases, Indian traders need to choose an English app。

▍ FAQs

1.Can Indian investors legally trade foreign exchange??

Yes, Indian traders have free and legal access to the foreign exchange market if they use the services of authorized financial intermediaries。However, only currency pairs containing the Indian rupee are allowed, so the legal options are USD / INR, GBP / INR, EUR / INR and JPY / INR.。

2.Is India's stock exchange open to retail traders??

Open, India has some of the world's largest stock exchanges, including the NSE, BSE and MCX-SX。These exchanges offer foreign exchange currency pairs and other financial instruments。

3.Can I trade Indian rupees??

Yes, almost all online forex brokers allow clients to buy and sell currency pairs including the Indian rupee。While non-Indian rupee currency pairs cannot be legally traded, most online brokers in India are free to offer these pairs.。

4.How to fund my trading account?

Online forex brokers often allow customers to deposit funds through commonly used credit and debit cards (such as MasterCard and Visa), online banking or modern e-wallets, which are fast, secure and convenient.。Investors in India can choose from various cards, PayPal, Skrill, PayU, Citrus Pay, etc.。

5.Can Forex Trading Guarantee Income??

No, Forex trading and CFDs are associated with high risk, and investors should always make sure they have a good understanding of the market and trends before investing real money.。Many forex traders, especially inexperienced traders, like to use leverage, which means they may lose more money than their original capital。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.