Best Forex Broker in Hong Kong (2024 Edition)

Are foreign exchange and CFDs allowed in Hong Kong??How to verify that a Forex broker is regulated in Hong Kong?

As one of the world's leading international financial centres, Hong Kong plays a pivotal role in global financial markets.。Hong Kong's official currency, the Hong Kong dollar (HKD), is one of the most traded currencies in the world.。

Foreign exchange transactions in Hong Kong are undertaken by the Securities and Futures Commission (SFC) of Hong Kong.。The SFC ensures that brokers and financial institutions operate within a framework of transparency and integrity and aims to safeguard Hong Kong's reputation as a reliable and safe venue for investment and trading activities.。

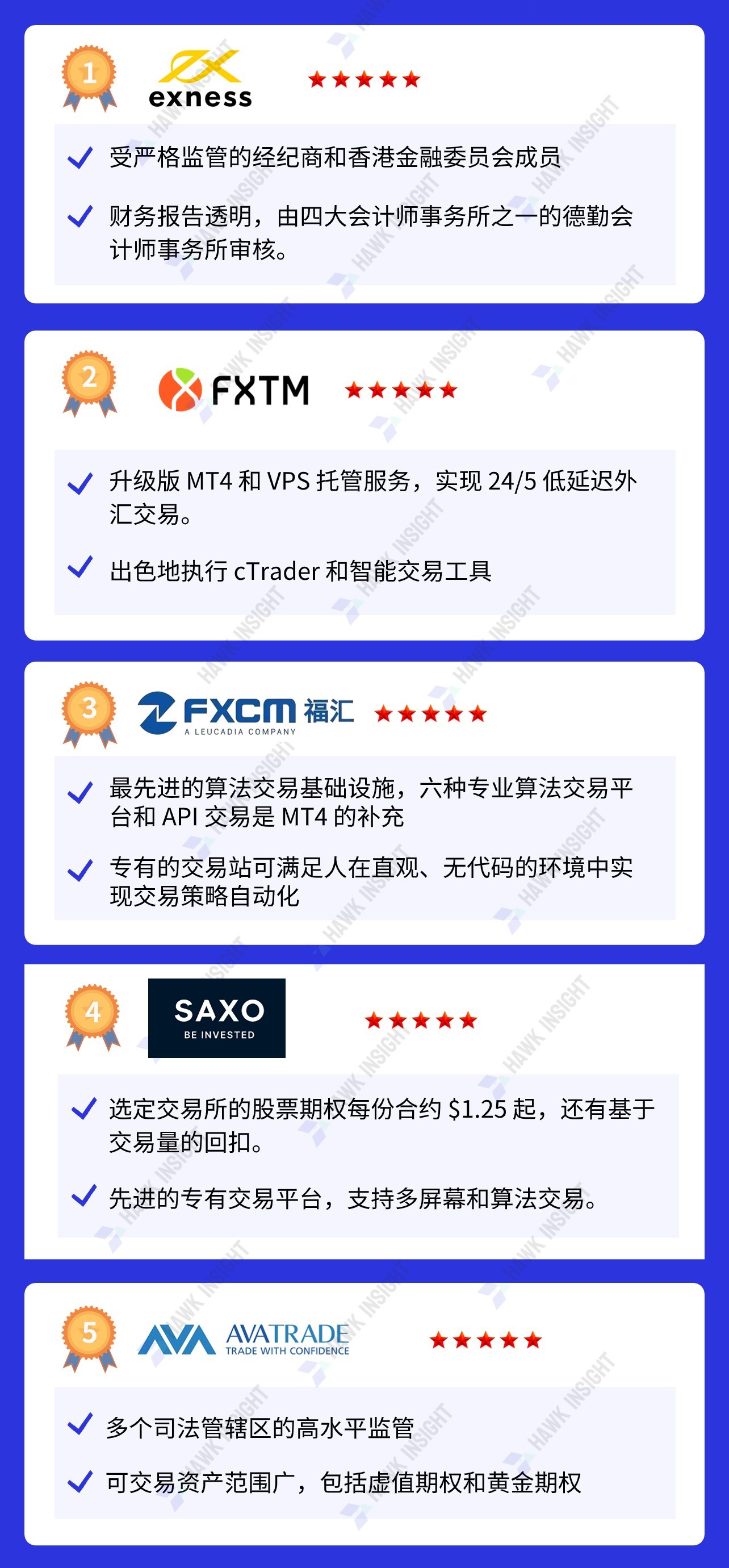

Here are the best Forex Brokers in Hong Kong by hawkinsight in 2024:

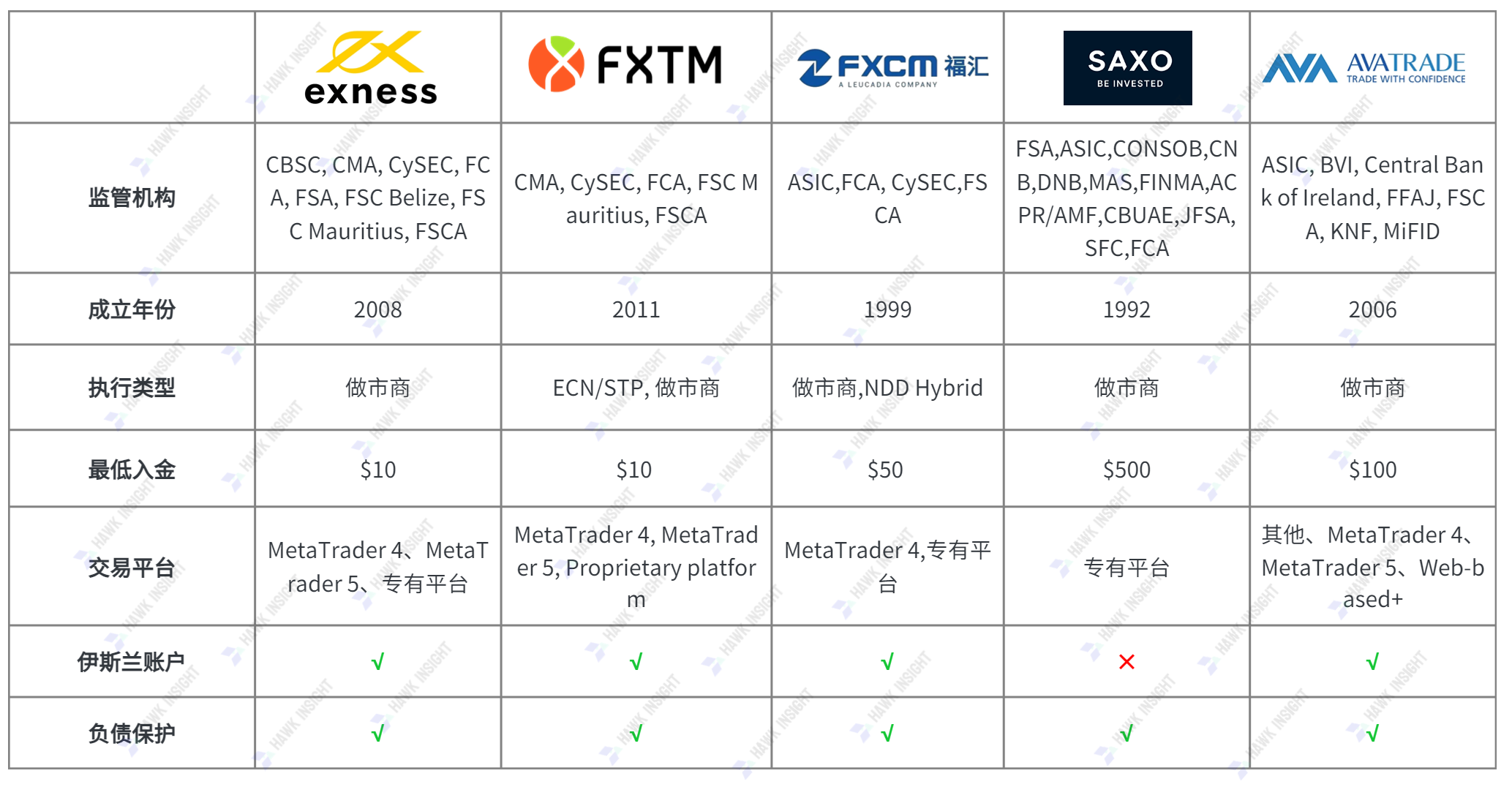

▍ Best Hong Kong Broker Comparison

○ exness

Exness official website has been localized to 15 languages, customer service across 13 languages, of which 11 languages service time is 24 hours a day, five days a week, and English and Chinese customer service is 24 hours a day, seven days a week。

Exness uses the leading trading platforms in the global marketplace, including MT4 / MT5 and web terminals。Traders can develop and implement trading strategies of various levels of complexity through MetaTrader 4, as well as submit most types of trade orders by using both order execution methods, instant execution and market execution.。

| Advantages | Disadvantages |

√ 24 / 7 multilingual customer service |

* No education for beginners |

| √ Multi-regulated broker with excellent order and volume statistics | |

| √ High transparency and financial audit of the big four accounting firm Deloitte | |

| √ Instant withdrawals from trusted brokers with numerous payment processors |

○ FXTM · Futto

FXTM is one of the most competitive Forex brokers in Hong Kong。Depending on the monthly transaction, each transaction costs $0..80 to $4.Between 00。The higher the volume of transactions, the lower the transaction costs, and the low level of fees is far ahead of the industry.。Mobile platforms are very popular in the Indonesian market, and Forex traders can use the upgraded MT4 / MT5 trading platform and FXTM Trader mobile app to trade。

Traders need to deposit a minimum of $500 to obtain a maximum floating leverage ratio of 1: 2000.。Mini account only costs $10, but the transaction cost is higher。

| Advantages | Disadvantages |

√ Excellent commission-based forex pricing environment & transparency |

* No cryptocurrency, limited choice of commodities |

| √ Upgraded MT4 / MT5 Trading Platform and FXTM Trader Mobile APP | |

| √ Quality market research and education content for junior traders | |

| √ Internal copy trading service FXTM Invest, low minimum deposit + high leverage |

○ FXCM · Fuhui

FXCM (Forex Capital Markets) is an international Forex broker founded in 1999.。The company is headquartered in New York, USA and offers foreign exchange and contract for difference (CFD) trading services worldwide.。

FXCM offers a variety of trading platforms, including their home-developed Trading Station platform and MetaTrader 4。These platforms provide real-time quotes, chart analysis tools, trade execution and other functions to facilitate traders' market analysis and placing orders.。

FXCM usually offers forex trading services on a commission-free basis, which means that no additional commission fees are charged for trading.。However, traders need to pay attention to spreads (the difference between the bid and ask prices), etc.。

| Advantages | Disadvantages |

√ There are many trading platforms to choose from, specifically supporting algorithmic trading |

× Commission-free but high cost of forex trading |

| √ Deep liquidity, transparent order execution and monthly slippage statistics | |

| √ Low commission cost structure with volume-based rebate scheme | |

| √ High-quality research and education through FXCM Plus |

○ SAXO · Saxo Bank

Saxo Bank offers options contracts listed on 20 exchanges and is one of the best options brokers。Saxo Bank's tailor-made trading tools for options trading volume are also eye-catching, including options chains, strategy generators, option rolling features and comprehensive risk data。By default, Saxo Bank only allows traders to buy options。Traders with an account balance of more than $5,000 and a written risk confirmation can also sell options。

In addition to listed stock, index and futures options, Saxo Bank offers foreign exchange vanity options。Traders can easily switch options by linking the option chain to the watch list。

| Advantages | Disadvantages |

| √ Large banking institutions | * US traders are not accepted |

| √ Comprehensive supervision |

AvaTrade is an ECN / STP broker based in Dublin, Ireland, founded in 2006。AvaTrade is one of the world's largest forex brokers and a trusted, highly regulated trading platform.。Key regulators include the Australian Securities and Investments Commission (ASIC), Japan's Financial Services Authority (JFSA) and the Investment Industry Regulatory Organization of Canada (IIROC).。However, AvaTrade enjoys a high level of regulation in Australia, Japan, South Africa, the British Virgin Islands and the European Union.。And take advantage of the most advanced trading options including MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO and WebTrader。

| Advantages | Disadvantages |

√ Provide high-quality education services through SharpTrader |

× Transaction costs are competitive, but nothing special |

| √ A variety of trading platforms to choose from to meet various trading needs | |

| √ Broad asset selection and cross-asset diversification opportunities | |

| √ Under the supervision of the Central Bank, brokers are well regulated and trustworthy |

Is foreign exchange trading legal in Hong Kong??

Forex trading is perfectly legal in Hong Kong。

Foreign exchange transactions in Hong Kong are regulated by the Securities and Futures Commission (SFC), which is responsible for ensuring the stability of capital markets and overseeing financial securities and derivatives.。Traders in Hong Kong can choose brokers regulated by the SFC or by international regulators。When choosing a broker, you must consider its security features, such as segregating funds, liability protection, and participation in compensation plans。

While the SFC does not require brokers to provide negative balance protection, it will provide funds to the Investor Compensation Fund (ICF) to insure retail traders up to HK $500,000.。In addition, the SFC has capped retail leverage at 1: 20, a measure aimed at reducing trading risk。

▍ How Hong Kong Traders Should Choose a Forex Broker?

There are several points to note when choosing a forex broker when trading in Hong Kong。Here are some important tips you can refer to:

1.Preferred Hong Kong Regulated Brokers

Local regulation by the SFC not only means that you have a trusted regulator at your service, but if the broker is regulated locally, if any problems or challenges arise, they can be solved more easily。

2.Liability protection

As negative balance protection is not mandatory in Hong Kong, not every broker offers liability protection。This means that if you really want to have this feature, then you should look for a broker that provides this feature。

3.Select a broker with a quality demo account

Any kind of transaction has risks。Especially if you are new to trading, the risk is even greater if you use leverage to trade。Therefore, you should definitely try to take advantage of some of the excellent demo accounts offered by the above brokers。It's a risk-free way to learn。

4.Customer Funds Isolation

Brokers must keep client funds in a separate bank account, separate from the corporate funds account。This is essential to reduce the risk of accounting errors.。

5.Limiting Market Risk

Limiting market risk protects traders from adverse price fluctuations。This is why the maximum leverage allowed by most top regulators is capped at 1: 30, while less stringent regulators can allow leverage as high as 1: 2000。

6.compensation plan

Depending on the jurisdiction in which the broker is located, compensation plans can also protect clients from corporate credit risk and liability。For example, brokers regulated by the Cyprus Securities and Exchange Commission (CySEC) all participate in the Investor Compensation Fund (ICF).。

Traders get up to €20,000 in compensation in case of company bankruptcy。The Financial Services Compensation Scheme (FSCS) under the UK's Financial Conduct Authority (FCA) can offer traders protection of up to £85,000。

▍ How to Verify Whether Forex Brokers Are Regulated in Hong Kong

There are several steps you can take to verify that the broker is regulated and determine the regulatory authority that regulates the broker。

After visiting the broker website, scroll down to the bottom of the page to find the legal name of the entity。Regulatory information is usually here.。You need to look up the reference / license number and log on to the official website of the Hong Kong Securities and Exchange Commission (https: / / www.sfc.hk), check its authorized entity registry as a way to verify the entity。

You also need to evaluate the transparency of the broker in terms of order execution and whether you can trust it not to manipulate the price action。You need to check whether the broker has a "best execution policy," whether it regularly publishes execution quality statements, and whether it states its average execution speed.。

What are the local characteristics of trading in Hong Kong??

There is a large time lag between the Asian trading session and the 2-hour window that overlaps the European and US trading sessions。During this time period, trading activity usually peaks, providing the most viable opportunities。However, this peak tends to occur after 11pm Hong Kong time, which is not ideal for local traders who prioritize a good night's sleep.。In order to better match their lifestyle, I recommend that traders based in Hong Kong choose a broker that offers a variety of trading tools in the local market (especially the Hong Kong Stock Exchange).。

▍ FAQs

1.Are foreign exchange and CFDs allowed in Hong Kong??

Yes, Forex and Contracts for Difference (CFD) trading is allowed in Hong Kong。

2.Who regulates the foreign exchange and CFD markets in Hong Kong?

The Hong Kong Securities and Futures Commission (SFC) regulates the local foreign exchange and CFD markets and ensures that brokers and financial service providers comply with strict regulatory standards to protect traders and investors.。

3.Can international traders participate in the Hong Kong foreign exchange market??

Yes, there are no legal barriers preventing international traders from engaging in financial derivatives trading in Hong Kong。

4.Do you need to pay tax on foreign exchange transactions in Hong Kong??

In Hong Kong, profits from foreign exchange transactions are generally not taxable。This is because Hong Kong does not impose capital gains tax, which in many jurisdictions applies to profits from foreign exchange transactions.。In addition, Hong Kong's tax system is territorial, which means that only income from Hong Kong is taxable.。Profits from foreign exchange transactions are generally considered to come from outside Hong Kong and are not normally covered by taxable income。For more information, please consult a professional tax advisor。

5.What is the difference in protection between SFC-regulated and offshore-regulated brokers?

The SFC-regulated brokers comply with strict financial regulations and provide strong investor protection, such as the Investor Compensation Fund and strict auditing standards.。In contrast, offshore regulated brokers may have varying degrees of regulatory rigor and investor protection schemes, often lacking the SEC's strict oversight。

6.Can I trade with an offshore regulated broker in Hong Kong??

Yes, in Hong Kong you can trade with offshore regulated brokers。However, it is important to note that these brokers may not be subject to the same stringent regulatory standards and investor protection that are regulated by the Securities and Futures Commission (SFC) in Hong Kong.。As a trader, you should conduct due diligence and understand the different levels of risk involved when choosing an offshore regulated broker。

7.Can Hong Kong trade cryptocurrencies??

Yes, Hong Kong allows cryptocurrency trading。

8.Can I trade forex in Hong Kong without a broker??

In Hong Kong, you can't trade forex without a broker。Brokers provide the necessary access to the foreign exchange market, trading platforms and liquidity, which makes them necessary for the execution of foreign exchange transactions.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.