8 social trading platforms

Social trading is a social network for traders that allows some traders to copy the strategies of others, first appearing as mirror trading in the early 2000s.。

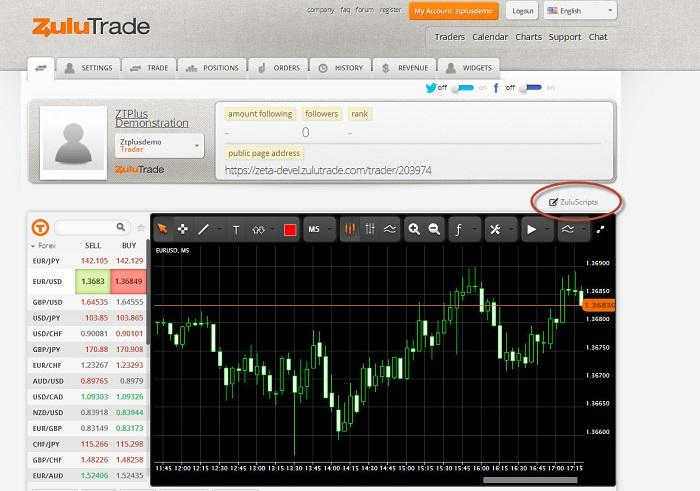

1. ZuluTrade

Back in 2007, a Greek entrepreneur named Leon Yohai launched this social trading platform, which changed the rules of the game in financial markets.。ZuluTrade started out as an automated trading feature, but over time it has expanded its social trading service。

ZuluTrade, which provides services through its own proprietary network and mobile app, also supports multiple brokers, and the platform has social interaction capabilities, but copy trading is its main feature。

Followers can search and edit a large number of high-quality suppliers using professional and advanced search tools。With its algorithmic trading portfolio capabilities, followers can combine and replicate strategies from multiple vendors。

In addition, there is a social chart feature that shows the provider's clear entry points and its recent closing of positions。In summary, ZuluTrade is one of the best social trading platforms on the market, you can try the platform for free with a demo account。

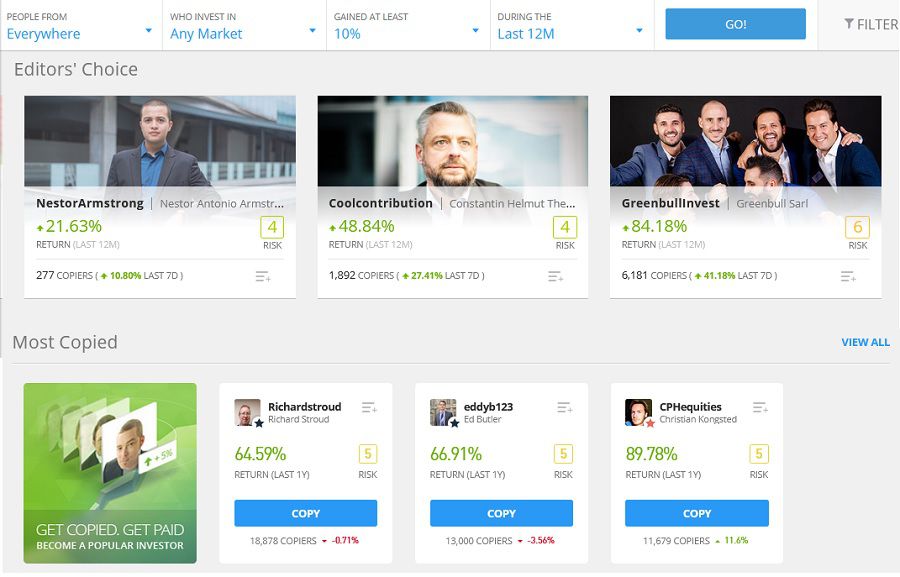

2. eToro

eToro is undoubtedly the company driving this trend, with its social trading feature originally founded by Yoni Assia, Ronen Assia and David Ring in 2007.。Today, it has amassed more than 13 million registered accounts.。

This platform allows you to monitor other people's trades in real time and manually copy their trades。Of course, you can also use the automatic copy trading function。

eToro's proprietary copy trading platform will automatically adjust your copy transactions in proportion to your funds, thereby implementing risk management。

The full demo account feature is available for free, so beginners can experience how copy trading works。In fact, eToro is a platform focused on educating junior traders。

As for trading instruments, eToro always offers stock copy trading at 0% commission instead of currency pairs.。In addition, foreign exchange CFDs assets are available and customers can trade on its proprietary platform.。

Founded in early 2007, eToro's mission is to make transactions available to anyone, anywhere, and to reduce reliance on traditional financial institutions.。The company has headquarters in the UK, Cyprus, USA and Australia。

eToro (Europe) Limited is a financial services company authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number # 109 / 10.。Meanwhile, eToro (UK) Limited is regulated and regulated by the Financial Conduct Authority (FCA) under license number FRN 583263.。

As for eToro AUS Capital Pty Ltd, its legal status is recognised by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services Licence 491139.。

As a 4-figure broker, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative CopyPortfoliosTM, a fully managed thematic portfolio.。

Since 2007, eToro has been at the forefront of the fintech revolution.。The latest is CopyPortfolio, which was launched in 2017 and is powered by machine learning Al。In addition to developing CopyPortfolio, the company also integrated Microsoft's machine learning technology into Momentum DD.。

The new CopyPortfolio investment strategy uses artificial intelligence to find the most stable traders who are most likely to earn double-digit returns and bundles traders into a fully managed portfolio.。eToro has hundreds of financial assets available for trading, including stocks, commodities, crypto assets, currencies, indices and ETFs。Each asset class has its own characteristics and can be traded using multiple investment strategies。

Certain positions on eToro involve ownership of underlying assets, such as non-leveraged positions in equities and crypto assets。Using contracts for difference (CFD) will make various options possible, such as leveraged trading, short (sell) positions, fractional ownership, etc.。For example, a trader can invest in gold at a minimum amount of $100, even if the price of a single unit of gold is $1,000.。eToro's most popular CFD commodities include gold, oil, gas, silver and platinum。

Currency can only be traded as CFD on eToro。In addition, CFD allows for short selling (short) positions and leveraged trading, even for assets that do not offer this option in traditional trading.。Some popular currency pairs include EUR / USD, GBP / USD, AUD / USD, USD / JPY, and USD / CAD。

In addition, an exchange-traded fund (ETF) is a financial instrument consisting of several assets and is used as a tradable fund.。After opening an eToro account, traders can invest at least $250 in an ETF that sells for $500.。Some popular ETFs on eToro include SPY, VXXB, TLT and HMMJ。

However, eToro also offers other features through the use of CFD trading。All leveraged ETF positions in the UK are regulated by the FCA。Meanwhile, all CFD positions executed by eToro Australia are regulated by ASIC.。

The company also has other advantages。Of all tradable financial assets, eToro does not charge any deposit or transaction fees other than spreads。

eToro charges $25 for withdrawals, with a minimum withdrawal amount of $50。Non-leveraged long positions held in cryptocurrencies, stocks and ETFs are not executed as CFD and are not charged。eToro charges overnight or weekend fees for CFD positions, such as leveraged positions and short (sell) orders。

Update of fees always applies to open positions。Fees are subject to change at any time and may change on a daily basis based on market conditions without prior notice。

As a beginner, traders can use eToro's copy trading feature。Unlike the features of other brokers, traders can copy the strategies of professional traders for free without splitting into profits。As a result, 100% of the profit goes entirely to the trader.。For example, when Trader A, copied by Trader B, generates 10% profit this month, Trader B also earns 10% profit。

The company is the world's leading social trading network.。Since eToro operates in complete transparency, each trader has valuable information in their eToro profile, so it is helpful for other traders interested in copying their trades when creating their best portfolio。

Another unique feature of eToro is personalized social news subscriptions。Just like on any social media, traders can post their own updates in a subscription, comment on other people's posts, and gradually create a subscription that suits a trader's trading and investing interests.。On the eToro social trading platform, traders will also be notified when there are new posts and other important updates from traders。

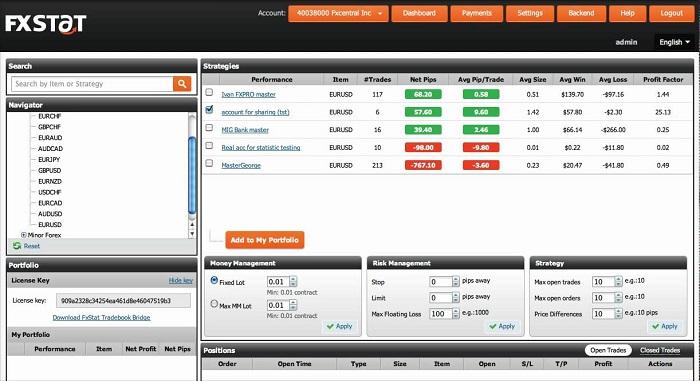

3. FxStat

FxStat is a reputable social trading platform with over 250,000 users.。Founded in 2010, the platform started as a forex analytics provider for traders to analyze and compare their own trading performance.。Since then, copy trading and automated trading capabilities have been added。

FxStat is available on the web and also on mobile via iPhone and Android apps。FxStat allows you to connect your MT4 trading account as long as your broker offers you such an option。

FxStat will show in the performance indicator whether the trader is using a manual or automated system。Social trading communities come in the form of discussion boards where traders can connect and follow each other。

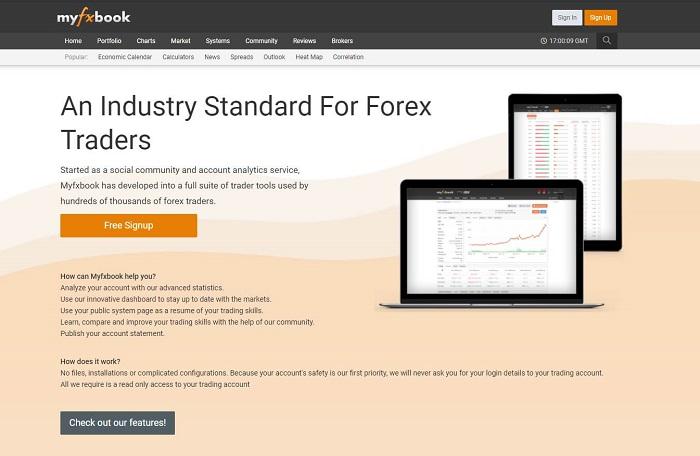

4. Myfxbook

Myfxbook may be the best choice for users seeking a large and active social trading community。The platform allows providers to connect their own trading accounts and share real-time trading signals for community discussion, but not every provider can do this.。

Due to its strict procedures, Myfxbook only allows the best traders to provide reproducible signals。

The platform will pay rewards to providers, but only for profitable trades, and the system ensures that the platform only provides the best signals.。In addition, after connecting the platform to your MT4 account, you can also use the automated trading function。Myfxbook currently supports more than 100 brokers。

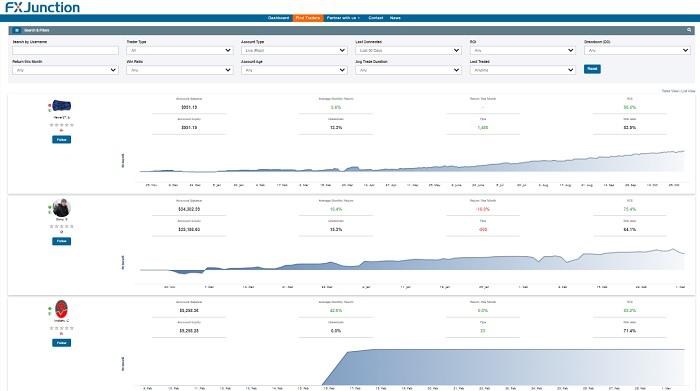

5. FxJunction

FXJunction is one of the most talked about social trading platforms。The platform allows you to combine and copy successful trading strategies into your MT4 or MT5 trading account to create a social trading portfolio。

Because FxJunction does not work with a broker, you can link an existing MT4 or MT5 account。In addition, providers are free to set their own fees。One of the practical features of FxJunction is a leaderboard showing provider transaction statistics。

Through this leaderboard, you can see which provider makes the most money and activate the copy transaction using the automatic copy function。Providers that typically do not show negative returns, nor do they show "unusually" positive returns。

Profits are usually generated through a degree of risk-taking。FxJunction wants to ensure that followers do not take an overly aggressive approach, leading to sustainable profitability。

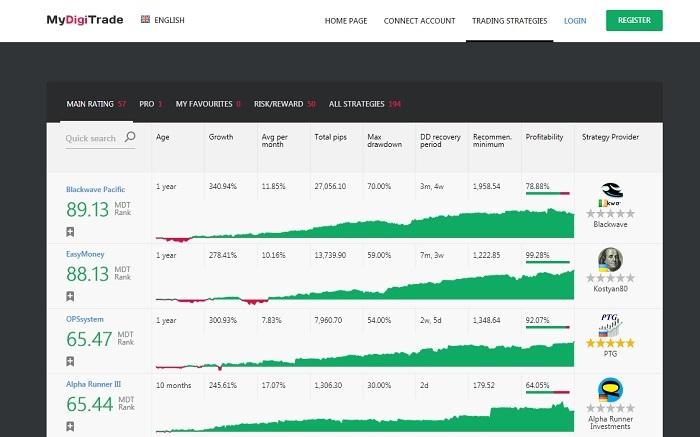

6. MyDigiTrade

Originally created in 2010 to mirror transactions, MyDigiTrade later added copy transactions and social interaction features such as reviews and ratings.。The platform is only aimed at the Forex market, so all signals provided are tailored for Forex traders。

Before investing real money, you can experiment with a free forex demo account, a platform that can be integrated into any broker's MT4 trading account。

Since the transaction volume of followers is proportional to the transaction volume of the provider, the funds of followers are safely distributed on the platform。For example, if a provider allocates 4% of its funds for its transactions, followers will only use 4% of their accounts。

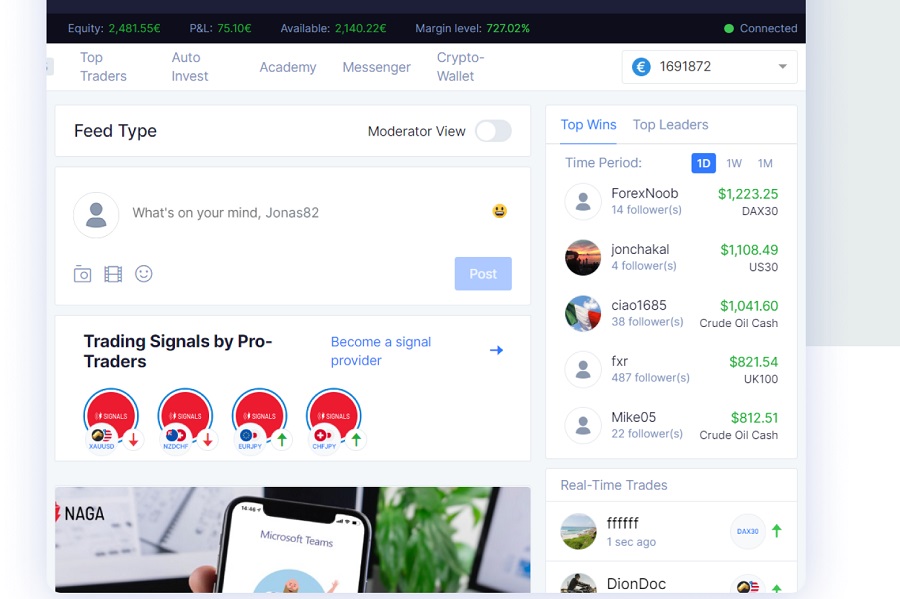

7. NAGA Trader

NAGA Trader, formerly known as SwipeStox, is a smartphone app developed similar to a social dating app.。So it's no surprise that SwipeStox has been hailed as the "Tinder of the trading world."。The platform promises to easily copy transactions with a single swipe, hence the name "SwipeStox."。

Today, it has been renamed NAGA Trader and expanded massively in terms of social trading services。NAGA Trader retains the algorithmic function to display matching trades based on your profile。

You can also interact with other traders.。NAGA Trader offers its own cryptocurrency NAGA Coin (NGC) as base currency。You can open a demo account on their mobile app or webtrader platform to test the platform。

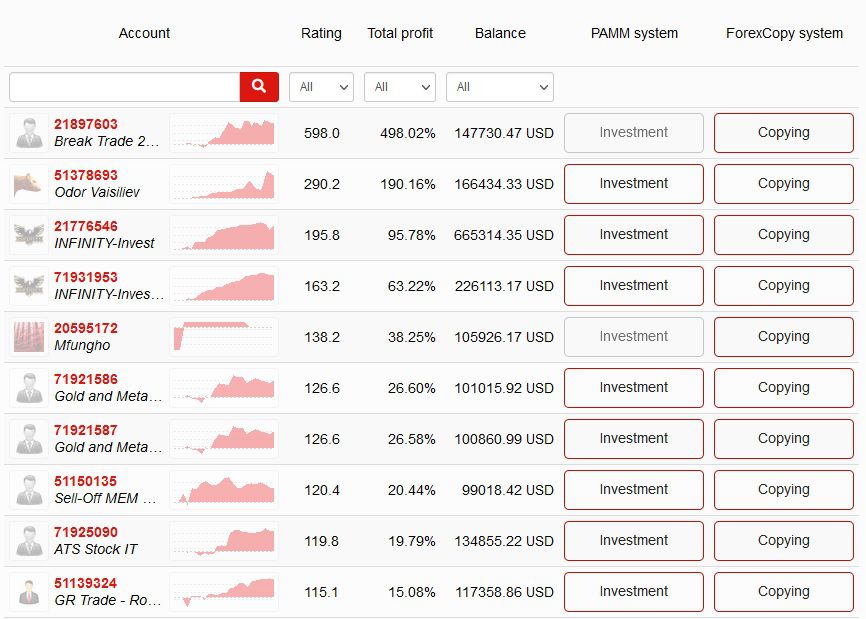

8.ForexCopy for InstaForex

As the most well-known broker in Asia, InstaForex is a household name in the forex industry and is worth considering。The broker has set up its own proprietary copy trading platform called ForexCopy。

Followers can be the best providers because the platform displays the provider's trading portfolio where they can arrange their own fees。However, they are only entitled to a commission if the copied trades are profitable at InstaForex。

Followers do not have to pay any fees to the provider if the transaction loses money。Followers can choose to cancel orders manually if the open position is not profitable。In addition, when copying trades, the platform allows you to define ratios, lots, and other settings for each trader。

InstaForex is an international broker offering trading services to traders worldwide。Since its inception in 2007, InstaForex has served up to 7 million traders from various countries.。InstaForex, headquartered in Kaliningrad, Russia, is always committed to improving the quality of the company in order to attract the hearts of customers。

InstaForex's efforts are there for all to see, and one of them is winning various awards, including the 2018 Best Forex Cryptocurrency Trading Platform from the UK Forex Awards, the 2018 Best ECN Broker in Asia from IBM, the 2018 Eastern European Forex Broker of the Year Award from Lee, the 2016-2017 Financial Olympus Fonti Award, Development Award and Success Award, among others.。

InstaForex offers 4 types of accounts that represent a common trading tool that helps to operate on international financial markets, such as Insta.Standard, Insta.Eurica, Cent.Standard and Cent.Eurica。The type of trading account varies depending on the method of calculating spreads and commissions and is selected by the account opening trader。

Insta.Standard accounts are linked to standard trading terms on the Forex market and allow trade settlement using classic spreads with no fees。Traders are charged a fixed spread every time they make a trade, with a spread range of 3-7 points。The main advantage of this type of account is its versatility, as the trader can change the trading leverage and use the convenient trader's deposit size。

with Insta.Standard account is different, Insta.The Eurica account does not need to pay any spreads when opening positions.。Therefore, such InstaForex account is suitable for a minimum trading volume of 0.01 hands of a beginner trader。

InstaForex also has other types of accounts, namely Cent.Standard and Cent.Eurica, available for beginners because they can use the smallest trading volume, which is 0.0001 lots (cost per lot is 0.1 cent)。The deposit currencies available to traders are EUR and USD (for all types of accounts)。

Trading at InstaForex is taken for granted as traders can choose to trade with leverage between 1: 1 and 1: 1,000。Since the minimum initial deposit requirement is only $1 (for all types of accounts), InstaForex customers have the opportunity to receive a 30% to 100% deposit bonus。

Not only that, beginners will not be confused when determining a forex trading strategy because the ForexCopy service provided by Instaforex allows traders to copy orders from professional traders in just a few minutes。

In addition, InstaForex provides traders with about 300 trading tools, in addition to currency pairs, there are futures, stocks, gold, silver, CFDs, Bitcoin, etc.。

Every InstaForex client is free to choose the trading platform that suits their needs。There are four types of trading platforms available, including InstaBinary, WebIFX, MetaTrader4 and MetaTrader5, each with advantages and disadvantages。InstaForex also offers video tutorials on how to register on each platform with the aim of making it more convenient for beginner traders who want to join InstaForex。

If traders are still confused after watching the video tutorials, traders can reach out to customer service 24 hours online via various social media including email, Skype, Whatsapp, Telegram, Viber, Twitter and phone。About 30 languages are available on the InstaForex website to facilitate traders from different countries。

Traders can also use the trading calculator available on the InstaForex website to help themselves and can accumulate currency pairs, leverage, trading volume and currency used。

InstaForex also has a variety of payment systems, with traders paying for deposits via Visa, Mastercard, Skrill, Neteller, PayCo and wire transfers.。All in all, InstaForex is a comprehensive broker for many types of traders。

Standard of Excellent Social Trading Platform

Reliability and ease of use

This is a very simple but crucial factor when choosing a social trading platform。If the platform is unstable and technical errors often occur, then they should be abandoned, and a good social trading platform should be fast and easy to use。

Support and social features

Customer support is another essential element of a good social platform。Fast, high-quality support can determine the success of the transaction。The social function here refers to the possibility of interaction between providers and followers, whether in the form of forums, reviews or ratings。A good social platform will have a large and active community where traders can gather to discuss topics related to trading。

Select Provider

Choose a social trading platform that can replicate multiple providers。The more providers, the richer the trading strategy。However, this is not only about the number of providers, but also about their quality。A good platform will allow providers to trade at the risk of their own money and have a good track record of trading activity。

Show Performance Analysis

Risk Score: A measure of the level of risk in a provider's trading performance to determine whether its style is aggressive or conservative.。Profit chart: a visual representation of the growth of the provider's profits。Sharply rising and falling charts indicate excessive risk-taking, while a 45-degree rising chart indicates a balance between risk and profitability.。Profit Per Time: Providers with long-term sustained trading success are more reliable and score higher。Shrinkage (%): A measure of the possible negative value of a position before it turns positive.。Shrinkage of good provider should not exceed 10% of account。

Risks of Social Trading

No matter what platform you use, and no matter your trading experience, social trading is risky。But in social trading, there are special risks。

The main risk is that you may be affected by bad traders, thereby affecting your decision-making。In addition, you will often inadvertently find some traders trumpeting their views without any reliable evidence。This seems to be the norm in every financial market, including foreign exchange, although other markets such as cryptocurrencies are considered riskier.。

Bad influences or hype aside, you need to remember the main function of social transactions-share ideas, gain knowledge, and apply this knowledge for your own benefit。Blindly following other traders without verifying information can only lead to mistakes and even huge losses.。

How to Benefit the Most from Social Trading

There are ways you can benefit from social trading and control risk。First, focus only on reputable traders。They usually have real trading expertise and a balanced view of the market。Learn from them as much as you can, but at the same time don't forget to do your own research。

The second is not to blindly follow any trading advice, especially overly enthusiastic advice such as "buy now or you'll regret it."。It's best to ignore these suggestions and do your own research first, even if the suggestions are true。Even if the advice is true, it is usually an overly risky approach that will damage your account in the long run。

The third is to learn how to copy transactions。Before choosing a replication provider, you must consider factors such as their experience, time horizon, odds, risk / reward ratio, etc.。The key is to replicate trades that suit your trading style and needs。

Advantages and Disadvantages of Social Trading

Advantages

You can communicate directly with experienced and successful traders。You can get professional analysis from other traders。You have the opportunity to learn and hone your skills in trading。

Disadvantages

Other traders can easily influence you, especially beginners。Anyone can share their views on social networks, including non-professionals。

FAQs

What is Social Trading?

Social trading is a form of trading that allows traders to communicate with each other。Through this interaction, traders can share trades, ideas or news with other traders。It is very similar to social media, but with a focus on transactions.。

In addition, traders can also copy the strategies of other traders, so it can be a gathering point for traders looking for signals and traders seeking additional commissions by sharing ideas。

Is Social Trading Legal??

Social transactions are legal.。You should definitely not blindly follow any advice as some traders may have limited or even questionable knowledge and some advice can only be obtained from competent professionals。

Also, it's best to avoid telling peers what to do or claiming to be 100% profitable。Other than that, social transactions are legal。

Is Social Trading Profitable??

Sure, but like any other form of trading, the risk of losing money is always there.。Trading wins are not guaranteed, so you must analyze in advance and apply your knowledge accordingly。

What is the difference between social transactions, copy transactions and mirror transactions??

Copy transactions, mirror transactions belong to the category of social transactions.。

A social trading platform that allows copy trading can copy an expert's trades and apply them to the accounts of followers who choose to copy trades。

Social trading with the concept of mirror trading is more operationally fixed。Traders automatically open and close positions at the same time as mirror traders through pre-coded trading signals and strategies, which focus more on Algo trading and automated trading。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.