Amazon Q3 Performance Exceeds Expectations Cloud Business Performance Stable CEO Says Optimistic About AI Opportunities

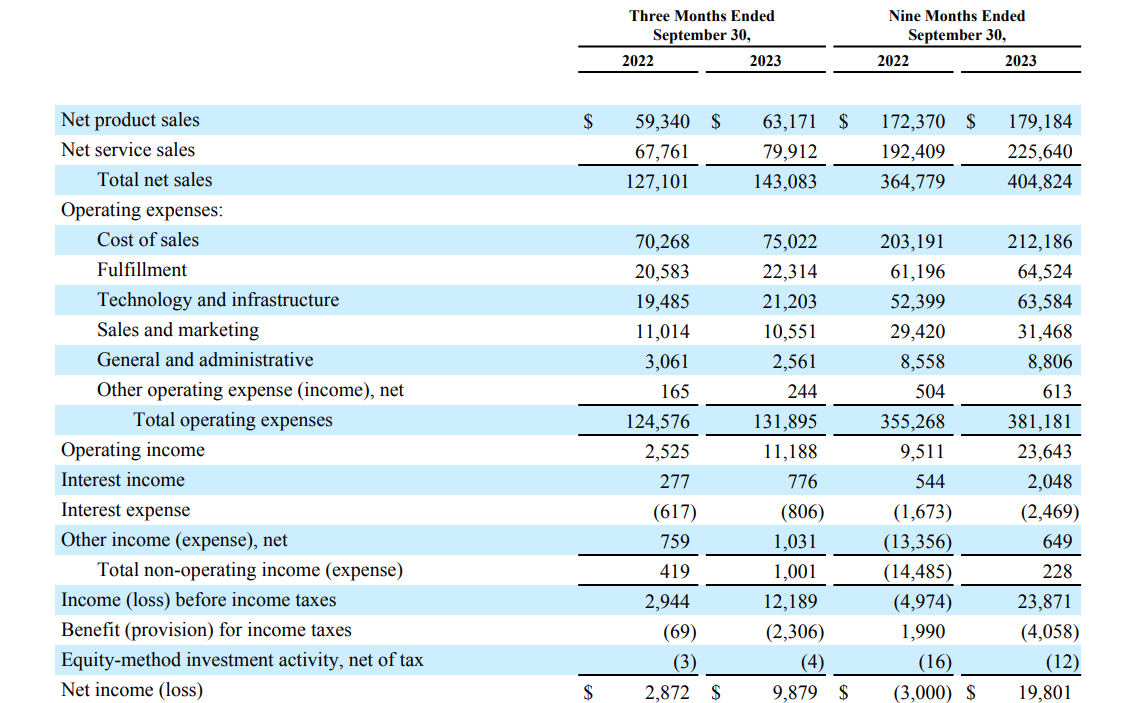

On October 26, Amazon announced its third-quarter financial results.。Net sales rose 13% year-over-year to $143.1 billion, higher than expected, data showed.。Operating profit rose more than fivefold year-over-year to $11.2 billion, well ahead of Wall Street's forecast of $7.7 billion.。

Local time on Thursday (October 26), Amazon announced the third quarter financial results ended September 30, 2023。

Third-quarter net sales rose 13 percent year-over-year to $143.1 billion, higher than forecast of $141.4 billion.。Operating profit rose more than fivefold year-over-year to $11.2 billion, well ahead of Wall Street's forecast of $7.7 billion.。Third-quarter net income rose to $9.9 billion, or 0 per diluted share.$94, more than triple the year-ago figure, well above Wall Street's consensus forecast of 0 per share..58美元。

Amazon closed down 1 on Thursday.5% at 119.57 美元。After-hours trading up nearly 5% after earnings release。Amazon shares have risen 42% so far this year, far outpacing the S & P 500's nearly 10% gain.。

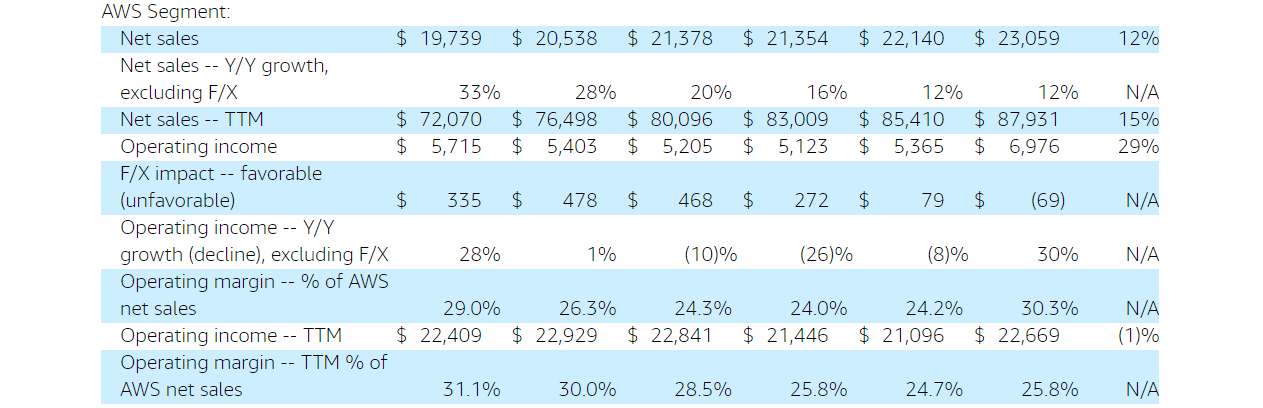

AWS segment stable, CEO expects AI to bring tens of billions of dollars of opportunities

Amazon Web Services (AWS), a closely watched cloud-related division, saw revenue climb after several quarters of deceleration。

In the third quarter, the segment's net sales were 230.$5.9 billion, up 12% year-over-year, slightly below analyst expectations of 231.300 million dollars。Operating profit reached 69.$7.6 billion, up about 30% year-over-year, higher than analysts' expectations of about $5.6 billion。In addition, AWS has an operating margin of 30.3%, the highest level since the first quarter of 2022。

In a note to clients, Jefferies analysts said Amazon's cloud sales rose 12 percent, a growth rate "enough to put the bogeyman off."。Sales were slightly higher than the previous quarter, marking the first quarter-on-quarter increase in AWS revenue growth in nearly two years.。

The company has always wanted to seize the opportunity of artificial intelligence and promote the development of the company in the field, this goal is mainly through AWS to achieve。

Adam Selipsky, CEO of AWS, said the division's strategy is to provide as much flexibility as possible to enterprise customers who want to build AI capabilities.。

This year, AWS launched the Bedrock AI service, which simplifies the development of large language models.。Recently, Amazon launched an artificial intelligence coding assistant Code Whisperer。Separately, in the third quarter, Amazon announced a partnership with AI startup Anthropic, while Amazon injected nearly $4 billion into it.。Under the agreement, Anthropoic will use AWS technology and provide its tools to cloud customers.。

Amazon CEO Andy Jassy said in a phone call that artificial intelligence represents "tens of billions of dollars" worth of opportunities for AWS.。Jassy acknowledges that AWS's growth has been hampered by the search for cost-cutting。But Jassy stressed that many customers are now turning to running new projects on Amazon's servers, saying, "Our generative AI business is growing very, very fast.。"

Jassy said that while AWS's third-quarter revenue was slightly below expectations, the business is stabilizing.。Aside from reassuring people, Jassy also revealed that the company has signed several new agreements with customers that will take effect this month, and the demand for generative AI could drive the unit in the future.。

"We believe that AWS net sales expectations have bottomed out and expect continued positive correction to drive the stock higher as cloud cost optimization headwinds subside and AI-driven workloads support new migrations," said Jefferies analysts.。"

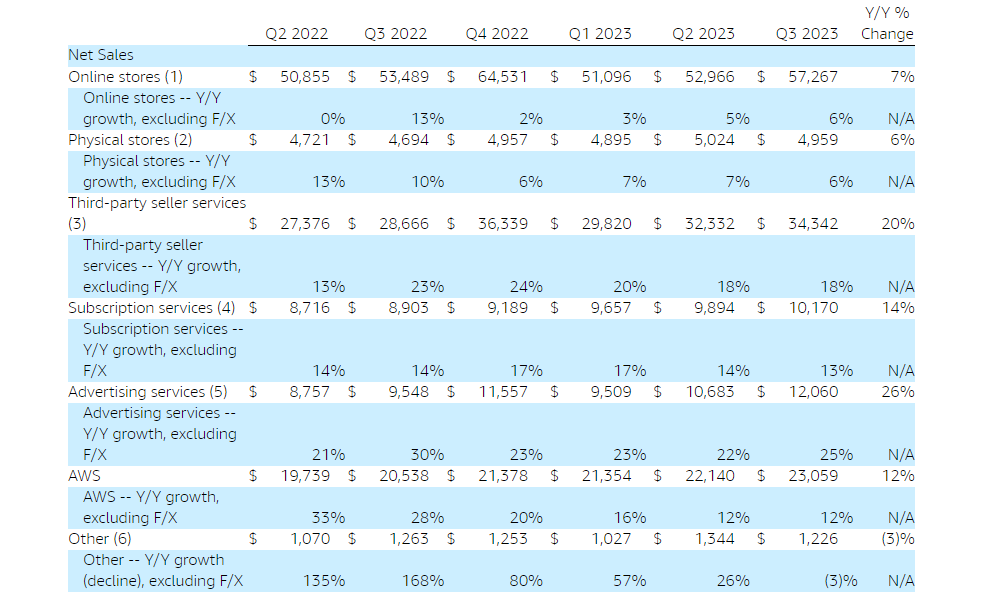

Online stores and advertising services performed well in the third quarter.

In addition to the AWS division, Amazon's other businesses performed admirably in the third quarter.。

For online stores, third-quarter revenue was 572.$6.7 billion, with market expectations of 568.$200 million, up 6%。The physical store side also achieved a 6% year-over-year increase in the third quarter, with revenue of 49.$5.9 billion。

Third-party seller services recorded revenue of 343 in the third quarter.$4.2 billion, higher than market expectations of $33.4 billion, up 18% year-on-year, and the growth rate was the same as the previous quarter.。

For subscription services, revenue for the third quarter was 101.$700 million, up 13% year-on-year, basically in line with market expectations。

Advertising Services Still Growing Rapidly in the Third Quarter。Advertising revenue totaled $12.1 billion in the third quarter, up 26% year-over-year, making it the company's fastest-growing business line.。Jassy said there are a lot of things to get excited about when it comes to advertising, with many ad-intensive businesses struggling to grow amid tough economic conditions.。Jassy also mentioned that Amazon has "only scratched the surface" in how it integrates advertising into video, audio and groceries.。And says Amazon is starting to externalize sponsored products to third-party sites。

Other business, recorded 12 in the third quarter.$2.6 billion, down 3% year-on-year, the first year-on-year decline in nearly two years。

Cost-cutting efforts are paying off

Like other big tech companies, Amazon has been pushing ahead with cost-cutting plans since last year。

To rein in spending, Amazon has shed about 27,000 employees this year, making it one of the biggest tech companies to cut jobs this year.。

Amazon also revamped its delivery business。Brian Olsavsky, Amazon's chief financial officer, said the "regionalization" of Amazon's vast logistics network meant goods could be stored closer to customers, with lower delivery costs and faster times.。These improvements were "a key driver of growth and led to increased purchase frequency"。

As seen in Q3 earnings, Amazon's cost-cutting efforts are paying off。

In sales and marketing, such spending declined in the third quarter from a year earlier for the first time since 2015.。In addition, technology and infrastructure spending (including software engineer salaries and AWS server costs) grew by only 8% in the third quarter..8%, about a quarter of what it was a year ago。

Cost cuts pushed its third-quarter operating profit to $11.2 billion, compared with just $2.5 billion a year earlier.。In addition, Amazon's operating margin has been growing, with an operating margin of 7 in the third quarter..8%, is since the first quarter of 2021 (8.2%) the highest level since。This suggests that Amazon's efforts to improve efficiency after the pandemic have been working。

However, the company said that AWS, as Amazon's main internal cost-cutting and efficiency target, related cost-cutting actions are not yet over。Olsavsky said businesses were still looking to cut IT costs, which remained a headwind for AWS, the core driver of group profits.。But he added that the pace of cost-cutting had slowed while "new workloads" were on the rise, including from companies looking to deploy generative AI.。

Festive Season Is Coming, Can Fourth Quarter Results Record Again

A big driver of the company's third-quarter results came from the annual Prime Day event held in July.。Thanks to the event, Amazon's North American sales reached about $13 billion, the highest level since early 2021, and the number of purchases increased by 25% compared to similar events in 2022.。Advertising sales rose 26% to $12 billion, also beating expectations。

Amazon is hosting a second Prime Day-like event this month called "Prime Big Deal Days," which is understood to be larger than a similar event last year, giving its year-end sales a strong start.。In addition, the fourth quarter will usher in many important festivals in North America, such as Christmas, Thanksgiving, Halloween and so on.。As a result, the market was very concerned about Amazon's guidance on fourth-quarter sales ahead of this earnings release。

But Amazon's guidance is more conservative, which surprised the market a bit.。

Amazon expects the company's quarterly sales to reach $160 billion to $167 billion by the end of December, up 7% to 12% from the same period last year, while analysts on average expect $166.6 billion, at the upper end of Amazon's guidance.。Operating income in the period will be $7 billion to $11 billion。The average analyst forecast is 87.100 million dollars。

Separately, Amazon executives also expressed cautious views on consumer spending in a conference call。

Chief Financial Officer Olsavsky said: "From a consumer behaviour perspective, we continue to see customers being cautious about trading as low as possible and looking for deals with lower discretionary spending.。He also said the easing of inflation helped bring down some of Amazon's transportation spending, which was partially offset by higher fuel costs.。

While company executives are cautious about holiday-season consumer spending, Insider Intelligence analyst Zak Stambor has an upbeat view。Stambor said Amazon's successful Prime Big Deal Days event brought $5.9 billion in sales to U.S. retail e-commerce, achieving an 8% year-over-year growth rate, which gave it a strong boost into the holiday season。

Hargreaves Lansdown equity analyst Sophie Lund-Yates is also more optimistic, but he is seeing "clues" from Amazon's hiring plan.。In a conference call, Amazon said it plans to hire 250,000 full-time, part-time and seasonal employees for its warehouses in anticipation of these important holidays.。Lund-Yates believes that Amazon's increase in seasonal hiring bodes well for consumer discretionary spending to some extent。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.