Fed officials continue to hawk gold day under pressure to fall back

Perhaps feeling the market's overly optimistic mood after the Fed announced a pause in rate hikes in November, Fed officials have been pouring cold water on the market these days。

On November 7, spot gold fell slightly in the day..05%, currently traded in 1968.07 USD / oz。

The weakening of gold is closely related to the recent voices of Fed officials.。Perhaps feeling the market's overly optimistic mood after the Fed announced a pause in rate hikes in November, Fed officials have been pouring cold water on the market these days。

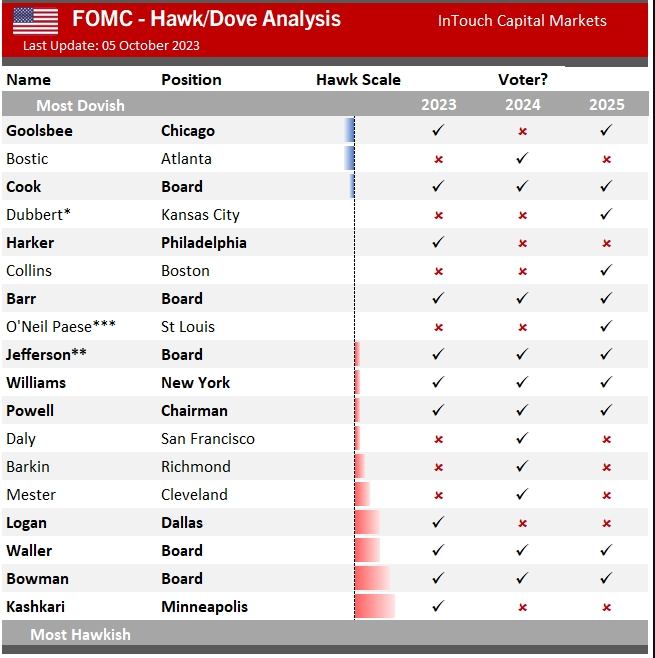

First on the scene was the representative of the Eagle within the Federal Reserve, Federal Reserve Bank of Minneapolis President Kashkari.。In his recent statement, he reiterated his firm commitment to curb inflation, saying he would rather tighten monetary policy excessively than not do enough to take measures to reduce inflation to the central bank's 2 percent target.。He also said that past experience had shown that the U.S. economy was resilient and that he feared that inflation would "go up again" and that "insufficient tightening" would most likely prevent inflation from returning to 2 percent in a reasonable period of time.。

Followed by Goolsby, president of the Federal Reserve Bank of Chicago.。He said in a recent interview that if long-term Treasury yields remain at a high level, it is likely to be equivalent to tightening policy, but reiterated that "the first task of changing the interest rate stance is the progress of inflation."。

Goolsby's speech was mainly in response to the Fed's November statement on the "U.S. bond yields rise to bring about a tightening of financial conditions" part - Fed officials have said that the U.S. bond yields rise to bring about a tightening of financial conditions, may have an impact on the economy and inflation.。Powell also said that tightening financial conditions is exactly what we want to achieve。

Experts believe that, as the "global asset pricing anchor," the U.S. 10-year Treasury yield symbolizes the cost of acquiring dollars, with pricing attributes for other assets.。When Treasury yields continue to rise, the cost of consumption and borrowing for U.S. residents will also rise, which will have a dampening effect on the economy and reduce the policy burden on the Federal Reserve.。According to Wall Street economists, the sharp decline in U.S. stocks and rising bond yields have had a fairly significant dampening effect on the economy over the past few months, to the extent that the Federal Reserve has raised interest rates by 3 to 4 basis points.。

However, in Goolsbee's eyes, two conditions need to be met for long-term interest rates to have an effect on policy tightening。First, long-term interest rates are high enough, and second, long-term interest rates are long enough, and if both conditions are met, it depends on inflation to determine whether interest rates need to be raised - which is undoubtedly another sign of hawkishness to shift the focus of the problem back from Treasury rates to inflation.。

Federal Reserve Bank of Dallas President Logan was even more blunt in saying that inflation in the U.S. is still too high, and the data looks to be moving towards 3 percent instead of 2 percent。In addition, Fed Governor Waller also believes that the U.S. economy is booming in the third quarter, and the Fed is paying close attention to the situation。

It's worth noting that all four are voting members of this year's FOMC and have a vote in the December rate resolution.。Among them, Waller will continue to serve as the voting committee of the FOMC in 2024, speaking weight is very heavy.。

For the future trend of gold, Everbright Futures said, overall, the Federal Reserve officials said slightly hawkish, pressure on precious metals trend。From the technical graphic trend, gold even short-term prices continue to fall finishing, has not yet seen a clear signal of stabilization, the recent support range below is 1950-1970 USD / oz, need to observe whether the gold price in this range can maintain stability。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.