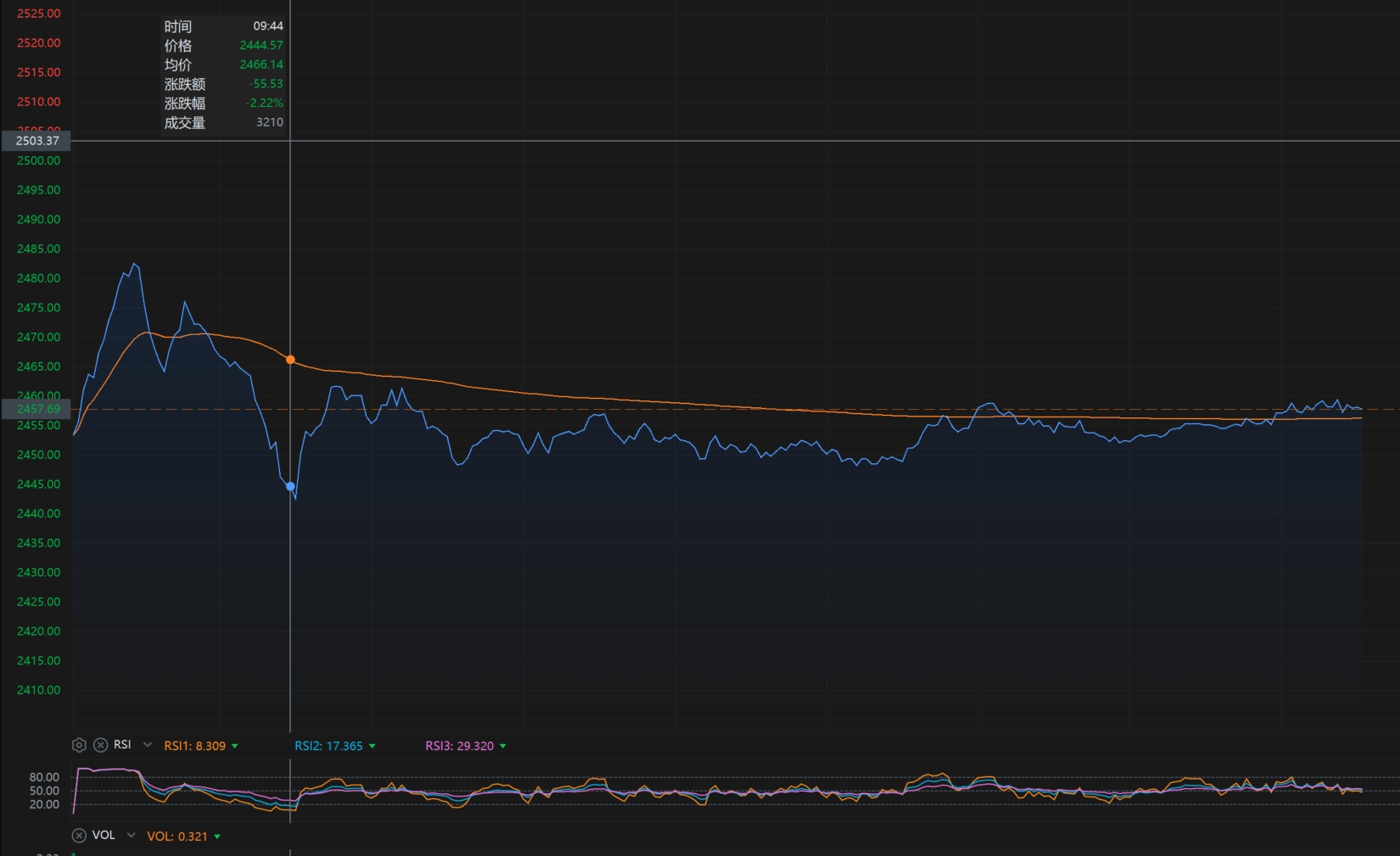

Asian stock markets fell as political turmoil triggered by South Korea's brief imposition of martial law rattled investors.

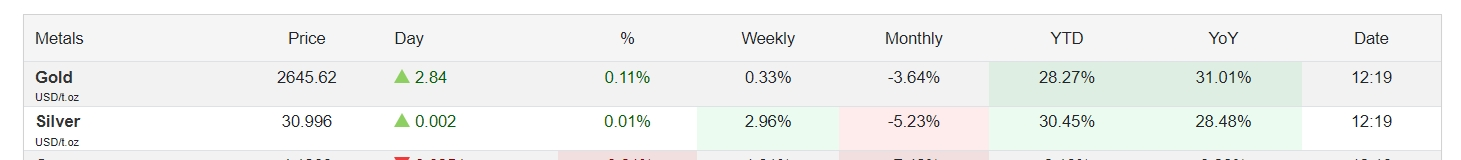

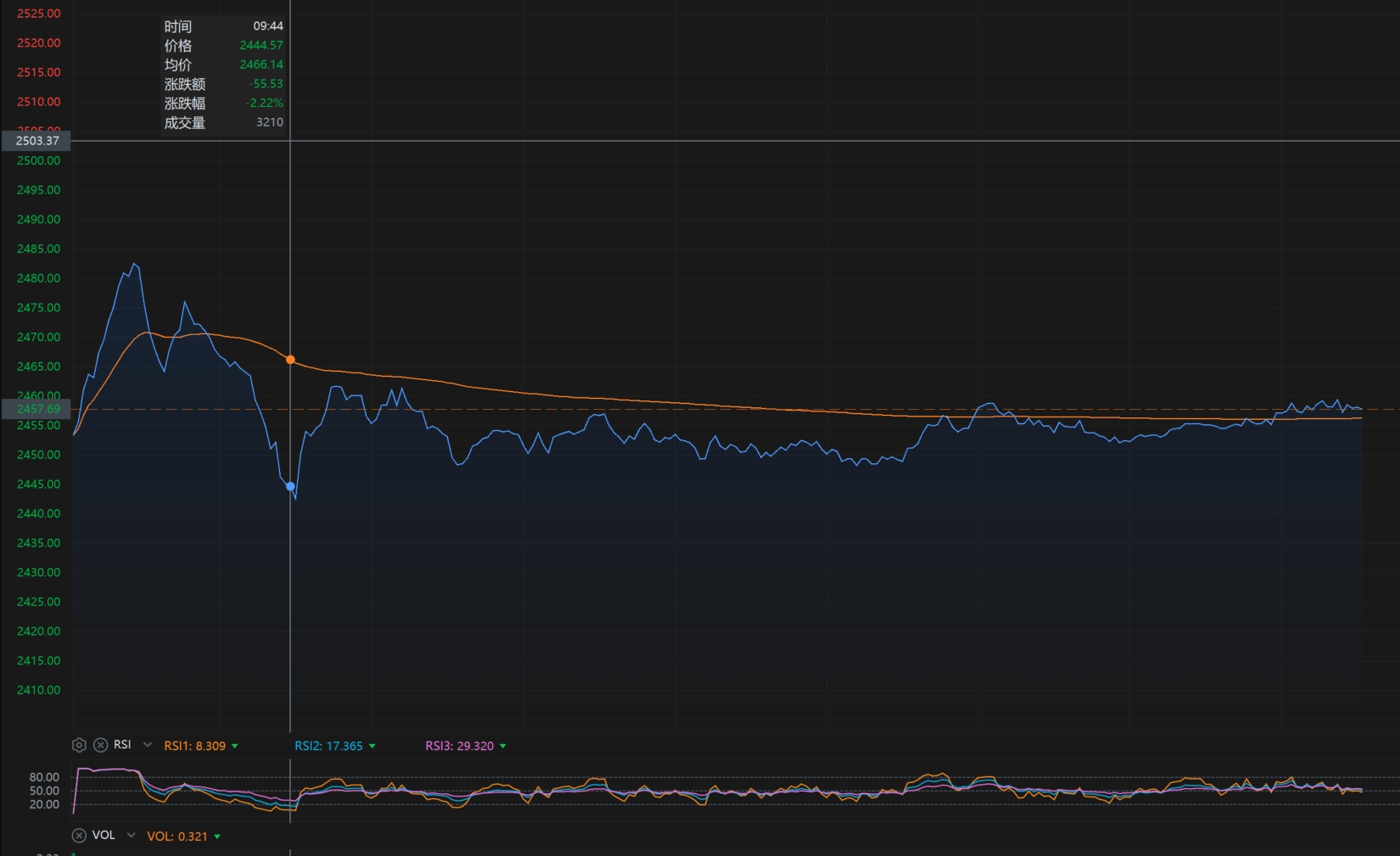

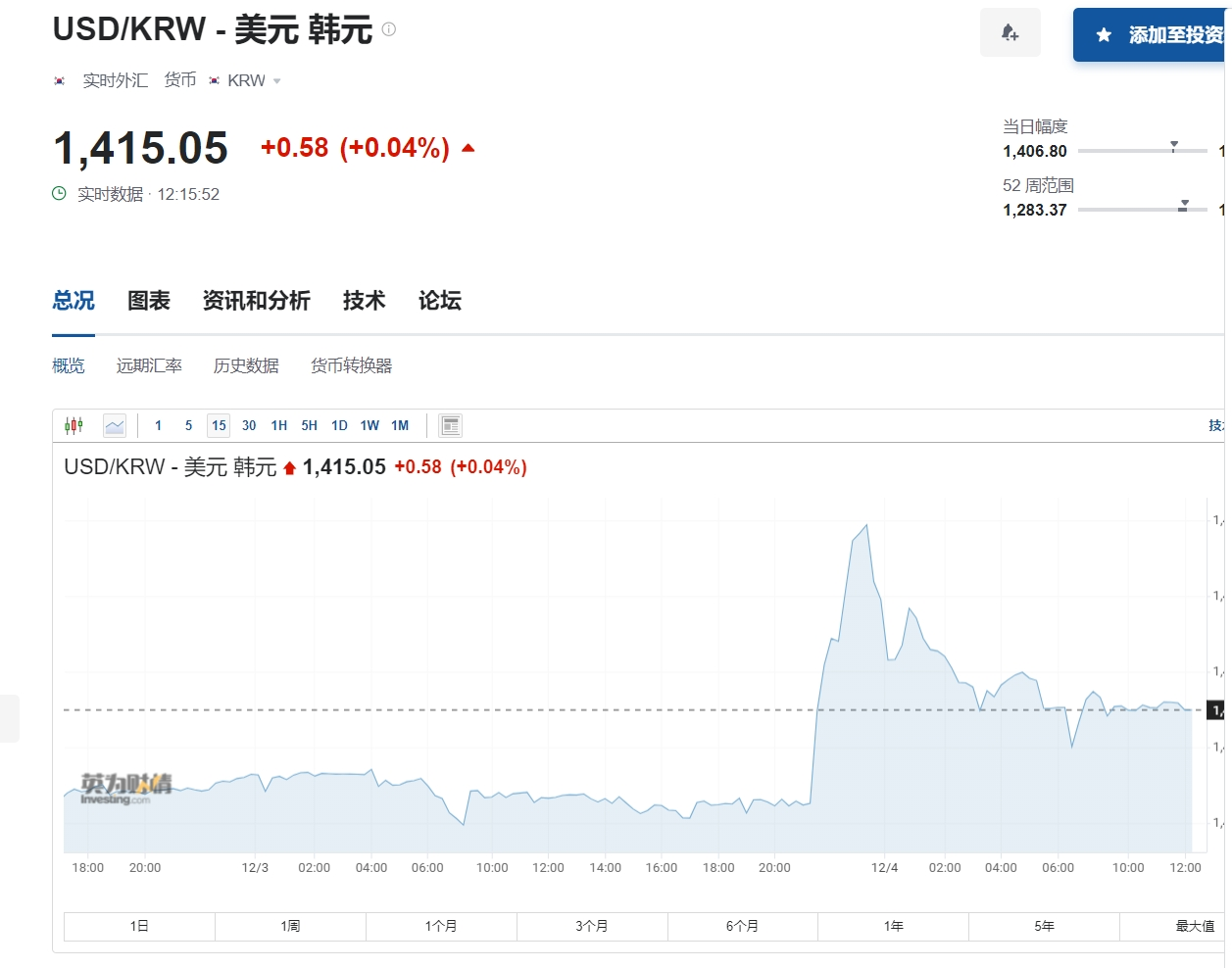

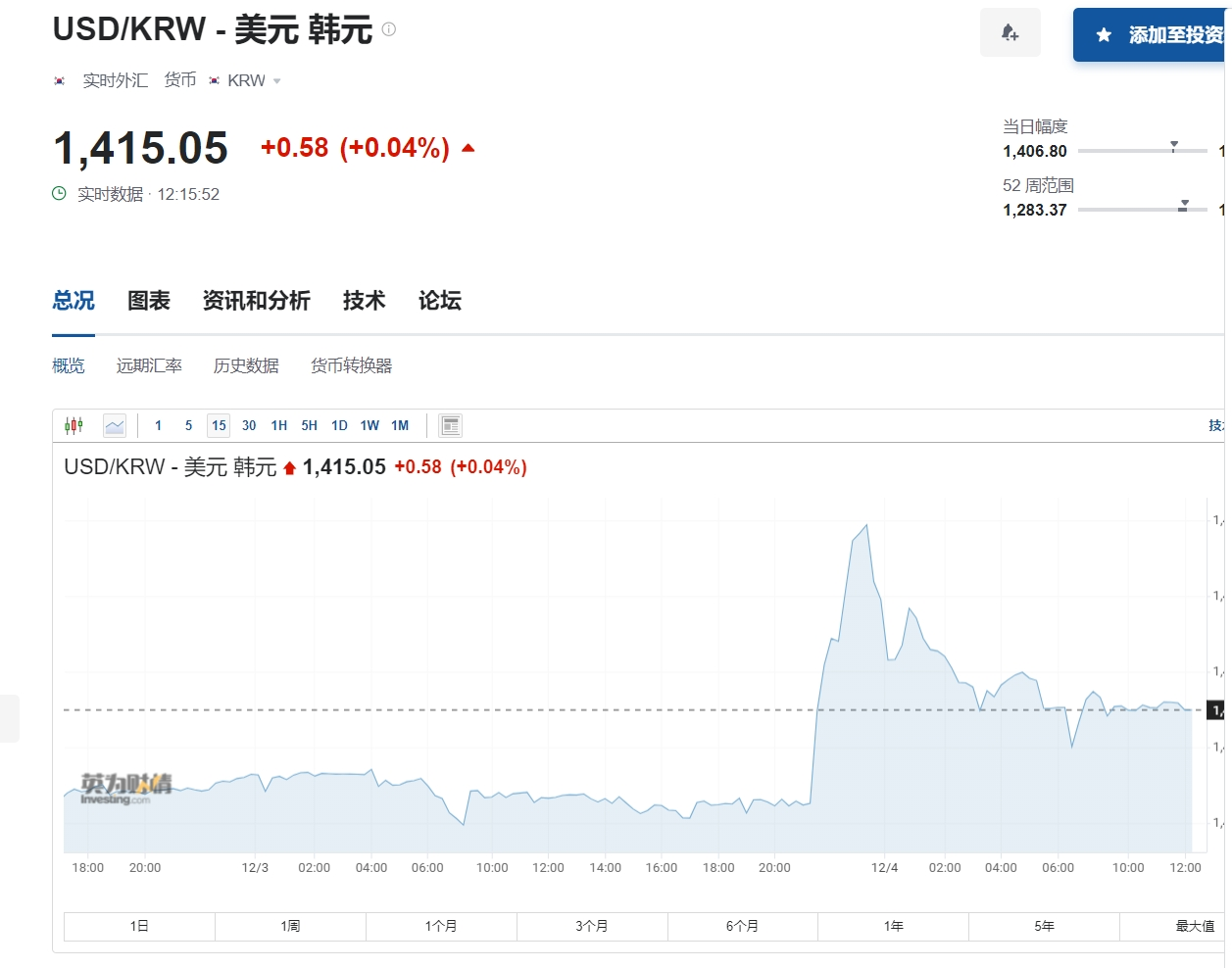

On December 4, after South Korea's related assets fell across the board overnight, the benchmark Kospi index fell as much as 2.3% on Wednesday.The MSCI Asia Pacific Index fell 0.5%, while stocks in Australia, Japan and the mainland of China fell.The won gained after falling in overnight offshore trade.

South Korean President Yoon Seok Yoon's sudden declaration of martial law-which was urgently lifted six hours later-appeared to push South Korea into a period of political turmoil, with opposition parties now pushing for his impeachment.The turmoil in South Korea has deepened caution among Asian investors at a time when Trump is approaching power and Asian economic growth is sluggish.

David Chao, global strategist at Invesco in Singapore, said: "The situation is still changing and the market may continue to experience volatility as the existing cabinet may be reshuffled and the impeachment process may be reviewed.However, developments are unlikely to have any lasting impact on the economy and financial markets.”

Faced with market fluctuations, the Bank of Korea said it would increase short-term liquidity.Kim Byung-hwan, chairman of the South Korean Financial Commission, said on December 4 that he would use all available measures to ensure the normal and stable operation of the financial market; a 10 trillion won (approximately 51.5 billion yuan) stock market stabilization fund will be put into operation at any time, and the bond market and capital markets will maximize the use of a bond market stabilization fund with a scale of 40 trillion won and corporate bonds and commercial paper (CP) purchase plans.

The opposition and opposition parties said they would immediately impeach Yoon Seok Yoon and South Korea's Defense Minister and Security Minister on charges of treason.

Charu Chanana, chief investment strategist at Saxo Markets, said: "Uncertainty does linger, but the rapid response of South Korean authorities means the impact on the region remains limited.”

Elsewhere in Asia, Australia's economic growth remained weak in the three months to September, with the Australian dollar's decline widening to 1%.

The U.S. 10-year Treasury yield was little changed at 4.23% after rising 3 basis points in the previous trading day.U.S. stock market futures were higher during Asian trading after the Standard & Poor's 500 index rose slightly to hit a new high.

Investors around the world are watching this week's U.S. jobs report and Jerome Powell's speech for clues as to whether the Federal Reserve will cut interest rates in December.The latest data shows job vacancies are picking up in the United States while layoffs are easing, indicating that demand for workers is stabilizing.Mary Daly, president of the Federal Reserve Bank of San Francisco, said a rate cut this month was uncertain but was still under consideration.

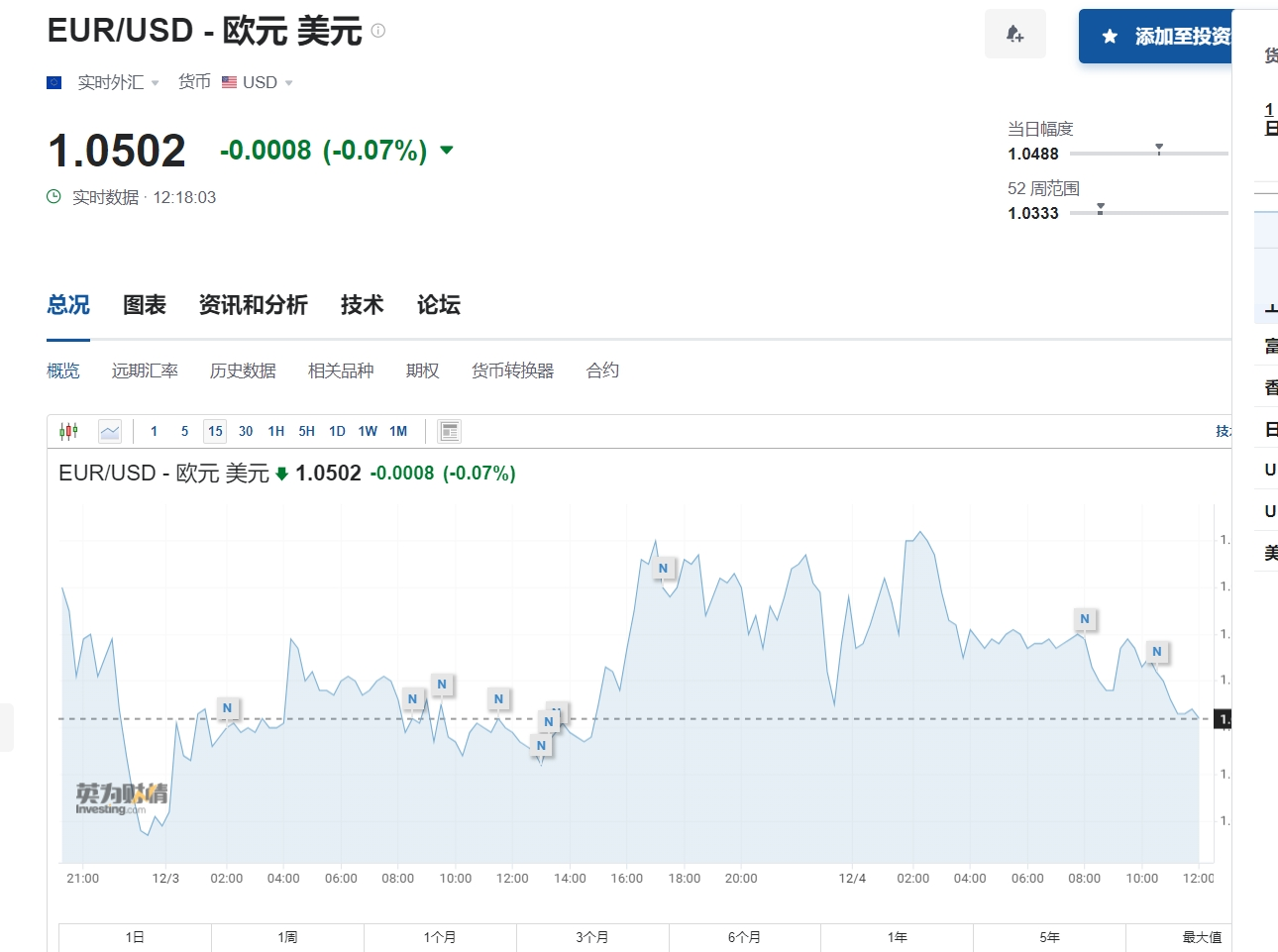

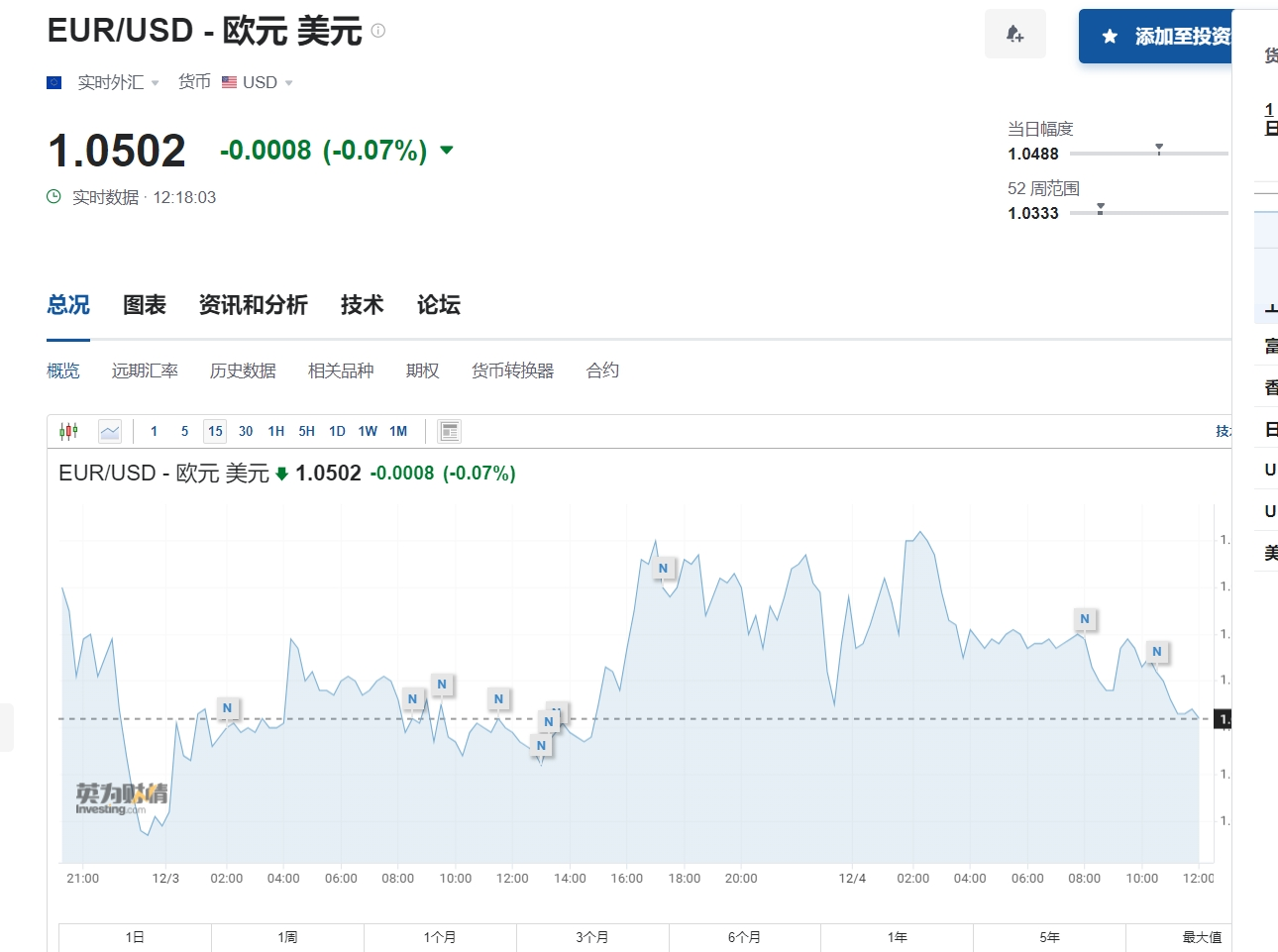

The euro fell as all eyes focused on the political stalemate in France.President Macron called on French lawmakers to put aside their personal ambitions and reject votes that could overthrow the government.

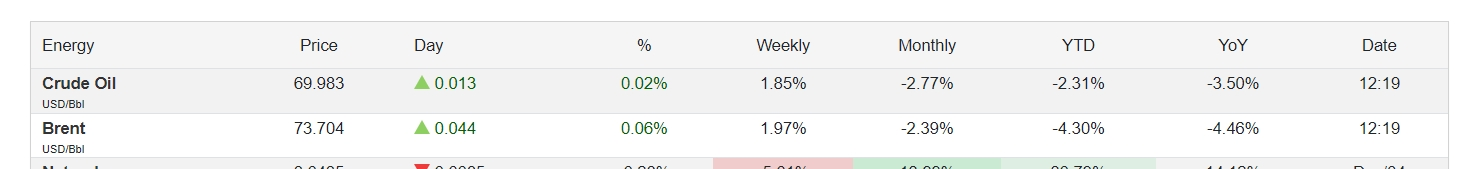

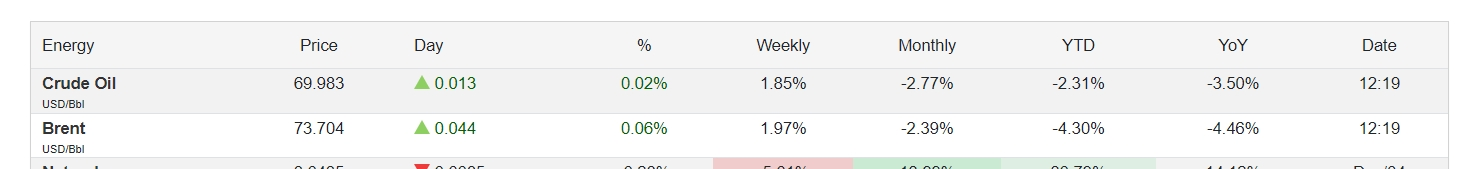

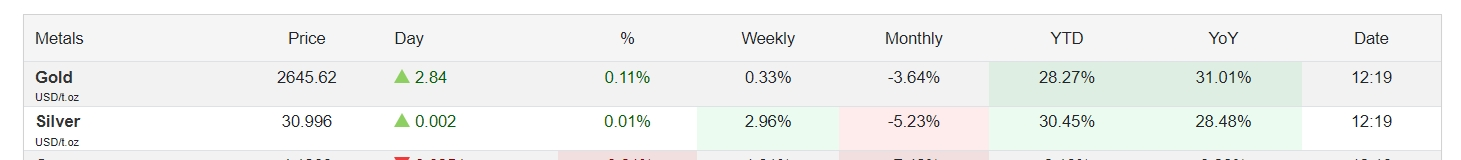

Oil has stabilized after its biggest gain in more than two weeks.Gold stabilized after rising Tuesday as political turmoil in South Korea and France spurred demand for safe-haven assets.