Under the pressure of interest rates, some hawkish officials of the ECB have been successfully "instigated."

After a July rate hike was a foregone conclusion, the ECB's governing council began to grow concerned that future interest rate conditions in the eurozone could put pressure on the economy。

After a July rate hike was a foregone conclusion, the ECB's governing council began to grow concerned that future interest rate conditions in the eurozone could put pressure on the economy。

The uncertain economic future of the euro zone has been successfully "instigated" by hawkish members.

On July 19, local time, Yannis Stournaras (Yannis Stournaras), a member of the ECB's Governing Council, said in an interview with the media that he was skeptical of the ECB's view of raising interest rates again after raising interest rates by 25 basis points next week, because: "Inflation is falling, we have found that we are at the best point, and further rate hikes may hurt the economy."。"

Stournaras has repeatedly expressed concern about high policy rates in the eurozone。On Monday, the ECB official also said at the Economist event in Athens, "It is important that our next steps be careful, they should be gradual and cautious,。He stressed that "we should curb inflation while ensuring financial stability and avoiding a recession."。"

Stournaras's views represent some of the doves in the ECB, in their eyes, the continued high pressure of monetary policy has been enough to make the economy reflect, if tightened again, it may be counterproductive.。

Just a day earlier, Klaas Knot, a member of the ECB's Governing Council and the governor of the Dutch central bank, had expressed similar views.。The official said in an interview: "For July, I think (a rate hike) is necessary, and as for anything after July, there is at most a certain possibility, but by no means a certainty.。"Underlying inflation appears to have stabilised, but in the coming months we expect to see more definitive evidence emerge."。"

It is worth noting that, previously, Knott has always been known as a "hawk" in the ECB Governing Council.。This was "doves" successfully "instigated," the market believes that it may be hinting that the ECB is about to suspend the process of raising interest rates。

According to the ECB's schedule, the bank will announce its July interest rate decision next Thursday。At present, the market generally believes that the bank will continue to raise interest rates by 25 basis points on this resolution.。Following the ECB's interest rate hike in June, the region's main refinancing rate, marginal lending rate and deposit facility rate have now risen to 4%, 4.25%, 3.5%。Since the start of the interest rate hike process in July last year, the European Central Bank has raised interest rates eight times in a row, a total of 400 basis points.。

According to the latest data released by Eurostat yesterday, inflation in the euro area recorded an annualized rate of 5 in June..5%, compared with 6 in May.1% lower, unchanged from expectations。

Big banks bullish on ECB to continue raising interest rates in September Analysts are divided

The major banks have also expressed their views on the direction of interest rates after the ECB in July。

Paul Hollingsworth, chief European economist at BNP Paribas, said in a note that the ECB is expected to reach a peak interest rate of 4 per cent at its September meeting, but recent ECB comments have somewhat reduced the bank's confidence.。

In line with market expectations, the 25 basis point rate hike at the July 27 meeting appears to be a done deal, but the future policy path appears to be more open.。Hollingsworth said: "Overall, the overall message is expected to shift in a firmly dovish direction compared to June.。The economist said it was highly unlikely the ECB would pre-commit to raising rates again in September, but it was expected to maintain a tenuous tightening bias.。

Royal Bank of Canada, for its part, said it expects the European Central Bank to suspend interest rate hikes after deposit rates reach 4%。The ECB is expected to raise interest rates by 25 basis points next week, bringing the deposit rate to 3, the bank said..75%, followed by a final 25 basis point rate hike in September, bringing the rate to 4.0%。

RBC stressed that while we expect the ECB to pause on rate hikes thereafter, given the recent market rally, we believe the risks in this area are skewed to the upside。In December, the ECB will publish new quarterly forecasts, including a forecast for 2026.。They said: "If inflation and the labour market have not cooled by then, we think it is possible to raise interest rates by a further 25 basis points in December or the first quarter of next year.。"

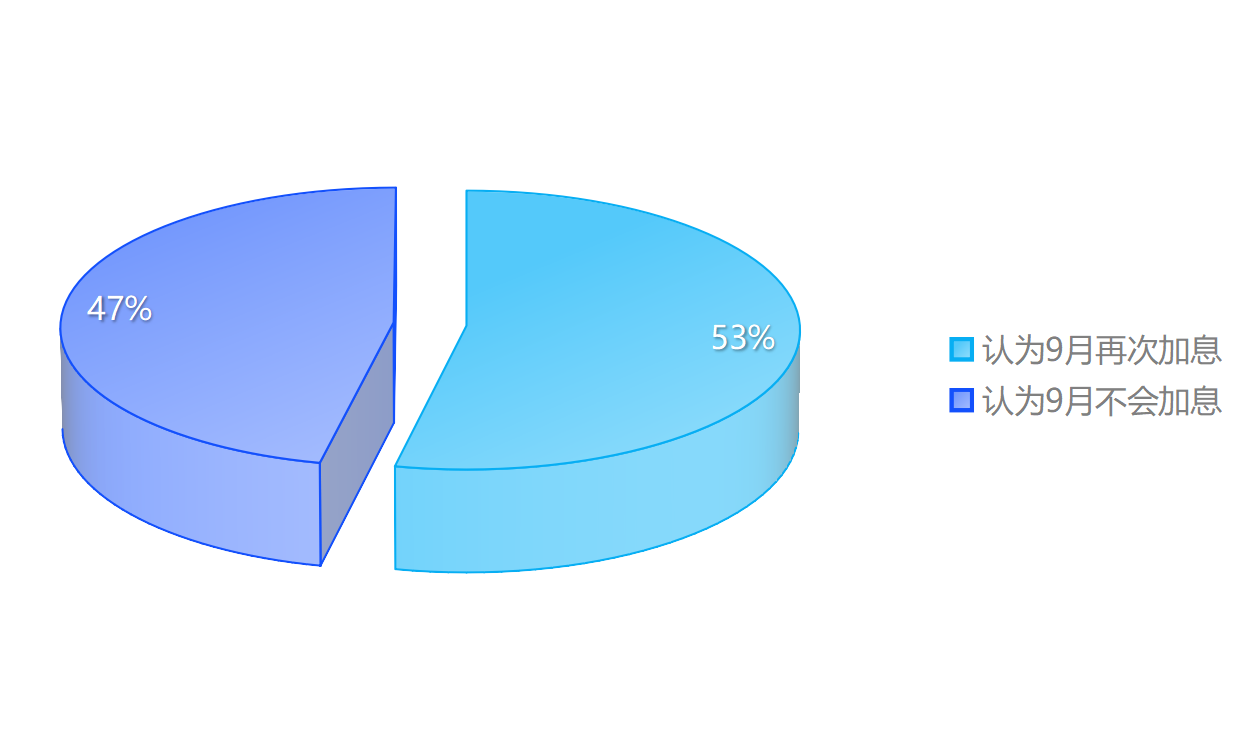

On the analyst side, analysts largely have no objection to the ECB continuing to raise interest rates in July, but are more divided on the bank's decision in September。According to the media survey, 40 of the 75 analysts surveyed expect the ECB to raise interest rates by another 25 basis points in September, while 35 do not expect another rate hike in September.。

In response, Rabobank senior macro strategist Basvan Geffen (Basvan Geffen) said, "July rate hike is almost a certainty, they have said they will raise interest rates, which will not surprise anyone.。The question is whether they will raise rates in September。Communication will be the hardest part for the next meeting... whether it's holding down or raising rates, they'll probably stay open。Either way, it's going to be a close call.。"

As of press time, the euro rose 0 against the dollar in the day..11%, reported 1.1213; EUR / HKD up 0 on day.16%, reported 8.7597; EUR / CNY (CFETS) down 0.53%, reported 8.05; dollar index still hovering around 100。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.