ECB hawkish views have loosened Dahua: increased momentum or push up Europe and the United States

The ECB's successive hawkish views have continued to bottom the currency pair in the near term.。Before the start of the week, the euro had already recorded two consecutive positives against the dollar at weekly level.。

On July 10, Europe and the United States fell slightly 0.17%, now traded at 1.09479, currently oscillating downward。

In terms of currency performance, the pair is not as strong today as it was on the last trading day of last week。On Friday, Europe and the United States rose 0 strong.72%, closed at 1.0964。

ECB's recent hawk to build bottom for Europe and the United States U.S. non-farm payrolls fell short of expectations in June

Previously, the ECB was particularly cautious about inflation governance, frequently expressing hawkish views。European Central Bank President Christine Lagarde said at the ECB's annual economic forum that inflation will be more persistent and intractable and that the ECB needs to develop monetary policy to deal with the current inflation situation.。She also said that although some inflation indicators in the euro area have shown signs of slowing down, inflationary pressures are still high, and in the face of more persistent inflation, the ECB is unlikely to confidently announce that interest rates have peaked in the near future.。

European Central Bank chief economist Lien (Philip Lane) has also pointed out that although the euro area is likely to be able to reduce inflation in the second half of this year, but it is estimated that within a few years the region's inflation levels are difficult to pull down to 2%。

The ECB's successive hawkish views have continued to bottom the currency pair in the near term.。Before the start of the week, the euro had already recorded two consecutive positives against the dollar at weekly level.。

On the dollar side, the slightly weaker jobs report provided some downward momentum for the currency.。On July 7, local time, the U.S. Department of Labor released the country's June non-farm payrolls report.。U.S. nonfarm payrolls rose just 20 percent in the month, data show.90,000, the smallest increase since December 2020, below economists' estimates of 22.50,000 people, data slightly cooled。

The data quickly caught the attention of the market。You know, the day before the release of the United States in June ADP data show that the United States in June, the number of employment increased by 49.70,000, well above the expected 22.50,000 people, flooding the market with expectations of a Fed rate hike, the same day the three major U.S. stock indices collectively closed down, even implicating the European market。

In this "bad news is good news" situation, the non-farm data is not expected to provide a glimmer of comfort to the market, the weakening of the resilience of the labor market cut the Fed's prospects for maintaining high interest rates for a long time.。However, for now alone, the U.S. inflation data is still some distance from the long-term target of 2%, superimposed on the Fed's June monetary meeting minutes revealed that the Fed's likelihood of raising interest rates this month has climbed rapidly。

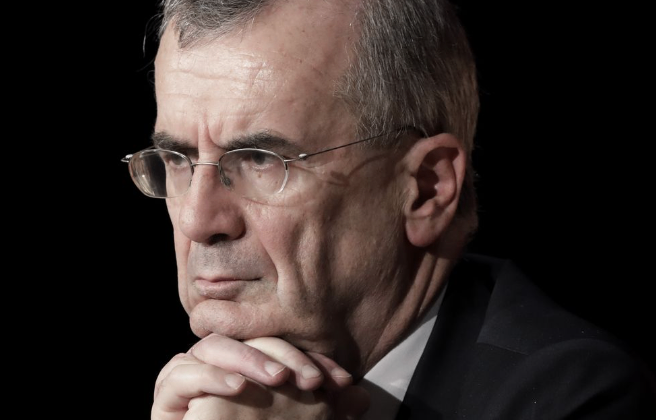

Villerueva: Eurozone will soon hit interest rate highs

It is worth noting that the ECB's monetary tightening policy may be about to face loosening under the rumble of hawks。

Today, Francois Villeroy de Galhau, governor of the French central bank and member of the European Central Bank's Governing Council, has said in a panel that the ECB is about to complete its rate hike, but will then keep interest rates "high" to ensure that interest rates have a full impact on the economy.。He also said the ECB's record tightening cycle would bring inflation to its 2 per cent target by 2025, adding that house price growth in France had already exceeded its peak, slowing to 5 per cent from more than 7 per cent earlier this year..3%。

Villerueva stresses belief that eurozone will hit interest rate highs soon。However, he said that the high point proposed here is not the concept of "peak," but the concept of "high," the euro zone may remain at this high level for a long enough time to fully transmit all the effects of monetary policy.。

At the same panel, Mario Centeno, the governor of Portugal's central bank and a member of the ECB's Governing Council, also made dovish remarks, saying it was important that the ECB's goal was to focus on overall inflation.。He also noted that all indicators show that inflation has peaked and believes that inflation will fall back to well below 3% by the end of the year.。

At present, the ECB's continued move to raise the eurozone policy rate in July is largely a certainty。Lagarde has said it will continue to raise interest rates in July unless there are major changes.。

But officials have been inconclusive about the bank's policy actions in September, which is also the focus of the market debate.。

Dahua: intraday euro rally may continue

For the future of Europe and the United States, UOB said that on an intraday basis, the bank's view that the euro would be range-traded on Friday was slightly biased, as it rose strongly in the North American session and soared to 1.0973。Strong surge seems excessive, but no signs of weakness yet, euro rally may extend。

The bank also said that due to overbought, today's 1.June high near 1010 unlikely to be threatened。To maintain momentum, the euro must remain at 1.0925 (light support at 1.0945) above。

Looking at the next 1 to 3 weeks, the euro fell to 1.After 0832 and rebounding, the bank stressed on Friday that "if the euro rises above 1.0925, which indicates that 1 will not be touched.0805。However, in the North American session, the euro not only rose above 1.0925, also soared 0.73% (closed at 1.0967), recording the biggest one-day gain in three weeks。

A sharp increase in momentum in Europe and the United States could lead to further gains in the euro.。In this case, investors need to focus on the June high 1.1010, then 1.1050。In order to maintain the momentum established, the euro must remain at 1 in the coming days..Above 0870 (current 'strong support' level)。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.