Google Q1 cloud business profit quadrupled! Announced first dividend to drive after-hours share price surge

In the first quarter, Google's parent company Alphabet's revenue reached $80.5 billion, higher than analysts' expectations of $78.6 billion, a year-on-year increase of 15%. The net profit was 23.66 billion US dollars, a year-on-year increase of 57%, far exceeding the expected 19.1 billion US dollars.

Google's parent company Alphabet announced its quarterly financial results for the year ended March 31, 2024, after the US stock market closed on Thursday (April 25).

Q1 Performance Exceeds Market Expectations

Alphabet's performance in the first quarter was impressive.

The revenue reached $80.5 billion, higher than analysts' expectations of $78.6 billion, a year-on-year increase of 15%, the fastest growth rate since the beginning of 2022, and also the fourth consecutive quarter of accelerated year-on-year growth recorded by Google.

In terms of profitability, Alphabet's net profit in the first quarter was $23.66 billion, a year-on-year increase of 57%, far exceeding the expected $19.1 billion. Adjusted earnings per share were $1.89, significantly higher than analyst expectations of $1.51, a year-on-year increase of 61.5%.

Specifically for each business.

● Advertising

The advertising business is the main source of revenue for Alphabet, including YouTube, Google Web, Google Search, and others.

The revenue of the advertising business in the first quarter was 61.7 billion US dollars, a year-on-year increase of 13%, higher than the expected 60.4 billion US dollars. Among them, the core search business recorded a revenue of 46.16 billion US dollars, a year-on-year increase of 14%. YouTube advertising revenue increased by 21% to reach $8.1 billion, higher than the expected $7.7 billion.

CEO Sundar Pichai revealed during a conference call that YouTube continues to grow and is in a leading position in the streaming industry. On average, global audiences watch over 1 billion hours of content on YouTube TV every day. In terms of subscriptions, in the first quarter, YouTube's global music and premium subscription users (including testers) exceeded 100 million, and YouTube TV currently has over 8 million paying subscribers.

In the fourth quarter of last year, as competition with other software such as Netflix, Instagram, and TikTok became increasingly fierce, Alphabet's advertising business fell below market expectations, leading to a sharp drop in stock prices. The advertising revenue in the first quarter of this year exceeded market expectations, indicating that the business has withstood pressure and is striving to stabilize.

During a conference call, Pichai stated that Google's artificial intelligence products have played a positive role in driving its core search results. He said, "We are encouraged to see an increase in search usage among people using artificial intelligence profiles."

● Cloud

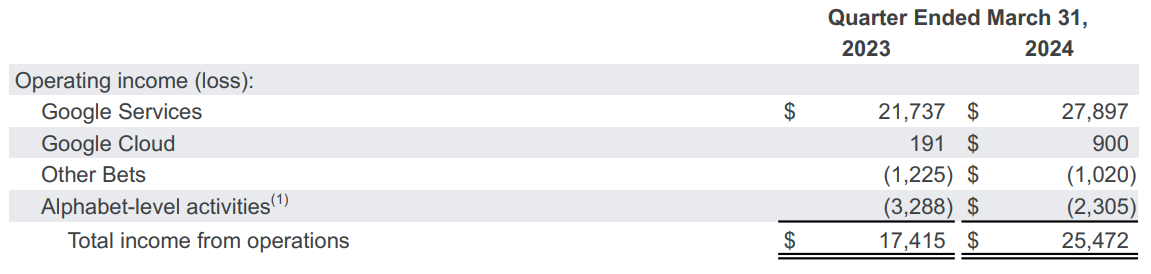

Another highly anticipated business unit of Google is its cloud business. In the first quarter, Google's cloud business generated revenue of 9.574 billion US dollars, higher than the expected 9.4 billion US dollars, a year-on-year increase of 28%. At the same time, the operating profit of Google's cloud business has more than quadrupled from $190 million in the same period last year to $900 million, which surprised the market.

The rapid development of Google's cloud business is inseparable from the assistance of AI. Chief Financial Officer Ruth Porat mentioned during a conference call, "The benefits that artificial intelligence brings to customers support our growth in the entire cloud computing field."

Due to the low price and ease of integration with other tools of Google's cloud services. Therefore, it is very attractive for startups developing generative artificial intelligence technology. According to data revealed by Pichai during a conference call, over 60% of Gen AI startups that have received funding and nearly 90% of Gen AI unicorns are customers of Google Cloud.

"Our leading position in artificial intelligence research and infrastructure, as well as our global product footprint, puts us in a favorable position in the next wave of artificial intelligence innovation," Pichai said in his financial report.

Due to its strong investment in artificial intelligence, Alphabet's capital expenditure in the first quarter also reached a new high, with a year-on-year increase of 91% to $12 billion, just like other tech giants.

Although this number is higher than market expectations, Porat still stated that it is expected that such spending will remain at this level or higher for the remainder of this year, as the company will spend on building artificial intelligence products. "We will continue to actively invest while focusing on profitable growth."

On April 18th, Google announced that it will integrate its research and DeepMind teams dedicated to building artificial intelligence models to further accelerate progress in the AI field. This may help improve efficiency and reduce costs.

First dividend in history

In the first quarter financial report, Alphabet brought big news that the company will start paying dividends.

Alphabet stated that the board of directors has approved the launch of a cash dividend plan. Each share will receive a cash dividend of $0.20, marking the first dividend in the company's history. This dividend will be paid to all categories of shareholders of the company registered as of June 10th on June 17th. Moreover, with the approval of the board of directors, the company plans to distribute cash dividends every quarter in the future.

The dividend yield paid by Alphabet is higher than that of Meta and Nvidia. Amazon and Tesla are currently the technology giants that still insist on non dividend payments. Meta also announced its first dividend payout in February this year, with a dividend of $0.50 per share.

Thomas Monteiro, a senior analyst at Investing.com, praised Google's decision to pay dividends. He said, "Alphabet's announcement of dividends and buybacks on a solid profit basis has not only brought fresh air to the entire technology market, but also a very wise strategy adopted by the search engine giant during this difficult period." He believes that this will make investors more likely to support Google's increased investment in developing artificial intelligence products, although these investments may take several years to take effect. "

The Alphabet board of directors has also approved a $70 billion stock buyback plan, reflecting confidence in the company's sustained growth prospects and financial stability.

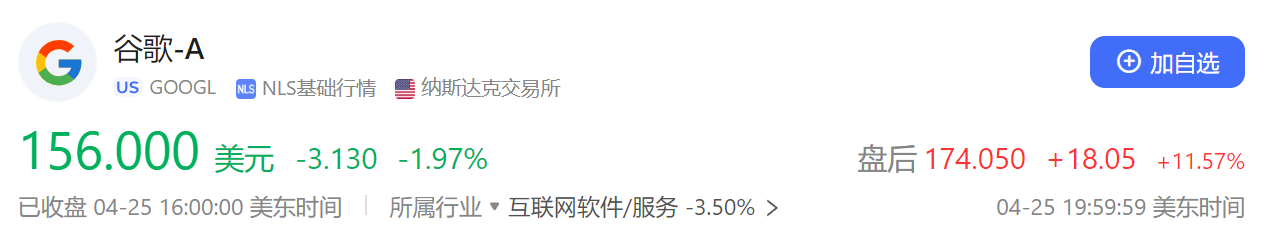

After the relevant news was released, Alphabet's stock price rose by about 11% in after hours trading on Thursday in the US stock market. If Alphabet can continue this post market rally into Friday's regular trading session, it is expected to drive the company's market value to exceed $2 trillion.

Troubled by troubles

Despite its good performance, Google still faces some troubles at present.

Currently, Google's search business is facing regulatory challenges, and the US Department of Justice is filing a lawsuit against Google's search engine.

The US Department of Justice accuses Google of abusing its power by negotiating lucrative deals with Apple and other companies, giving it an unfair advantage over potential competitors, thereby stifling innovation and competition.

After a two-month trial last autumn, the closing debate of this antitrust case is scheduled to begin next week, and federal judges are expected to rule on whether Google is illegal by the end of this year.

In addition, Google's cloud department has also encountered difficulties recently.

Recently, several Google employees have protested against a project called Nimbus within Google. The Nimbus project is a $1.2 billion joint contract signed between Google, Amazon, and the Israeli government, aimed at providing artificial intelligence and cloud services to the Israeli government and military.

The protesting employees believe that the above-mentioned contract provided assistance to the Israeli military in the Gaza conflict, but Google denies this claim.

This month, Google has seen protests in its offices in San Francisco, New York, Seattle, and Durham, North Carolina. Subsequently, Google fired several employees who participated in the protest activities.

"We have a vibrant and open culture of discussion that allows us to create amazing products and turn great ideas into action. It is important to preserve this," Pichai wrote in a recent statement."But ultimately, we are a workplace, and our policies and expectations are clear: this is a business, not a place to act in a way that disrupts colleagues or makes them feel unsafe, nor a place to try to use the company as a personal platform or to fight or debate politics on disruptive issues. As a company, this is a very important moment, and we cannot be distracted."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.