Tesla Q1 results fell short of expectations, Musk said will accelerate the launch of a new generation of cars

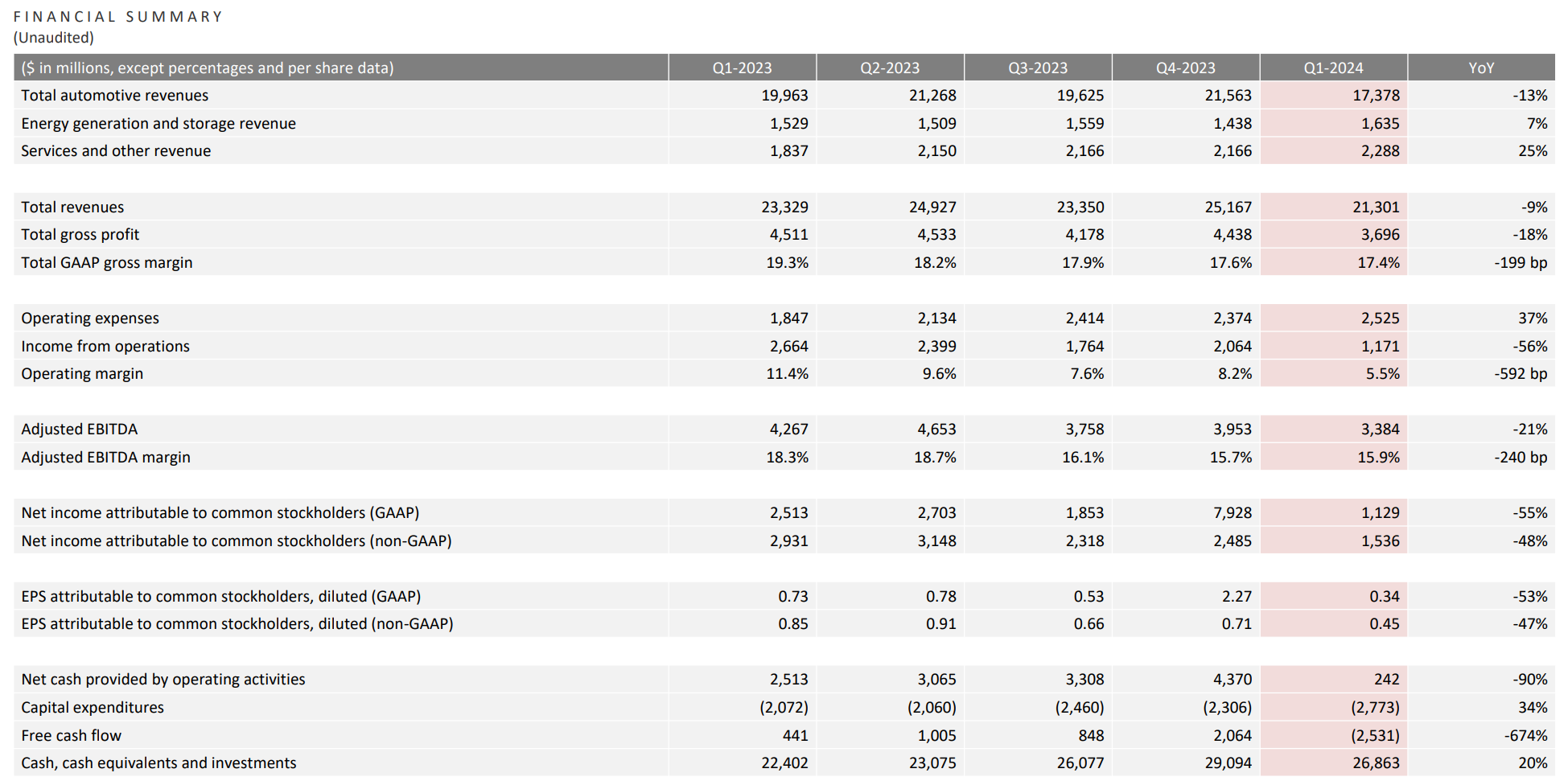

Tesla's first quarter revenue was $21.3 billion, lower than analyst expectations of $22.3 billion, a 9% year-on-year decline, the largest year-on-year decline since 2021.

After the U.S. stock market on April 23, Tesla announced its first quarter results.

Performance below market expectations

Specifically, Tesla's revenue in the first quarter was $21.3 billion, lower than analysts' expectations of $22.3 billion, a year-on-year decline of 9%, the largest year-on-year decline since 2021.

In terms of profitability, Tesla's adjusted net profit in the first quarter was $1.536 billion, a year-on-year decrease of 48%. Adjusted earnings per share were $0.45, lower than analyst expectations of $0.52, a year-on-year decrease of 47%, and the lowest level since the first quarter of 2021 (31 cents per share).

Tesla's gross profit margin in the first quarter still recorded a month on month decline, but it was better than market expectations, reaching 17.4%, compared to analyst expectations of 16.5%. Tesla's gross profit margin for the same period last year was 19.3%, and the gross profit margin for the previous quarter was 17.6%.

Although Tesla's performance in the first quarter was poor, the stock surged by over 13% after market hours. This surge is mainly boosted by the latest news from Tesla's new generation of low-priced cars (known as the Model 2).

Tesla will accelerate the introduction of low-cost cars

During the earnings conference call, Tesla CEO Elon Musk made it clear that the company has not given up on the development of a new generation of low-priced cars, and stated that "the new model will start production in early 2025 even if it is not later this year." This is even earlier than the promised end of 2025.

Tesla did not disclose detailed information about its promised new low-priced model, such as target price or production volume.Musk's remarks were a blow to the face. The news that the Model 2 plan, previously reported by the media, had already been aborted, also gave investors a shot in the arm.

In the first quarter of this year, Tesla's global delivery volume was 386,810 vehicles, a year-on-year decrease of 8.5%, far below the market's expectation of 449,080 vehicles. This has raised concerns in the market about Tesla. Against the backdrop of slowing growth in electric vehicles and intensifying industry competition, investors feel confused about Tesla's growth momentum. Therefore, Model 2 is widely regarded as Tesla's "hope" for the upcoming automotive business.

Musk stated that the new model will be able to be produced on the same production line as the existing car lineup. He also stated that the company will launch Robotaxi on August 8th, and there will be more discussions on low-cost cars at that time.

When talking about Robotaxi, it is inevitable to also talk about autonomous driving.

The company stated in its financial report, "The future is not only electric, but also autonomous driving. We believe that only through data from millions of cars and a vast artificial intelligence training cluster can we achieve large-scale autonomous driving. We already have and continue to expand both." The company believes that the next wave of growth will be initiated by advances in autonomous driving technology and the launch of new products, including those built on our next-generation automotive platform. "

Earlier this month, Tesla lowered the subscription price for fully autonomous driving (FSD) in the United States to $99 per month and the purchase price from $12,000 to $8,000. Musk also revealed that Tesla is currently in discussions with a major automaker regarding FSD licensing matters.

Musk also told investors during a conference call that he speculates Tesla's humanoid robot Optimus will be able to perform tasks at the factory by the end of this year and sell Optimus to the public before the end of next year.

"In fact, we should be seen as an artificial intelligence or robotics company," Musk added during a earnings conference call. "If people evaluate Tesla like they do a car company, it's a fundamental mistake." If someone doesn't believe Tesla will solve the problem of autonomous driving, I don't think they should become investors in the company. "

The dilemma is still

Although Tesla released positive news during the earnings conference call, this does not mean that the difficulties the company is currently facing can be ignored.

Firstly, Tesla's various businesses experienced varying degrees of decline in the first quarter. As the majority of the company's revenue source, Tesla's automotive business revenue was $17.378 billion, a year-on-year decrease of 13%. In contrast, the other two businesses both recorded growth, but the growth rate slowed down. Energy and storage business revenue increased by 7% year-on-year in the fourth quarter to $1.635 billion, while service and other revenue increased by 24.6% year-on-year to $2.288 billion. In the previous quarter, these two businesses grew by 10% and 27% respectively.

Regarding the decline in automotive performance, Tesla's CFO Vaibhav Taneja stated that it is mainly influenced by factors such as seasonality and uncertainty in the macroeconomic environment.

The second is that Tesla's auto margins are still under pressure. Tesla's gross profit margin for the first quarter was 16.4%, lower than Wall Street's expected 17.6%. This is far from the peak profit margin of 30% reported in early 2022.

It is widely believed that Tesla's frequent price cuts are an important factor in putting pressure on profit margins. However, Taneja stated that the impact of Tesla's pricing actions has been largely offset by the reduction in unit costs and revenue recognition from certain autonomous driving functions in vehicles in the United States.

Additionally, it is worth noting that in the first quarter, Tesla's global automotive inventory rose to 28 days, almost twice the level at the end of the previous quarter. Meanwhile, Tesla's first quarter capital expenditure reached $2.8 billion, with negative free cash flow of $2.53 billion and analyst expectations of positive $653.6 million.

In response, Taneja stated that the mismatch between manufacturing and delivery leads to an increase in inventory, while the negative free cash flow is due to the company's increased capital expenditures on various plans, including artificial intelligence computing. Taneja stated that it is expected that the increase in inventory will reverse in the second quarter, and free cash flow will once again return to positive values.

The third issue is that the recent layoffs and executive departures of the company have raised concerns about the stability of its personnel.

Regarding the announced layoffs this month, Taneja stated that while preparing for the company's next phase of growth, Tesla has had to make a difficult but necessary decision, which is to lay off more than 10% of its workforce and expect to save over $1 billion annually.

During Tuesday's conference call, Martin Viecha, another senior executive of Tesla and the current head of Tesla's investor relations, announced that he will resign.

Viecha later posted on X, stating that "working for Tesla for the past 7 years has been the greatest honor of my career." He also stated, "In the coming years, I will continue to follow Tesla as a supporter and shareholder. But now, after 7 years of sprint, it's time to take a break and spend more time with my family."

Viecha's departure means that within less than two weeks, three Tesla executives have announced their departure.

Although Tesla is facing many challenges now, based on market reactions, investors are more concerned about the company's future growth potential.

Gene Munster, Managing Partner at Deepwater Asset Management, said, "What's important is that investors have a glimmer of hope that growth will accelerate again next year. For Musk's followers, he has given them enough to persevere."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.