Q3 Underperformed Share Price Still Up?Intel CEO rhetoric: Arm chip shortage for fear!

Kissinger boldly predicts that the company is still on track to catch up with TSMC's chip manufacturing technology in 2025。

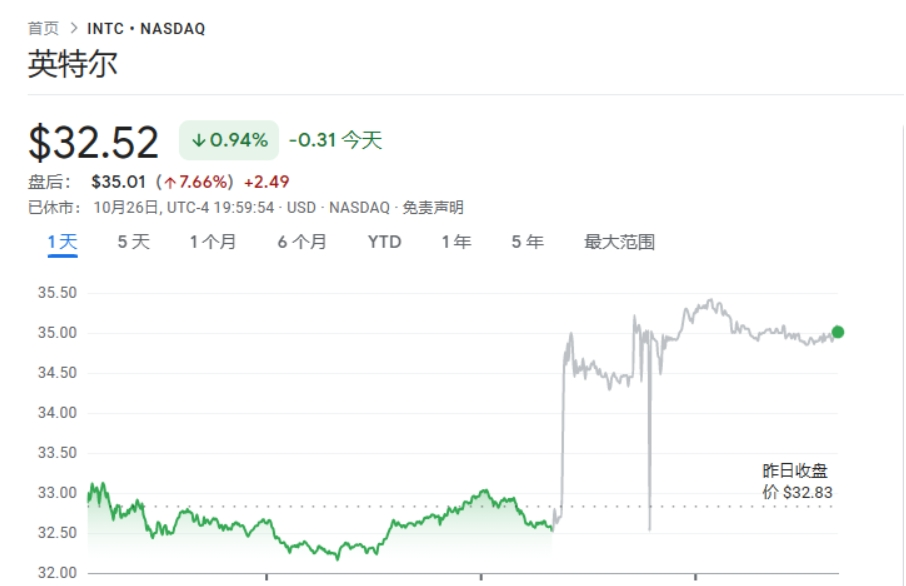

A number of indicators underperformed Intel still up 8% after hours

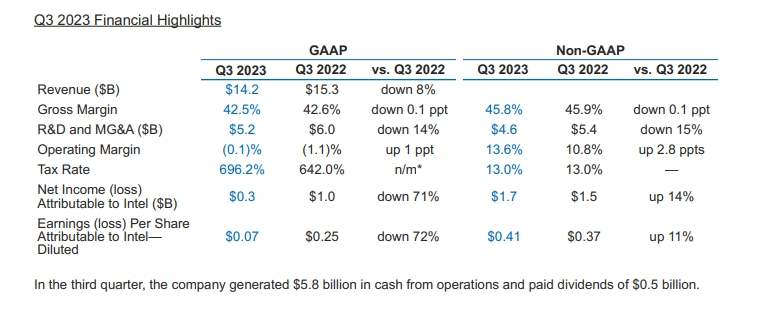

In terms of financial metrics, Intel underperformed during the reporting period compared to the same period last year: in the fiscal quarter, Intel's revenue fell 8% from the same period in 2022, recording a seventh consecutive quarter of sales decline;.$200 million, compared with less than $300 million recorded in the quarter, which is equivalent to Intel's net profit shrinking by more than two-thirds year-on-year;.8%。

However, Intel remained strong after hours up more than 8% due to both revenue and EPS exceeding market expectations and the company's strong Q4 guidance。Intel revealed that it expects adjusted EPS to reach 0 in the fourth quarter.$23, revenue will reach $14.6 billion to $15.6 billion, a figure that beat LSEG's previous estimate of 143.100 million dollars。

By business, revenue from Intel's client computing division, which covers laptops and PC processors, fell 3 percent to just $7.9 billion in the quarter; Intel's data center and artificial intelligence divisions, which provide server chips, were the hardest hit, with revenue down 10 percent to $3.8 billion in the quarter.。Intel said the division faced strong competitive pressure this season, and that the overall market size for server processors was shrinking.。

Intel's self-driving car parts listed subsidiary Mobileye's performance was a highlight of the quarter, with sales surging 18% to 5% during the reporting period..$300 million; Intel's emerging chip manufacturing business, Intel OEM Services, also performed well in the fiscal quarter, with revenue up nearly 300% from the same period last year。Intel said the surge in contract service revenue this quarter was mainly due to "an important customer who booked Intel's capacity in advance and paid a large deposit."。

Kissinger: ARM is not enough to fear; it can catch up with TSMC in 2025

In a conference call, Intel CEO Pat Gelsinger said the company expects to cut costs by about $3 billion this year.。Intel Chief Financial Officer David Zinsner also said that the company's current strong EPS is due to the company's cost control program, under which the company's operating expenses fell by about 15% compared to a year ago.。

A significant portion of the savings from Zinsner's so-called "cost control program" came from Intel's layoffs.。

Since October 2022, Intel has made a series of changes to the staffing of various departments.。In May, research firm SemiAnalysis revealed that Intel plans to cut its budget by 10%, and that the company's customer computing business group (CCG) and data center division (DCG) are expected to lay off 20% of their jobs.。

Intel revealed in an earnings call that the company currently employs 120,300 people, compared to 131,500 in the same period last year.。

In addition to the cost control issue, one other thing that has intrigued analysts is the spin-off process for Intel Solutions (PSG)。

Earlier this month, Intel had announced that its PSG division would be split into independent businesses, operating independently from January 1, 2024, with an independent IPO in the next 2-3 years.。However, until PSG operates independently next year, the division is still nominally attached to Intel's data center and artificial intelligence division, which has underperformed this fiscal quarter。

In response, Intel said that, as we discussed earlier this month, after a period of strong growth and tight supply, the company's FPGA (programmable gate array) business is entering an inventory depletion period.。

Competition in the chip market in 2023 is fierce。Chip giants Nvidia and AMD are said to be developing ARM-based chip products to compete with Intel in the PC market。In response, Kissinger admitted that some customers have begun to abandon Intel's central processing units in favor of Nvidia's artificial intelligence chips.。

However, Kissinger called for calm in the market, saying that ARM's chips have not historically received much attention in the market.。He also said that although the industry has observed some changes in the market share of CPUs and accelerators in the past few quarters, this situation has improved into the fourth quarter and signs of market normalization have begun to appear.。

He went on to say that for now, both ARM and Windows client alternatives have been relegated to a fairly insignificant role in the PC industry.。Strategically, Intel will take all competition seriously。But, tactically, guided by history, we don't think these challenges are that important overall。

Kissinger revealed that Intel had developed a plan called "five nodes in four years" to improve the chip manufacturing process to compete with competitors, and that progress had been made during the quarter, starting mass production of chips using EUV extreme ultraviolet lithography (the most advanced semiconductor manufacturing technology on the market) at the Fab 34 plant in Lexlip, Ireland.。

Accordingly, Kissinger boldly predicts that the company is still expected to catch up with TSMC's chip manufacturing technology in 2025。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.