2023 Jackson Hole Central Bank Annual Meeting: Powell still not satisfied with current inflation levels September rate hike expectations rise

The Jackson Hole Central Bank Annual Meeting is held once a year and attracts the world's leading central bankers, finance officials, economists, leading academics, and financial media to discuss the economic outlook and monetary policy.。

On August 25, US Eastern Time, Federal Reserve Chairman Jerome Powell (Jerome Powell) attended the Jackson Hole Central Bank Annual Meeting and delivered a speech entitled "Inflation: Progress and the Way Forward."。In his 20-minute speech, Powell again expressed his views on current U.S. inflation, monetary policy and other issues。

The Jackson Hole Central Bank Annual Meeting is held once a year and attracts the world's leading central bankers, finance officials, economists, leading academics, and financial media to discuss the economic outlook and monetary policy.。

Powell: Inflation still too high to watch data closely in the future

Powell first set the tone for the U.S. inflation situation: still too high。He said the Fed has tightened monetary policy significantly over the past year。Although inflation has fallen from its peak (a welcome development), it is still too high。Food and energy prices are subject to consistently volatile global factors that may provide misleading signals about the direction of inflation。

Next, Powell explained the core inflation indicator excluding food and energy, focusing on the three major components of core personal consumption expenditure inflation - goods inflation, housing services inflation and non-housing services inflation。

Specifically, Powell said that core commodity inflation has fallen sharply, especially for durable goods, because tight monetary policy and the slow easing of supply-demand imbalances are causing (core commodity) inflation to fall.。The effects of monetary tightening should become more fully apparent over time。Continued progress is needed and restrictive monetary policies are needed to achieve this progress。

On the inflation side of housing services, the effects of monetary policy became apparent shortly after launch, as the real estate sector is highly sensitive to interest rates。Growth in market rents quickly peaked and then steadily declined。Measured housing services inflation lags behind these changes but has recently started to decline。Due to slow rental turnover, it will take some time for the decline in market rental growth to affect the overall inflation indicator。

Looking ahead, if market rent growth stabilizes near pre-pandemic levels, housing services inflation should also fall to pre-pandemic levels.。We will continue to closely monitor market rent data for signals of upside and downside risks to housing services inflation.。

In terms of inflation for non-housing services, the sub-segment accounts for more than half of the core PCE index and includes a wide range of services such as health care, food services, transportation and accommodation.。According to Powell, the industry's twelve-month inflation rate has been trading sideways since its inception, however, its inflation rate has declined over the past three and six months。

Powell said part of the reason for the modest decline in inflation so far in non-housing services is that many of those services are less affected by bottlenecks in global supply chains and are generally considered less sensitive to interest rates than other sectors such as housing or durable goods.。The production of these services is also relatively labour-intensive and the labour market remains tight。Given the size of the sector, further progress is essential to restore price stability.。

Labor Demand Slows Powell Admits Restrictive Interest Rates

In addition to the level of inflation, Powell also commented on other elements of the U.S. economy。

In response to the continued fiery labor market in the United States, Powell said that the rebalancing of the labor market has continued over the past year but is still incomplete.。In addition, the demand for labor in the market has slowed.。While job vacancies remain high, there has been a downward trend, with wage employment growth slowing significantly。

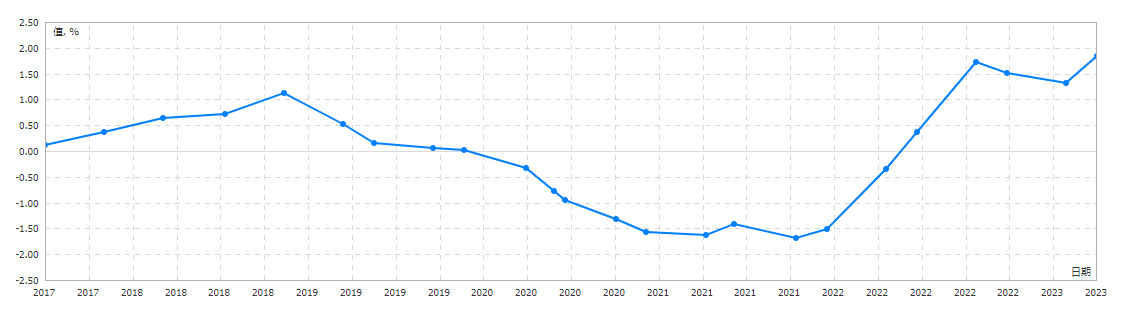

Powell noted that total hours worked were flat over the past six months and that average weekly hours worked had fallen to the lower end of the pre-pandemic range, reflecting a gradual normalization of labor market conditions, a rebalancing that has eased wage pressures.。Wage growth continues to slow, albeit gradually, over a series of measures。While nominal wage growth must eventually slow to levels consistent with 2% inflation, what matters to households is real wage growth.。Despite the slowdown in nominal wage growth, real wage growth has been increasing as inflation has fallen。

Powell warned that labor market rebalancing is expected to continue, but evidence that labor market tensions are no longer easing could lead to monetary policy responses。

On U.S. monetary policy, Powell again stressed that 2 percent remains our inflation target and that we are committed to achieving and maintaining a sufficiently strict monetary policy stance to bring inflation down to that level over time.。

Powell also acknowledged that real interest rates are now positive, well above mainstream estimates of the neutral policy rate: we believe that the current policy stance is restrictive, putting downward pressure on economic activity, employment and inflation。However, we cannot determine the neutral interest rate, so there is always uncertainty about the accuracy of monetary policy constraints。This assessment is compounded by uncertainty about the lag time for monetary tightening to affect economic activity, especially inflation。

Powell argues that in addition to these traditional sources of policy uncertainty, the supply-demand dislocation unique to this cycle has further compounded the complexity through its impact on inflation and labor market dynamics.。These old and new uncertainties complicate our task of balancing the risk of excessive tightening of monetary policy with the risk of too little tightening.。Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to squeeze more persistent inflation from the economy at high employment costs.。Doing too much can also cause unnecessary damage to the economy.。

Finally, Powell said that at the upcoming meeting, our progress will be evaluated based on overall data and changing prospects and risks.。Based on this assessment, we will proceed with caution to decide whether to tighten monetary policy further or leave the policy rate unchanged and await further data.。

After the speech, U.S. five-year inflation-protected bond (TIPS) yields, which measure real interest rates, rose above 2.26%, the highest since 2008。The resilience of U.S. labor market data has convinced bond traders that the Fed is likely to keep interest rates high until next year, analysts say。

Currently, according to the latest CME Fed Watch tool, the market expects the probability of the Fed suspending rate hikes at its September meeting to be 84.5%, the probability of a 25 basis point rate hike is 15.5%; the probability of a rate hike is expected to remain suspended at the November meeting at 49.8%, with a probability of 43 for a 25 basis point rate hike.3%, with a 50 basis point rate hike probability of 6.9%。

This week, U.S. PCE inflation data and non-farm payrolls data directly related to the Fed's September interest rate decision will be released soon.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.