JPMorgan: plans to open more than 500 new branches in next three years

On Tuesday (February 6, local time), JPMorgan Chase & Co (JPMorgan Chase & Co) said it plans to add more than 500 branch outlets in the United States by 2027 to expand its business scope in areas with less dense outlets.。

On Tuesday (February 6, local time), JPMorgan Chase & Co (JPMorgan Chase & Co) said it plans to add more than 500 branch outlets in the United States by 2027 to expand its business scope in areas with less dense outlets.。

JPMorgan's proposed new branches will be located primarily in cities such as Boston, Charlotte, Washington, D.C., Philadelphia and Minneapolis.。These cities are basically dominated by other big banks。For example, Minneapolis is the dominant market for Bank of America, while Charlotte is dominated by Bank of America and Wells Fargo.。

While JPMorgan didn't specify the exact amount of the investment, adding so many new branches would probably cost billions of dollars.。

Marianne Lake, CEO of JPMorgan's Consumer and Community Banking, said: "When we opened branches, we invested not only in the financial health of our residents, but in the health and vitality of our entire communities.。"

Lake had said at an investor conference in December that the bank was continuing to invest in its branch network.。Because of the top 50 markets it is trying to expand, 17 have branch shares of less than 5%。

With the widespread adoption of digital banking services on smartphones and a reduced need for cash, most Americans are now banking less often。This makes most of the newly designed branches smaller in size and equipped with more automatic service machines。

Jennifer Roberts, chief executive of JPMorgan's consumer banking business, said the new branch will have an advisory area for clients to have private conversations, shifting the focus away from the usual teller service.。

Roberts also said: "Our branch network is one of the key reasons customers open accounts with us and it helps us attract deposits.。"We do see our branch as a storefront for the entire company and it is a pillar for us to expand our relationship with our customers as we aim to be their primary financial partner."。"

JPMorgan's aggressive expansion strategy comes as other banks have been scaling back。According to the Federal Deposit Insurance Corporation (FDIC), as of the end of June last year, the number of branches in the United States fell by 4.2%。As of June 30, 2023, JPMorgan Chase had 4,875 branches and principal offices, followed by Wells Fargo with 4,555 branches and principal offices, according to the FDIC.。

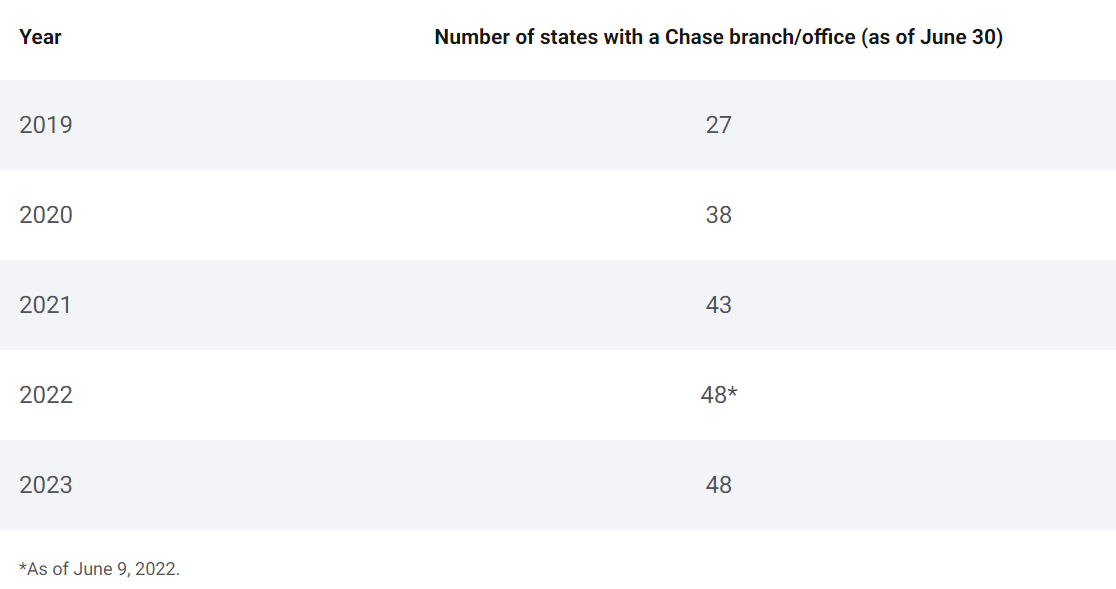

As part of its growth strategy, JPMorgan has added about 650 new branches over the past six years.。JPMorgan became the first U.S. bank to have branches in all 48 states in 2022, according to Bankrate.。

JPMorgan achieved a record annual profit in 2023, boosted by tough consumers and more revenue from customer interest payments as the Federal Reserve raised borrowing costs。This may be the main reason why JPMorgan decided to buck the trend of new branches。

Roberts said late last year: "Branches have been our winning strategy and it has helped us capture more market share.。"

In addition to the newly announced plans to add new branches, JPMorgan Chase plans to renovate its other nearly 1,700 existing branches in the United States and will hire an additional 3,500 employees for its branch network.。At the end of December, the bank had 309,926 employees worldwide, more than any of its peers.。

Last year, when JPMorgan bought First Republic Bank, it also bought nearly 60 of its branches.。JPMorgan now plans to close 30 of its branches。Prior to the acquisition, First Republic Bank had 84 branches in eight U.S. states, and shortly after the acquisition, JPMorgan Chase announced the closure of 21 of them。

JPMorgan also said it will work to transform some branches of First Republic Bank into JPMorgan branches.。First Republic is the largest U.S. bank to fail since 2008。JPMorgan says its consolidation efforts are on track。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.