Tron Meme Coin SUNDOG Skyrockets 100X as Justin Sun Eats into Solana’s Dominance

Tron’s meme coin SUNDOG soared 100x, surpassing $200M in market cap, fueled by Justin Sun's support. Will the rally continue?

- Tron-based meme coin SUNDOG surged 100x in value, from $0.002 to $0.20 in days.

- Justin Sun's backing boosts SUNDOG, challenging Solana's meme coin dominance.

- SUNDOG is overbought as the price faces risk of profit-taking that could send it to $0.17.

Sundog (SUNDOG), a meme coin built on the Tron blockchain, has taken the crypto market by surprise. Its market cap has risen from $2 million a few days ago to $200 million today.

Fueled by large investments and vocal support from Tron’s founder Justin Sun, the meme coin popularity continues to overshadow those launched on Solana.

Sun Takes the Front Row in Leading Tron Meme Coin Mania

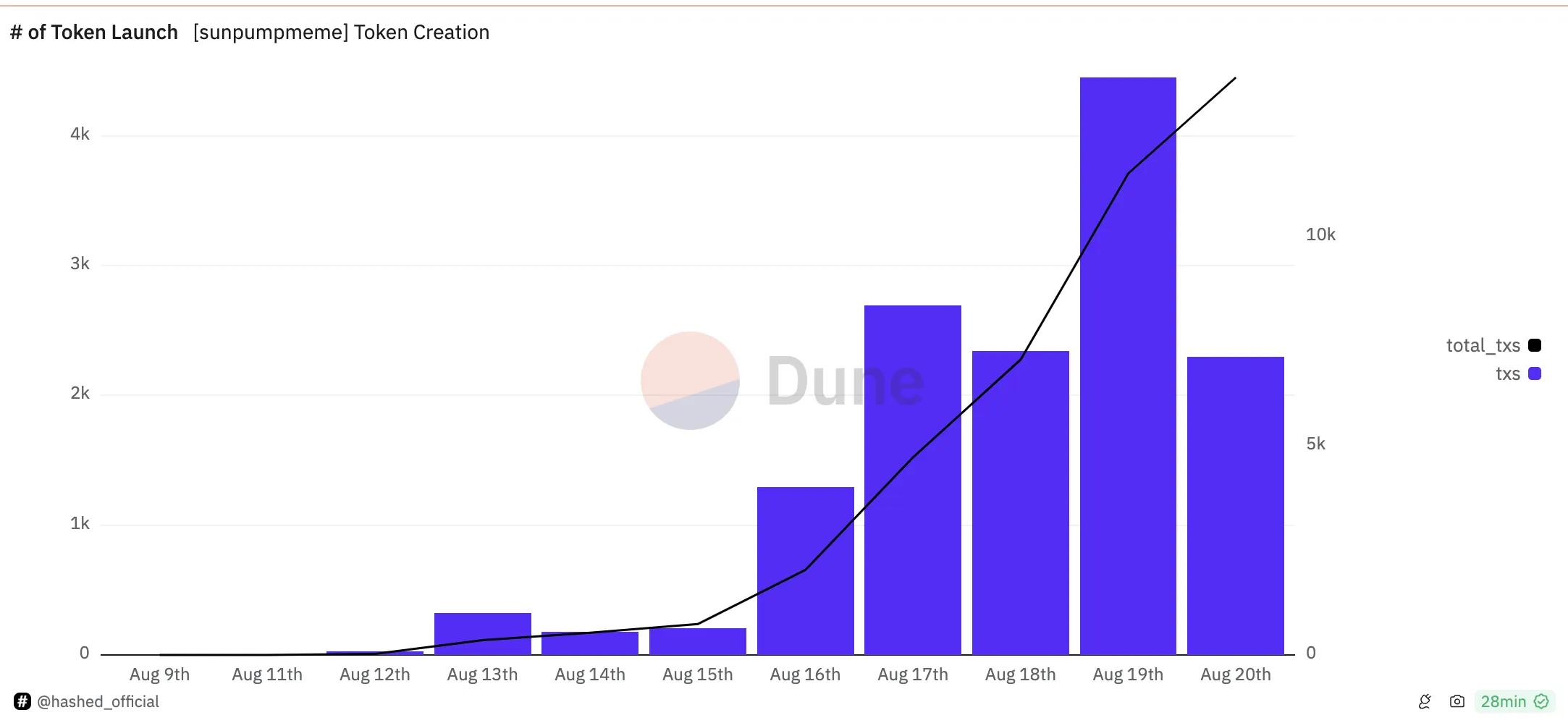

SUNDOG became a popular name among crypto meme coin traders after Justin Sun announced the launch of SunPump. Since its launch, SumPump seems to have taken a notable part of pump.fun’s market share, a similar token generator built on Solana.

During the platform launch’s early stages, there were fears that the hype would fizzle out quickly. However, this has not been the case, as it appears that SUNDOG may become the first billion-dollar Tron meme coin, as the billionaire blockchain founder predicted.

According to CoinGecko, SUNDOG’s price is $0.20, representing a 131% increase over the last 24 hours. Just a few days ago, this same value was $0.0020, indicating that it has skyrocketed by 100x within a very short time.

Furthermore, the meme coin’s incredible rise has drawn comparisons to dogwifhat (WIF). According to BeInCrypto’s findings, a ton of comments on X believe that the meme coin can replicate WIF’s run to a billion-dollar market cap.

For that to happen, some of the liquidity that Solana meme coins enjoyed might have to move to the Tron flagship meme coin. However, some SUNDOG holders believe that it is not impossible.

“The speculation that outperforming Tron would do a much better job than Avax at sucking in liquidity has aged perfectly. TRX printed another HH, and sentiment hasn’t been better this year,” pseudonymous trader ANBESSA wrote on X.

Read more:7 Best Tron Wallets for Storing TRX

Meanwhile, Sundog’s impressive performance has fueled a surge in the number of tokens launched on SunPump. On August 18, there were fewer than 6,000 meme coins on Tron. According to Dune Analytics, that number has since jumped to 13,815.

If the increase continues, more liquidity might flow from Solana’s pump.fun to SunPump. This could, in turn, trigger a rise in demand for TRX and SUNDOG.

SUNDOG Price Prediction: Meme Coin Becomes Overbought

The one-hour chart below shows that SUNDOG’s price has pulled back from its peak of $0.22. This decline could be attributed to the signal that the Tron meme coin was overbought.

For example, the Bollinger Bands (BB), which measure volatility, tapped the token’s price at $0.21. Typically, when the upper band touches a cryptocurrency’s price, it signals overbought conditions. Conversely, when the lower band is hit, it suggests the asset is oversold.

Amid this increased volatility, the meme coin experienced a retracement. The Relative Strength Index (RSI) further supports this outlook. The RSI measures momentum and identifies overbought and oversold conditions.

An RSI reading above 70.00 indicates an overbought asset, while a reading below 30.00 signals it is oversold. On the chart below, the RSI for SUNDOG initially reached 78.20, signaling it was overbought and leading to a price correction.

Read more:7 Hot Meme Coins and Altcoins that are Trending in 2024

Additionally, the token might face increased profit-taking. If this happens, the price might drop to $0.17 or $0.14. However, a rise in buying pressure could send the price back up, possibly retesting $0.22.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.