Meta's 4Q results beat expectations Announced first dividend to boost stocks up 15%!

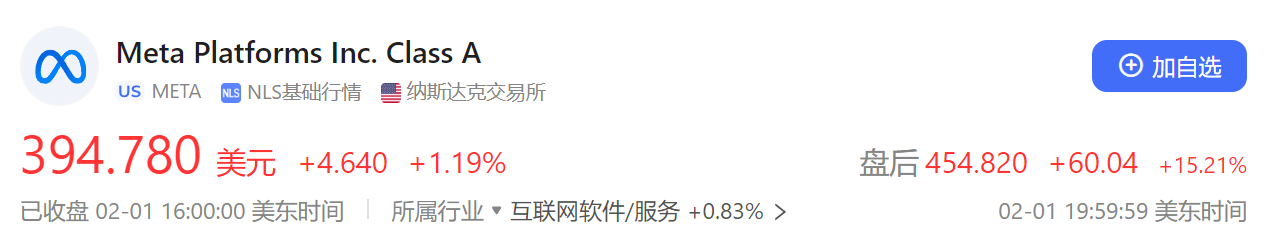

On February 1, local time, Meta reported its fourth-quarter fiscal 2023 earnings after hours in U.S. stocks, with overall results exceeding analysts' expectations。Meta's shares surged more than 15% to 454 in after-hours trading on the back of strong results and an initial dividend payout..82 USD。

On Feb. 1, local time, social networking giant Meta reported its fourth-quarter fiscal 2023 earnings after hours in U.S. stocks, with overall results exceeding analysts' expectations。

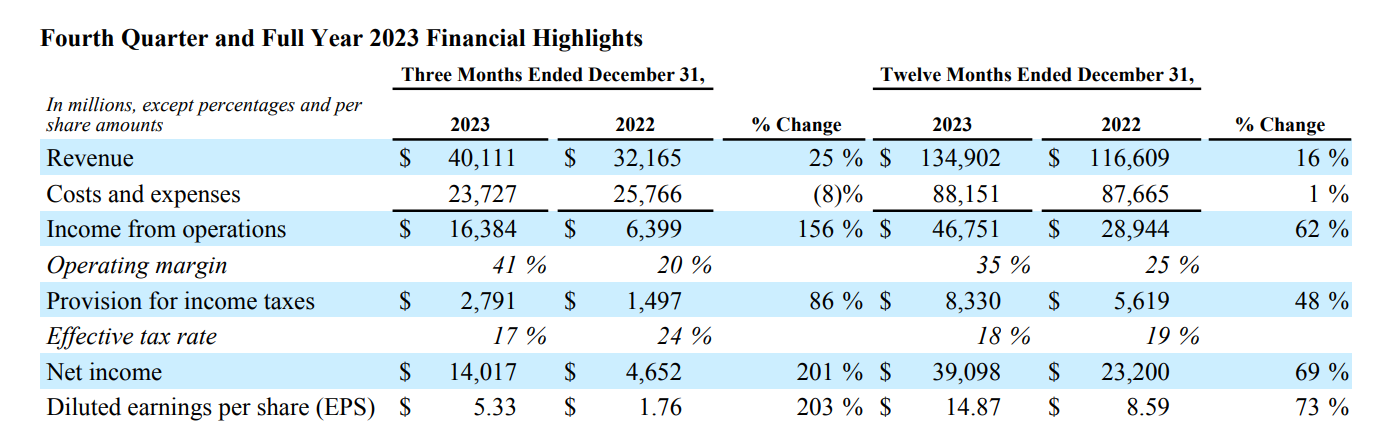

Specifically, Meta's revenue in the fourth quarter increased 25% year-over-year to 401.$1.1 billion, above analyst expectations of $39.1 billion。Net profit of 140.$1.7 billion, up 201% year-over-year; adjusted earnings per share of 5.$33, up 203% year-over-year, above Wall Street's average estimate of 4.82 USD。

For the full year, Meta's revenue reached 1,349 in 2023.$02 billion, up 16% YoY。The net profit was 390.$9.8 billion, up 69%。Adjusted EPS of 17.$87, up 73%。

Meta is also optimistic about next quarter revenue guidance, at $34.5 billion to $37 billion, with a median guidance of 357.$500 million, 5 more than analysts expected $33.9 billion.5%。

Both business segments outperformed expectations

Take a look at the performance of Meta's two major business units in the fourth quarter of last year.。

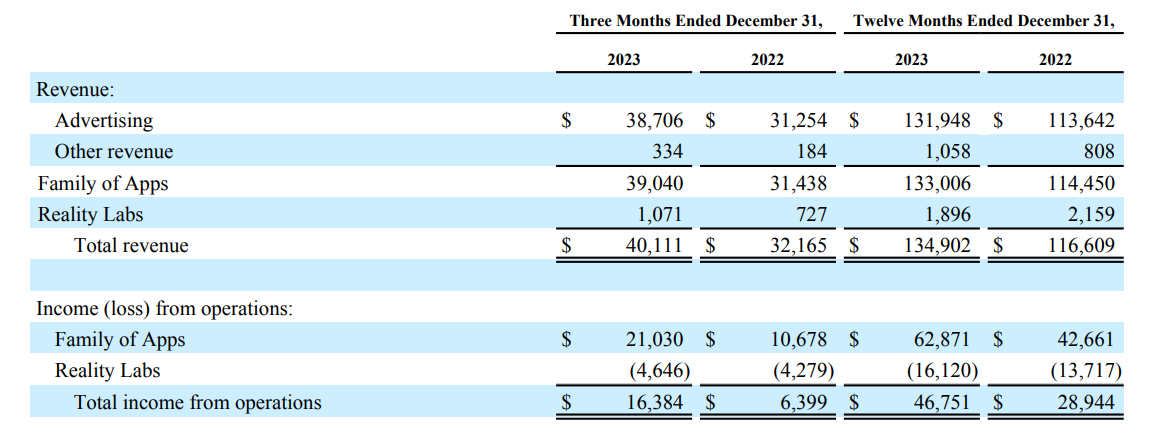

The first is the Family of Apps (FoA).。FoA includes Facebook, Instagram, Reels, Threads and WhatsApp。Meta's revenue is basically contributed by the advertising revenue of these applications.。

Meta's FoA revenue was 390 in the fourth quarter.$400 million, beating analyst expectations of 381.$600 million, operating profit of 210.300 million dollars。Among them, advertising revenue was 387.$600 million, significantly higher than the expected 329.$400 million。

On the user side, the company reported that in September 2023, the average daily active person (DAP) for these apps was 31..900 million, up 8% year-on-year。As of December 31, 2023, the monthly active population (MAP) was 39.800 million, up 6% year-on-year。

In terms of advertising, in the fourth quarter, Meta's ad impressions in the app series increased by 21% year-over-year, and the average price per ad increased by 2% year-over-year.。For the year as a whole, ad impressions grew 28% year-over-year, but the average price per ad fell 9% year-over-year。

Let's look at the performance of another business unit of Meta, Reality Labs (RL).。RL includes consumer hardware, software, and content related to augmented reality (XR), mixed reality (MR), and virtual reality (VR)。In the fourth quarter, RL achieved revenue of 10.$7.1 billion, higher than analysts expected 8.$12.6 billion。Currently, RL is still in the red, recording an operating loss of 46 in the fourth quarter..$4.6 billion, full-year loss of 161.$2 billion, a loss compared to 137 in 2022.$1.7 billion expanded again。

First dividend

In addition to disclosing the results, Meta also released a big news in this financial report - it will pay dividends to shareholders.。

Meta's board of directors announced that it will pay the first dividend in the company's history on March 26, 2024, with a dividend of 0 per share..50美元。Meta also said: "We intend to pay cash dividends on a quarterly basis in the future, depending on market conditions and with the approval of the Board of Directors.。"

Meta's shares surged more than 15% to 454 in after-hours trading on the back of strong results and an initial dividend payout..82 USD。

Meta's move came as a surprise to Wall Street, which has also been reading the act。

By analysts, the share price move already reflects a positive reaction from investors to Meta's earnings beat expectations and dividend payouts。Meta's new dividend may extend Meta's institutional ownership to investors who want or need a dividend on their holdings。At the same time, it also shows that Meta's founder and CEO Mark Zuckerberg is confident about the company's prospects.。

In addition, some analysts believe that Meta's move may spur Google's parent company Alphabet to do the same。All along, Alphabet has not paid dividends to shareholders, and the company prefers to return cash to shareholders through massive share buybacks.。But tech giants like Meta and Alphabet, with huge cash flows in hand, can actually do both share buybacks and dividend payments。In 2023, Meta repurchased a total of $20 billion of shares, and as of the end of 2023, Meta also owned 309.$300 million of funds available and authorized for repurchase。At the same time, Meta also announced that it would increase its share repurchase authorization by $50 billion.。

In addition, it is expected that other large technology companies such as Amazon and Tesla may also be candidates for the next dividend payout amid growing revenue and free cash flow。

The above-mentioned non-dividend-paying technology companies have historically said that they are prioritizing spending in other growth business areas。But for investors, dividends are increasingly seen as a sign of executive confidence in the company.。Apple and Microsoft have always had a "tradition" of paying dividends, but this does not prevent them from reaching the top of the world's highest market capitalization "throne."。

Meta: Will increase investment in AI

In this earnings report, Meta also raised the upper limit of this year's capital expenditure budget range.。

Meta said it expects full-year 2024 capital spending to be between $30 billion and $37 billion, up from guidance of $30 billion to $35 billion given by the company in the third quarter of last year.。This compares to $28.1 billion in capital expenditures for the full year 2023.。

Meta explains the increase in capital expenditure guidance caps as follows: "We expect investment in servers (including AI and non-AI hardware) and data centers to drive growth as we ramp up site construction with the new data center architecture we previously announced.。Our updated outlook reflects our continued understanding of the need for AI capabilities。"

Meta also hinted that next year's capital spending budget could grow again.。"While we will not provide guidance beyond 2024, we anticipate that our ambitious long-term AI research and product development efforts will require increasing infrastructure investment beyond this year."。"

Insider Intelligence analyst Jasmine Enberg said Meta's investment in AI "demonstrates the company's commitment to becoming an AI heavyweight that will pay off for both investors and advertisers."。But at the same time, Emberg also warned: "Meta still faces the daunting task of proving that it can combine artificial intelligence with its other big bet, the meta-universe."。Moreover, the withdrawal of Chinese advertisers may adversely affect its advertising business, and investors will be reluctant to ignore the growing losses of its reality lab if Meta's advertising business goes wrong.。"

The self-developed chip is coming?

On February 2, a media report said that according to an internal company document, Meta plans to deploy a new version of custom chips in its data centers this year to support the development of its artificial intelligence.。

Dylan Patel, founder of SemiAnalysis, said that at Meta's scale of operations, successfully deploying its own chips could save hundreds of millions of dollars in annual energy costs and billions of dollars in chip procurement costs.。

Subsequently, a Meta spokesperson confirmed the news that the company plans to put the updated chip into production in 2024.。In a statement, the spokesperson said: "We believe that our in-house developed accelerator will be highly complementary to GPUs on the market in terms of providing the best combination of performance and efficiency for Meta-specific workloads.。It is worth mentioning that last month, Zuckerberg also said on the social media platform that Meta plans to have 350,000 Nvidia H100 chips by the end of this year, and the company's total calculation power will be close to 600,000 H100 chips.。

During the earnings call, Zuckerberg said that artificial intelligence will be the company's largest investment area in internal engineering and infrastructure this year.。He expects the training and operation of AI models to be "more computationally intensive" in the future, suggesting that more GPUs will need to be purchased.。He said, "We are fighting for victory in the field of artificial intelligence."。Zuckerberg said the company would not repeat its previous mistake of underinvesting in chips, "expecting us to continue to invest aggressively in this area."。"

Meta to recruit top AI talent after multiple rounds of layoffs

Last year, Zuckerberg announced the launch of the "Year of Efficiency" (Year of Efficiency), a year-long cost reduction and efficiency increase for Meta.。

To slash costs, Meta conducts multiple rounds of layoffs。As of December 31, 2023, Meta had 67,317 employees, a decrease of 22%。Last year, severance payments alone cost Meta nearly $1.2 billion.。

"Starting in 2022, we have taken a number of steps to pursue greater efficiency and realign our business and strategic priorities.。As of December 31, 2023, we completed our data center program and staff layoffs, and substantially completed our facility consolidation program。"

Zuckerberg said on a conference call that he plans to keep headcount growth "relatively low" in 2024 and beyond.。"Until our execution capabilities really get stuck, I want to stay streamlined because I think from a (corporate) culture perspective, this is the right thing for us to do.。"

Even so, Meta said in its earnings report that salary costs are expected to be higher in 2024.。The reason for the rising recruitment costs is likely to be that Meta will next recruit more top AI talents with high salaries.。Meta said in its earnings report: "As we address our current under-recruitment problem and add incremental talent to support priority areas in 2024, we expect payroll expenses to grow.。This will further shift our workforce composition towards more costly technical roles。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.