Fed's October Beige Book on Economic Conditions Announces Expectations to Continue to Suspend Interest Rates at Month-End Meeting

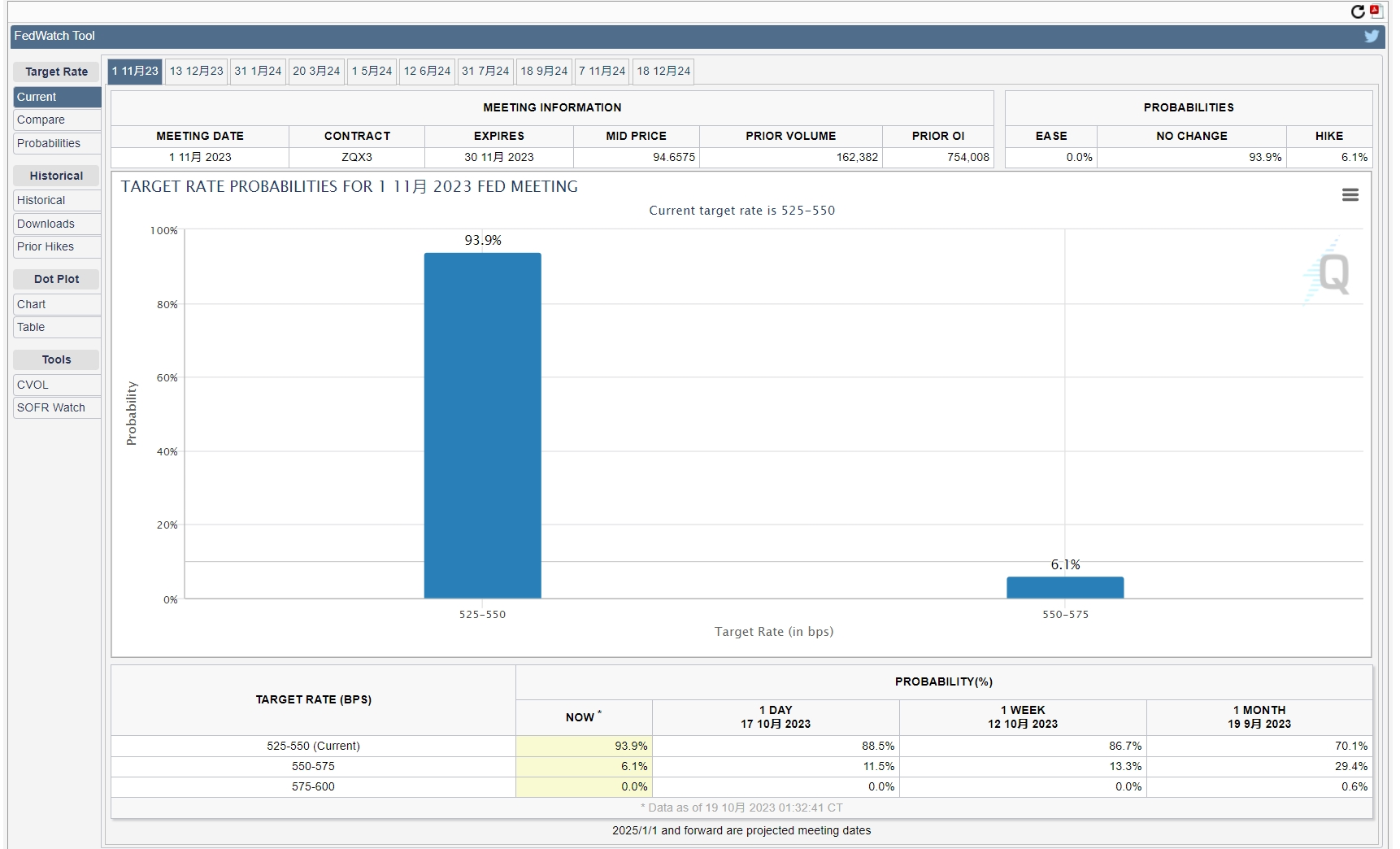

As of press time, according to CME Fed Watch, the bank's probability of keeping monetary policy unchanged at its end-of-month meeting has reached 93.9%。

On October 18, local time, the United States released the latest issue of the Brown Book of Economic Conditions, which provides an analysis of the current basic economic situation in the United States.。Since the Beige Book is generally published two weeks before the Fed's meeting on interest rates, the document is an important reference for the Fed's monetary policymaking。

U.S. economic growth outlook stable or slightly slower

According to the introduction, the data collection in this Beige Book originated from 12 local feds across the United States, and the deadline for data is October 6.。By convention, the Fed will issue a brown book on economic conditions eight times a year, and the last time the Fed released the Brown Book was September 6.。

In the September Beige Book, the Fed had announced the good news that prices were falling.。In September, most regions already reported an overall slowdown in price growth, with the manufacturing and consumer goods sectors slowing even faster, the bank wrote in the filing.。So, at the FOMC meeting two weeks later, Fed officials decided to keep the policy rate at 5.25% -5.5% interval。

In the Beige Book, the Fed continued to say that the economy remained stable in most parts of the United States, labor market tensions improved further, and price expectations were expected to stabilize.。

Specifically, overall economic activity in the United States has changed little since the September report.。Among them, consumer spending is mixed due to differences in prices and product availability, which is particularly evident among general retailers and car dealers.。In addition, U.S. tourism activity continues to improve, with some areas reporting a slowdown in consumer travel, but some areas also reporting an increase in business travel compared to the past.。Respondents believe that the near-term economic outlook is stable or that growth is slowing slightly.。

On the financial credit side, loan demand declined slightly。Consumer credit quality stable, delinquency rates remain historically low but up slightly。Property conditions have barely changed, and inventories of homes for sale remain low。The outlook for manufacturing has improved in some regions, but the overall performance remains divergent.。

On the labor market, the Beige Book notes that tensions continue to ease。Employment increased slightly in most areas, and the urgency of corporate recruitment decreased.。Several districts reported an increase in talent recruitment and retention rates as the number of applicants increased, the range of candidates expanded and those recorded were less willing to negotiate employment terms。

On the payroll front, wage increases were moderate in most areas。Several regions report less resistance from candidates to wage conditions offered by employers。Companies are modifying compensation packages to mitigate increased labor costs, including wage increases such as allowing remote work instead of higher wages, reducing signing bonuses, shifting to a more performance-based compensation model, and burdening employees with a greater share of the cost of benefits such as health care。

The price aspect of the Fed's focus, the Beige Book says prices in general continue to rise at a moderate pace。Various localities said that the growth of manufacturers' input costs has slowed down or stabilized, but the input costs of service industry enterprises are still rising.。Product sales prices are rising at a slower rate than input prices, as consumers become more price-sensitive and firms struggle to pass on cost pressures。Therefore, it is difficult for enterprises to maintain ideal profit margins.。Overall, companies expect prices to rise in the coming quarters, but at a slower rate than in previous quarters, the Beige Book said.。Some regions report that the number of companies expecting significant price increases in the future has decreased。

In addition, according to regional reports, five of the 12 Fed jurisdictions reported moderate growth in economic activity, three reported little change, and four reported a slight contraction in economic activity, the most since January.。

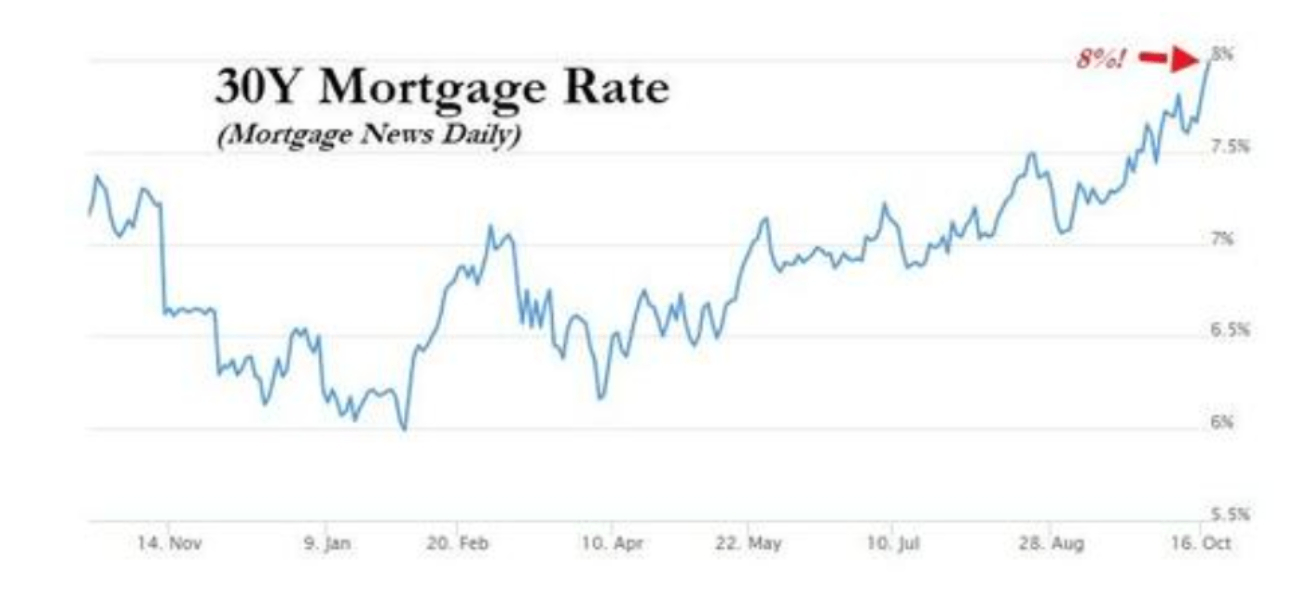

Fixed mortgage rates soar, multiple officials hint at a pause in rate hikes

Currently, U.S. 10-year Treasuries have suffered a historic sell-off this month due to high policy rates, and according to Mortgage News Daily, the popular 30-year fixed mortgage rate averaged 8 percent, the highest level since mid-2000.。

In this context, several Fed officials have already hinted at a pause in rate hikes in the coming months。

Fed Governor Waller says you can wait, watch and wait for the economy to develop before taking definitive action on interest rate policy。He noted that pay growth has slowed, but U.S. households have not seen spending cuts and it is too early to know how the data will change.。He added that the time has not yet come to stop raising interest rates and that interest rate cuts will not be discussed。

Federal Reserve Bank of New York President Williams also said that the policy stance still needs to remain restrictive for some time to reduce inflation.。He added that the Fed has made progress in reducing inflation, but there is still some way to go。

Two economists at the Federal Reserve Bank of Chicago also believe that the Fed has raised interest rates in the past 18 months by a total of 5.25 percentage points, probably enough to bring inflation down to the central bank's 2 percent target and avoid a recession.。

As of press time, according to CME Fed Watch, the bank's probability of keeping monetary policy unchanged at its end-of-month meeting has reached 93.9%。The market expects the Fed to suspend interest rate hikes again at this meeting and open the door to a December rate hike window: at the December meeting, the Fed may announce a policy rate hike to 5.5% -5.75% range, which is also likely to be the peak of interest rates in this protracted rate hike cycle。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.