Japan's net overseas bond purchases hit record high Yen bearish expectations increase

Japanese investors are holding large amounts of overseas bonds, a trend that will likely keep yen bulls on the sidelines。

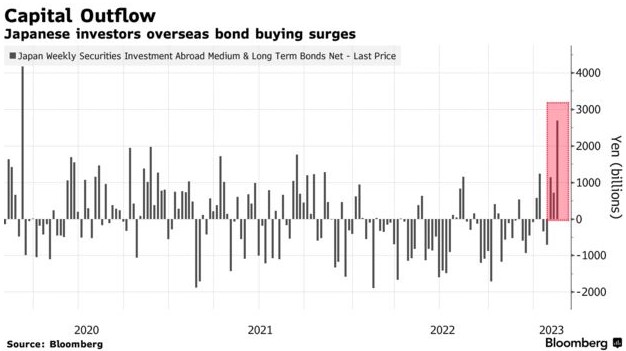

Japanese investors are holding large amounts of overseas bonds, a trend that will likely keep yen bulls on the sidelines。According to news released on Friday local time, Japan's asset managers bought a net 2.7 trillion yen ($19.8 billion) in overseas bonds。This is the largest net outflow of capital from Japan since the March 2020 epidemic and is about 20 times the average weekly outflow over the past decade.。

(Japanese investors' overseas bond purchases surge)

The buying follows a record number of overseas bonds sold by Japanese investors last year, which may have contributed to the yen's volatility in 2022.。According to balance of payments data published by the Ministry of Finance, fund managers in Asian countries decreased by 23.8 trillion yen ($181 billion) in foreign fixed income securities holdings。

Japanese investors may also be forced to buy foreign debt on an unhedged basis as the cost of guarding against exchange rate fluctuations is too high。

Three-month currency hedging costs of more than 5% for dollar exposure and more than 3% for euro exposure, and are likely to remain high for some time。Bank of Japan governor nominee Kazuo Ueda says it is appropriate to keep monetary easing until trends improve。In contrast, the Fed raised its policy rate at least three more times and kept it above 5%.。

Meanwhile, February's outflow from Japan was faster than any month on record.。That helps explain why analysts have scaled back bullish expectations for the yen, while Morgan Stanley has shifted to a bearish stance on the currency.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.