Forex Trading Automation Becoming Key to Risk Management?

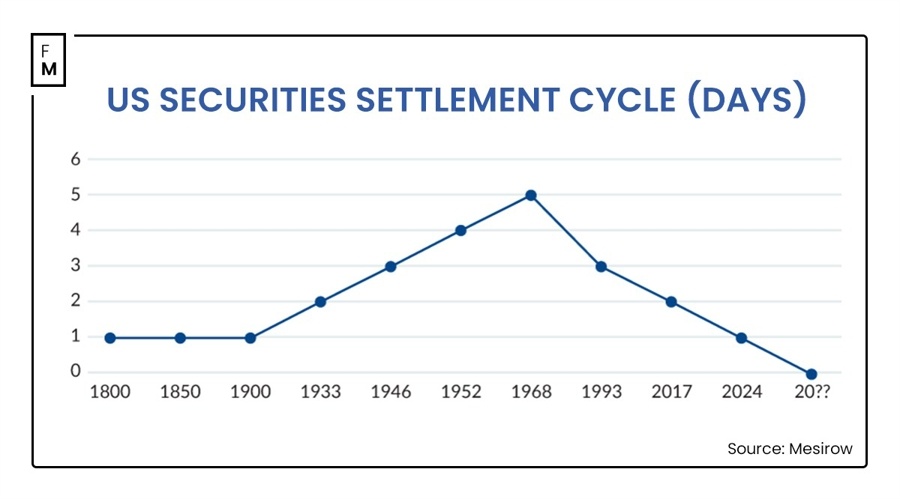

With only a few weeks left before the introduction of T+1 settlement of securities in the US, market participants should carefully assess their ability to utilise the foreign exchange transactions to fund the settlement of securities.

With only a few weeks left until the implementation of T+1 settlement in the United States, market participants should carefully assess their ability to provide funds for securities settlement through relevant foreign exchange transactions.

Since the Foreign Exchange Division of the Global Financial Markets Association pointed out in a report titled "Foreign Exchange Considerations for T+1 U.S. Securities Settlement," the shift to faster settlement has been nearly a year in the making. The report notes that meeting the matching, confirmation, and payment requirements within the local currency cutoff time for transactions may increase the risk of transactions relying on foreign exchange settlement not occurring in a timely manner.

At the end of last year, the Foreign Exchange Professionals Association issued guidance recommending traders to comprehensively review the impact of the new settlement timeframe, considering factors such as trading relationships, credit and operational processes, and funds.

Focused on T+1 securities settlement

"Institutions should automate workflows as much as possible and be prepared to make changes to current workflows," advised Tara Taylor, Director of North American StreetFX Pricing Services. She stated that simultaneous execution of stock and currency trades depends on workflows, technology, internal trade execution, and operational setup.

She noted that workflow assessments should consider where stock and currency executions occur and whether they are done through a central team or across multiple locations.

"Automated solutions with consistent workflows allow managers to choose execution times to better align with securities execution, and since spreads are pre-negotiated, price and cost transparency are consistent," Taylor added.

Scott Gold, Director of Sales for BidFX Americas, also agreed that clients need technology and execution management platforms capable of handling rapid decision-making and execution. He added that automation is becoming widespread to capture favorable pricing opportunities while mitigating risks.

Managers need to carefully consider forex elements related to investment decisions because USD liquidity against all currencies dries up on Friday afternoons, with the U.S. dollar market closing for the U.S. weekend. This situation is particularly severe when U.S. public holidays fall on Mondays and requires careful planning.

Overcoming forex risks

"In our view, many risks related to forex issues in trading can be addressed, but there are no ready-made solutions for sourcing forex during market closures," said Gerard Walsh, Global Head of Client Solutions for Capital Markets at Northern Trust.

He suggested that the key to simultaneously executing stock and currency trades is to collaborate with as few participants as possible and only with those embedded with highly automated participants throughout the entire lifecycle of the trade.

Katie Renouf, Senior Vice President of Mesirow's Global Investment Management Distribution team, pointed out that a large number of transactions are settled through CLS, but its current cutoff time does not apply to the transition to T+1.

Earlier this month, CLS confirmed that it would not make any operational changes to its settlement before T+1 is implemented in the United States.

"Settling trades outside of CLS not only exacerbates settlement risk but may also have an indirect impact on bank credit lines," Renouf said, noting that some clients are considering opening spot trading desks in North America. She observed that simultaneous execution of stock and currency trades is underway but carries the risk of trade failures and forex must be transacted back at prevailing market rates.

"Additionally, clients typically don't know the exact amount they need to fund, so they estimate based on screen prices," she said. "I would guess that most people trading based on estimates buy or sell 90-95% of the target amount and then transact for the actual amount once it's determined."

Transition-related risk factors have not been fully addressed industry-wide, although individual firms are taking steps to minimize impact, they will face challenges in matching forex transactions required for stock trades and executions.

This is the opinion of Vikas Srivastava, Chief Revenue Officer of Integral, who said that the optimal workflow is an automated sequential workflow starting with stock execution, followed by stock trade confirmation, and then currency trade execution.

"The burden primarily falls on asset managers purchasing U.S. stocks," he said. "Banks seem to have an opportunity to provide greater support to their asset management clients in addressing these challenges by connecting their forex pricing and execution services with the asset managers' forex order and execution management systems via APIs."

Resolving transition risks

After the change takes effect, there is expected to be an increased demand for STP operation types services, leading Nathan Vurgest, Trading Director at Record Financial Group, to believe that the market has not fully addressed potential impacts yet.

"The issue with simultaneous execution of stock and currency trades is not so much operationally challenging as it is expected to increase the cost of forex transactions because forex transactions are often not fully dedicated to by independent forex trading departments but are completed in the background by custodians or banks' automated STP workflows alongside other asset trades," he said.

Mismatched settlement cycles between the United States, the United Kingdom, and the European Union may persist for at least three years.

"The UK Faster Payments Working Group proposed the earliest possible implementation for the UK by 2027," Walsh said. "The situation in Europe is more complex, with achieving it by the end of this century being bold, given the need to coordinate multiple exchanges and currencies, at least two time zones, and numerous political and regulatory organizations."

Vurgest observed that the UK is expected to be the first European country to achieve T+1, although the EU may follow suit by 2027, "but considering the need for coordination among multiple jurisdictions and approvals, 2030 is more likely."

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.