Q3 recorded its strongest quarterly results in two years. Why did Meta's share price turn around and fall?

On October 25, local time, Meta announced its third quarter financial results。In the third quarter, Meta's revenue increased by 23% year-on-year, and net profit increased by 164% year-on-year.。It was Meta's fastest growth since the third quarter of 2021 and the strongest quarterly result since the company changed its name from Facebook to Meta two years ago.。

On October 25, local time, Meta announced its financial results for the quarter ended September 30, 2023.。

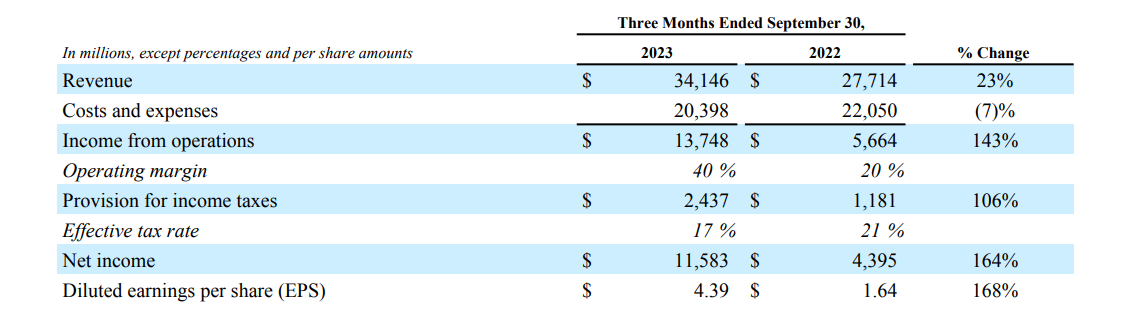

Performance data show that in the third quarter, Meta's revenue was 341.$500 million, up 23% year-over-year, beating expectations of $33.5 billion。Net profit of 115.$8.5 billion, or diluted earnings per share (EPS) of 4.$39, a sharp increase of 164% year-over-year, well above the consensus estimate of $9.4 billion。Operating margin of 40%, double year-ago。

Notably, this was Meta's fastest growth since the third quarter of 2021 and the strongest quarterly result since the company changed its name from Facebook to Meta two years ago.。

ADVERTISING BUSINESS GROWTH, "META-COSMIC" CONTINUES LOSSES

Meta's revenue is largely contributed by ads from app campaigns。The Meta app series includes Facebook, Instagram, Reels, Threads, WhatsApp and more。

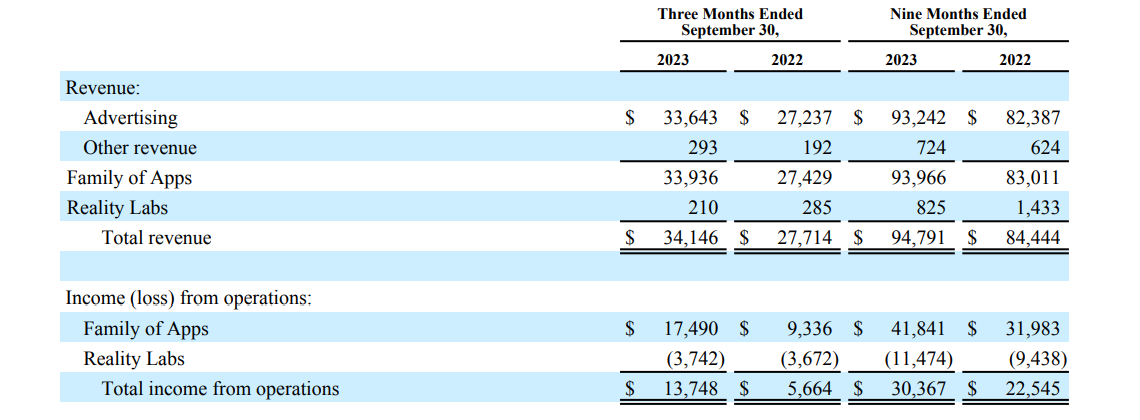

Revenue from these applications in the third quarter was 339.$3.6 billion, operating profit of 174.$900 million, beating analyst expectations of 152.300 million dollars。Among them, advertising revenue is 336.$400 million, higher than expected 329.$400 million。

In terms of active users, the company reported that in September 2023, the average daily active person (DAP) for these apps was 31..400 million, up 7% year-on-year。As of September 30, 2023, the monthly active number (MAP) was 39.600 million, up 7% year-on-year。

In the third quarter, Meta's ad impressions in app campaigns increased 31% year-over-year, although the average price per ad fell 6% year-over-year。

The "veteran" of the Meta app series - Facebook recorded an average daily active user (DAU) of 20 in September.900 million, up 5% year-on-year, better than the 20 expected by analysts..700 million。Facebook had 30 monthly active users (MAUs) at the end of September..500 million, up 3% year-on-year。

As for Reels, the short video software launched by Meta in response to TikTok and others, Mark Zuckerberg, CEO of Meta, said, "We also reached our earnings milestone earlier than expected, and we estimate that Reels is now net neutral for the company's overall advertising revenue.。And according to a recent UBS report, the bank's channel checks showed that Reels outperformed TikTok, with lower fees per thousand displays and significantly higher engagement.。UBS also said that Instagram and Facebook, the two apps, saw their download share rise to 18% and 19% respectively, while TikTok's download share fell to 22% from more than 25% last year.。

In addition, as Meta's new "Twitter killer" launched in July this year, Threads has about 100 million monthly active users.。"As far as we know, people have loved it so far.。Zuckerberg said in an earnings call, "We are now focused on further developing the community."。He later added: "For a long time I thought there should be a public conversation app for a billion people... I believe this will be the next major pillar of our business."。More than 600 million conversations between people and businesses on our platform every day。"

Meta's apps series performed well in the third quarter, while its other division, Reality Labs, which focuses on "meta-cosmos" related businesses such as virtual reality, continued to lose money.。

Reality Labs Reported 2 in Third Degrees.$100 million, loss of $3.7 billion。Analysts had expected average revenue of 3.$13.4 billion, operating loss of 3.9.$400 million。In the first nine months of this year, the unit has lost about $11.5 billion.。

The company began selling its latest virtual reality headset, the Quest 3, in October.。Meta expects Real Labs' operating loss to increase substantially year-over-year due to continued product development。

The contradiction between cost reduction and efficiency in the "efficiency year" and AI investment

In the third quarter, Meta's spending as a percentage of revenue fell to 59%, a multi-year low.。

2022 was a "dark" year for Meta, with its shares plunging more than 70% for the year.。In this case, Zuckerberg announced that he would start a "Year of Efficiency" and begin to cut costs significantly, including layoffs.。

Since the end of last year, the company has made multiple rounds of layoffs, cutting at least 21,000 jobs.。The company currently employs 66,185 people.。

"Starting in 2022, we have taken a number of steps to pursue greater efficiency and refocus our business and strategy.。"As of September 30, 2023, we have substantially completed our planned staff reductions while continuing to evaluate our facilities consolidation and data center restructuring plans."。"

In addition to cutting costs, Meta said it would change some practices in line with regulations.。In Europe, for example, the company plans to offer paid subscriptions to Facebook and Instagram users who want to be ad-free.。This policy, if it does take effect, could improve the company's revenue performance。

But with the advent of generative artificial intelligence, Meta must increase its investment to remain competitive.。

Zuckerberg said he is pleased with the progress in efficiency, "We are a leaner organization, growing faster, and advancing the most advanced technologies in all of our long-term plans, while investing heavily for the future.。"

Meta spent 92 on research and development in the third quarter.4.1 billion U.S. dollars, basically unchanged from the same period last year, an increase of less than 1%。In the first nine months of the year, the company spent 279 on research and development..$6.6 billion, up about 9.4%。

During the call, Zuckerberg said: "In terms of investment priorities, artificial intelligence will be our largest investment area in engineering and computing resources in 2024.。He added: "We will continue to reduce the priority of some non-AI projects within the company to divert people to work in the field of AI."。He said the company would "continue to focus on operating efficiently."。

It's worth noting that after a major layoff, Meta is ready to rehire new talent to cater to the company's strategic shift。The company said most of the money next year will be used to continuously expand the technology infrastructure to run sophisticated artificial intelligence and virtual reality tools, and said it will hire more workers in "higher-cost technology roles" to build these products.。Specifically, the company will hire most of its staff next year in artificial intelligence, monetization, meta-cosmos and Reality Labs, as well as regulatory compliance needs.。

Meta's approach to AI competition differs from that of its big tech peers。This year, Meta announced that its large language models are free for developers to use.。At its September developer conference, the company unveiled its first consumer-facing generative artificial intelligence features, including a variety of chatbots and image editing tools for platforms such as Instagram and Facebook.。Meta believes that this open strategy will help improve technology faster, which of course means that companies will not be able to recover these R & D costs for a longer period of time.。

Despite Meta's ambitions, Morningstar warned that Meta management must delicately balance its cost-cutting plans with the need to invest heavily in AI.。In a recent report, Morningstar said: "We hope the company will discuss its latest plans for the metasurface and whether it will make an active investment in this area to restart.。We think artificial intelligence is an important part of the meta-universe。"

Stock turns lower as fourth-quarter outlook falls short of expectations

Although Meta filed a good report card in the third quarter, the stock went from up to down, closing down more than 4 percent at 299, as company executives warned on a conference call about the next advertising business..53 USD。Losses extended in after-hours trading, down nearly 4%。

During the company's earnings call, Susan Li, Meta's chief financial officer, said recent geo-conflicts in the Middle East and beyond were causing "weakness" in the advertising market.。

Li said: "Historically, we have seen broader demand weakness following other regional conflicts in the past.。So, this is something that we continue to monitor。We reflect the latest trends and advertiser reactions that we already have。We have an outlook for the fourth quarter, which I think again reflects greater uncertainty and volatility going forward.。"

With its shares up more than 130% so far this year, Meta is one of the best-performing tech stocks, significantly outperforming the S & P 500 and Nasdaq Internet Index, which are up about 10% and 34% respectively this year.。

In its third-quarter earnings report, Meta updated its outlook for fourth-quarter and full-year 2023 results.。Overall, the new outlook looks more conservative。

Meta expects total revenue in the fourth quarter of 2023 to be between $36.5 billion and $40 billion, up about 2% year-over-year, compared to analysts' expectations of $38.9 billion.。

Brent Thill, an analyst at Jefferies, said in a note that Meta's fourth-quarter revenue guidance was "unusually broad in scope, suggesting the midpoint could slow."。

In addition, Meta expects total spending for the full year 2023 to be between $87-89 billion, down from $88-91 billion previously.。The outlook includes about $3.5 billion in restructuring costs related to facility integration expenses and severance and other personnel costs, the company said.。At the same time, the company expects total spending for the full year 2024 to be in the range of $94-99 billion.。

Meta also cited several factors that they believe could be drivers of total expense growth in 2024.。One is that the company expects infrastructure-related costs to rise next year and will drive up operating costs。The second is the expectation that restarting hiring to compete in areas such as artificial intelligence will lead to higher wage spending, as it will shift its workforce structure to higher-cost technical jobs.。Third, for Reality Labs, the company's ongoing product development efforts in augmented reality / virtual reality and investments to further expand the ecosystem will result in a significant year-over-year increase in operating losses for the division.。

The company expects capital expenditures in 2023 to be in the range of $27-29 billion, compared to an earlier estimate of $27-30 billion.。It also expects full-year 2024 capital expenditures to be in the range of $30-35 billion, mainly reflected in the company's increased server construction, including non-AI and AI hardware and data center investments that will drive growth.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.