Google Q3 earnings release: revenue net profit exceeded expectations Cloud business growth slowdown "spooked" the market

On October 24, local time, Google's parent company Alphabet released its third-quarter 2023 results.。Data showed that the company's revenue and earnings per share were better than expected, but Google's shares fell about 6% in after-hours trading due to slowing growth in its cloud business.。

On October 24, local time, Google's parent company Alphabet released its third-quarter 2023 results.。

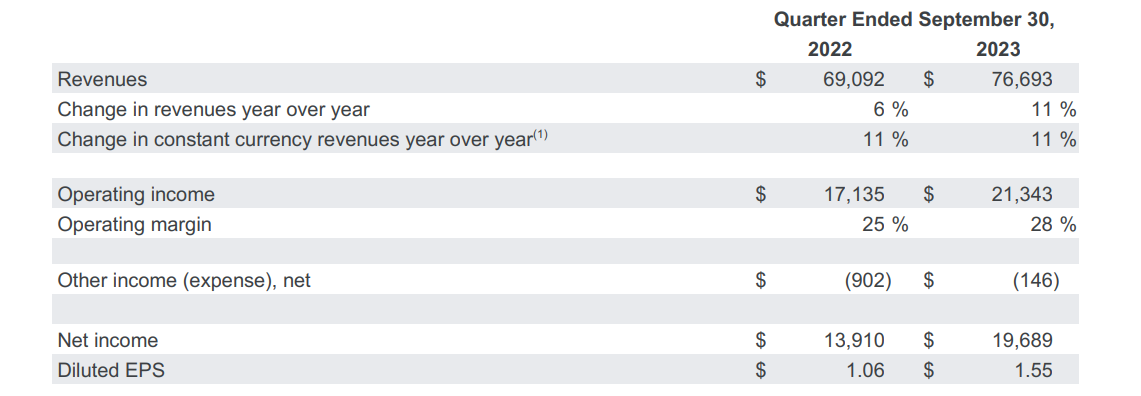

Performance data shows that Alphabet's revenue in the third quarter was 766.$9.3 billion, up 11% YoY, better than expected 759.700 million dollars。Operating profit was 213.$400 million, up 24% year-over-year, slightly lower than the expected $21.4 billion。Net profit is 196.$8.9 billion, an increase of about 41.5%, diluted EPS 1.55, above Wall Street expectations of 1.45美元。

Revenue and earnings per share were better than expected, but Google's shares fell about 6% in after-hours trading。

Still, Google stock outperformed the broader market this year。So far this year, Google-A is up 57%, compared with more than 10% for the S & P 500 and more than 25% for the Nasdaq.。

Slowing growth in cloud business raises concerns

The main driver of Google's share price decline was that its cloud business did not grow as expected.。

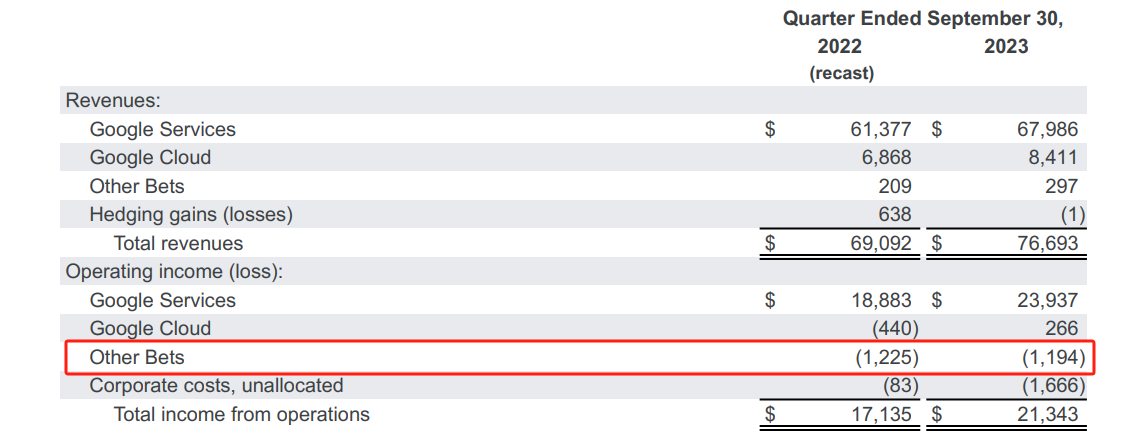

According to the financial report, Alphabet's cloud business revenue in the third quarter was 84.$100 million, below market expectations of 86.$0 billion。Cloud business grew 22% year-over-year in the third quarter, falling to its lowest level since the first quarter of 2021。In contrast, year-on-year growth was 28 per cent in both quarters of the first half of the year and 32 per cent in the fourth quarter of last year.。

In terms of earnings, Alphabet's cloud business had an operating profit of 2 in the third quarter..$6.6 billion, significantly below market expectations of 4.$3.4 billion。The business was profitable for the first time in the first quarter of this year, and while it continued to be profitable in the second and third quarters, the slowdown in growth has left the market concerned that Google will lag behind its competitors such as Microsoft in this area.。

In contrast, Microsoft's intelligent cloud division grew to $24.3 billion in revenue in the third quarter, higher than analyst estimates of 234..900 million dollars。29% YoY, higher than market 26.2% growth forecast。Microsoft shares up 5% after hours。

Investing."While Alphabet's quarterly earnings and revenue beat expectations, investors were disappointed by the relatively weak performance of its Google Cloud platform, which is at risk of falling further behind Azure and AWS," said Com senior analyst Jesse Cohen.。"

Ruth Porat, chief financial officer of Alphabet and Google, said in an interview that sales in the cloud business unit had been affected by cost-cutting by some customers.。Porat did not disclose any further information.。

"Cloud computing is a more volatile business than advertising, and Google faces stiff competition.。According to Max Willens, an analyst at market research firm Insider Intelligence, "While its appeal among AI startups may bear fruit in the long run, it's not helping Google Cloud enough to please investors at the moment."。"

Advertising revenue exceeded expectations, AI computing investment increased significantly

In the third quarter of the financial report, although the cloud business performance is less than expected, but Alphabet's other business performance is still remarkable。

In terms of advertising revenue, Alphabet recorded advertising revenue in the third quarter 596.$500 million, slightly above analysts' expectations of $59.1 billion, compared with $544 million in the same period last year..$800 million growth of about 9.5%。In the advertising business, the main source of revenue - Google search business advertising revenue of 440.$300 million, higher than market expectations of $43.2 billion。YouTube ads also did well in the third quarter, with revenue of 79.$500 million, up 12.45%, better than 78.$200 million market expectation。

Porat said on a conference call after the results that it was pleased with the growth in its advertising revenue after a period of "historic volatility."。

For Alphabet's Other Bets, third-quarter revenue was 2.$9.7 billion, compared with 2.$9 billion increase。The business is the only remaining loss-making unit of Alphabet, which lost $1.2 billion in the third quarter, roughly in line with analysts' forecasts.。The company's Other Bet business includes self-driving car project Waymo and life sciences division Verily.。

In the third quarter, Alphabet's capital expenditures were $8.1 billion, below consensus estimates of $9.1 billion.。Porat said that due to the significant increase in investment in artificial intelligence computing, the vast majority of the company's capital expenditure went to technology infrastructure.。Of these, servers are the largest component of capital expenditure, followed by data centers.。At the same time, Porat also revealed that Alphabet is expected to make "higher levels of investment" this year and next.。

While investing heavily in cutting-edge technologies such as artificial intelligence, the company has struggled to rein in spending。

In its earnings report, the company revealed that its employee severance payments and related expenses reached $2.1 billion in the first nine months of the year。Earlier this year, Alphabet laid off about 12,000 employees, or about 6 percent of its global workforce, in what the company said was an effort to adapt to "different economic realities."。The company also laid off hundreds of employees from its global recruitment team in September.。As of September 30, 2023, the company had approximately 182,000 employees.。

Porat noted that the company will maintain a slower employee growth rate。The goal of these efforts is to free up as much space as possible to invest in opportunities such as artificial intelligence.。Porat said: "We remain focused on a lasting redesign of our cost base to create investment capabilities to support our growth priorities, foremost among which is artificial intelligence.。"

In addition, the financial report also mentioned that as the company further evaluates its real estate needs, additional costs may be incurred in the future.。

Sundar Pichai, CEO of Alphabet, said: "We will take all necessary steps to ensure we have the world's leading AI models and infrastructure.。Pichai also said that the company is making exciting progress in artificial intelligence, and there will be more progress.。

The trend of monopoly cases is not clear.

The results come as the company is responding to an antitrust lawsuit filed by the U.S. Department of Justice.。

The U.S. Department of Justice alleges the company has been abusing its power to boost profits while stifling competition and innovation.。According to Statista, 95% of mobile device queries in the U.S. use Google。The search engines that followed Google were Microsoft's Bing and Yahoo Search, which each had a market share of 6.4% and 2.3%。

According to the Justice Department, Google limited Apple's innovation or development as a search competitor by entering into a revenue-sharing agreement for search ads generated by Apple's Safari browser.。According to the contract, Apple must use Google Search by default, which means it cannot provide default locations to other companies.。This approach allows Google to obtain so much data that competitors cannot compete fairly。

The charges also mention that Google pays $10 billion a year to device makers such as Apple, wireless companies such as AT & T and browser makers such as Mozilla to maintain market share for its search engine.。

Google vehemently denies the allegations, claiming its success simply stems from the revenue its search engine brings to consumers and advertisers.。

The case is the most significant U.S. monopoly case since 1998.。Google executives, including Google CEO Sundar Pichai, will give evidence in a two-month trial.。Top executives at Apple and Microsoft, including the latter's CEO Satya Nadella, are also likely to testify.。

The trial is expected to last until December.。Judge will decide whether Google violated antitrust laws in managing search and search ads。If Google is found to be breaking the law, the judge may decide to simply order Google to stop the illegal behavior, or may order Google to sell assets。

In addition to the United States, this week Japan's Fair Trade Commission also announced an investigation into whether Google violated the Antitrust Act.。Google requires smartphone makers to default to Google Search at initial setup, says committee。The move is suspected of shielding competitors, crowding out competition in the same industry and abusing market position.。Statistics show that Google has more than 70% of the Japanese search market。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.