4 Hypotheses on Pi Network Valuation: From Logical to Unbelievable

Pi Network valuation debate sprouts after mainnet launch. Experts predict anything from a major drop to an unrealistic token price.

- Conservative valuation suggests a price decline post-launch. Analyst Crypto King predicts Pi will trade briefly at $1 before falling further.

- Technology-based valuation shows Pi’s FDV could decrease 70%. Pi’s $65 billion FDV is significantly higher than similar projects.

- Global Consensus Value (GCV) hypothesis suggests a $314,000 token price. However, this idea remains speculative with no real-world application backing it.

Pi Network’s mainnet launch on Thursday has ignited extensive discussions regarding its valuation. Hypotheses range from conservative estimates to highly optimistic projections.

With insights from recent developments and expert opinions, this article explores four prevailing perspectives on Pi Network’s potential market value.

Conservative Valuation Based on Comparable Projects

Pi Network shares similarities with projects like Hamster Kombat (HMSTR). Both employtap-to-earn models, attracting millions of users, manynew to cryptocurrency, who harbor aspirations for significant financial gains.

However, historical data indicates that such projects can experience substantial price declines post-launch. Recently, DeFi analyst Crypto King cautioned against inflated expectations, warning that Pi’s listing price is unlikely to reach $30-$40 or even $5. Indeed, and as BeInCrypto reported, the token launched at $2.

“I would like to see people winning and getting life changes with Pi, but what I can’t tolerate is the fake pricing. I still remember someone took a massive loan to buy a car thinking about the HMSTR that they would receive through airdrop eventually ending up disappointed and selling the car,” wrote the analyst.

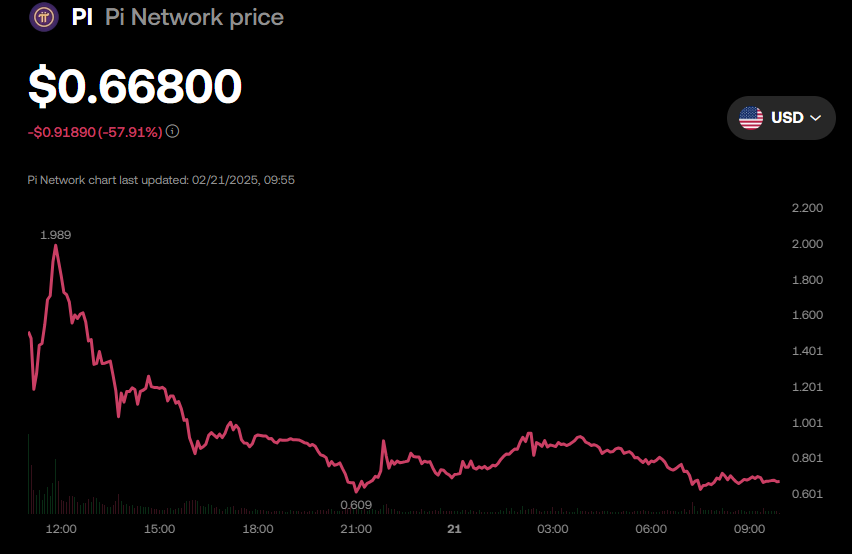

Further, the analyst said Pi Network’s PI coin would trade briefly at $1 before declining. As of this writing, PI was selling for $0.668 on the OKX exchange, representing a drop of nearly 60% since Friday’s session opened.

Valuation Based on Underlying Technology

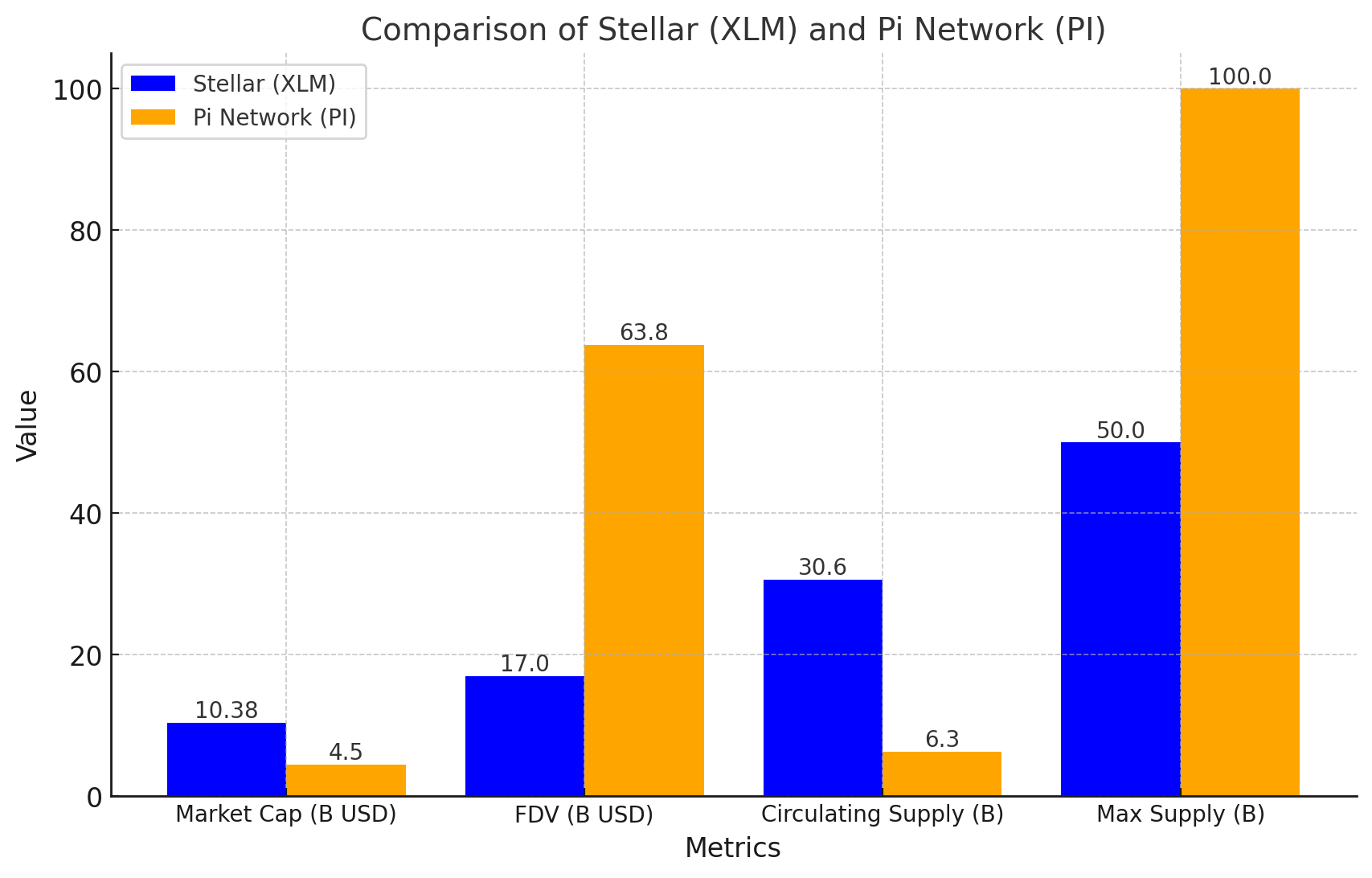

Pi Network’s architecture is primarily based on the Stellar blockchain, with minimal modifications. Stellar’s native token, XLM, has a fully diluted valuation (FDV) of approximately $17 billion.

In contrast, Pi’s FDV stands at $65 billion, raising questions about its valuation relative to its technological foundation.

The disparity suggests that Pi’s price could decrease by up to 70% to align more closely with XLM’s FDV. This implies that a significant market correction may be forthcoming.

Inflationary Concerns and Ecosystem Development

The Pi Network whitepaper acknowledges the possibility of continued inflation after the total circulating supply of 100 billion tokens is reached.

“For the health of the network and ecosystem, the network may face questions such as whether there needs to be any inflation after the completion of the distribution of the 100 Billion Pi,” an excerpt in the document reads.

Additionally, the lack of outstanding applications within the Pi ecosystem could adversely affect the token’s value, as utility and demand are critical drivers of cryptocurrency valuation.

The Global Consensus Value (GCV) Hypothesis

Some proponents advocate for a Global Consensus Value (GCV) of $314,159 per Pi token within the Pi Network community. They draw inspiration from the mathematical constant π (approximately 3.14159). Meanwhile, others say that Pi needs to undergo natural price discovery like Bitcoin and Ethereum.

“GCV is a vision, not a market price. Pi will likely start at exchange rates & increase gradually with adoption,” one user on X commented.

It comes amid concerns that the current Pi prices on centralized exchanges (CEXs) are speculative and potentially manipulated. With analysts predicting potential drops following the mainnet launch, some hold that the Pi Core team may burn tokens traded in violation of network rules.

“The Core Team is likely to monitor and regulate speculative market manipulations closely and could burn (confiscate) any Pi traded in violation of its terms,” one user on X explained.

However, this hypothesis lacks empirical support and is viewed by many as overly ambitious. The general concern is based on the nascent state of the Pi Network ecosystem and the absence of substantial real-world applications.

Nevertheless, this symbolic valuation has gained traction on social media platforms. Supporters assert that Pi’s scarcity and economic potential justify such a price point.

Meanwhile, Pi Network’s mainnet launch on February 20, 2025, marked a significant milestone. As BeInCrypto reported, it resulted in the largest crypto airdrop, valued at $12.6 billion. Despite this achievement, market indicators reveal weak momentum, reflecting a shift from intense buying pressure to a more cautious market sentiment.

Adding to the controversy, Bybit exchange CEO Ben Zhou reiterated his skepticism towards Pi Network. He referenced a 2023 warning from Chinese law enforcement that labeled the project a “pyramid scheme” targeting vulnerable populations.

“Regarding PI, if you still want to go back to the mainland occasionally, I suggest you don’t report it or touch it,” crypto analyst Colin Wu recentlycautioned.

These remarks mirror the ongoing debate within the cryptocurrency community regarding Pi’s legitimacy and long-term viability.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.