The "last mile" of overall inflation cooling and interest rate hikes in the United States in October may have been completed.

The lower inflation data, overlaid with a cooling job market, suggests that both key data on the U.S. economy are moving in the direction the Fed expects.。

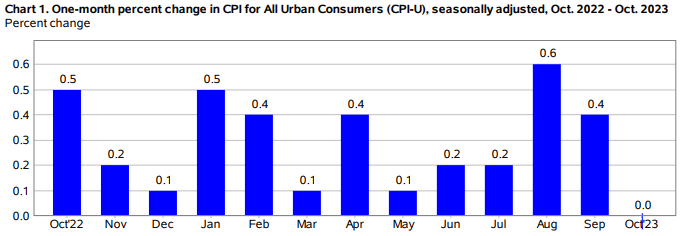

On November 14, US Eastern Time, the US Consumer Price Index (CPI) for October was released as scheduled.。According to the U.S. Bureau of Labor Statistics, the U.S. CPI index remained unchanged in October, up 3% year-on-year before seasonal adjustment..2%; after excluding food and energy prices, which are more volatile due to seasonal influences, the U.S. core CPI increased by 0% in October..2%, seasonally adjusted YoY growth of 4.0%。

Pretty good inflation report

Overall, the inflation report performed quite well: in addition to the October nominal inflation data lower than the previous value, the October nominal inflation data and core inflation data are lower than the forecast, indicating that the level of inflation in the United States has cooled substantially, even U.S. President Biden also said in a statement that the United States has made more progress in reducing inflation。

Excellent inflation data significantly reduced the Fed's interest rate hike, but also ignited yesterday's market sentiment。At one point yesterday, U.S. stocks jumped higher and then went up all the way.。S & P 500 closed up 84 at close.15 points, up 1.91%, at 4495.70 points。Dow closes up 489.83 points, up 1.43%, at 34,827.70 points。Nasdaq closed up 326.64 points, up 2.37%, at 14,094.38 points。

Specifically, in terms of non-core inflation, the rapid fall in U.S. gasoline prices in October dragged down this sub-item.。Data show that U.S. gasoline prices fell 5% in October from a year earlier, up 2.1%, mainly due to the expected increase in oil production in Latin America following the easing of U.S. sanctions on Venezuela and the easing of supply disruptions in the Middle East.。In terms of food, U.S. food prices grew at a rate of 0% month-on-month in October..1% up slightly to 0.3%, non-household food chain growth rate to maintain 0.4% unchanged。The analysis said the recent drought and wildfires in the western United States have had some impact on crop yields, but food inflation is expected to be more difficult to rebound significantly month-on-month。

In terms of core inflation, core commodities have recorded negative month-on-month growth for the fifth consecutive month, with a growth rate of -0 in October..1%, the previous value is -0.4%, mainly dragged down by second-hand car prices。Data show that with the U.S. auto inventory normalization trend further obvious, the U.S. Manheim used car wholesale prices continue to fall, is expected to further decline in the future used car prices, in the future continue to hit core commodity prices。

In terms of core services, the main contribution to this core inflation is core housing inflation。Data show that the U.S. core housing inflation growth rate in October from 0.6% down to 0.3%, and the growth rate of the main residence rental item and the owner's equivalent rental item was 0..5%, 0.4%。Analysts say the year-on-year growth rate of housing inflation is expected to continue to decline in the future as the Fed is expected to keep interest rates high for an extended period of time。

In addition, the Fed's highly concerned indicator, super core inflation, also recorded a decline in year-on-year growth, from September's 3.91% fell back to 3 in October.75%, the third consecutive month of decline;.22%, compared with the previous value of 0.61% also has obvious downward trend。

After the release of the data, the probability of the Fed not raising interest rates in December and subsequent further upward。As of the close of November 14, the CME Fed Watch tool showed a probability of 97 for the Fed not raising rates in December and a 25bp rate cut, respectively.6% and 2.4%, the former value was 90.9% and 9.1%; the probability of no rate hike and 25bp rate cut in January 2024 is 95.6% and 65.9%, the futures implied federal funds rate terminal value from 5.39% down to 5.32%。

Markets are betting that the rate hike cycle is over

The lower inflation data, overlaid with a cooling job market, suggests that both key data on the U.S. economy are moving in the direction the Fed expects.。So far, a number of analysts have stepped up their forecasts that the rate hike cycle is over。

Oscar Munoz, chief U.S. macro strategist at TD Securities, said that core commodities are still in the midst of a slowdown in inflation, which surprised us and we had expected the sector to strengthen.。The decline in new car prices and clothing prices is beyond our expectation.。Although rents continue to fluctuate horizontally, with some concern, the decline in landlords' equivalent rents is expected。Out-of-home accommodation was a driver of inflation in September, but today there has been a return to normal levels。All in all, this report is a good report for the Fed, they will continue to maintain the possibility of another rate hike, Fed officials will strive to convey the message is "higher interest rates, longer."。

Thomas Hayes, chairman of hedge fund Great Hill Capital, agrees that we are pleased to see lower than expected overall and core CPI.。It tells us that the Fed has done its job and that it has nothing left to do。While the possibility of deflation must be closely watched, this is the Goldilocks period, which is what the Fed has been looking for - slower inflation, a slower labor market, and a steady economy at the same time.。

Jay Bryson, chief economist at Wells Fargo, said the threshold for further Fed rate hikes is getting higher。Greg McBride, chief financial analyst at Bankrate, said that for households still dealing with the cumulative effects of rising prices, the slowdown in inflation did not offer much comfort.。The pressures on household budgets are real, with CPI up more than 18% over the past three years。

Bryce Doty, senior portfolio manager at Sit Investment Associates, stressed that it looks sensible that the Fed has effectively ended the tightening cycle as inflation continues to slow。U.S. bond yields have fallen sharply as the last investors who don't believe the Fed has ended rate hikes may be throwing in the towel。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.