The three major negatives have made gold prices fail to rise. Some gold bulls have left the market.

While analysts generally believe that the gold market has entered a seasonally strong point, they also believe that it will be difficult to break through all-time highs in the future.。

On November 20, spot gold fell 0.04%, currently traded in 1979.$86 / oz。

Gold failed to stand at $2,000 last week and the market is still betting that the Fed will not raise interest rates.

Last week, key data came out one after another, U.S. employment, inflation two major data are cold, the Fed's interest rate hike is expected to end again upward, U.S. debt plummeted。A series of market performance ignited the gold bulls, spot gold prices rebounded sharply last week, but ultimately failed to stand on the $2,000 mark。

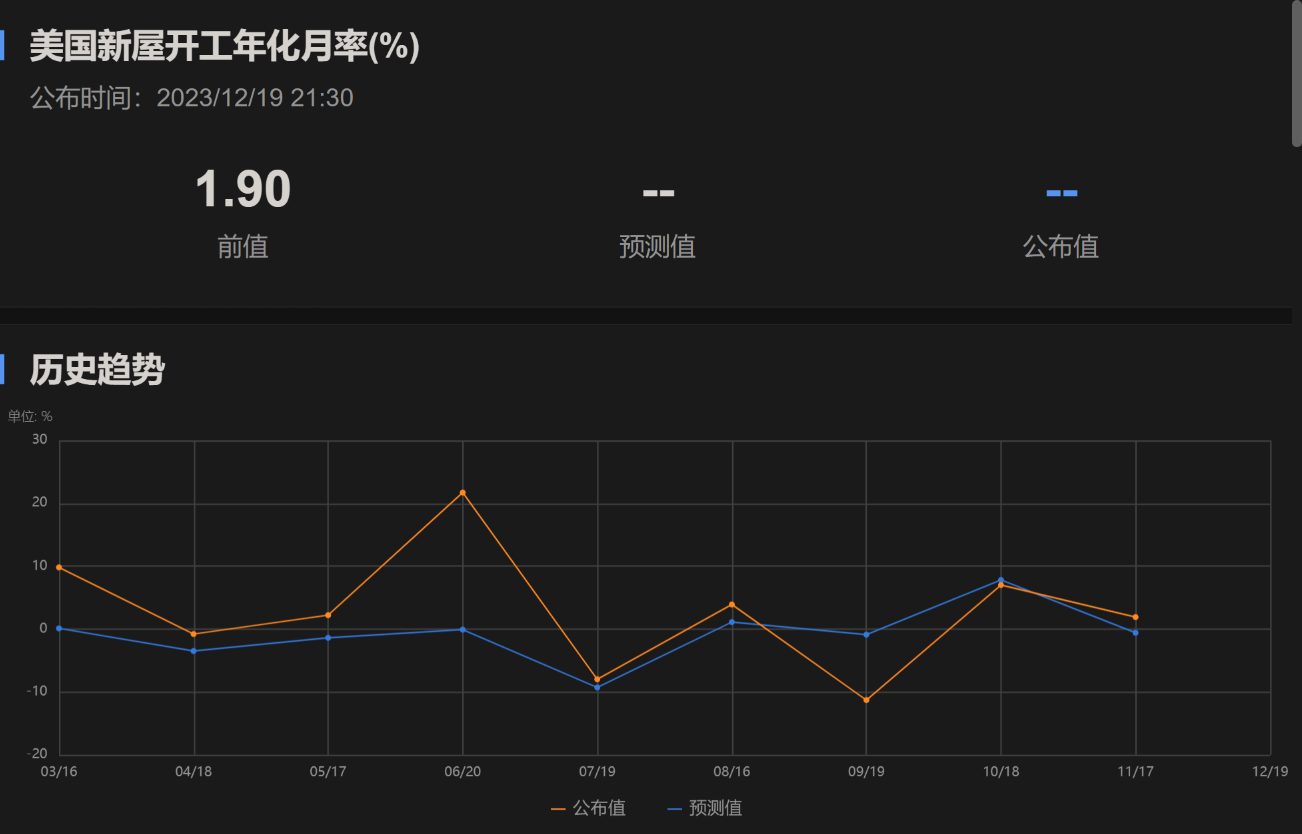

Analysts believe that last Friday, the United States in October real estate released strong data, curbing the upward trend in gold prices。According to monthly data released by the U.S. Census Bureau, the U.S. new home starts rate in October was a revised 3.1% growth 1.9%, while building permits increased by 1.1%, the previous data for a decline of 4.5%。

At the end of last Friday, a number of Fed officials came out to release the hawk.。Boston Fed President Collins said that while observing evidence that financial conditions remain favorable to the Fed and welcoming the recent cooling in inflation, it would not be easy for her to abandon further tightening。

Chicago Fed President Goolsby said inflation is our focus, although the data has improved, but still too high, we will do everything we can to beat inflation。San Francisco Fed President Daley also said that it is uncertain whether inflation will reach the 2% target, that it is too early to declare victory over inflation, and that the central bank policy debate is now focused on what constitutes sufficient restraint and how long to maintain that stance。

There are also analysts who are skeptical about the "weak" employment data in the United States.。Santander analyst Stephen Stanley said in a note that the unexpected jump in jobless claims was an outlier and that "unless the trend in the weekly data starts to pile up in one direction in unison, it's best to ignore it."。

Stanley went on to claim that the "modest distortion" caused by the auto workers' strike still pollutes the data, which tends to fluctuate at this time of year.。"I'll put today's increase in that context and I won't read too much into that until I see next week's figures."。"

Still, markets are betting that the Fed won't keep raising rates at its December meeting.。According to CME "Fed Watch": Fed keeps rates at 5 in December.25% -5.The probability of a constant 50% interval is 100%.。The probability of keeping interest rates unchanged by February next year is 100%.。The probability of a cumulative 25 basis point rate cut by March next year is 30% and the probability of keeping rates unchanged is 70%。

Gold prices still have difficulties in rising Australia and New Zealand say US election will not affect policy path

Looking ahead, while analysts generally believe that the gold market has entered a seasonally strong point, they also believe that the future to break through all-time highs, will also face considerable difficulties。

Well-known forex analysis site Forexlive.Adam Button, chief currency strategist at com, said the time is ripe for the gold market to break through $2,000 / oz。However, he added that the market may need to see weak economic data to generate sustainable momentum.。He added: "The Fed is going to hold on longer than it actually takes, but that just means they're going to have to cut rates more sharply, and I think those expectations are supporting gold prices."。"

Commerzbank commodities analyst Barbara Lambrecht also said that while the Fed is unlikely to raise rates in December, she also does not expect a rate cut soon, limiting gold's upside potential.。Lambrecht added: "The recovery in the gold market is unlikely to last," she said。"We expect gold prices to continue to break the $2,000 mark in the middle of next year.。"

According to the latest CFTC position report, for the week ending November 14, COMEX gold speculators reduced their net long positions by 12,576 lots to 92,660 lots; COMEX silver speculators increased their net long positions by 7,353 lots to 9,584 lots; and COMEX copper speculators increased their net short positions by 3,799 lots to 11,576 lots.。The data suggests that some gold bulls are already starting to leave the market.。

As for the Fed's future policy path, Martin, an economist at ANZ, said the US economy was expected to slow in 2024, but a soft landing appeared likely.。The impact of the Fed's aggressive tightening will be felt next year as fiscal stimulus wanes。The average GDP growth rate in the United States next year is expected to be 1.1%, down from 2 expected in 2023.4%。He also said the 2024 U.S. presidential election is unlikely to have a material impact on economic growth or policy arrangements, and the Fed is expected to start cutting interest rates in the third quarter.。

Goldman Sachs, for its part, noted in its latest research paper this morning that the Fed is expected to begin adjusting the pace of tapering in the third quarter of next year。Goldman Sachs said it expects the FOMC to start considering changing the pace of tapering around the third quarter of 2024 and complete tapering in the first quarter of 2025, with the key risk being that an increase in the supply of debt leads to an intermediary bottleneck, which in turn forces the Fed to stop tapering early。

According to the minutes of several recent meetings, the Fed's hawkish and dovish discourse is about the same amount。Even if economic growth remains below average, inflation could be high enough to force the Fed to keep interest rates on hold for much of next year, analysts said.。There are also analysts who believe that it may be only the U.S. economy that has seen a very severe downturn and that the core PCE deflator has fallen to 2.Near 5%, the Fed will only consider a rate cut。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.