U.S. employment data again upset spot gold day to stabilize upward

Faced with this eye-popping initial request, markets are once again predicting that the Fed's rate hike cycle is over。

On November 17, spot gold oscillated in the $1980 / oz to $1990 / oz range。

Inflation, employment data both cold market bets on the end of the rate hike cycle

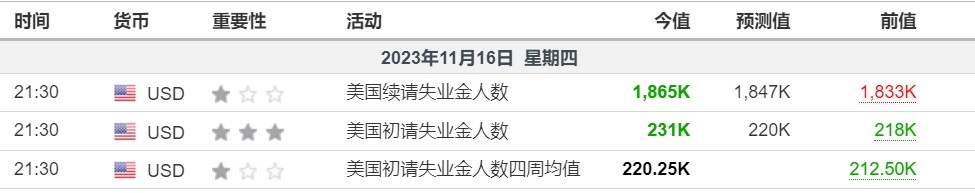

Fundamentally, following the cooling of U.S. inflation data in October, U.S. initial jobless claims exceeded expectations last week, reaching 23.10,000, the highest in nearly March; jobless claims rose to 186.50,000, the highest level in nearly two years。Data suggest U.S. economy cooling trend evident amid strong Fed rate hike pace。

In addition to the rise in jobless claims, the number of states that have worsened their jobless claims data is also increasing, which is usually an early sign of a recession.。However, some economists tend to attribute this "extreme" unemployment to seasonal volatility difficulties rather than substantial changes in the labor market.。

Nevertheless, the employment data and inflation data both cold, on paper also greatly stimulated the market's bet that the Fed's interest rate hike cycle has ended: the price of spot gold in the trading day is still stable recovery。

On top of that, this record-breaking initial request data has even depressed the recent surge in U.S. bond rates。U.S. two-year Treasury yields fall to 4 after data.83%, with five-year and ten-year Treasury yields falling to 4.43% and 4.45%, London gold is the highest closing price in more than two weeks, standing at $1980 / oz.。

So far, according to CME "Fed Watch": the Fed kept interest rates at 5 in December..25% -5.The probability of a constant 50% interval is 99.7%, raising interest rates by 25 basis points to 5.50% -5.The 75% interval has a probability of 0.3%。The probability of keeping interest rates unchanged by February next year is 95.6%, the probability of a 25 basis point rate cut is 4.1%, with a cumulative 25 basis point rate hike probability of 0.3%。

Analysts: Gold price to move in 1985-2000 point range

Faced with this eye-popping initial request, markets are once again predicting that the Fed's rate hike cycle is over。

Goldman Sachs, a leading investment bank, said easing conditions in the labor market, coupled with falling inflation and cooling consumer spending, have boosted expectations that the Fed will end its current cycle of rate hikes。

UBS foreign exchange strategist Vassili Serebriakov also said: "For a long time, we expected the Fed's easing policy to come faster than the market thought.。However, there are many reasons why the dollar won't depreciate too quickly, mainly because economic growth outside the U.S. remains fairly weak。UBS economists expect the Fed could start cutting rates by the end of the first quarter of 2024.。

Bank of America strategists also said: "We now believe that the rate hike cycle is over.。Markets agree: at the time of writing, they see less than a 10% chance of another hike。The Bank of America also said that the Fed could resume raising its benchmark interest rate in 2024 only if inflation accelerated sharply again, a scenario that was not part of the bank's underlying assumptions.。

However, there are also analysts who disagree with the view that the rate hike cycle is over, arguing that despite the recent good performance of the inflation data, Fed Chairman Powell and other Fed officials are still slow to relent on rate hikes。Powell has stressed that the Fed can raise interest rates again if necessary。

Analysts also expect the FOMC to explicitly announce the end of the rate hike cycle if and only if the core CPI continues at current levels for several months.。

For the gold market, City Index senior analyst Matt Simpson said: "Gold prices rebounded strongly from the 200-day moving average, giving the bulls the upper hand in the short term, so we tend to buy on dips above $1940 / oz as gold prices may move to the 1985-2000 $/ oz range.。"

Simpson went on to add: "Gold price volatility has subsided after the euphoria following the US inflation report, and while the dollar is trying to regain some of its lost ground, gold looks fairly comfortable around $1,960 per ounce.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.