Technical indicators are seriously overbought. Gold fell back quickly after setting a new record.

"Although gold prices retreated after rising to new all-time highs, bullish potential remains intact.。"

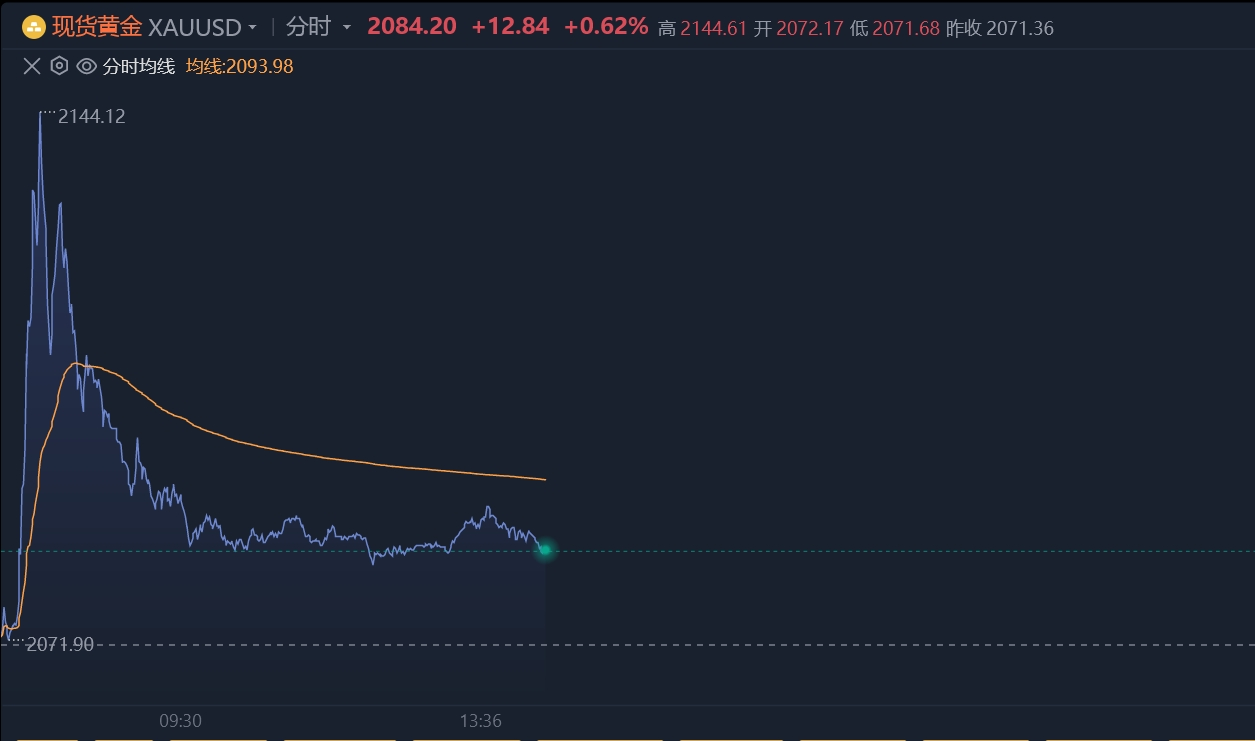

Spot gold fell back to near $2084 / oz in Asian trading on December 4。Spot gold hit a new high as soon as the opening bell rang in Asia this morning, hitting a high of 2144.$12 / oz, a new record。

Powell speech interpreted by markets as dovish

On Friday, Federal Reserve Chairman Jerome Powell (Jerome Powell) said in his opening speech at the Spelman College in Atlanta that the Fed is moving forward cautiously because the risks of insufficient and excessive tightening are becoming more balanced.。He reiterated the Fed's intention to remain cautious, but also offered an optimistic view of the current progress in reducing inflation。

Powell noted that a key inflation indicator averaged 2 in the six months to October this year..5%, close to the Fed's 2% target。He said it was clear that US monetary policy had slowed the economy as expected and that the overnight benchmark interest rate had "entered a restrictive range."。In addition, in response to a question from Helene Gayle, president of Shelman College, Powell said that as the Fed moves forward, "the data will tell us if further rate hikes are needed."。

After Powell's speech, according to CME Fed Watch, U.S. interest rate futures reflect a 64% chance of a rate cut in March next year, much higher than last Thursday's 43%, and the Fed's chance of a rate cut in May next year soared to 90% from about 76% on Thursday, representing the market's interpretation of Powell's speech as dovish.。

New York independent metals trader analysis said: "gold bulls focus on Powell's interest rates are already at a restrictive level on this matter, which provides support for the upcoming theme of interest rate cuts, and Powell's warning that it is too early to speculate on interest rate cuts is clearly not.。The commentary also said that Powell's speech, overlaid with recent key economic data showing inflation and economic developments, showed weakness, and the market seemed certain that the dollar rate hike might be over and that it was likely to be cut sooner than originally expected.。

During the year, the Fed will also hold its last meeting on interest rates。As of press time, according to the relevant interest rate futures, the Fed kept interest rates at 5 in December..25% -5.The probability of the 50% interval being constant is 98.8%, the probability of a 25 basis point rate hike is 1.2%。The probability of keeping interest rates unchanged by February next year is 84.7%, with a cumulative probability of a 25 basis point cut of 14.3%, with a probability of a cumulative rate hike of 25 basis points of 1.0%。

FXStreet: Gold bullish potential remains intact

Gold quickly retreated after hitting record highs this morning as technical indicators were extremely overbought。In response, Haresh Menghani, an analyst at FXStreet, a well-known foreign exchange information site, wrote an urgent article saying that although gold prices fell after rising to record highs, the bullish potential remained intact。

Menghani noted that gold prices gained strong positive traction on Monday and at one point surged to record highs.。Cautious market sentiment, coupled with dovish Fed expectations, benefits gold。Menghani also said that in the case of the relative strength index (RSI) on the daily chart is extremely overbought, the price of gold fell back, but the downward trend in the price of gold seems to be limited: the RSI on the daily chart shows an extremely overbought situation, preventing bulls from making new bets around the price of gold。

Looking ahead to the market, from a technical point of view, the intraday correction pushed gold prices back down to 23, which began at November lows..Below the 6% Fibonacci retracement (i.e., near the $1932-1931 / oz region)。However, any further correction in gold prices could find support near the $2079-2080 / oz region.。Once the gold price falls below this area, the gold price could slip to 38.2% Fibonacci level, i.e. around $2063-2062 / oz。

On the upside, Menghani said that if gold prices rise back above the short-term barrier of $2095-2100 / oz, gold prices may encounter some resistance near $2118 / oz.。In addition, some follow-up buying should allow gold prices to retest their highs in the region of about $2144-2145 / oz.。If gold prices capture these areas, it will strengthen the near-term positive outlook and pave the way for further gains.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.