Minutes of the Fed's January 2024 meeting: risks of premature rate cuts still need to be closely observed data

The Committee does not expect a reduction in the interest rate target range to be appropriate until there is greater confidence that inflation will continue to fall back to the 2 per cent target。

On February 21, the Federal Reserve released the minutes of its January monetary policy meeting.。The minutes show that while Fed officials welcomed the lower inflation results ahead of the meeting, they also saw the same risks of premature easing of the monetary policy stance.。

At its first monetary policy meeting of the year, held Jan. 30-31, the Fed kept its target range for the federal funds rate at 5 for the fourth time in a row since last September..25% to 5.5%, the highest level since 2001.。But if inflation continues to subside, officials have also hinted at the start of a rate cut later this year.。

At present, the market has gradually got rid of the "extravagant hope" of cutting interest rates in March, and instead set its sights on the longer-term June.。According to CME Fed Watch, as of 21 EST, the likelihood of the Fed keeping interest rates unchanged in March is as high as 93%。Although the Fed acknowledged in its statement after the rate decision that "the risks of achieving employment and inflation targets are being better balanced," they also agreed that a rate cut is not imminent.。

When to cut interest rates?Fed's attitude ambiguous

In considering any adjustment to the target range for the federal funds rate, the Committee will carefully assess the newly received data, the evolving outlook and the balance of risks. "。The Committee does not expect it to be appropriate to lower the interest rate target range until there is greater confidence that inflation continues to fall back to the 2 per cent target.。

However, for when to open the rate cut window。The minutes of the meeting are very ambiguous.。The minutes showed that Fed officials "unanimously judged that the policy rate may be at the peak of the current tightening cycle," and most of the officials "noted the risk of premature easing of the policy stance," and stressed the importance of carefully assessing the upcoming data to determine whether the inflation rate is continuing to decline towards the long-term target level of 2% - which means that the Fed is still cautious on the path of rate cuts.。

At the same time, some Fed officials also believe it may be appropriate to begin slowing the pace of reducing the size of the balance sheet。Many participants suggested that the Federal Open Market Committee, which sets monetary policy, should discuss the topic in depth at its March meeting.。

The minutes also showed that officials at the meeting saw "significant progress" in the recent return of inflation to target levels.。But some officials point out that this reflects only a brief upturn and that the slowdown in inflation could stop or even reverse once consumer spending is higher than expected, borrowing costs fall or financial conditions become too accommodative.。

US economic resilience "unexpected"

Currently, the level of inflation in the United States has increased from 9.The 1% peak has fallen sharply, but remains above the Fed's 2% target。Consumer and business lending rates in the United States have risen under the Fed's aggressive rate hikes, causing many employers to have to save money, thereby pressuring the economy。The rate hike also caused the average interest rate on a 30-year mortgage in the United States to exceed 7% for the first time in years.。Home equity lines of credit, car loans, and even credit card borrowing costs are soaring.。

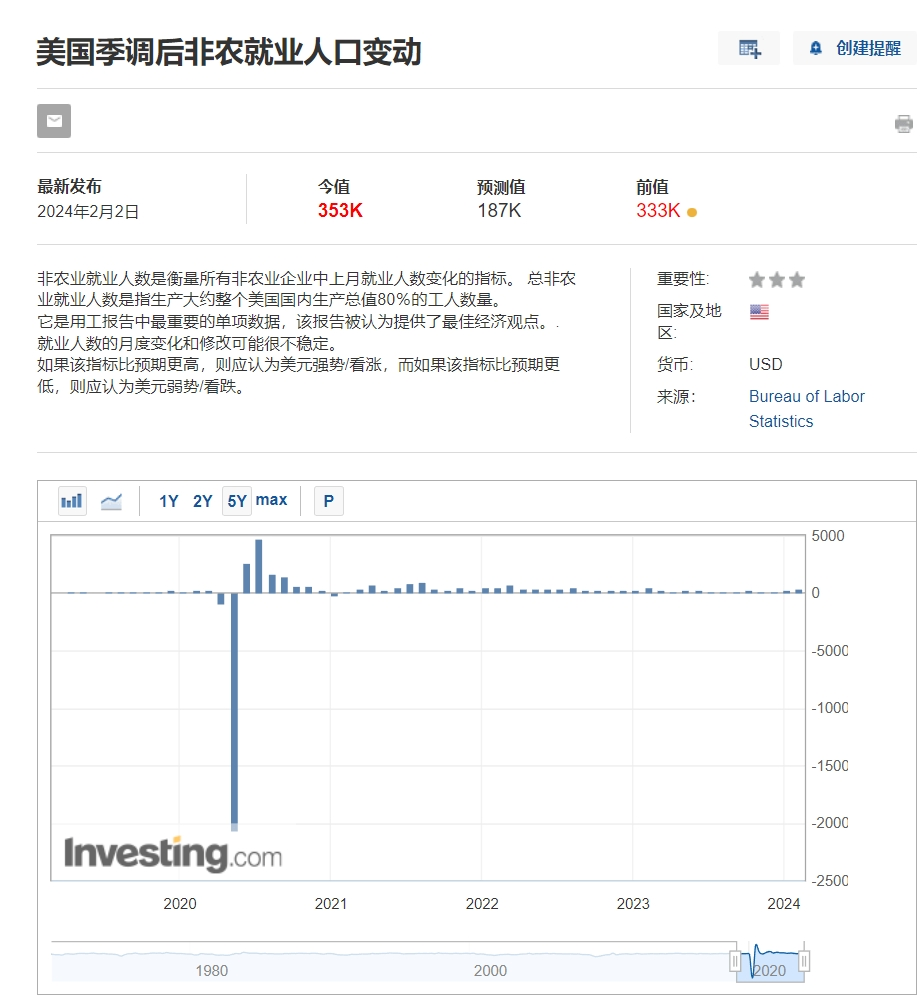

Yet despite rapidly rising interest rates, the resilience of the U.S. economy has been unexpected。The labor market continues to move forward at a healthy pace, with employers adding 35 new jobs in January..30,000 workers, almost double what economists expected。Job vacancies remain high and unemployment continues at 3.Hovering around 7%。In addition, inflation unexpectedly rose in January, jumping 3.1%。

Jeffrey Roach, chief economist at LPL Financial, said: "It is clear that the message from the minutes, combined with the hype of the Fed spokesman, is that they are concerned about whether they will move too quickly before declaring a final victory in calming inflation.。"

The Fed's next monetary policy meeting will take place on March 19-20.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.