Spot gold day narrow shock Fed "three hands" to PCE data set KPI

Following the minutes of the Fed's ultra-hawkish monetary policy meeting, the "doves" of officials also appeared insignificant.。

On July 11, spot gold was narrowly volatile, rising slightly by 0 per cent during the day..24%, now traded in 1929.$93 / oz。

Market turns to focus on June CPI data after two jobs reports

Markets trade relatively cautiously ahead of Wednesday's US June CPI data。Previously, two very different jobs reports had once caused waves in the market, and the market needed more information to judge the inflation data and the Fed's monetary policy stance。

On the data side, local time last Thursday, the U.S. June ADP data was released, recording 49 new jobs for the month..70,000, more than double the expected figure。In addition, the former value of this data is given by 27.80,000 revised down to 26.70,000, making June ADP data gains more exaggerated。Expectations of the Fed raising interest rates twice this year quickly warmed after the data was released。On the same day, the three major U.S. stock indexes collectively closed down, even implicating the European market。

In just one day, the more important U.S. non-farm payrolls data for June is released。According to the data, U.S. non-farm payrolls rose by only 20 in the month..90,000, the smallest increase since December 2020, below economists' estimates of 22.50,000 people, data slightly cooled。In the context of the previous day's interest rate hike is expected to heat up, non-farm data is not as expected but to give the market a glimmer of respite, weakening the Fed's prospects for maintaining high interest rates for a long time, superimposed on the market has gradually digested the Fed's interest rate hike expectations in July, gold bullish sentiment is heating up again。

In this regard, some analysts said that although the non farm reading is relatively weak, but still not enough to challenge the Fed's interest rate hike in July。In this context, analysts called on investors to turn their attention to the upcoming July CPI data, and said that only a deep misunderstanding of the data can change this view。

On July 12, local time, the U.S. Department of Labor will release the country's June CPI data。It is worth noting that this CPI data for the Fed to press the interest rate hike pause button after the first inflation data, will cause great concern in the market。In addition, according to information revealed in the minutes of the previous Fed meeting, the bank may pay special attention to the core CPI data and use it as an indicator of whether inflation is easing.。

And according to a survey released today by the New York Fed, U.S. consumers' one-year inflation expectations in June have fallen to their lowest level since April 2021。According to respondents, they believe that the level of inflation in the United States will stay at 3 a year from now..8%, the data is three percentage points lower than the peak of a year ago。

Notably, the survey also found that respondents' expectations for future house price increases have increased for the fifth month in a row, returning to the levels of a year ago.。

Hawks in power! The Fed's "three-in-command" sets KPIs for PCE data

On the news, following the minutes of the Fed's ultra-hawkish monetary policy meeting, the "doves" of officials also appeared insignificant.。

On July 10, local time, Atlanta Fed President Raphael Bostic (Raphael Bostic) said in a speech at the Atlanta Cobb County Chamber of Commerce that the current policy is "obviously" in a restrictive area, and the Fed can be patient.。The Fed still has time to let austerity work, but will be uneasy if inflation stalls or expectations rise。Further rate adjustments may be needed if inflation expectations lose anchor。

Among the many Fed officials who are certain to raise interest rates, Bostic is an exception.。Earlier, he also called for the Fed to keep interest rates unchanged for the rest of the year and "continue until 2024."。However, as can be seen from the minutes of the Fed's June meeting released this time, the bank's hawks now have the upper hand, and Bostic's voice was quickly overshadowed by the hawkish views of his colleagues.。

On the same day, Cleveland Fed President Mester (Loretta Mester) also pointed out in a speech to economists in San Diego, California, that the (U.S.) economy has shown more potential strength this year than expected at the beginning of the year, inflation remains stubbornly high, and progress in core inflation (falling) has stalled.。

She also stressed that in order to ensure a sustainable and timely return of inflation to the 2% level, she argued that "the federal funds rate needs to be raised further and then held at peak levels for some time so that we can accumulate more information on how the economy is evolving."。"

In addition, San Francisco Fed President Mary Daly (Mary Daly) also stressed that the U.S. economy continues to be surprising momentum, in this momentum, more measures are needed to raise interest rates。But she also noted that slowing the pace of rate hikes is appropriate。The economy is showing signs of slowing and inflation is falling, but still short of the target of 2 per cent.。The current labor market remains strong, inflation is high, and the risk of insufficient action outweighs the risk of excessive action.。

Daley's argument for a slowdown in rate hikes came in support of earlier remarks by Fed Chairman Jerome Powell at a press conference following the June rate decision.。At the time, the Fed chief had said after announcing a pause in rate hikes that the Fed should moderate its rate hikes, and the pause in rate hikes at this meeting reflects that process。He also noted that the pace of rate hikes and the terminal rate are separate variables and that the pace of slowdown is independent of the level of the terminal rate。

That is to say, in the eyes of Fed officials, the suspension of interest rate hikes is still an important path in the process of raising interest rates, is to "slow down" way to continue to raise interest rates。

Today, the Fed's "three hands," FOMC permanent vote committee, New York Fed President Williams (John Williams) also came out to speak, said monetary policy needs to continue to tighten, in order to achieve a balance between labor supply and demand and stable inflation.。He also stressed that the process of balance sheet reduction was under way and that there was no strain on financial markets as a result of that process.。The current monetary policy framework appears to be effective in dealing with inflation and economic volatility。

Williams also specifically mentioned the Fed's policy inflation indicator, the PCE indicator.。He said that if the figure drops to 3% this year, it will drop to 2 next year..5%, then there is no need to further increase the unemployment rate or have a further impact on the economy, which may be hinting at the Fed's "assessment target" for the data this year and next.。

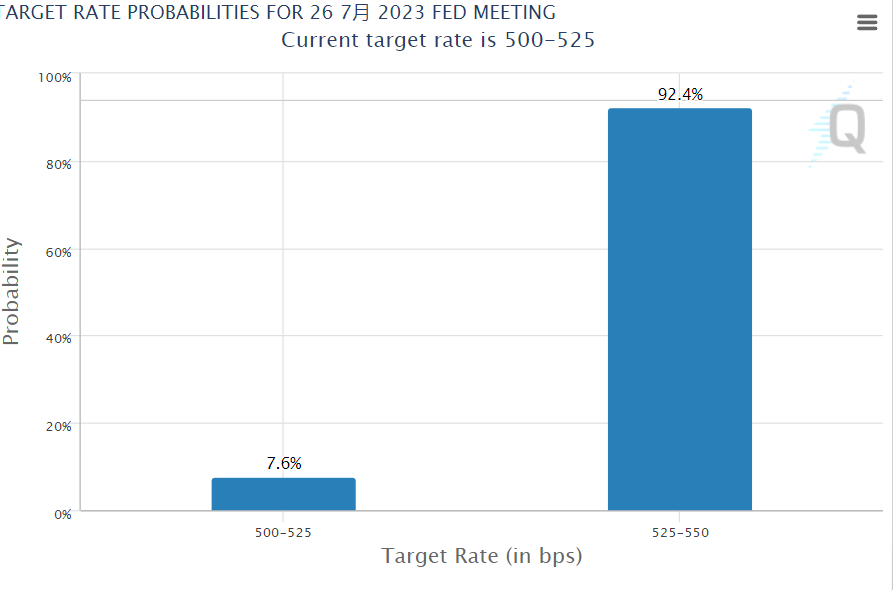

The market is now pricing the probability of a Fed rate hike at its July policy meeting as high as 92.4%。Apparently, the market is ready for the Fed's policy meeting in late July to raise the terminal rate ceiling to 5.5% psychological preparation。

Richard Hunter, head of markets at Interactive Investor, said: "The market is not free of rate hikes and it is clear that interest rates will continue to rise, a trend that is now being confirmed by the resilience of the US economy and ongoing inflation.。As a result, the consumer price index data released on Wednesday will be the focus of traders' attention, the analyst said.。In addition, the Fed's Beige Book report on economic sentiment will also be released on Wednesday.。

BOC: 1925 is the first resistance for bulls to break through

Technically, analysts point out that gold currently remains low and volatile at the daily level。Gold prices last week again held the 1900 mark near the support, the possibility of a short-term bottom increased, the above pay attention to the 21-day moving average 1928.58 near the resistance, if you can top the resistance, it is expected to further run to the 100-day moving average, the current 100-day moving average resistance in 1948.40 around.。In the short term, last week's high of 1934.There are also some resistances near the 86 and 1940 passes respectively.。

Bank of China says $1925 at the lower end of the range volatility pattern could be the first resistance for the bulls to break through if bullish forces persist。After breaking this level, the price may face a restrictive trend line connecting the recent downward highs, after which it will challenge the upper boundary of the narrow range in the $1950-1985 region.。If this resistance band breaks through, traders may focus on the key $2,000 psychological barrier。

On the downside, the last three-month low of 1,893 will be the strongest defensive bottom line for gold bulls。If that bottom collapses, the focus could turn to the March resistance level of $1857, which is very close to the 200-day moving average.。Breaking below the zone could pave the way for testing the bottom of $1804 in 2023。

Precious metals retailer Kitco senior analyst Jim Wyckoff (Jim Wyckoff) said: "From the technical chart, the gold price at $1900 has some strong support.。If inflation continues to heat up, the price of gold could fall below that level or quickly fall to the $1848 level。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.