What signal did the Fed's "quasi-second-in-command" reveal by the rare release of pigeons??

On May 31, the United States has released May Chicago PMI data and April JOLTs job vacancies data, the Federal Reserve also released a brown book on economic conditions, according to the report shows that the jurisdictions of future economic growth is expected to decline slightly。In response, Fed Vice Chairman nominee Jefferson expressed his views in his speech。

The last day of May, for the US market, is not a day of rest。

Heavy data hit the spot gold staged a "roller coaster" market

On May 31, the U.S. released Chicago PMI data for May and JOLTs job openings data for April.。Among them, the Chicago PMI in May recorded 40.4, expected 47.0, previous value 48.6, again below the 50% cut-off point, marking the ninth consecutive month of contraction in business activity in the region and the weakest month for the data since November.。In addition, according to data released by the U.S. Department of Labor, U.S. JOLTs job openings in April 1010.30,000, better than expected 937.50,000 and the previous value of 9.59 million。Of these, the retail trade, healthcare, transport and warehousing sectors ranked first in the number of vacancies, while the number of vacancies in accommodation and catering services, business services and manufacturing decreased.。

Along with these two opposite sentiment reports, spot gold also staged a wave of nervous stimulus "roller coaster" market.。First Chicago PMI data is relatively weak, the market bet on the Fed to suspend interest rate hikes is expected to heat up again, spot gold short-term pull up 0.26%, the highest touch in 1973.$80 / oz。Subsequently, the better-than-expected employment data re-highlighted the resilience of the U.S. economy, superimposed on the recent weakness in gold prices, spot gold quickly erased the gains just recorded, the short-term plunge of more than $8, the lowest hit 1960.52 yuan / ounce。

It can be seen that the volatility of gold prices has been amplified after the data, especially after last night's data, which may be related to the Fed's recent emphasis on the importance of data.。On the one hand, according to the minutes of the Fed's FOMC meeting in May, while the pause and rate hikers did not agree on the issue at the policy meeting, both sides agreed that upcoming information would be closely monitored in the future.。On the other hand, Fed Chairman Jerome Powell (Jerome Powell) also commented on the issue, saying that a cautious decision is needed: "The committee needs to closely review the data and make a prudent assessment."。Although the two sides hold different views on the future of monetary policy, their emphasis on economic data can be said to remain highly consistent.。

The climax of the economic situation Beige Book heavy announcement of the Federal Reserve "quasi-second-in-command" dove to guide market expectations

Also released last night, along with the Fed's Beige Book of Economic Conditions, compiled from the latest findings of the Fed's 12 regional reserve banks, provides a more comprehensive picture of the U.S. macroeconomic situation.。

According to the report, while the U.S. economy has shown signs of cooling in recent weeks, with employment and inflation slowing slightly, the U.S. economy has not slowed enough to ease stubbornly high inflation.。Specifically, economic activity in the United States in April and early May was little changed overall, with four of the Reserve Banks in the jurisdictions reporting modest economic growth, six reporting no change, and two reporting a slight decline in economic activity.。However, according to the report, the jurisdictions' expectations for future economic growth declined slightly.。

On the employment front, jurisdictions said job growth was "showing signs of cooling," with businesses in some jurisdictions reporting that they had planned to suspend hiring or start cutting jobs amid weak demand and increased uncertainty.。In terms of prices, according to the jurisdictions reported that inflation growth has slowed, prices "moderate" rise, most jurisdictions are expected to the next few months, price growth will remain stable, but there are also some areas said that consumers are beginning to be more and more sensitive to prices。Overall, according to the report, while inflation remains stubbornly high, recession fears are emerging, particularly in the employment sector.。

In the face of this situation, yesterday, the Fed vice chairman nominee Jefferson (Philip Jefferson) also came out to speak out, said that June does not raise interest rates will give policymakers more time to assess the data, but does not rule out the possibility of future tightening policy.。Previously, Jefferson's wording on monetary policy and the Fed's FOMC statement released at the beginning of the month were consistent, both mentioned the need to observe the "lag effect" of monetary policy, and in this speech, in fact, also continued this view, that future monetary decisions need more data and time to do the assessment。

Jefferson, 61, only joined the Fed's board of governors on May 23, 2022.。In less than a year, he was nominated by President Joseph Biden (Joseph Biden) as vice chairman of the committee, as the Fed's "quasi-second-in-command" position, successfully entered the Fed's core circle.。It can be said that his point of view, now has a pivotal role。

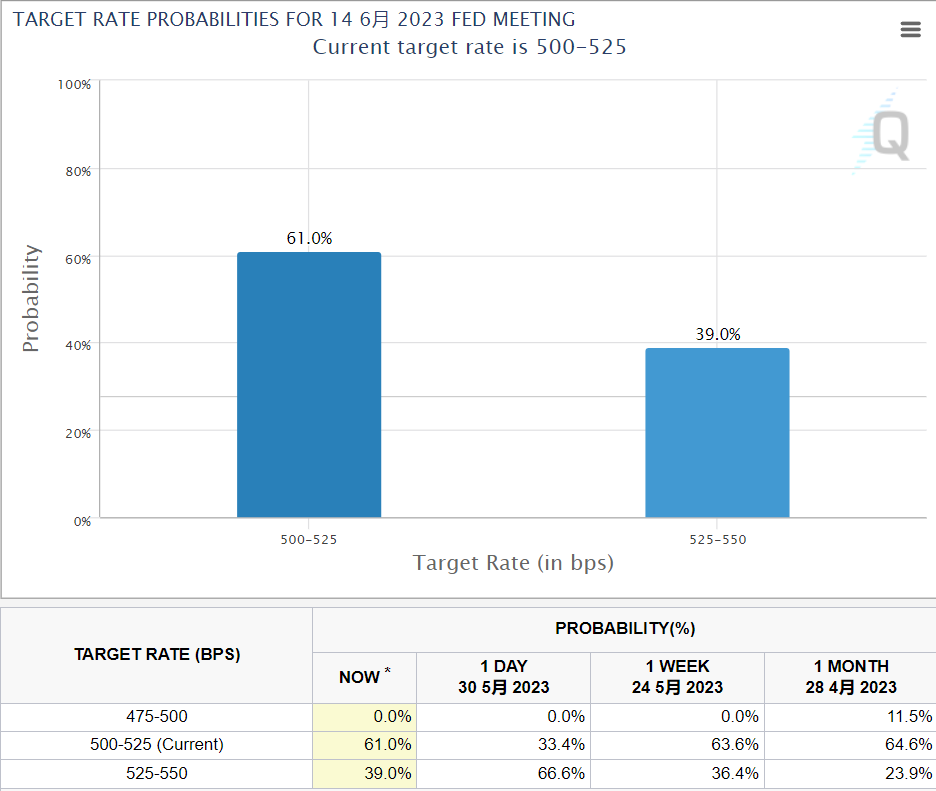

According to CME Fed Watch, after Jefferson's speech, investors' bets on a June 13-14 FOMC rate hike plunged to around 35 percent from nearly 60 percent a day earlier.。As of press time, the data has recovered slightly to 39%, but is still significantly behind the Fed's 61% probability of suspending rate hikes。

In this regard, the Federal Reserve "microphone" Timmiros (Nick Timiraos) said that the market needs to pay special attention to Jefferson's recent speech, because Biden nominated him in May as vice chairman of the Federal Reserve, and this position usually helps the Fed chairman to set the policy agenda before the FOMC meeting.。In addition, there are views that Jefferson's dovish remarks essentially undercut the importance of the monthly U.S. non-farm payrolls report, scheduled for Friday, which is often seen by Wall Street as a key data point to influence policy.。

On the evening of June 2, Beijing time (this Friday), the U.S. Department of Labor will release U.S. May quarterly adjusted non-farm payrolls data and U.S. May unemployment data.。According to the forecast, the US non-farm payrolls will increase by 19% in May..50,000 people, wages will increase by 0.3%, the biggest gain in a year。In addition, the U.S. unemployment rate is expected to increase by 0 in May..1% to 3..5%, a slight increase, estimated to be roughly equivalent to the Fed's Beige Book revelations

As of press time, spot gold edged down 0 in the day.05%, erasing some of yesterday's gains, currently trading in 1961.$63 / oz, daily level or stop four consecutive positive。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.