As soon as this data was released, Citi said that gold prices would break the historical record again.

Following the PPI and CPI data both cold, the market has begun to increase the Fed's expectations of the end of the rate hike cycle, and the unsatisfactory monthly rate of retail sales, is undoubtedly once again to add to this view。

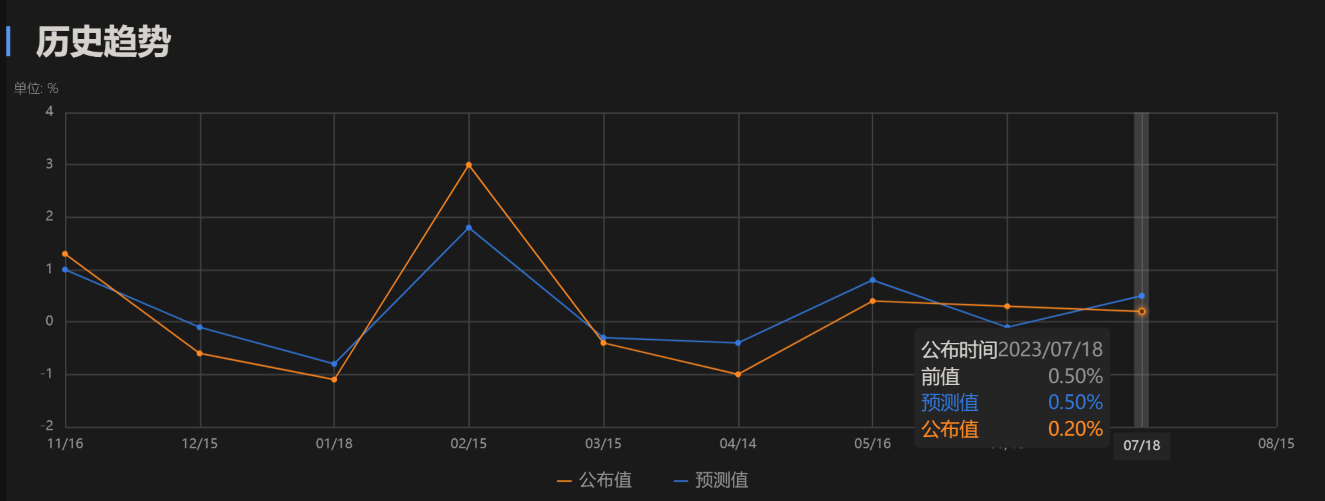

On July 18, local time, the monthly rate of retail sales in the United States, known as "terrorist data," was announced.。According to data released by the U.S. Department of Commerce, the monthly rate of retail sales in the United States recorded 0 in June..2%, lower than expected 0.5% and previous value 0.3%, while the previous value of 0.2 percentage points to 0.5%。Overall, this is another slightly weaker piece of data from the United States recently。

The slowdown in consumer spending does not change the overall trend.

While U.S. retail sales rose less than expected in June, consumer spending remained solid。According to the report, core retail sales excluding automobiles, gasoline, construction materials and food services increased by 0.6%, double the increase in May, and sales in seven of the 13 retail categories recorded increases in June, including non-store retailers, electronics stores and furniture stores.。

However, these figures only reflect spending on U.S. goods purchases and do not portray in detail the consumption of U.S. services during the month。According to the report, sales in restaurants and bars, the only service sector category it counts, rose only slightly in June by 0.1%, significantly behind the 1 recorded last month..2%。Overall, the state of the U.S. consumer portrayed in this report is not entirely clear。

Market analysts note that the elasticity of consumer spending has puzzled economists for months, given that the Federal Reserve has been trying to curb consumer demand for goods and services to lower U.S. inflation.。Many economists and analysts had argued that consumers should have caved in and cut back on spending in the face of rising interest rates and inflationary pressures, yet the fact is that consumer spending remains resilient。However, while some discretionary consumption has retreated, it has not seen a sharp decline, as some predicted last year, the so-called "consumer spending cliff."。

Wells Fargo also said that overall, the slowdown in consumer spending has not changed the overall general trend。The growth of consumer spending in the services sector is the main driver of the economy, and the swing in the services sector over the past three years has had a distorting effect on the economy, especially during the epidemic blockade, which was severely affected, but this distortion is subsiding as the economy gradually recovers.。

On the same day, the United States also released the country's monthly rate of industrial output for June, which recorded -0.5%, also lower than the expected value of 0.00% and previous value - 0.2%。From this data, U.S. industrial output was weaker than expected in June, and the Fed's inflation governance was intended to curb consumption, but inevitably brought additional damage to the industrial sector.。

Continued weakness in data, bulls ignite gold to rise above $1,980 / oz.

Following the PPI and CPI data both cold, the market has begun to increase the Fed's expectations of the end of the rate hike cycle, and the unsatisfactory monthly rate of retail sales, is undoubtedly once again to add to this view。Sure enough, after the data was released, gold bulls ushered in a carnival。Dollar index at one point falls to new 15-month low 99.55, while spot gold climbed all the way to above $1980 / oz, hitting as high as 1984.$41 / oz。

In this regard, the Dutch international group foreign exchange strategist Francesco Pesole (Francesco Pesole) believes that in the short term, it is impossible to determine whether the dollar can further significantly lower。While momentum is clearly skewed towards the negative, at the same time, the next move can begin to wane。The outlook for further ECB rate hikes in September is unclear after eurozone economic activity slowed in June。Given the weakness of the eurozone economy and the risk of a pause in interest rate hikes in September, the market may reassess the euro against the dollar if the Fed takes a tough tone when it raises interest rates next week。

Ricardo Evangelista, senior analyst at ActivTrades, noted that the dollar may remain under pressure as the rate hike cycle of other major central banks is not yet over, which could benefit gold prices.。Gold appears to have a new support level of $1,950 and is unlikely to fall below this level in the short term。And U.S. interest rates are unlikely to start falling in the short to medium term, which also limits the upside of gold prices to some extent。

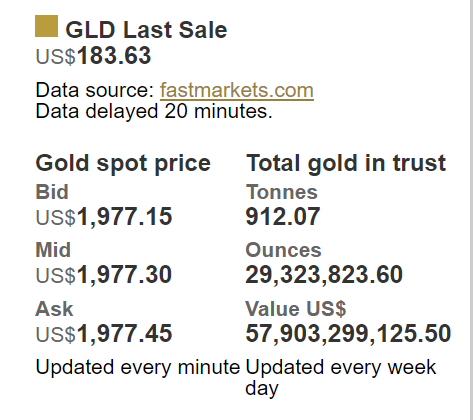

UBS (UBS) analyst Giovanni Staunovo (Giovanni Staunovo) said that before the Fed's view of the recent data becomes clearer, gold will fluctuate in the short term, "the next round of rise needs the recovery of gold ETF demand."。

Yesterday, the world's largest gold ETF - SPDR Gold Trust position decreased by 0 from the previous day..86 tons, the current position is 912.07 tons。

Institutions: Short-term gold price upside is limited 2024 is expected to set a new record again

For the outlook for gold prices, some institutional analysts said that gold is expected to rise in the short term is limited, but does not hinder the cause of long attention。

Gold prices surged 1 on Tuesday, according to Windsor Brokers, a well-known institution..After 2%, the key resistance has been broken.。The dollar is under pressure, which boosts gold demand, but gold's rally may be limited as the Fed is unlikely to start cutting interest rates in the near future。

Looking at the daily chart, the outlook for gold prices is bullish, but the overbought situation warns that bulls may start to lose traction。However, as long as the gold price remains at 38.2% Fibonacci retracement above $1964 / oz, then gold prices may still be driven by bargain hunting and rise to $1986 / oz (50% Fibonacci retracement) and $2000 / oz (psychological price)。

FXStreet analyst Anil Panchal (Anil Panchal) wrote that the overbought relative strength index line highlights the position of $2,000 / oz, which is an important upward obstacle for gold bulls to focus on further rulings。The analyst said that if the price of gold remains firm above $2,000 / oz, then it is not ruled out that the price of gold will gradually rise to the level of the April peak of around $2,050 / oz, and then climb further to the annual high of around $2,067 / oz.。

Downward direction, the daily closing price below the resistance level near $1962 / oz converted to the support level, as well as the 50 moving average support level of $1952 / oz, is a necessary condition for the return of gold shorts。Even so, for gold sellers, four months of being in the horizontal area around $1935 / oz seems like a tough nut to crack.。Overall, even with limited upside, gold prices remain in the bulls' focus。

Citi, on the other hand, analyzes that the average price of gold is expected to be $1,957 / oz in 2023 and $2,040 / oz in 2024, and it is expected that the price of gold may break through $2,150 / oz and set a new record sometime in the first half of 2024.。

As of press time, spot gold edged down 0 on the day.01%, currently traded in 1975.$67 / oz。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.