The dust settles! The Fed raises interest rates by another 25 basis points Powell refuses to jump to conclusions Gold prices break through record highs

On May 3, local time, the Federal Reserve released the minutes of the May Federal Open Market Committee (FOMC) monetary policy meeting, raising the target range for the federal funds rate by 25 basis points to 5% to 5%..Between 25%。

On May 3, local time, the Federal Reserve released the minutes of the May Federal Open Market Committee (FOMC) monetary policy meeting, raising the target range for the federal funds rate by 25 basis points to 5% to 5%..Between 25%。

After the banking crisis, there are endless calls to suspend interest rate hikes. Core PCE data feed the Fed to take "reassurance."

The rate hike is the 10th rate hike by the Federal Reserve since March 2022 to fight high inflation and the third rate hike this year, with a cumulative rate hike of a staggering 500 basis points.。

On March 16, 2022, the Federal Reserve said in its FOMC statement that indicators of economic activity and employment have continued to improve in recent months, with strong job growth and a sharp decline in the unemployment rate, but inflation has continued to climb due to the imbalance between supply and demand caused by the epidemic, rising energy prices, widespread price pressures and the conflict between Russia and Ukraine.。In this case, the Fed embarked on a year-long cycle of rate hikes in an effort to bring inflation down to 2 percent in the long term。

However, with the fermentation of the banking crisis, and there is a gradual spread of the trend, people are increasingly worried that if the continued focus on interest rate policy, the United States may fall into a "moderate recession" ahead of time.。

On April 24, according to U.S. First Republic Bank's financial results, the bank's deposits actually lost more than $100 billion in the first quarter due to a run on depositors.。Just a week later, the California Department of Financial Protection and Innovation (DFPI) announced the closure and takeover of First Republic and designated the Federal Deposit Insurance Corporation (FDIC) as the receiver of First Republic Bank.。The FDIC has now accepted JPMorgan's offer to buy most of the assets of First Republic Bank, which means that First Republic Bank has entered a market-based debt restructuring phase.。

So far, First Republic has become the third U.S. bank to fall in the past six weeks, followed by Silicon Valley Bank and Signature Bank。This morning, there is news that the United Pacific Bank of the United States is considering selling itself, fearing to become the next possible failure of the Bank of America, and the surviving banks did not rest easy, the pressure of tightening credit conditions forced the banks to fight a "battle for deposits."。It can be seen that the potential crisis of liquidity is still lingering in the U.S. banking industry, and the haze has not yet fully dissipated.。

Earlier, a joint study by Stanford University, the University of Southern California, Columbia University and Northwestern University had targeted the banking crisis at the Federal Reserve。The study notes that it is the Fed's aggressive rate hikes that have weakened the value of government bonds in the hands of the U.S. banking industry and caused the financial situation of many banks to deteriorate, making them more vulnerable to a liquidity crisis.。

In the face of the intensifying banking crisis, calling for the Fed to suspend the interest rate hike cycle more and more voices, even the Fed officials also appeared within some differences, but the United States recently a series of strong economic data seems to give the Fed to eat the interest rate hike "reassurance."。

In early April, the U.S. non-farm payrolls after the March quarter adjustment and the U.S. unemployment rate in March were released, both better than expected, and the unemployment rate fell to 3..5%, the U.S. Labor Department says the U.S. labor force participation rate has risen to its highest level before the new crown pandemic.。On April 21, the initial value of the U.S. manufacturing PMI for April broke through the 50 cut-off point, representing the overall improvement in the overall development of the U.S. manufacturing sector.。On April 28, the Fed's highly focused March core PCE blockbuster was announced, down 0 from the previous value..1 percentage point, recorded 4.6%, but still higher than the expected value of 4.5%, more than twice the Fed's 2% policy target。

It can be said that the U.S. March core PCE data to the vigorous interest rate war on the last straw, the Federal Reserve stepped on this stepping stone, to the U.S. federal funds rate heavily added 25 basis points。

Listen to who?Fed "microphone" hints that the rate hike cycle will be suspended Powell said he did not rule out the possibility of continuing to raise interest rates.

The Fed's FOMC said in a statement that U.S. economic activity expanded moderately in the first quarter, with strong job creation in recent months, unemployment remaining low and inflation remaining high.。The U.S. banking system is healthy and resilient, but tighter credit conditions for households and businesses are likely to weigh on economic activity, employment and inflation, the extent of which remains uncertain。

The statement also said that the Fed's Open Market Committee remains highly concerned about inflation risks and that members of the Open Market Committee have unanimously agreed to raise the target range for the federal funds rate to 5 to 5 percent in order to achieve employment and inflation targets..25%。The Fed will continue to reduce its holdings of U.S. Treasuries and agency bonds in accordance with its previously announced plan and is committed to lowering inflation to its 2 percent target level。

Fed "mouthpiece" says Nick Timiraos,In this statement, the Fed's FOMC removed a sentence from its March policy statement that "some additional policy tightening may be appropriate," suggesting that officials may pause to raise interest rates after the latest move.。

In addition, the Fed no longer emphasizes a "full tightening" stance, but is committed to consolidating the tightening effect through the cumulative and lagging effects of monetary policy.。In determining future additional monetary tightening, the Committee will take into account the cumulative effects of existing monetary policy, the lag in monetary policy, and the overall economic and financial environment, the statement said.。

At a subsequent press conference, Fed Chairman Jerome Powell (Jerome Powell) said that although the current U.S. inflation is still well above the target level, the Fed still has a long way to go in terms of reducing inflation, but inflation has eased, but non-housing services inflation has not improved much.。

Powell acknowledged that monetary policy is currently tight, with real interest rates at about 2 percent, significantly higher than the neutral rate。He said it would take time for the full impact of the monetary tightening to be felt, and it could take months of data to prove that the Fed's policy is correct, and more data is needed to verify it.。

On the issue of the rate hike cycle that the market is concerned about, Powell said that the pause was not part of the committee's decision today, but that some policymakers had already talked about the pause at the meeting, and he stressed that the committee still had to look closely at the data and make a cautious assessment.。In addition, Powell did not completely rule out the possibility of continuing to raise interest rates.。He said we are prepared to do more if necessary.。

Powell said the change in the wording of the FOMC statement is meaningful and that we have to balance the risks of not doing enough and doing too much, and we believe this rate hike and statement change is the right way to balance the。

To the point, the Fed's FOMC statement to take a more moderate language, revealing the possibility of a pause in interest rate hikes, but Powell's speech shows that the future direction of monetary policy still needs more data to assess, it is difficult to jump to conclusions。

At the press conference, Powell also gave his views on recent hot issues in the U.S. economy。

On the banking crisis, Powell said the overall situation in the U.S. banking sector has improved, the U.S. banking system is now healthy and resilient, and the pressure for the failure of three banks has been resolved.。While the extent of the impact of the banking crisis is uncertain, large bank deposit flows have truly stabilized。

He also noted that the credit crunch will be a particular concern for the Fed now and in the future, but that it is currently difficult to determine how much of an impact the credit crunch will have on interest rates.。

With regard to the potential economic recession in the United States, Powell has also changed his silence in previous press conferences, and this time he has finally made a statement.。He predicts that the U.S. economy will grow at a moderate rate, not a recession。He says the U.S. is likely to avoid a recession, and if it does, he wants it to be mild.。

On the debt ceiling issue, he said that while this interest rate resolution does not take into account the debt ceiling impasse, the authorities must raise the federal government debt ceiling in a timely manner。He further said that failure to reach a debt ceiling deal would have "highly uncertain" consequences for the U.S. economy.。

The market expects to suspend the probability of raising interest rates in June, nearly 90% of gold's opening surge hit a record high.

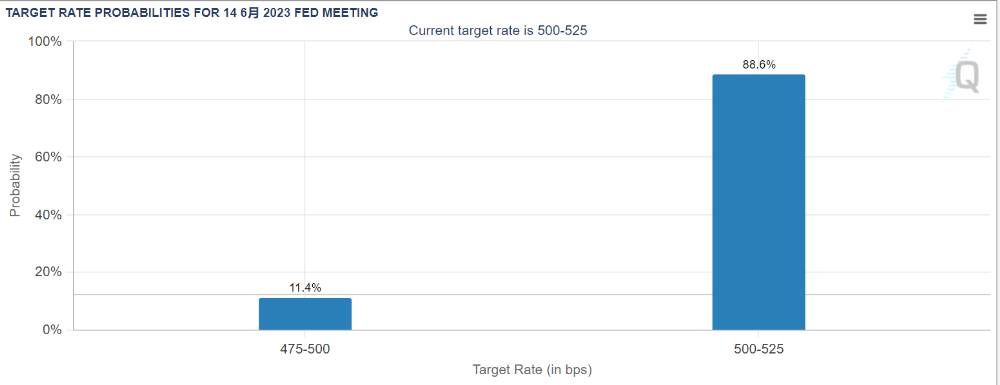

Despite the Fed's more conservative attitude, it is widely expected that the Fed will pause its rate hikes after this rate hike and begin cutting rates at the end of the year。According to CME Fed Watch, the probability of the Fed leaving its benchmark interest rate unchanged at its next meeting is as high as 88.6%。

Spot gold opens up $30 at 2072, boosted by news.$18 an ounce, followed by an all-time high of 2079.$76 / oz。

Spot gold falls back to 2033 as of press time.08 USD / oz, down 0 on day.29%。

It is reported that the Fed's next interest rate meeting will be held on June 14, local time, when there will be more data for the Fed's reference.。Perhaps by then, the market's appetite will no longer be satisfied with the Fed's suspension of interest rate hikes, but to focus on when the interest rate cut window will open, I do not know whether the Fed, which has always been conservative, will be able to cope.?

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.