Economic data super week hit gold can "salted fish turn over"?

For the recent weak gold price, a series of economic data released this week is extremely critical。In terms of the intensity and importance of data releases alone, this week will be a veritable "super week" of economic data.。

On June 12, spot gold stopped falling during the day and is now up slightly by 0.21%, traded in 1965.$29 / oz。

Economic data "super week": U.S. CPI, "terror data" rounds of air strikes within a week, the three countries announced key interest rates

For the recent weak gold price, a series of economic data released this week is extremely critical。In terms of the intensity and importance of data releases alone, this week will be a veritable "super week" of economic data.。

Beijing time on Tuesday evening, the United States will release May CPI data, the recent employment data is strong, the Federal Reserve will be highly concerned about the inflation situation。It is now widely believed that the Fed will skip this rate hike in exchange for more assessment time。However, if the inflation data significantly exceeds expectations, we do not rule out the possibility that the FOMC will continue to tighten monetary policy at this meeting.。It is reported that the previous value of the data is 4.9%, while economists give a forecast of 4.1%。

A day later, on Wednesday evening, Beijing time, the U.S. Labor Office will also announce the annual rate of the U.S. PPI for May.。Prior to the release of this data, the data has recorded 10 consecutive declines, the market's concern about the data is whether the data will break the downward trend.。Because the data is designed to measure changes in the prices of various goods at different stages of production, it is also considered a leading indicator of consumer inflation。Similarly, policymakers are expected to focus on the data at the FOMC meeting in June as a reference for monetary policy formulation.。

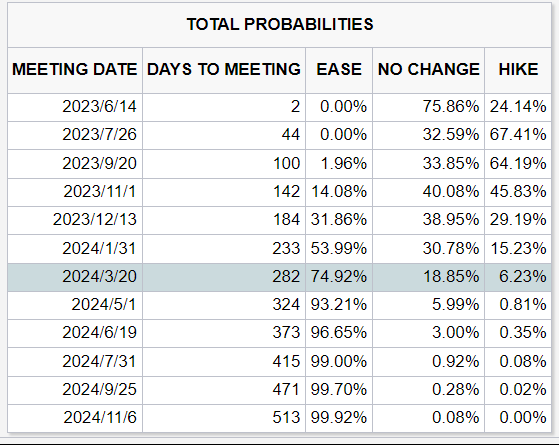

Hours after the PPI data is released, the Fed's policy rate will be released at 2 a.m. Beijing time on Thursday.。Currently, according to CME Fed Watch, the probability that the Fed will suspend rate hikes in June is as high as 75.9%, while the probability of a resumption of interest rate hikes in July rose to 67.41%。After the policy rate dust hit, investors also need to be concerned about the "horror data" released that night - the monthly rate of U.S. retail sales in May, as well as the manufacturing index released by the regional Federal Reserve Bank.。

Internationally, this week in addition to the United States, the euro zone and Japan will also announce their key interest rates for June.。For the euro zone, a 25 basis point rate hike this week is basically a done deal, and the market even expects the bank to continue its rate action in July。Japan, as the country is facing a low degree of distortion in the bond market, wages continue to be weak, early elections and other issues, its monetary policy normalization is facing multiple difficulties, the market is expected to the Bank of Japan in June will maintain the current monetary policy, the yen or will continue to weaken。

and variables?Before the interest rate decision, the market is highly concerned about this week's CPI data.

In the face of such intensive data, some analysts have pointed out that this CPI data will have a crucial impact on the interest rate decision。

Among them, some market participants warned that the May CPI data released a day earlier than the FOMC resolution has the risk of blowout growth, and the trend of overall inflation below core inflation may continue.。If the monthly rate of core inflation is higher than the market consensus of 0.4%, may make the market's interest rate hike expectations continue to heat up。

The well-known financial website FXStreet analyst Anil Panchal (Anil Panchal) also said that although the probability of the Fed will not raise interest rates in June reached 70%, but the U.S. CPI in May is crucial for Fed watchers.。He also said caution ahead of this week's key US data and monetary policy meeting would be a challenge for gold bulls.。

Analysts at ANZ Bank (ANZ), for their part, said US May CPI data will be released before the FOMC makes a decision, adding some uncertainty to the immediate forecast - strong core CPI data could force the FOMC to take action。The median market estimate expects core inflation to rise by 0.4 per cent, with overall inflation expected to rise by 0 per cent month-on-month due to lower energy costs..2%。However, if core inflation rises above the 0.4%, may make the market's interest rate hike expectations continue to heat up。

Economists at Commerzbank (Commerzbank) also pointed out that gold prices will fluctuate further in the coming days, given that US inflation data will be released on Tuesday - a heavyweight that could once again significantly change market interest rate expectations。

Position positions, according to the U.S. Commodity Futures Trading Commission (CFTC) released data show that as of the week of June 10, CMX gold futures speculative net long positions increased by 6312 lots to 114165 lots, long and short positions strength than rebound 5.8% to 85.7% level, CMX silver futures speculative net long positions increased slightly by 0.04 million lots, long / short position strength ratio down 1.37% to 40.3%。

In this regard, Meierya Futures said that hedge funds and other speculative bulls on the precious metals gold and silver future trend judgment is divided, mainly based on the medium- and long-term dollar credit logic continues to be bullish on gold, interest rate hikes to curb the short-term economy and weak silver.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.