U.S. June CPI data released: a dovish "alternative" victory

Before the data was released, there were predictions that the CPI data would slow sharply, but the eventual slowdown in this inflation data was still unexpected。

On July 12, local time, the U.S. Department of Labor released June CPI data。

CPI data all-round slowdown U.S. stocks gold rose U.S. index fell sharply.

Before the release of the data, there are many predictions, the CPI data will slow down significantly, even before the release of the data, spot gold prices have ushered in a wave of upward adjustment, but the final slowdown in the inflation data is still beyond market expectations。

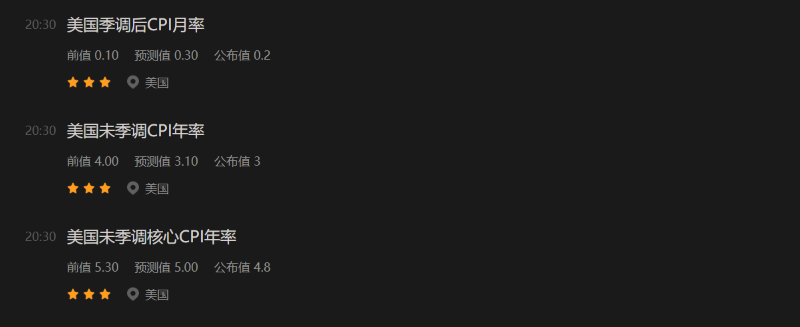

According to the U.S. Department of Labor, the U.S. non-quarterly CPI recorded an annual rate of 3% in June, down sharply again from the previous value of 4% and below expectations of 3.1%, a two-year low, just 1 percentage point away from the Fed's target of lowering inflation to 2%;.2%, also lower than the previous and predicted values。

More importantly, the Fed's recent focus on core CPI data also recorded a decline, from 5.3% down 0.5 percentage points to 4.8%; the core services CPI indicator, which Fed Chairman Jerome Powell (Jerome Powell) is highly aware of, also performed well in June, up 4% year-on-year, the smallest year-on-year increase in 18 months.。

Two years later, under the Fed's protracted interest rate hike cycle, inflation governance in the United States has finally been effective, with CPI data back to 3, which was as high as 9 in the same period last year..1%。Although not ruled out in the year-on-year statistical caliber, yesterday's data released again by the high base effect, but this does not prevent the release of data to boost market confidence, especially in the Fed's interest rate hike cycle is coming to an end。After the data, U.S. stocks and gold rose, the dollar index slipped, and U.S. 10-year Treasury yields fell rapidly to 3.Below 9%。

Specifically, in the non-core CPI, the food price segment was 0 from the previous value..2% down to 0.1%, of which the downward trend of egg prices is obvious, down more than 7% month-on-month;.6% rebound to 0.6%, of which the prices of gasoline, electricity and natural gas all rebounded from the previous value of -5.6%, -1% and -2.6% to 1.0%, 0.9% and -1.7%。

In the core CPI, the price of core commodities increased from the previous value of 0.6% down to -0.1%, in addition to the important sub-item used car prices recorded a larger decline, health care goods, leisure goods, alcoholic beverages and other commodities also collectively fell, together dragging the data negative;.3%, even though the largest contributor to overall inflation is housing, which contributes 2.56 percentage points year-on-year increase, still unable to stop the downward trend in core service prices.。

Interest rate hike in July is still unshakable, and the probability of a second rate hike in the year has declined.

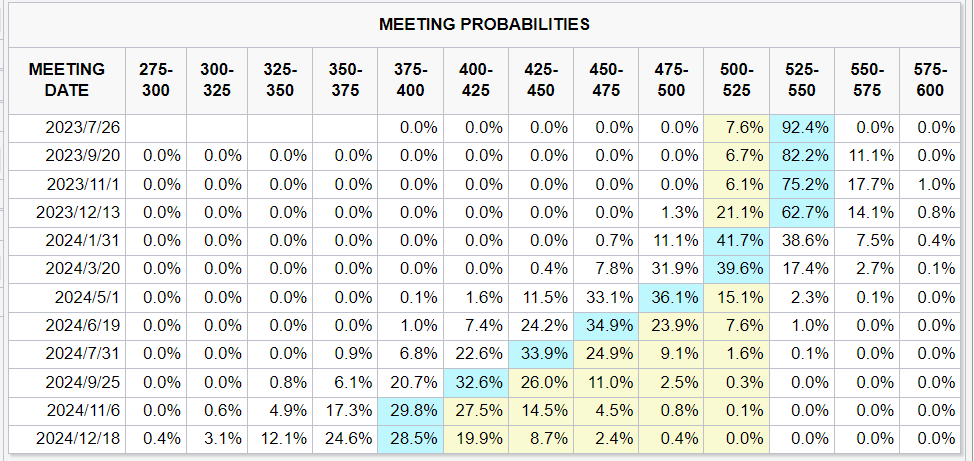

There is no doubt that this inflation data released at this point in time is sure to fuel speculation that the rate hike cycle is coming to an end。Previously, according to the Fed's dot plot, the bank will also raise interest rates twice within this year, but traders have been slow to price the argument, "stubborn" that the Fed will raise interest rates in July 25 basis points after the end of the interest rate hike cycle。

As of press time, according to CME Fed Watch, the bank's probability of raising interest rates at its July meeting has come to 92.4%, and if no surprises, the bank will raise its policy rate ceiling to 5 at the end of the month..5%。In addition, according to market pricing, the bank's probability of a second rate hike in September has declined, suggesting that the market believes that yesterday's inflation data is not enough to shake the Fed's determination to continue raising rates in July, but can considerably reduce the bank's probability of a second rate hike before this year.。

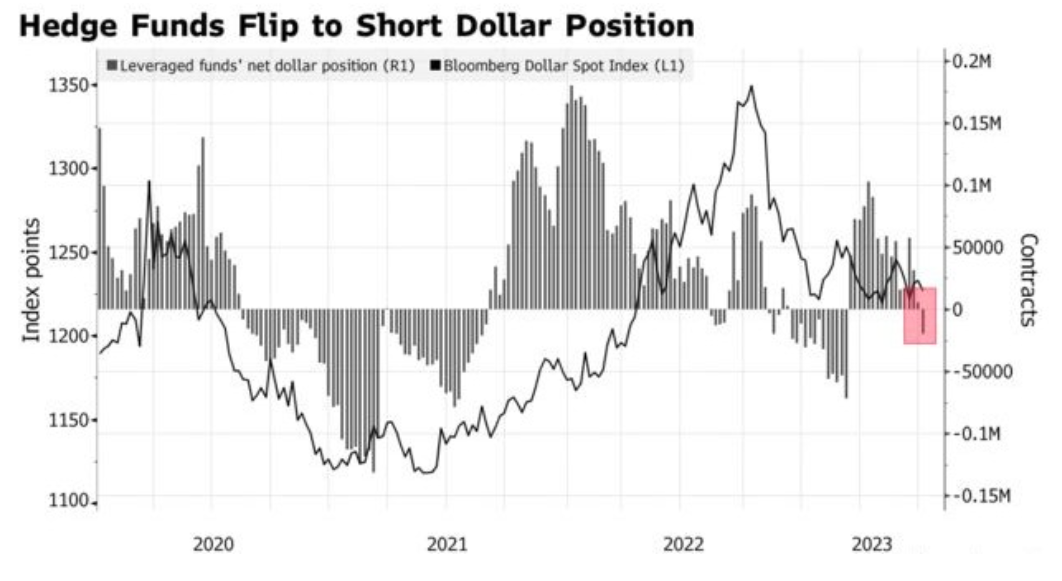

Another noteworthy piece of data is that, according to the U.S. Commodity Futures Trading Commission (CFTC), leveraged investors have moved from a net long position of 5,196 contracts a week earlier to a net short position of 20,091 contracts in the week ended July 7, representing the first time hedge funds have turned overall bearish on the dollar since March, betting that the Fed is nearing the end of its rate hike cycle.。

Markets see tightening cycle coming to an end Fed reiterates inflation target

While all the signs are leading the market to lower expectations of a Fed rate hike after July, as before, the market's voice and the Fed's voice are always different。

Ryan Sweet, chief US economist at Oxford Economics, said: "The latest inflation data may give the Fed reason to debate whether further rate hikes are needed after this month.。Fed's tightening cycle may be coming to an end "。

In addition, Bloomberg Economics (Bloomberg Economics) also believes that "June's weak CPI report comes at a critical time when the Fed's rate hike cycle is nearing its end."。Not only did the base effect help cool inflation, but economic weakness also played a role。While the Federal Open Market Committee (FOMC) is likely to raise rates at its July meeting, more officials are likely to be skeptical about the need for further rate hikes thereafter. "。

Politically, even U.S. Senator Elizabeth Warren (Elizabeth Warren) has called for the Fed to stop raising interest rates.。She said in an interview, "Chairman Powell, please give a positive answer, stop raising interest rates.。The mission has been completed. "。

The Fed, for its part, has consistently called on markets to remain calm.。After yesterday's data, Richmond Fed Chairman Thomas Barkin (Thomas Barkin) was the first to stand up and reiterate the Fed's commitment to restoring price stability。He said: "Inflation is too high.。Our target is 2%, and if we exit too early, inflation will rebound strongly, which requires more action from the Fed。"

In addition, Minneapolis Fed President Neel Kashkari also wrote in an article published Wednesday that policy rates may need to be raised if inflation turns out to be more entrenched than expected.。

Overall, although this inflation report can not overwhelmingly eliminate the market's doubts about the second rate hike for the rest of the year, but it has intensified the debate between the market and the Federal Reserve on the need for a second rate hike, further weakening the Fed's "credibility" on the previous rate hike argument, to the end of the rate hike cycle injected a layer of psychological "dawn."。

From this point of view, this may also be regarded as a dove "alternative" victory。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.